SYLA Technologies: New Regional Revitalization Funds And AI Could Imply Undervaluation

Summary

- SYLA Technologies, a Japanese real estate company, is expected to see growth due to its use of AI technologies, changes in Japanese real estate law, and the growing digital real estate market.

- SYT operates two platforms, Rimawari-kun and Rimawari-kun Pro, which use AI to customize offers to customers and increase transaction success rates.

- Despite potential risks such as commodity price volatility and lower-than-expected net sales, SYLA Technologies is predicted to trade at a higher price mark due to its innovative offerings.

ronniechua

SYLA Technologies Co., Ltd. (NASDAQ:SYT) recently launched new regional revitalization funds, which may not only bring new cash, but also further stock demand from investors. In my view, as more investors learn about the application of AI technologies used by SYT, the beneficial change in the real estate law in Japan, and the growing real estate digital market, SYLA will likely receive more attention from market participants. There are obvious risks from the price of commodities, lack of innovation, or lower net sales than expected, however I believe that SYLA could trade at a higher price mark.

SYLA Technologies

Founded in Japan in 2009 and with active operations to date, SYLA Technologies is a real estate company focused on democratizing the offering of this industry as well as providing related technologies and asset management as related services.

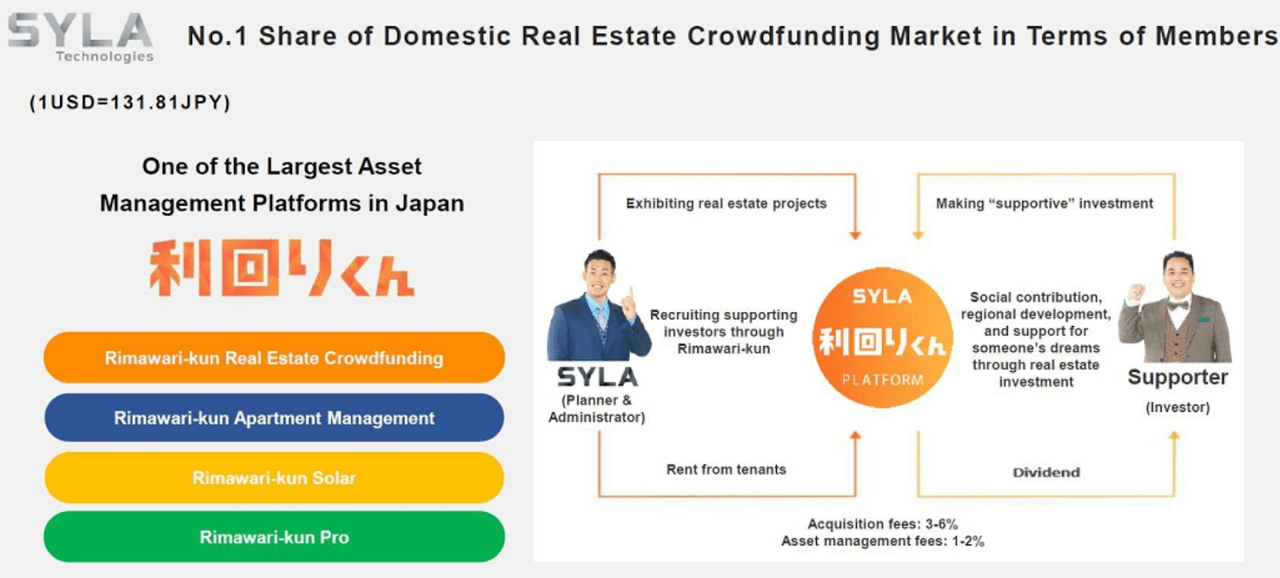

The three main businesses of this company are related to real estate asset management, which include the operation of the platforms Rimawari-kun and Rimawari-kun Pro, added to brokering, advisory, and housing construction services.

The business through the platform Himawari-kun is focused on bringing investment proposals closer to individual investments as well as generating proposals for financing of different types of real estate projects, whether in land acquisition or construction. This platform is operated by SYLA, and works for users as a portfolio of opportunities in real estate investment.

The platform Rimawari-Kun Pro is available to sizable real estate agents, private investors, and real estate companies. The properties displayed on this platform are those that belong to SYLA and properties of another company. The company acts as a real estate broker to bring the parties together. In my opinion, it is essential to highlight that both of these platforms have large investments for technological development, and currently involve artificial intelligence functions to customize the offer to customers as well as to increase the margins of success in transactions.

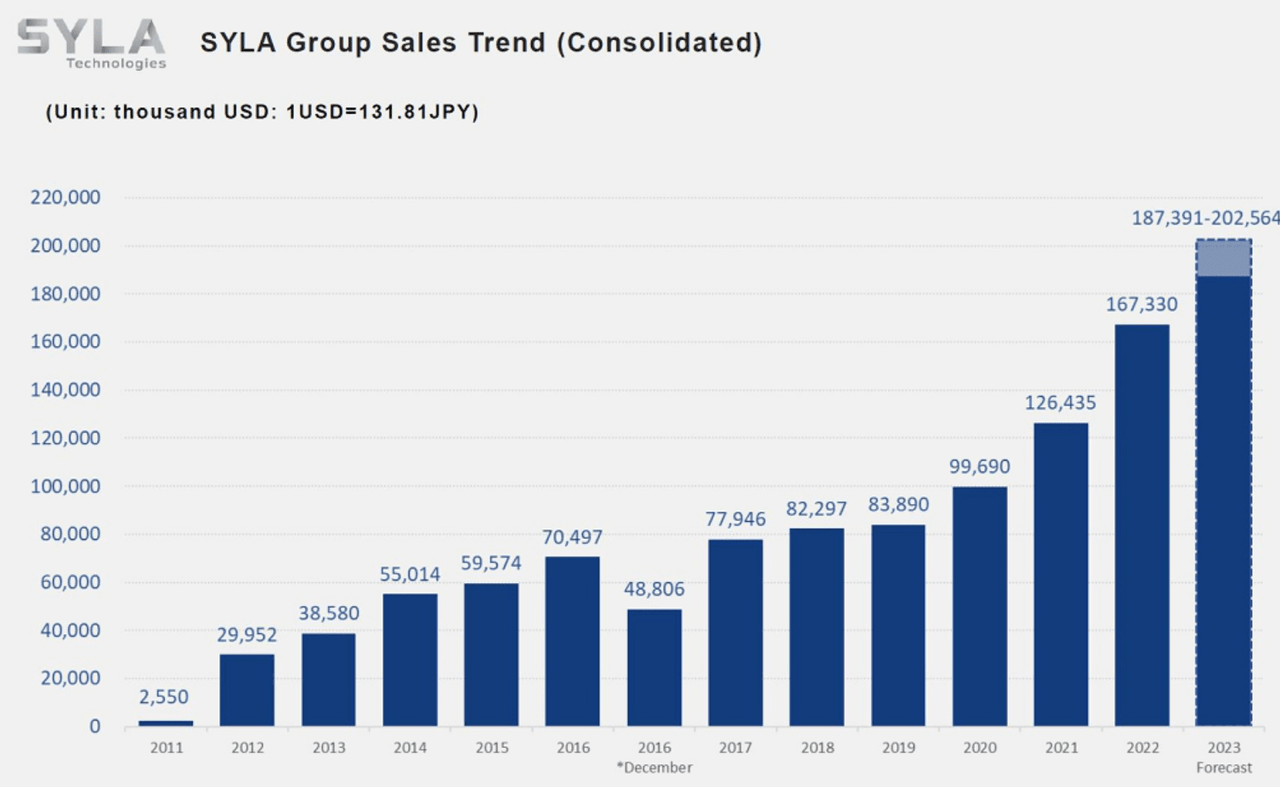

Also, as we pointed out, the company functions as a broker in real estate operations in the traditional way, and offers development and maintenance services for construction and income management in this industry. I believe that SYLA Technologies is quite interesting not only because of its innovative offering, but also because of recent growth and optimistic guidance. Sales grew significantly in the past.

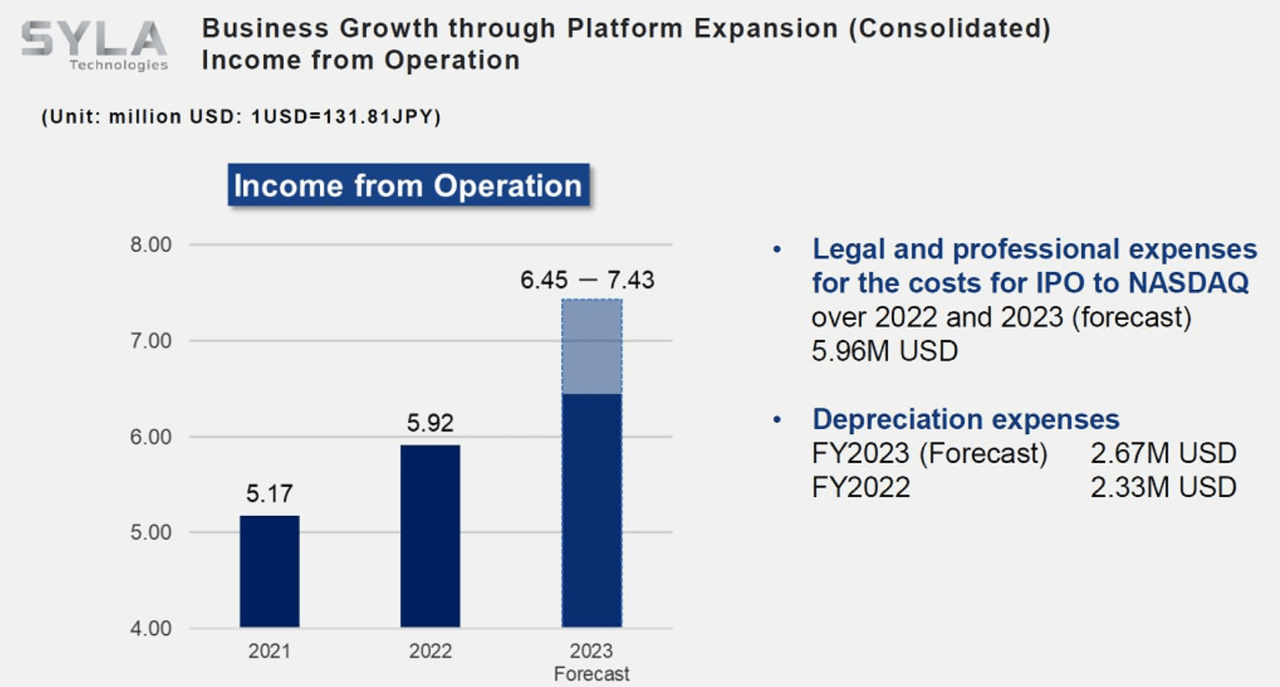

Management expects income from operations growth in 2023 and depreciation expenses growth. Besides, management also expects some legal and professional expenses in 2023 because of the cost of the IPO. In my view, these costs will most likely be transitory. We may not see that expenses in 2024 and in the future.

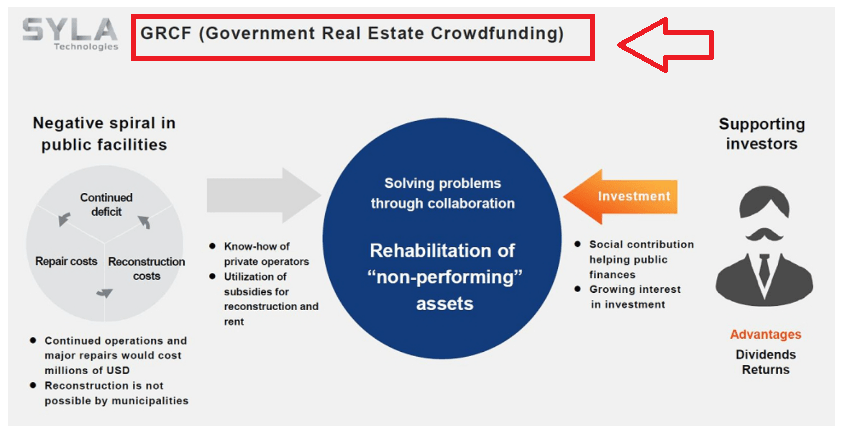

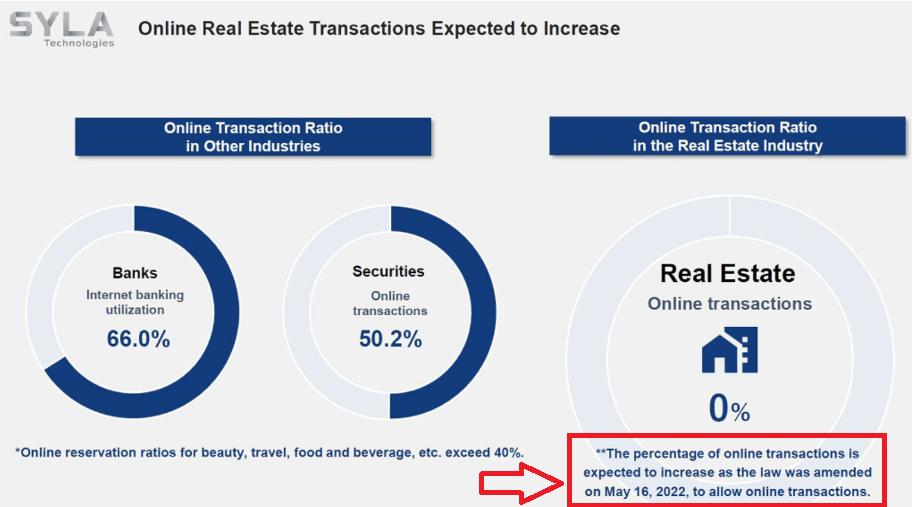

With the previous expectations, it is also worth noting that the market in which SYLA operates may expect significant business growth. SYLA may benefit from government real estate crowdfunding and recent changes in the law. The company offered several explanations in a corporate presentation.

Source: Investor Presentation Source: Investor Presentation

Balance Sheet

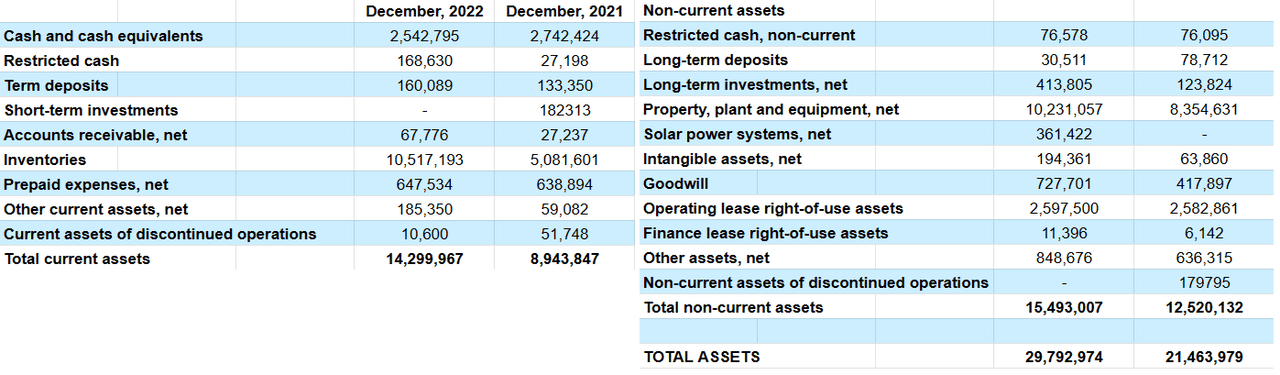

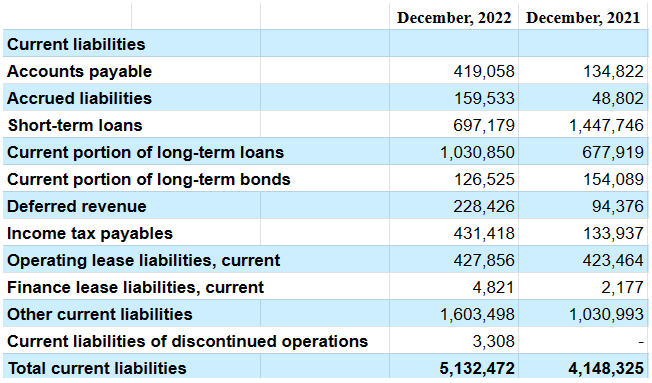

In the last quarterly report, SYLA Technologies noted cash and cash equivalents of JPY2.542 billion, restricted cash worth JPY168 million, term deposits close to JPY160 million, and inventories worth JPY10.517 billion.

Also, with prepaid expenses of JPY647 million and other current assets of about JPY185 million, total current assets stood at JPY14.299 billion. The total amount of current assets is significantly larger than the total amount of current liabilities, so I believe that we may not see a liquidity crisis in the coming months.

Non-current assets include restricted cash of JPY76 million, long-term deposits close to JPY30 million, and long-term investments of about JPY413 million. Also, with property, plant, and equipment worth JPY10.231 billion, solar power systems of close to JPY361 million, and intangible assets of JPY194 million, goodwill stood at JPY727 million. Finally, total assets were equal to JPY29.792 billion, and the asset/liability ratio was equal to 1x. With this in mind, I believe that the financial situation appears very stable.

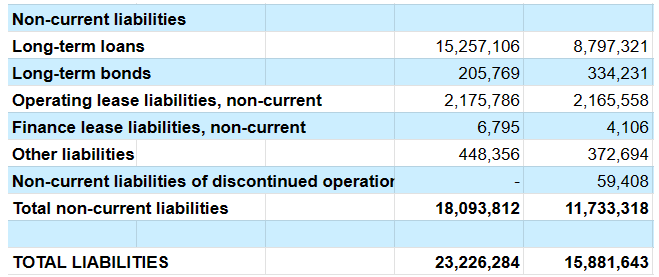

The list of liabilities includes accounts payable worth JPY419 million, accrued liabilities of JPY159 million, short-term loans close to JPY697 million, and current portion of long-term loans of about JPY1030 million. Besides, with current portion of long-term bonds worth JPY126 million and deferred revenue of JPY228 million, total current liabilities were equal to JPY5132 million.

Long term liabilities include long-term loans worth JPY1.5257 billion, long-term bonds worth JPY205 million, and other liabilities of about JPY448 million. Total liabilities stand at JPY23.226 billion.

Source: 20-F Source: 20-F

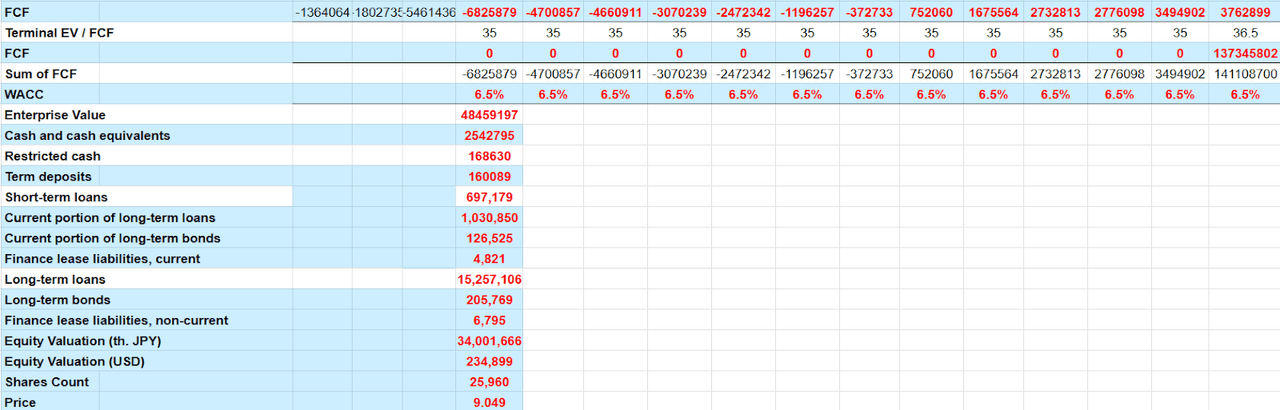

Conservative Assumptions Lead To A DCF Model With An Implied Stock Price Of $9.05 Per Share

The company's current strategy is to be a pioneer in the use of digital media for brokering and investment in real estate in Japan. According to the company's reports, bank financing activity in the field of real estate is concentrated in certain cities with a high concentration of assets. This means that supply and demand is reduced to a small portion of the territory. Under my DCF model, I assumed that the company would successfully expand and diversify the investments of its clients towards new less urban regions showing significant business potential.

Based on the fact that more than 50% of banking operations during this year were carried out digitally, I think that creating online investment offers for real estate is an opportunity to quickly position itself as a benchmark and leader in this market. Under my base case scenario, I assumed that the new legal framework will bring significant FCF growth.

I also believe that investments in technology and artificial intelligence for the development of new platforms will likely play a key role. I believe that these investments may accelerate the analysis of client profiles, and efficiency could increase. As a result, I believe that we may see a gradual increase in free cash flow. In this regard, the company provided several details with regards to the use of new AI technologies.

Furthermore, we believe that we differentiate ourselves from our competitors by providing data-driven services that utilize AI. As an expert in AI and technology, SYLA Brain Co., Ltd.'s founder and Chief AI Officer, Tianqi Li, has developed a highly accurate AI system, which is a competitive advantage. Rimawari-kun AI developed by SYLA Brain is based on a proprietary algorithm and has been recognized as the "most accurate price estimation model" by the Japanese Society for Artificial Intelligence 2020 and MIPR 2021. Source: 20-F

Regarding the expansion of the business outside these borders, I would be optimistic about potential expansion outside Japan. In this regard, it is worth noting that in the last annual report, the company noted that it expects to generate shared financing options to install the business in the United States.

In addition, I am quite optimistic about the recent applications to be received for the new local revitalization funds DOTOWN HOUSE Ocean Front. New funds to be received may enhance the balance sheet, which may lower the cost of capital. Besides, in my opinion, sufficient marketing about new offerings could bring more stock investors, and may lead to stock price increases.

SYLA will begin accepting applications for a series of local revitalization funds DOTOWN HOUSE Ocean Front Vol.2 and DOTOWN HOUSE Ocean Front Vol.3 on the same day on Monday, July 10, together with DOTOWN. The total offering amount is 35.28 million yen and 42.58 million yen respectively (77.86 million yen in total). Source: [Rimawari-kun] Regional revitalization fund by Rimawari-kun x DOTOWN is now serialized!

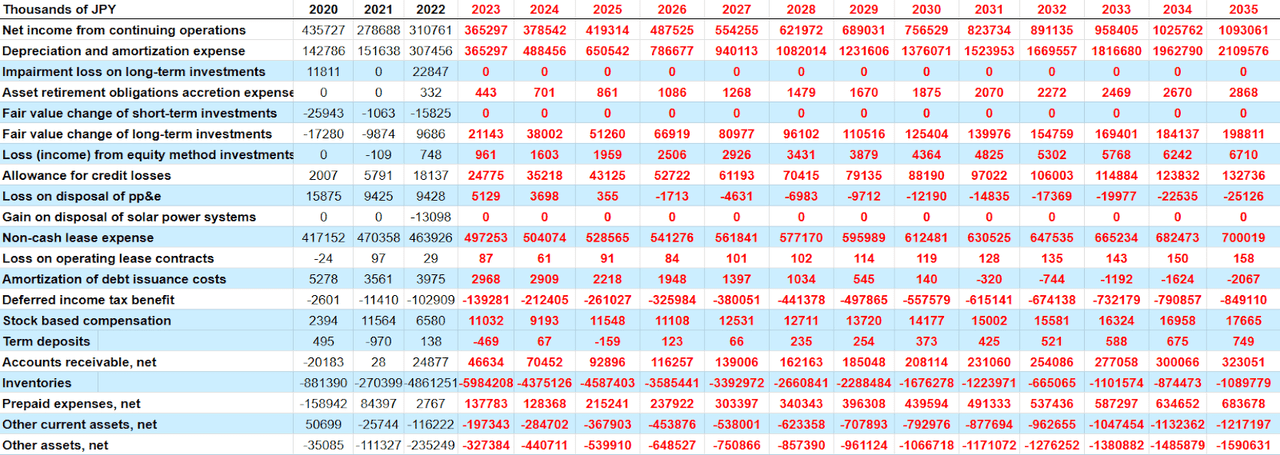

My financial model includes 2035 net income from continuing operations close to JPY1.093 billion, 2035 depreciation and amortization expense worth JPY2109 million, fair value change of long-term investments of JPY198 million, non-cash lease expenses worth JPY700 million, and stock based compensation of close to JPY17 million.

Besides, with term deposits of JPY0 million, changes in accounts receivable close to JPY323 million, changes in inventories worth -JPY1090 million, and changes in prepaid expenses close to JPY683 million, 2035 changes in accounts payable would be about JPY2250 million. Finally, with changes in accrued liabilities of about JPY841 million and changes in deferred revenue close to JPY616 million, 2035 CFO would be about JPY6596 million. If we also include 2035 purchase of property, plant, and equipment worth -JPY2834 million, 2035 FCF would be JPY3762.55 million.

Source: My Financial Model Source: My Financial Model

Now, if we assume a terminal EV/2035 FCF of 36.55x and a WACC of 6.55%, the implied enterprise value would be close to JPY48.459 billion. I also added cash and cash equivalents of JPY2542 million, restricted cash close to JPY168 million, term deposits of JPY160 million, short-term loans worth JPY697 million, and current portion of long-term loans worth JPY1.030 billion. Finally, with the current portion of long-term bonds close to JPY126 million, current finance lease liabilities of JPY4 million, long-term loans worth JPY15.257 billion, and long-term bonds of JPY205 million, the equity valuation would be JPY34.001 billion. The implied equity valuation would be $234 million, and the stock price would be JPY9.055 per share.

Competition

The competition in the Japanese real estate market is high, and is given by historical participants as well as small companies that join. In 2022 alone, 280 new companies entered the market. Some of the historical references are Owner's Book, Creal, and Rimple.

In particular, the real estate crowdfunding industry is crowded with competitors, with 280 companies having entered the market as of December 31, 2022, including many leading listed companies such as Owner's Book, Creal, and Rimple. Source: 20-F

SYLA's platforms registered 237 thousand members in 2022, being the digital offer company for real estate investment with the most clients in the country. In my view, the allocation of resources for the development of services that use artificial intelligence is a fundamental factor since this currently means the greatest differential of the company's services over its competitors.

Risks

The company generates revenue in Japan, which means that new operating and financing challenges may appear when the company manages to expand its operations internationally. On the other hand, I would expect a great variation in the application of laws in other countries. In sum, I would expect a lot of uncertainty about future free cash flow projections. Future net sales and FCF margins may be lower than expected.

I believe that SYLA's operations and businesses have demonstrated great achievements in its application. Besides, the projection of its activities into the future is focused on the potential growth of the digital market within the real estate field. However, it may happen that the company's forecasts are not accurate. In my view, if investors see less net sales than expected, some of the shareholders may sell equity, which may lead to lower stock demand and lower stock price.

There are risks which are common to the real estate market, such as dependence on third parties and changes in the prices of land and materials. To these factors, I would add the potential increase in costs when transforming into a public company as well as the possibility that the new laws may not result in the growing market than management expects.

Conclusion

SYLA Technologies appears well prepared to exhibit FCF growth thanks to the new regulation in Japan as well as new AI technologies applied to the real estate market. I am also quite optimistic about the new funds related to the DOTOWN HOUSE Ocean Front and new offerings that the company could launch soon. Finally, considering the optimistic guidance for 2023, I believe that SYLA Technologies could impress investors in 2023 and beyond. There are several risks from changing regulations in Japan, commodity price volatility, and even lack of innovation, however I think that the stock price could trade at a higher price mark.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SYT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.