JPXN Is One Way To Gain Exposure To Japan

Summary

- We discuss the potential of investing in the Japanese stock market, particularly through BlackRock's iShares JPX-Nikkei 400 ETF, which tracks the Nikkei Index and holds 393 companies.

- The Japanese economy has lower inflation than many other large OECD economies and a low unemployment rate but faces a demographic challenge with a declining birth rate and insufficient immigration.

- The gap between JPXN and SPY could narrow as institutional investors potentially move more of their portfolio to the equity market, but there may be impact from changes in foreign exchange.

DoctorEgg

Investment Thesis

We are often told that the stock market is good for long-term investments.

There is both truth and falsehood in such a general statement. It reminds me of what a good friend told me some years ago. He said that he had made a short-term speculation on a stock that turned into a long-term investment. It was clear that the price had tanked and my friend had fallen into the anchoring biases waiting for the price to recover so that he could get rid of the shares. As if the market cared what he had paid for it.

One classic example of this is if you had bought the Nikkei Index as a Christmas gift in 1989 and held it until today – you would have lost 14.7%

Nikkei 225 lost 14% since 1989 (Yahoo Finance)

That is not good when you consider that $1 in 1989 is equivalent in purchasing power to about $2.45 today, according to the CPI inflation calculator.

There were plenty of warning lights that should have put people off from buying into the Japanese stock market at the peak of what was a tremendous bubble. A cyclically adjusted price to earnings, or CAPE, does matter. It had elevated to 77 by the end of 1989. CAPE for the S&P500 was just below 20. The Japanese market even revisited these high CAPE numbers between 2000 and 2008.

CAPE of Nikkei 225 versus S&P 500 (Barclays)

After the GFC, the valuations of Japanese stocks have become more attractive.

It is easy to understand why the Japanese stock market, despite its large size, was not popular with investors in the past. However, the past is the past and should only serve as a great lesson to investors.

What about the future? Is Japan more investable now?

Why buy an ETF as opposed to individual stocks in Japan?

We cover some of Blackrock’s iShares ETFs for various stock markets in Asia. These are for the stock market in China (CNYA), Hong Kong (EWH), and Singapore (EWS). In addition, we do cover some Japanese companies such as Mitsubishi UFJ Financial Group (MUFG) and Mitsubishi Corporation. (OTCPK:MSBHF)

It is not for everybody to invest in individual stocks. We are also humble enough to admit that it is very difficult to find alpha from stock picking.

Blackrock does have an ETF for the large and mid-cap Japanese stocks called iShares JPX-Nikkei 400 ETF (NYSEARCA:JPXN). This ETF aims to track the broad-based Nikkei Index while still selectively choosing companies that are profitable and shareholder-friendly. According to BlackRock (BLK), these companies should also deliver an acceptable return on equity.

The ETF holds 393 companies in the fund in order to closely track the Nikkei 400. Here is a list of the largest 10 positions in the fund:

JPXN - top 10 holdings (Blackrock)

The NAV of the fund is $89.3 million with the NAV per unit of $66.43 which is close to the share price of $66.16 as of the 3rd of July 2023.

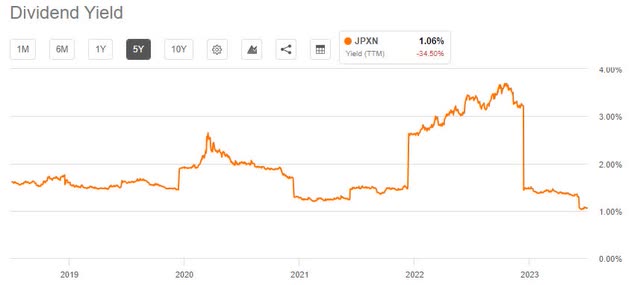

The expense ratio for the fund is 0.48%, and the dividend yield over the last five years has been between 1% and 2%, except for last year when it was above 3%.

JPXN's 5-year dividend history (SA)

Japan’s Economy

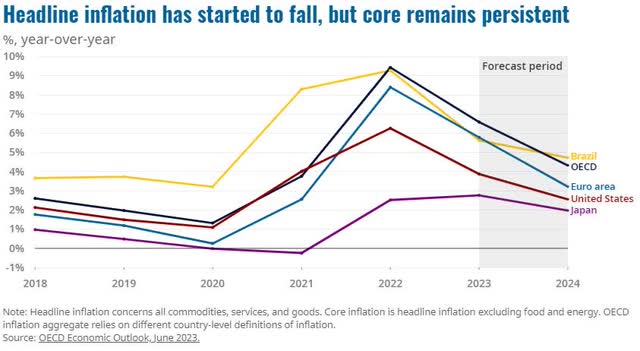

One positive aspect of the Japanese economy has been its lower inflation than many other large OECD economies.

Japan's low headline inflation compared to other OECD countries (OECD)

As a result of the lower inflation, the Japanese central bank has kept its ultra-low interest rate pretty much unchanged. On the 16th of June, the policy board of BOJ decided to keep their policy interest rate at minus 0.1%.

They will continue with Quantitative and Qualitative Monetary Easing (QQE) and with a Yield Curve Control, aiming to achieve price stability.

In terms of GDP growth, according to OECD's June report on their outlook, they have a projection of Japan’s GDP to grow 1.3% this year and 1.1% in 2024.

Japan’s unemployment rate is also fairly low at just 2.6%, as of May 2023.

The broader picture is that we expect that the world is going to enter a period of a super-cycle in new large capital investments in equipment that will change mobility, industries, mining and energy, and technology for two different reasons. These investments will come from both governments and the private sector.

- Decarbonization.

We have just published an analysis of how the shipping industry is now in the middle of huge changes in terms of reducing its large carbon footprint. Hundreds of billions of dollars will be required to complete this transformation. The same is happening in large polluting industries like mining, steel manufacturing, chemical, and cement manufacturing.

- Diversify supply chains.

The world had become very dependent on the supply of everything from pumps to microchips produced in China and Taiwan. The strict restrictions they put on the movements of people during the pandemic caused huge interruptions to manufacturing over the last two years. The implication was felt globally. This has prompted global companies to diversify their supply chain. The Russian invasion of Ukraine was the next geopolitical event that put a higher importance on companies and countries' need to become more antifragile.

We have just started this journey, and the winners from these huge investments will be large companies that manufacture machinery, new power equipment, technology including microchips, military equipment, and so forth.

Japan does have a large high-technology manufacturing base with several companies that should benefit from this. To name some, we would mention MSBHF, HTHIY, TOELF, and KYCCF.

Risks and Conclusion

We have often reminded our readers that Japan has a demographic challenge with a declining birth rate. Contrary to some other countries with declining birthrates, Japan does not have enough immigration to make up for the loss.

However, although the population is shrinking and as such the number of individual taxpayers fall, Japan has always been good at exporting and setting up businesses oversea. Therefore, this shrinking population should not be much risk to their companies' profitability.

However, the share price of JPXN has lagged SPY quite a lot over the last five years.

Comparison between JPXN and SPY (SA)

JPXN has been up just 3.4% against SPY adding on a healthy 62% over a five-year period.

We could see the gap between the SPY and JPXN narrow going forward as institutional investors, such as large life insurance companies and pension funds potentially move more of their portfolio away from fixed income to the equity market.

One important factor to keep in mind when investing in markets that are not in your own home market is the impact of changes to foreign exchange. Although JPXN is in USD, the underlying assets and its dividends are derived from the Japanese Yen.

The Japanese Yen has weakened over the last seven months. Should this trend continue, it will be negative for JPXN.

Our stance is that of a Hold for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.