10% Yielding REIT Buying Opportunities

Summary

- Most commercial mortgage REITs are today heavily discounted.

- But they are discounted for a good reason: they are heavily leveraged and have high exposure to the office sector.

- We highlight 10% yielding mREITs to consider and our current top pick.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

chaofann

Co-produced by Austin Rogers

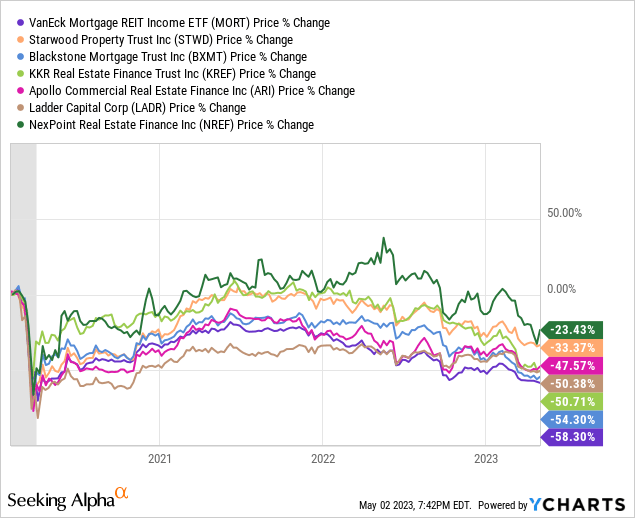

Commercial mortgage REITs, or REITs whose primary assets are loans secured by commercial real estate properties, have been absolutely crushed over the last year. Frankly, they haven't had a good time over the last three years:

YCHARTS

On a price basis alone, the index (MORT), which includes residential mREITs, is down over 50%, while several commercial mREITs are likewise down over 50% from their pre-COVID levels.

Some degree of selloff is warranted, because the basic business model of mREITs is to borrow at a cheaper rate than they lend. They are not depositary institutions or banks that take deposits and pay very low interest rates on those deposits. They need to use debt, and the lenders on the other side of their debt expect a high enough interest rate to generate a return.

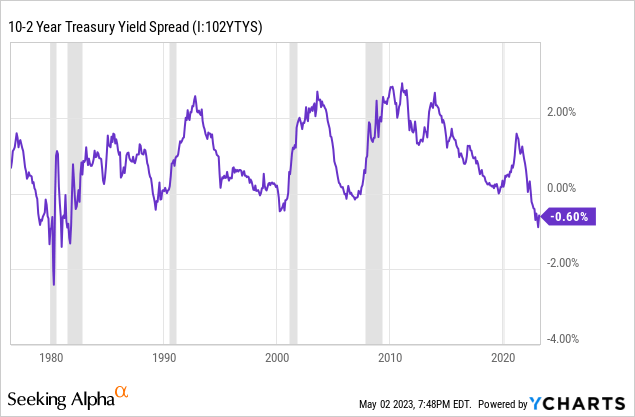

Right now is a particularly difficult environment to make this model work, because mREITs generally lend long-term and borrow short-term, but the yield curve is deeply inverted, and short-term interest rates are higher than long-term interest rates!

YCHARTS

Moreover, commercial mREITs are selling off as investors fear the consequences of the chaos playing out in office real estate right now. Office landlords are defaulting left and right and simply handing the keys back to the lender, who then has to sell the property at what could be a discount to the value they assumed when they extended the loan.

So, for commercial mortgage REITs with office exposure, the fear is that:

- Borrowers won't have the income to keep servicing their debt, and thus the mREIT's distributable EPS will take a hit, potentially necessitating a dividend cut.

- The mREIT will have to take possession of certain real estate that has lost significant value from its underwriting assumptions, or else be forced to accept a workout in which it takes a loss or a lower yield.

That said, the degree to which mREITs have sold off may be overdone.

Could there be value amid the rubble?

To find out, we take a look at six key commercial mREITs to see if we can find attractive value and relatively safe dividend yields.

Comparing 6 Commercial mREITs

If you'd like to look through the most recent investor presentations for each company, here they are:

- Starwood Property Trust (STWD)

- Blackstone Mortgage Trust (BXMT)

- KKR Real Estate Finance Trust (KREF)

- Apollo Commercial Real Estate Finance (ARI)

- Ladder Capital (LADR)

- NexPoint Real Estate Finance Inc. (NREF)

To be clear, these six mortgage REITs are not cookie-cutter copies of each other. There are unique aspects to each of them.

STWD also engages in infrastructure lending, and about 9% of its loan portfolio is in infrastructure (primarily midstream energy and renewable natural gas) loans.

BXMT has the benefit of being managed by Blackstone (BX), the largest real estate-focused private equity / alternative asset management firm in the world.

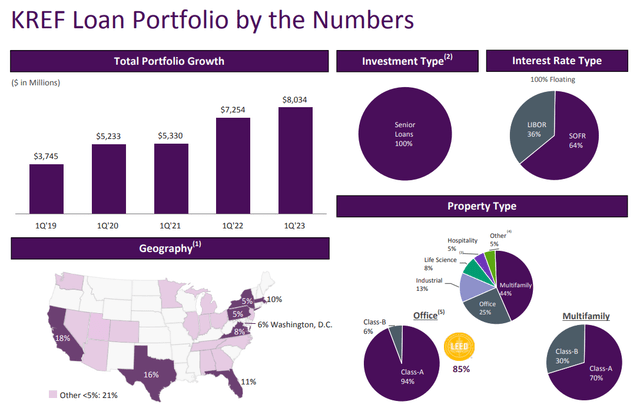

KREF is managed by KKR & Co. (KKR), another leading alternative asset manager, and it's useful to note that 94% of KREF's office loans are backed by Class A office buildings.

ARI is managed by Apollo Global Management (APO), another alternative asset manager, has a sizable exposure to European real estate (including less risky European office properties), and the loan-to-value ratio for its office portfolio sits at a remarkably low 50% as of Q1 2023.

LADR is internally managed (rare in the mREIT space) with over 10% insider ownership, and the company also has a ~$700 million portfolio of directly owned CRE, most of which is net lease.

Lastly, NREF is managed by NexPoint Advisors and boasts a highly defensive portfolio of multifamily and single-family residential loans backed by properties located overwhelmingly in Sunbelt states like Georgia, Florida, and Texas.

There are myriad other small differences between these six companies, but what all have in common is that their primary assets are loans secured by commercial real estate. They earn a profit by issuing equity and (mostly) debt and investing in assets at a spread over their cost of capital.

Real Estate Sector Exposure

For the core loan portfolios, here are the real estate sector exposures of each mREIT:

| SECTOR EXPOSURE | Residential | Office | Retail | Industrial | Hotel |

| Starwood Property (STWD) | 33% | 23% | 2% | 6% | 16% |

| Blackstone Mortgage (BXMT) | 27% | 34% | 4% | 9% | 19% |

| KKR RE Finance (KREF) | 44% | 25% | 0% | 13% | 5% |

| Apollo CRE Finance (ARI) | 19% | 18% | 16% | 3% | 23% |

| Ladder Capital (LADR) | 37% | 24% | 6% | 7% | 4% |

| NexPoint RE Finance (NREF) | 95% | 0% | 0% | 0% | 0% |

As previously stated, NREF's loans are about 95% multifamily and single-family, with the remaining in life science and self-storage.

Of the rest, BXMT has the highest exposure to office space at a little over 1/3rd of the loan portfolio. Among that office exposure, 36% is located outside the US (Europe and Australia). Also, 25% of its US office exposure is backed by office buildings in the Sunbelt, which generally has higher office utilization.

STWD has the aforementioned ~10% of its loan portfolio in infrastructure assets, but of the CRE loans, slightly under 1/4th is in office, and about 1/3rd is in residential property loans.

KREF's portfolio, interestingly, features a 57% concentration in residential and industrial property loans, which appears defensive in the current environment. Meanwhile, one quarter of its portfolio is in office, but as previously stated, 94% of that office portfolio is backed by Class A buildings.

What's striking about ARI's loan portfolio is its diversification across its four main sectors of hospitality, residential, office, and retail.

When it comes to the type of loans each mREIT makes, it should be unsurprising to find striking similarities between the six:

| PORTFOLIO METRICS | % Floating Rate | % Senior Secured |

| STWD | 99% | 92% |

| BXMT | 100% | 100% |

| KREF | 100% | 100% |

| ARI | 99% | 93% |

| LADR | 88% | 99% |

| NREF | N/A | 41% |

Of note here, NREF does not report the floating rate share of its portfolio, but we can surmise that it is around 50% or higher. Meanwhile, its share of senior secured debt (the highest priority in the capital stack and thus technically the safest) is the lowest at 41%. Other forms of investment are CMBS, mezzanine, and preferred equity.

Balance Sheet Strength

Turning to some debt metrics (for both the investment loans and the mREITs' own balance sheets):

| DEBT METRICS | Portfolio LTV | Debt-To-Equity |

| STWD | 60% | 3.8x |

| BXMT | 64% | 4.5x |

| KREF | 66% | 4.2x |

| ARI | 58% | 3.0x |

| LADR | 68% | 2.7x |

| NREF | 69% | 2.7x |

The "portfolio LTV" is the loan-to-value of each mREIT's respective loan portfolio. ARI has the lowest portfolio LTV at 58%, while NREF has the highest at 69%.

Meanwhile, using a simple debt-to-equity measurement (taking total debt on the 10-Q and dividing it by the shareholder equity on the 10-Q), we find that BXMT is highest levered mREIT in the list, while LADR and NREF are tied for the lowest.

I would caveat this, however, by noting that NREF has a high amount of "bonds payable" on its balance sheet. If these are added back into the total debt mix, NREF's debt-to-equity to surge to 20x.

So, we can summarily state that LADR has the lowest debt-to-equity in this list, perhaps as a result of management's conservatism.

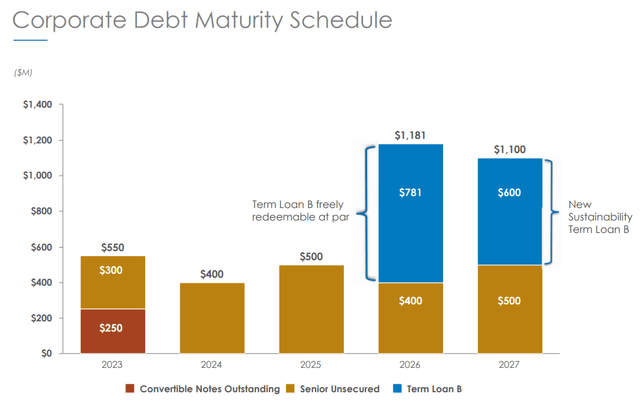

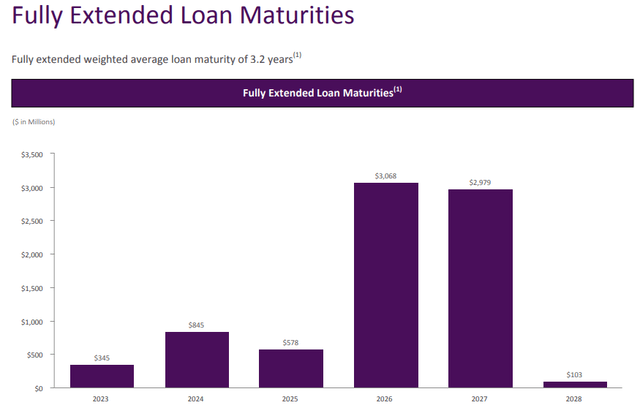

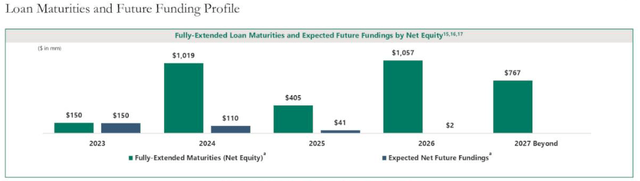

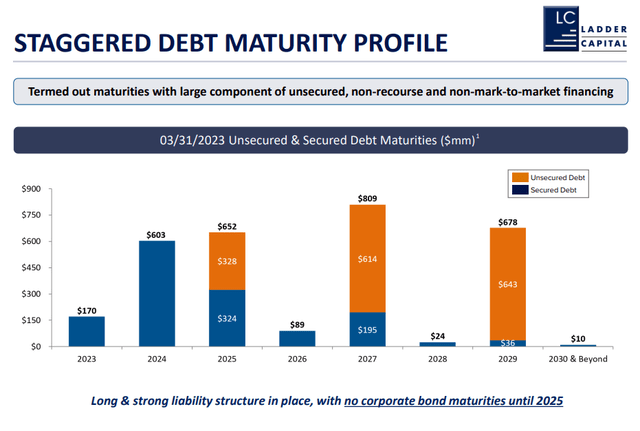

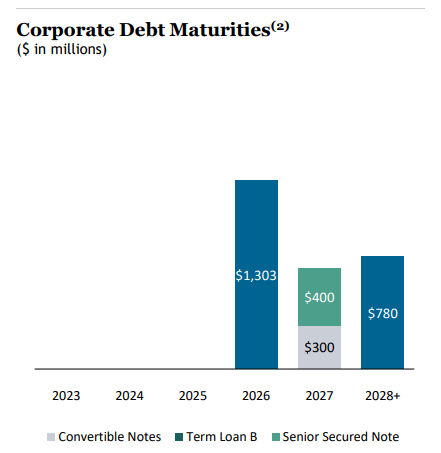

But this is only one way to look at mREITs' balance sheet strength. Another way is by analyzing the debt maturity schedule. Right now, lenders are likely less than enthusiastic about extending credit to mREITs with office exposure, so having fewer debt maturities in the near future would be a strength.

Let's take a look at each mREIT's debt maturity schedule one by one:

Starwood Property Trust:

Blackstone Mortgage Trust:

Blackstone Mortgage Trust

KKR RE Finance:

Apollo CRE Finance:

Ladder Capital:

NREF does not include a slide like the above showing its debt maturity schedule, but its 10-Q shows a weighted average debt term to maturity of 5.1 years and no debt maturing in 2023 or 2024, making its debt maturity schedule look quite strong.

The strongest debt maturity in this list, though, has to be BXMT, which has no maturities until 2026.

The second strongest would be NREF, and the third strongest would probably be KREF, as a manageable amount of debt matures each year until the next big hurdle of 2026.

Dividend Coverage

What about the safety of the dividend? All six have double-digit dividend yields, but how much coverage do those dividends have from distributable earnings?

| DIVIDEND METRICS | Coverage | Yield |

| STWD | 104% | 11.2% |

| BXMT | 127% | 14.1% |

| KREF | 112% | 16.5% |

| ARI | 146% | 14.6% |

| LADR | 165% | 10.1% |

| NREF | 110% | 13.9% |

Of this list, we can see that LADR offers the highest dividend coverage at 165%, while STWD has the lowest coverage at a mere 104%.

Management teams are still projecting confidence in quarterly conference calls about the sustainability of their dividends, but for such highly leveraged vehicles as mREITs, the potential of a handful of bad loans necessitating a dividend cut can never be discounted.

This is especially true amid the fallout of office real estate, some of which is suffering huge declines in market value as loans come due and force fire sales.

We think that the risk-to-reward is relatively attractive for all of these mREITs assuming that you have a long investment horizon and a high risk tolerance.

But here is our favorite option of all:

Our Favorite Option: KREF's Preferred Stock

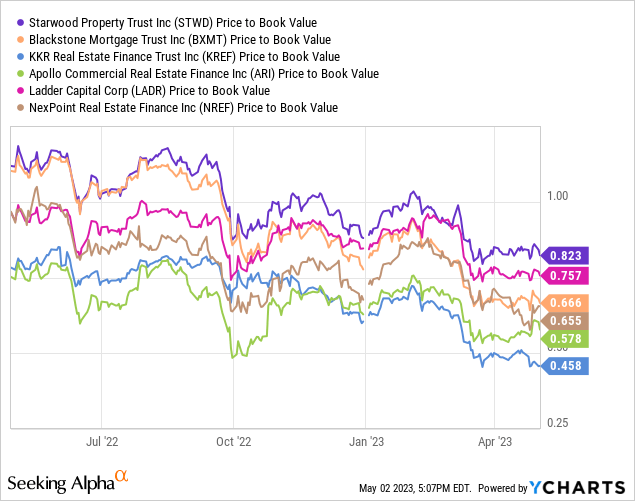

While the six mREITs mentioned above do look attractive based on their price to book values (all trading under 1x)...

YCHARTS

...we would urge caution around these names because of the risk just mentioned. When you operate with this much leverage (85%+ debt to assets) and this high of dividend payout ratios (80-95%), it only takes a few bad apples to cause your distributable earnings to sink well below your dividend, necessitating a cut.

But there is an alternative that we find more attractive than any of these mREIT common stocks, and that is the KKR Real Estate Finance Trust 6.5% Series A Preferred Stock (KREF.PA).

The pref stock has sold off along with the common shares of commercial mortgage REITs even though its dividend is significantly safer than those of the common shares.

As of this writing, KREF.PA trades at a dividend yield of right at 9-10%. Here are some basic details about KREF.PA:

| Call Date | April 2026 (No required maturity date) |

| Total Capitalization | $326 Million |

| Pref Capitalization To KREF Total Capitalization | 4.5% |

| Annual Preferred Dividends | $21.2 Million |

| Quarterly Preferred Dividends | $5.3 Million |

| KREF Q1 2023 Distributable Earnings | $33.1 Million |

| KREF Q1 2023 Distributable Earnings Before Pref Dividends | $38.4 Million |

| Q1 2023 Preferred Dividend Coverage | 725% |

| Q1 2023 Preferred Dividend Payout Ratio | 13.8% |

Moreover, keep in mind that KREF.PA's dividend is cumulative, which means that the full quarterly amount is required to be paid up through its eventual redemption. If any dividends go unpaid, they accrue and must eventually be paid to preferred shareholders. Also, KREF cannot pay a common dividend until and unless KREF.PA's cumulative dividends have been paid in full.

Things would have to go really wrong for KREF.PA's dividends to be permanently in danger.

Likewise, consider the quality of KREF's 100% senior secured, 100% floating rate loan portfolio:

Yes, 25% of loans are backed by office buildings, but keep in mind that 94% of those office buildings are Class A. Although all office buildings are suffering from negative sentiment and occupancy declines right now, there's a strong case to be made that Class A offices will survive the current crisis as tenants make a "flight to quality" in the years to come.

What's more, the remainder of KREF's loan portfolio in multifamily, industrial, life science, and hotels looks well-positioned. These property types are generally not suffering much, if at all, right now. Most of them continue to thrive with rising rents and expanding debt service coverage ratios.

For this reason, we are today initiating a small position for Retirement Portfolio with the purchase of 200 shares.

We believe that the risk-to-reward is compelling with the shares trading at a 35% discount to par and offering a 10% dividend yield. Alternatively,

Bottom Line

While commercial mREITs look cheap on a price-to-book value basis, it is difficult to assess the damage they could incur from the fallout of the office real estate crisis ongoing right now. Occupancies are dropping, and the market values of office properties are dropping as well. This could translate into big losses for the mREITs who have extended loans to office landlords.

But with KREF.PA, you get a ~10% yield that is far safer than the dividend yields of any mREIT common stock. Plus, it is backed by a strong portfolio of CRE loans managed by one of the top alternative asset management firms in the world.

Join 2,500+ Subscribers...

At Just ~1/2 Of The Regular Rate!

For a Limited-Time - You can join Seeking Alpha’s #1-rated community of real estate investors at just $39 per month

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have 500 five-star reviews from happy members who are already profiting from our real estate strategies.

Try it Free for 2-Weeks. If you don’t like it, we won’t charge you a penny! We have 500 five-star reviews from happy members who are already profiting from our real estate strategies.

We spend 1000s of hours and over $100,000 per year researching the market for the most profitable investment opportunities and share the results with you at a tiny fraction of the cost.

(*Limited spots available)

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KREF.PA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (8)