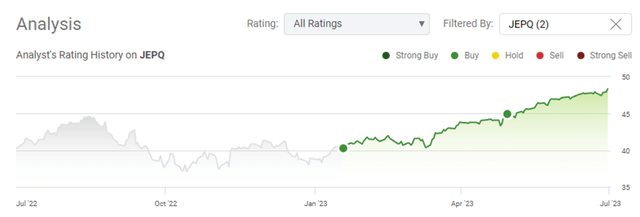

JEPQ Can Continue Higher And Deliver 10%+ Yields

Summary

- JEPQ has seen a total return of 7.56% since April 2023, outperforming the S&P, AUM has grown by 70% to $3.89 billion.

- Its investment methodology differs from other high-yield ETFs like the Global X Nasdaq 100 Covered-Call ETF.

- JEPQ's strategy allows it to generate double-digit yields without capping the upside potential, appealing to both income investors and those seeking a hybrid approach.

- It is expected to continue to climb as several catalysts could contribute to the market's appreciation throughout the year and into 2024.

PM Images

Since my last article on the JPMorgan Equity Premium Income ETF (NASDAQ:JEPQ) was published on 4/29/23, shares of this popular ETF have appreciated by 6.73% and generated 2 dividends, bringing the total return to 7.56% compared to the S&P appreciating by 6.79%. JPEQs assets under management (AUM) have also increased by 70% ($1.61 billion), from $2.28 billion to $3.89 billion. I feel that Global X paved the way for the high-income ETFs with their covered-call strategy, but JPMorgan Chase (JPM) has created a product that is appealing to both income investors and investors seeking a hybrid approach toward income and capital appreciation. Unlike the Global X Nasdaq 100 Covered-Call ETF (QYLD), JEPQ doesn't completely cap the upside potential. Due to JEPQs strategy, if you believe the market is ultimately going higher and will be led by big tech, then JEPQ will also go higher and should be able to generate double-digit yields.

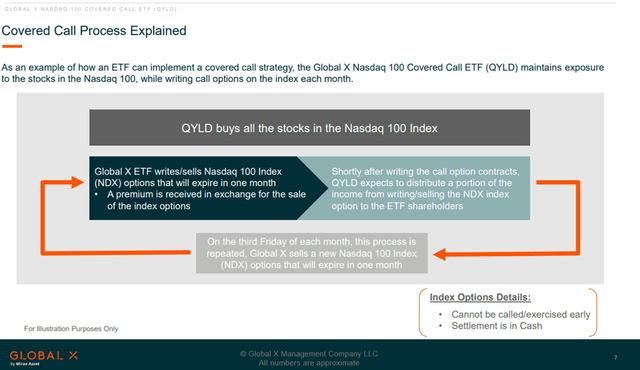

Not all Nasdaq-focused ETFs focused on high-yield are created equal. Here is the difference between QYLD and JEPQ

I am a shareholder of both QYLD and JEPQ and for the record, I own more QYLD than JEPQ. I had been acquiring shares of QYLD since before JEPQ went public, and that's the main reason why I own more QYLD. On the surface, QYLD and JEPQ are similar as they invest in companies listed on the Nasdaq, pay a monthly dividend, and have yields between 11.49% and 11.67%. While they are both similar and have billions in AUM, their investment methodologies are completely different.

Global X took the approach of creating an income ETF that utilized a Covered-Call overlay strategy. QYLD owns the underlying assets as it invests in the companies that make up the Nasdaq 100 and then writes covered calls against those positions. The options are written at the money on a monthly basis, and the premiums collected are used to fund its monthly distributions to shareholders. Covered Calls are written on 100% of the portfolio, which is how QYLD is able to pay a monthly dividend that currently has a double-digit yield base on the trailing twelve months (TTM). The trade-off is that a large portion of capital appreciation is capped if the market rallies because of the at-the-money-covered calls that are written on the underlying positions within QYLD.

JEPQ also invests in equities found within the Nasdaq 100 but has taken a different approach Global X as to how it generates its double-digit yielding income. JEPQ does utilize covered calls, but they do so by selling call options through equity-linked notes rather than on the entire portfolio. JEPQ has an 80/20 split where it invests at least 80% of its assets in equities securities, and the other 20% is allocated to ELNs. While the portfolio builds for QYLD and JEPQ may look similar, the mechanics of the fund are different where QYLD's capital appreciation is restrictive through its covered calls while JEPQ's income generation is predominantly confined to the ELN portion allowing the equity side to benefit from appreciation in the market.

JEPQ has been delivering capital appreciation and income for investors in 2023

2023 has been a strong year for the markets as they have rebounded off the bear market of 2022. As a baseline, the Invesco QQQ Trust ETF (QQQ) has appreciated by 39.68% YTD. QYLD has appreciated by 11.92%, while JEPQ is up 18.93% in 2023. JEPQ has appreciated by $7.70 from $40.67 to $48.37 while delivering $2.74 of dividend income. If you had invested in JEPQ on 1/3/23, JEPQ would have generated an income of 6.74% on invested capital for every share you purchased.

In the TTM, JEPQ has paid $5.64 of dividend income. This has created a TTM yield of 11.67% on shares of JEPQ. In 2023, JEPQ paid $2.74, which is 94.6% of the first 6 months of the TTM income ($2.90), indicating that JEPQ can continuously replicate its income characteristics. The dividend isn't stagnant throughout the year as it's predicated on the covered-call income produced within the ELNs rather than distributing a portion of EPS like traditional equities. While the dividend fluctuates with JEPQ, its strategy allows it to produce monthly income without sacrificing all the capital appreciation prospects.

Steven Fiorillo, Seeking Alpha

If you look at investing from the lens of a builder, there are different tools to complete different tasks. You won't pick up a hammer when you need a saw to cut a 2x4. The same holds true for investing, as different investors have different goals which require different investments. Some investors only want capital appreciation, some are income investors, and some take a hybrid approach. While JEPQ won't satisfy someone's needs who is focused on capital appreciation, the large yield should please income and hybrid investors, while the capital appreciation checks off the box for investors who want both income and prospects of capital appreciation. 2023 has shown us that in an upmarket, JEPQ can still deliver large amounts of income as it will still generate substantial premiums, just as when the market declines.

JEPQ is an attractive alternative to risk-free investments and still has prospects for capital appreciation

It's been quite a year for income investors, as you don't even have to work to find strong yields these days. The yield-starved environment that many got used to has vanished due to the Fed raising interest rates. Risk-free assets have become attractive once again as many CDs that offer in the mid to high 4% levels, and several that meet or exceed a 5% yield. A money market from Schwab with a $0 minimum investment will generate 4.93%, and parking money in a 10-year T-bill will generate a yield of 3.84%. From an income perspective, taking on equity risk to generate a low to mid-single-digit yield doesn't necessarily make sense when you can get 4.93% from money markets and 5%+ from CDs.

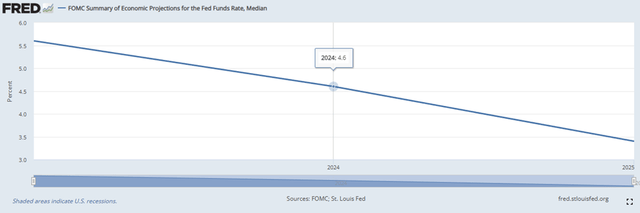

JEPQ provides an interesting alternative to risk-free income-producing investments because of the double-digit yield, and the prospects for capital appreciation. In the current environment, buying a Dividend King such as The Coca-Cola Company (KO) may not be as appealing, which yields 3.06% even though it has provided 60 years of dividend increases when you can get 5% without taking on equity exposure. When the yield changes to 11%, the conversation is a bit different because your able to generate more than double the highest risk-free yields and still benefit from an appreciating market. The Fed has indicated that there will be 2 more rate hikes, so investors will still have a chance to maximize their yields from risk-free assets, but the cuts are expected to decline in 2024. The St. Louis Fed indicates that rates will decline to 4.6% in 2024 and 3.4% in 2025. While 3.5% is still attractive, it makes higher-yielding income assets such as REITs, BDCs, and MLPs more appealing and ETFs such as JEPQ very attractive.

The real question is, can the market continue to appreciate, and can JEPQ continue to climb? While nobody can predict the future, several catalysts could contribute to the market continuing to appreciate throughout the year and into 2024. While inflation continues to trend downward, the Fed is continuing its hawkish stance and is adamant about raising rates. While some are pessimistic, this is a positive sign as it indicates the economy is strong and can continue to absorb increased rates. If the Fed pivoted and started to cut, it could be seen as bearish that the economy wasn't as strong as many have indicated, and the Fed was cutting to stimulate the economy. The market is forward-looking, has baked in additional hikes, and is signaling that in addition to the economy being able to absorb it, so can the market.

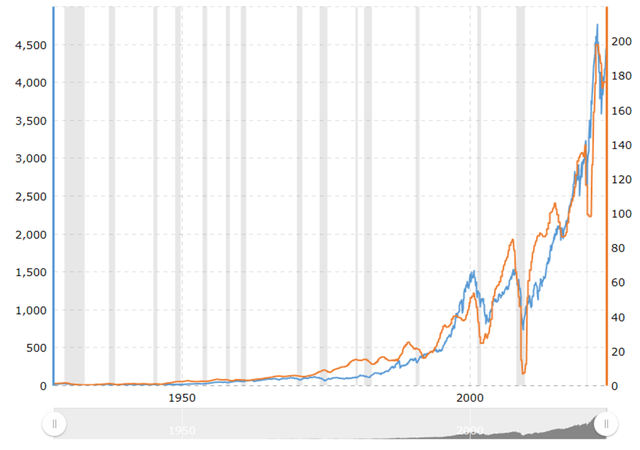

S&P 500 Earnings - 90-Year Historical Chart

S&P 500 earnings are bouncing off the recent lows during the height of inflation. Forward estimates for Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta Platforms (META), Tesla (TSLA), and Nvidia (NVDA) look strong and could carry the market higher, especially the Nasdaq. These 7 companies represent 45.13% of JEPQs portfolio, so if they rally, JEPQ should continue to appreciate. When I look at the analyst consensus estimates out to 2025, things look bright for big tech. With all of its top holdings projected to see large EPS increases, the market could move higher, and JEPQ right along with it.

• AAPL $5.97 in 2023 to $7.14 in 2025, 19.6% increase

• MSFT $9.64 in 2023 to $12.54 in 2025, 30.08% increase

• AMZN $1.43 in 2023 to $3.55 in 2025, 148.25% increase

• GOOGL $5.28 in 2023 to $7.34 in 2025, 39.02% increase

• META $9.78 in 2023 to $14.70 in 2025, 50.31% increase

• NVDA $7.78 in 2023 to $12.52 in 2025, 60.93% increase

• TSLA $3.51 in 2023 to $6.18 in 2025, 76.07% increase

In 2024 the Fed is also projected to start cutting rates. This will make the cost of capital less, and companies will be more incentivized to expand as growth becomes less prohibited. This could lead to 2 things. First, if companies utilize the lower cost of capital to expand, they will be spending money, and this could drive earnings higher for companies such as AAPL and MSFT. The second aspect is that when the Fed lowers rates, risk-free assets become less attractive, and money from the sidelines could flow into equities, which could drive the markets higher.

Conclusion

JEPQ has delivered for investors focused on larger amounts of income than risk-free assets offer while benefiting from appreciating markets. JEPQ has generated a 6.74% yield on invested capital since the beginning of 2023 ($2.74 / $40.67) and is on track to deliver double-digit yields for 2023 based on historical data. JEPQ can continue to appreciate with the markets as 45.13% of its holdings are tied to the magnificent 7 as AAPL, MSFT, GOOGL, AMZN, META, TSLA, and NVDA are being named. The main difference between JEPQ and other high-yield ETFs is that JEPQ doesn't cap the equity side of its holdings by writing covered calls against them as it generates income from the ELN side. This allows JEPQ to benefit more than others during times of appreciation, and if big tech leads the way, JEPQ will follow. While we could see retracements in the market, I feel that they will end 2023 higher and extend their rally into 2024. Investors who want a combination of high-yield and capital appreciation in the same fund should consider JEPQ, as it's set up to deliver on both.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JEPQ, QYLD, AAPL, MSFT, GOOGL, AMZN, TSLA, META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

What is the downside in the worst case scenario. Is it a fund to hang on to at the bottom of the market?

What are the taxes in a taxable non-IRA account?