SunOpta: Attractive Growth Justifies An Upgrade

Summary

- SunOpta, a food and beverage company, has experienced a significant downturn, with shares plummeting 28.1% due to a weak first quarter in 2023, despite optimistic management and potential long-term catalysts.

- STKL's revenue fell 6.8% year on year in Q1 2023, with the Fruit-Based Foods and Beverages unit experiencing a 9.7% drop in revenue, leading to a decline in profitability.

- Despite the downturn, the company forecasts a revenue increase of between 7% and 12% for 2023 and the overall picture for the firm should still be bullish.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Everyday better to do everything you love/iStock via Getty Images

One undeniable fact about the stock market that I can share with you is that it can and will be extremely volatile from time to time. This could be the market more broadly, but it can also involve individual firms. Sometimes, that volatility is warranted. Other times, it's not. Sometimes, if it presents a buying opportunity or an attractive selling opportunity, it can be welcomed by investors. Other times, investors hate it. It all depends on the circumstances that said investors find themselves in. One firm that has recently experienced a great deal of downside, some of which has probably been warranted, is SunOpta (NASDAQ:STKL). Uncertain economic conditions, combined with a rough start to the 2023 fiscal year was perceived negatively by the market. But with management still optimistic about the near term and attractive catalysts for the long run, I do believe that now is a good time to upgrade the company from the 'hold' I had it at previously to a soft 'buy'.

A look at recent volatility

Not since October of last year have I written an article detailing the investment worthiness of SunOpta. At that time, I found myself impressed with continued attractive performance on both the companies top and bottom lines. But given how shares were priced at that time, I could not rate the company any higher than a 'hold'. This kind of rating denotes my belief that shares should generate performance that more or less matches the broader market for the foreseeable future. But when conditions change, my opinion will also change. Since the publication of that article, the S&P 500 has experienced impressive upside of 18.2%. Shares of SunOpta, however, have plummeted 28.1%.

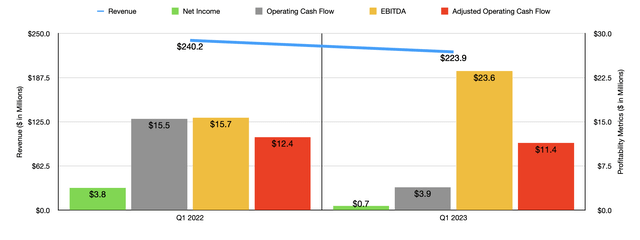

A weak first quarter was largely to blame for this downturn in my opinion. Consider revenue. During the first quarter of its 2023 fiscal year, the company reported sales of $223.9 million. That was 6.8% below the $240.2 million reported for the same quarter last year. Even though the Plant-Based Foods and Beverages portion of the company reported weakness, the biggest hit involved the Fruit-Based Foods and Beverages unit. Revenue there plummeted 9.7%, falling from $104.7 million to $94.5 million. This decline, according to management, was driven entirely by an 11% hit associated with a reduction in volume and a change in product mix. This, management stated, came about as retail customers adjust to their inventories to account for lower consumer demand and as food service customers experienced slower traffic because of current economic conditions. Higher incremental volumes that management deemed to be one time in nature in the first quarter of 2022 also played a role in the year over year decline. This pain was only partially offset by a 1.3% increase in pricing.

The drop in revenue also brought with it a decline in profitability period the company went from generating a net profit of $3.8 million in the first quarter of last year to generating a net profit of only $0.7 million the same time this year. This came about even as foreign currency fluctuations helped the company on a year over year basis to the tune of $1.7 million. The pain was largely driven by a couple of key factors. For starters, interest expense for the business more than doubled from $2.5 million to $5.8 million. On top of this, the company suffered from a nearly $6 million year over year increase in startup costs associated with, amongst other things, its new plant-based beverage facility in Texas that opened in February of this year. Other profitability metrics followed a similar trajectory. Operating cash flow dropped from $15.5 million to $3.9 million. Even if we adjust for changes in working capital, we would have seen it drop from $12.4 million to $11.4 million. The only profitability metric that improved year over year was EBITDA. It popped up from $15.7 million to $23.6 million in large part because it added back the aforementioned one-time items, including a $0.5 million swing in business development expenses.

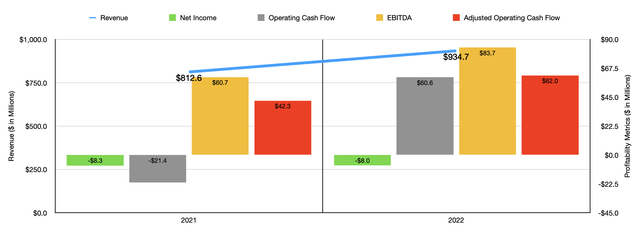

This relatively weak performance for the company follows a robust showing for 2022. For that year as a whole, the company managed to generate revenue of $934.7 million. This translates to a year-over-year improvement of 15% compared to the $812.6 million reported for 2021. Despite the significant improvement in the final quarter of the year, the firm's net loss was almost the same in both years. The net loss narrowed only marginally from $8.3 million down to $8 million. However, operating cash flow swung from a negative $21.4 million to a positive $60.6 million. If we adjust for changes in working capital, it would have moved from $42.3 million to $62 million. Even EBITDA rose nicely, climbing from $60.7 million to $83.7 million.

For 2023, management has provided some guidance. They think that revenue will come in at between $1 billion and $1.05 billion. This would translate to a year-over-year increase of between 7% and 12%. Actual organic revenue, which excludes prior revenue generated from the sunflower business that has since been divested, would actually have grown by between 14% and 20% under this scenario. Some of this growth will undoubtedly be attributable to the new $125 million plant-based beverage manufacturing facility that the company opened in Texas in early February of this year. At present, the new production facility has 285,000 square feet of space. Though the company could increase that to 400,000 square feet depending on demand in the future. It's also the largest portion of the nearly $200 million that the company has invested in its plant-based production capacity over the past three years. And the ultimate goal of this is to help the company achieve its target of doubling its plant-based production volumes by 2025.

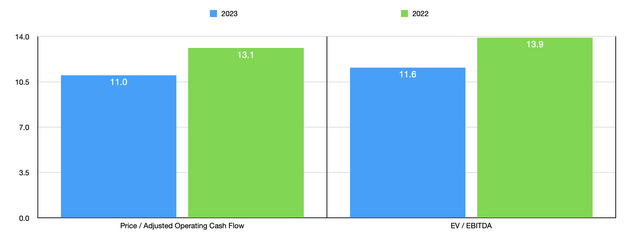

Aided in part by this new production facility, but also because of just other overall growth, the company is forecasting EBITDA for 2023 of between $97 million and $103 million. That's between 16% and 23% higher than what was generated in 2022. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA it's forecasted to, then we should anticipate a reading of about $74.1 million for 2023. Based on these figures, the company is trading at a forward price to adjusted operating cash flow multiple of 11.0 and at a forward EV to EBITDA multiple of 11.6. As you can see in the chart above, this is meaningfully cheaper than what we get using data from 2022. To finalize my analysis, I also decided to compare the company to five similar firms. On a price to operating cash flow basis, only one of the five firms ended up being cheaper than our prospect. Meanwhile, using the EV to EBITDA approach, only two of the five companies ended up being cheaper than our target here.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| SunOpta | 13.1 | 13.9 |

| Adecoagro S.A. (AGRO) | 3.2 | 4.0 |

| Calavo Growers (CVGW) | 22.6 | 46.1 |

| Mission Produce (AVO) | 18.6 | 217.4 |

| Limoneira (LMNR) | 166.5 | 7.6 |

| Vital Farms (VITL) | 265.7 | 18.2 |

Incorporated in my analysis is also the fact that management was forced by one of its preferred investors to exchange half of the preferred stock the company currently has outstanding for nearly 6.1 million common shares of the business. Although this resulted in a 5.3% dilutive impact for common shareholders, it should save the company around $1.2 million in preferred distributions annually. The company still does have about $15 million worth of preferred stock outstanding at this time.

Takeaway

I understand why some investors may not find SunOpta to be particularly appealing. I generally don't care much for the food and beverage space. I see it as highly competitive and low margin. The company also has some issues regarding profitability. However, cash flows are respectable and growth achieved by the business looks appealing if we assume the first quarter to be a bump in the road and rely on management's guidance for 2023. Of course, we don't know what the future holds. But if management can pull through on current guidance, shares would be looking fairly attractive on an absolute basis. Even as they stand, they don't look particularly bad, either on an absolute basis or relative to similar firms. Given the direction management is driving the company, I would argue that it probably does offer some upside from here. As such, I've decided to change my writing from a 'hold' to a soft 'buy' at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.