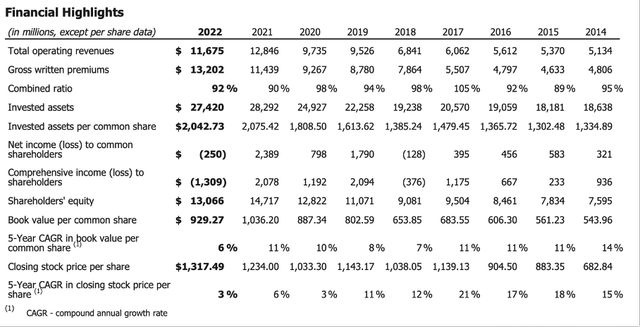

Markel: An Undervalued Financial Holding Company

Summary

- Markel is a financial holding company consisting of three "financial engines" - insurance, investments, and ventures.

- The company could report a great first quarter for fiscal 2023, following a mediocre fiscal 2022, but we should look at the long-term picture.

- As the company is operating in a niche, we can argue for a wide economic moat around the business.

- And even when assuming rather moderate assumptions, the stock seems to be undervalued right now.

CatLane

In the last few weeks, I added two new companies - Brookfield Asset Management (BAM) as well as Dolby Laboratories (DLB) - to my watchlist (or list of stocks I keep a close eye on). With the following article, I will add another company - the insurance and investment company Markel Group Inc. (NYSE:MKL). The company is often compared to Berkshire Hathaway (BRK.A) (BRK.B) as it has a similar business model. And as Berkshire Hathaway is, without doubt, one of the great businesses, Markel certainly deserves a closer look.

Business Description

Markel Corporation was founded in 1930 as a specialty insurance company and is today a diverse financial holding company with more than 20,000 employees headquartered in Richmond, Virginia. The company had its IPO in 1986, and the stock was first listed on Nasdaq but moved to the New York Stock Exchange in 1997. In 2023, Markel Corporation changed its name to Markel Group Inc.

When looking at the first quarter results for fiscal 2023, total operating revenues were $3,643 million compared to $2,606 million in the same quarter last year - resulting in 39.8% year-over-year growth. This is resulting in higher earned premiums (11.8% growth), higher net investment income (72.6% growth), and higher product revenues (20.0% growth), but the biggest part is stemming from $373 million in net investment gains - compared to $358 million in losses in the same quarter last year. And instead of an operating loss of $40 million in the same quarter last year, the company reported $754 million in operating profit. And instead of a diluted loss per common share of $6.50 in Q1/22, the company reported $37.26 in diluted net income per share in Q1/23.

But Markel is a business with little consistency on a year-over-year or quarter-over-quarter basis. One of the reasons is a problem Markel and other businesses structured in a similar way have. According to GAAP, unrealized losses must be included in the income statement, but this might sometimes give an inaccurate description of the business. Thomas S. Gayner, Markel's CEO, is distinguishing between two different kinds of revenue - orange revenues and blue revenues. Unrealized losses from the equity portfolio, for example, are "blue revenue" and, by nature, this number can be highly volatile as financial markets are volatile. Orange revenues are consisting of sales of products and services of the different companies (Markel Venture), dividend and interest income as well as insurance premiums and fee income. These "orange revenues" should be less volatile.

Therefore, it makes sense to look at longer timeframes and compare numbers not just year-over-year but look at least at one decade to get a better picture of the business.

The holding group consists of three major business segments (or three financial engines as the company calls it):

- Insurance: This business markets and underwrites specialty insurance products.

- Investments: Similar to Berkshire Hathaway, Markel used the premiums paid by policyholders to invest in diversified assets (including bonds and equities) to generate long-term returns.

- Ventures: Through the Markel Ventures operations, the company owns controlling interests in a diverse portfolio of businesses operating in a variety of industries (all non-insurance companies).

We are now looking at the three financial engines in more detail, starting with the insurance business.

Insurance Business

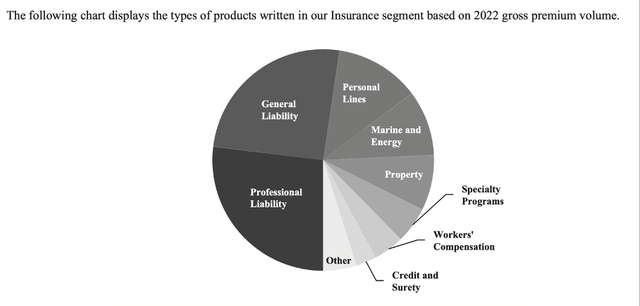

The insurance engine is comprised of three different operations - underwriting, insurance-linked securities, and program services. Markel is focusing on the specialty insurance market and is, therefore, focused on a niche market. Examples include liability coverage for highly specialized professionals, wind and earthquake-exposed commercial properties, transaction-related risks, classic cars, or credit-related risks.

When looking at the underwriting segments and the insurance segment (which is responsible for more than 80% of profits and earned premiums), we get the following distribution between the different types of products written in the Insurance segment.

And in fiscal 2022, the business segment generated $7.6 billion in earned premiums, which is an increase of 17% compared to $6.5 billion in fiscal 2021. The company also reported $627 million in underwriting profits - almost the same as in 2021 ($628 million).

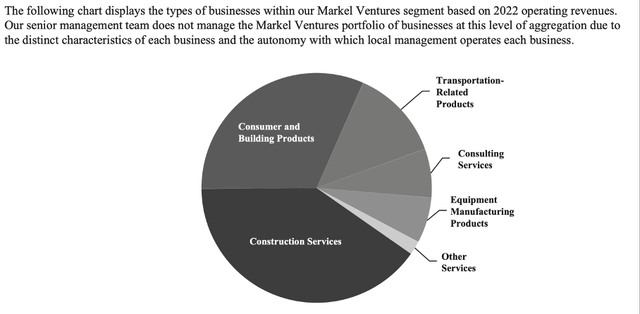

Markel Ventures

Markel Ventures was started in 2005 and, through the wholly-owned subsidiary Markel Ventures, Inc., the company is owning controlling interests in different businesses that are operating in a variety of industries. Similar to Buffett's and Munger's approach, management teams for each business operate autonomously with the holding company not interfering.

Markel Ventures consists of 19 businesses right now. And when looking at the operating revenue in 2022, the biggest part stemmed from "Consumer and Building Products" as well as "Construction Services" (both being responsible for about two-thirds of operating revenue).

In 2022, Markel Ventures earned operating revenues of $4.8 billion, and compared to $3.6 billion in 2021, this is an increase of 31%. And according to the differentiation in orange and blue revenue above, this is all orange revenue. EBITDA increased from $403 million in 2021 to $506 million in 2022 - resulting in 26% year-over-year growth.

Investment Engine

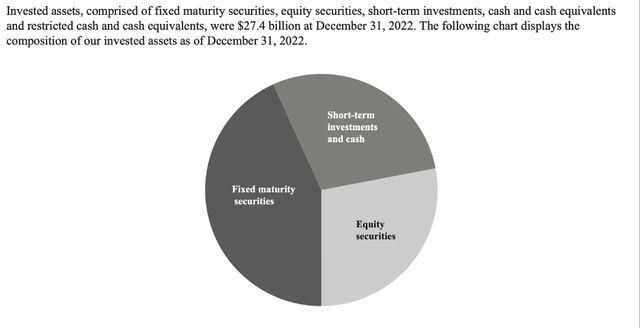

Also similar to Berkshire Hathaway, Markel is not only trying to own controlling interests in businesses, but it is also investing in liquid financial assets like fixed maturity securities or equities.

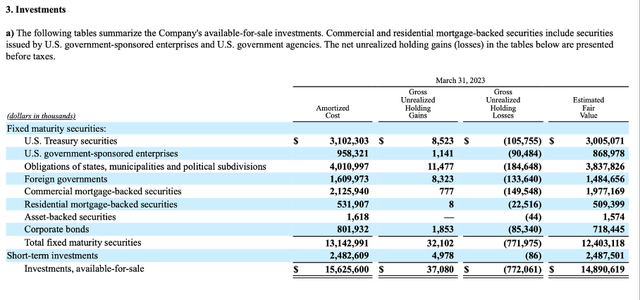

On March 31, 2023, the company had $4,032 million in cash and cash equivalents on its balance sheet. Additionally, Markel had $2,488 million in short-term investments, $12,403 million in fixed-maturity securities, and $8,113 million in equity securities.

When looking at the fixed-maturity securities, the company has about $3 billion in U.S. Treasury securities and about $3.8 billion in obligations of states, municipalities, and political subdivisions on its balance sheet. Almost $2 billion are also commercial mortgage-backed securities and about $1.5 billion are foreign government bonds.

When looking at the equity portfolio, we see many well-known names and many companies I have covered here on Seeking Alpha. The biggest position is Berkshire Hathaway (about 13% of the equity portfolio is invested in A shares and B shares). Additional major investments are, for example, Alphabet (GOOG), Brookfield Corporation (BN), Home Depot (HD), and Diageo (DEO) (each between 3% and 4% of total equity portfolio). And we can also find many more companies which I would ascribe a wide economic moat to: Novo Nordisk (NVO), Microsoft (MSFT), BlackRock (BLK), and Visa (V).

In 2022, the investment operations earned interest and dividends of $447 million compared to $367 million a year ago - resulting in an increase of 22%. And while this "orange revenue" was positive, this segment was also responsible for the overall horrible results in 2022. The total return of the equity portfolio was a decline of 16.0% resulting in $1,596 million in unrealized losses from investments.

Economic Moat

When analyzing a new company, one of the most important aspects is the economic moat around a business. Aside from a few exceptions, I try to include only businesses with a wide economic moat in my portfolio and we, therefore, must look for competitive advantages. For starters, Markel is often compared with Berkshire Hathaway, and Berkshire is viewed as a business with a wide and deep moat around its business. And I would argue for Markel to have an economic moat as well, but we must take a closer look.

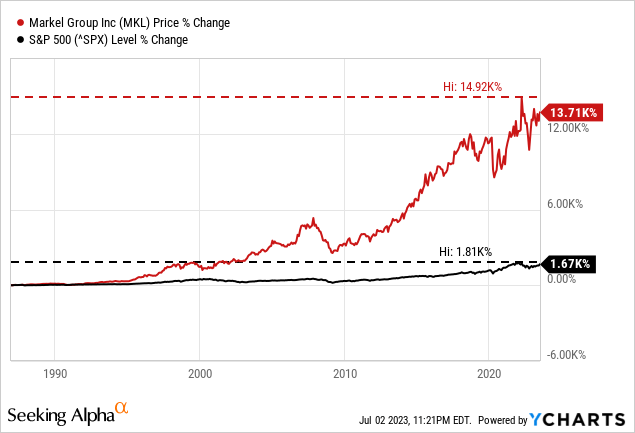

One strong hint for a wide economic moat around the business is the outperformance of the stock since its IPO in 1986. While the S&P 500 gained 1,670% in the last 37 years, Markel Group clearly outperformed in an impressive way and gained 13,710% (it would be better to look at total return, but I could not find the data since 1986 - but Markel would have outperformed as well). And while a stock can outperform the S&P 500 for several different reasons - and without an economic moat - an outperformance over several decades without some structural advantage is rather seldom.

And especially the insurance business is a segment in which companies rather struggle to create a wide economic moat around the business. Insurance is a commodity-like industry and it is difficult for the companies to differentiate according to quality aspects. As a result, the price is usually the main criteria for customers to make decision, and for businesses, it is rather difficult to achieve (and remain) pricing power.

But Markel is focusing on certain niches in the market, which is generating a competitive advantage (statement from Annual Report):

By focusing on market niches where we have underwriting expertise, and leveraging capabilities offered through our multiple insurance platforms, we seek to earn consistent underwriting profits, which are a key component of our strategy.

Operating in a market niche can often generate cost advantages for a business. These are often rather small companies operating in small markets, but these companies often have a relatively large market share or sometimes even a near-monopoly position. Being market leader in a specific market segment can lead to huge advantages. When markets are only big enough to allow just one company to be profitable, it doesn't make much sense for a new entrant to enter the market and destroy profitability for both companies. As these are also rather small markets, big corporations are usually not interested in entering the market as the potential profits are not high enough.

And the specialty insurance market differs from the standard insurance market. In the standard market, insurance rates and forms are highly regulated, and companies tend to compete on the basis of price. The specialty market, however, provides coverage for hard-to-place risks which don't fit the underwriting criteria of standard carriers. And this is generating a competitive advantage for Markel as the company has the necessary expertise and extensive knowledge in these markets. Many of the solutions are customized and this makes it more difficult to find alternatives and compare prices and is leading to a competitive advantage for the business.

And while we mentioned above that Markel is missing the stability and continuity on a year-over-year basis, the business model with the three different business segments is contributing to stability and consistency for the business over a long timeframe - as described in the annual letter:

How we remain resilient, durable, and growing, stems from our integrated architectural design of the three-engine system. Our combination of Insurance, Markel Ventures, and Investments work together to support and reinforce each other continuously.

For example, all three engines benefit from the excess cash that each generates. The cash flows to the holding company where we allocate it across our 360-degree view of options, using our four-part catechism. We can lean into and pursue any rational opportunity we find. Our system and a broad range of operations, in and of itself, exposes us to a never-ending array of opportunities. The system should continue to do so.

Intrinsic Value Calculation

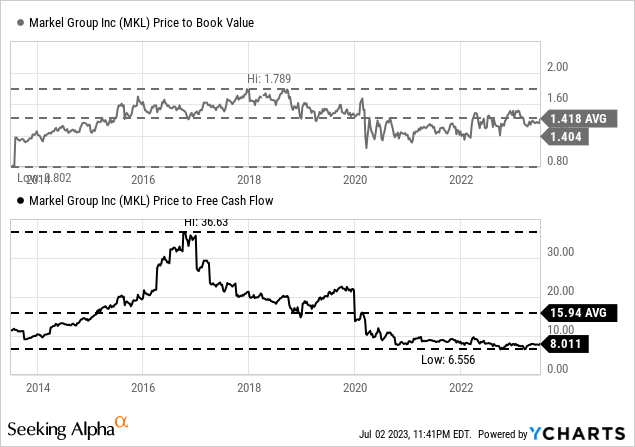

One final step in every analysis is determining a price target for the stock or calculating an intrinsic value. And in the case of Markel, I find it rather difficult to provide a compelling intrinsic value calculation. Let's start by looking at simple valuation metrics to get a first feeling about the stock. In the case of Markel, it can make sense to look at the price-to-book value ratio - a ratio I use rather seldom. In the last ten years, the stock was trading for an average P/BV ratio of 1.41, and right now, the stock is trading for 1.40 times book value. So according to this metric, the stock is neither cheap nor expensive.

The picture is getting different when looking at the price-free-cash-flow ratio. Markel is trading only for 8 times free cash flow and very close to the lowest ratio in the last 10 years and clearly below the average of the last ten years (15.94). From this point of view, Markel seems extremely undervalued - especially for a company that is targeting high growth rates.

But there seems to be a reason for the extremely low P/FCF ratio - the free cash flow in the last four quarters was probably an outlier, and we see huge fluctuations in the last few years making it difficult to provide reasonable predictions for a discount cash flow calculation. In the following section, I will calculate several different intrinsic values by using different assumptions. We calculate with 13.5 million outstanding shares and - as always - with a 10% discount rate.

As a basis for our calculation, we can take the average free cash flow of the last five years, which was $1,631 million. And although this is below the free cash flow of the last four quarters, it seems rather optimistic. Additionally, we can also take the net income of the last five years, which was $920 million, as a basis. And finally, I will also calculate with the average net income of the last 10 years, which was $673 million. A second important assumption we must make is a growth rate that seems realistic in the years to come. In the last five years, Markel could grow its book value with a CAGR of 6%, revenue growth in the last three years was 7.5%. And, therefore, calculating with either 5% or 6% growth till perpetuity seems like a realistic (and still cautious) assumption. But when looking at the past growth rates, we can be more optimistic and, therefore, assume 10% growth for the next ten years, followed by 6% growth till perpetuity.

Growth Rates | $673 million | $920 million | $1,631 million |

|---|---|---|---|

5% growth till perpetuity | $997 | $1,362 | $2,416 |

6% growth till perpetuity | $1,246 | $1,704 | $3,020 |

10% growth next 10 years, 6% perpetuity | $1,654 | $2,261 | $4,009 |

When looking at past growth rates and the ambitions of Markel, we can make the case for rather high growth rates, and when looking at the different calculations above, Markel would be overvalued in only two cases (out of nine calculations). It seems more reasonable right now to see Markel as undervalued - and maybe the stock is even deeply undervalued as the assumptions can be seen as rather cautious in most cases.

Conclusion

Markel has been struggling in the last few quarters - but this was mostly due to the unrealized losses that must be included due to GAAP accounting standards. In my opinion, Markel is rather undervalued than overvalued, and we could actually look at a bargain.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (1)