Envestnet Guides To Slow Revenue Growth In 2023

Summary

- Envestnet provides a suite of wealth management software and related services in the U.S. and overseas.

- The company is exposed to the challenged banking sector in its customer base, and management has guided to only 2% topline revenue growth in 2023.

- Until leadership proves its ability to reignite revenue growth, I'm Neutral (Hold) on Envestnet.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

Blue Planet Studio

A Quick Take On Envestnet

Envestnet, Inc. (NYSE:ENV) reported its Q1 2023 financial results on May 4, 2023, missing revenue estimates but beating expected earnings.

The company provides a suite of wealth management and data software and services worldwide.

While Envestnet, Inc. management is continuing to invest in bringing new capabilities to its suite of offerings, until it proves that it can reignite topline revenue growth, I'm Neutral (Hold) on ENV.

Envestnet Overview

Chicago, Illinois-based Envestnet was founded in 1999 to provide a variety of wealth management and data software applications to investment managers and traders.

The firm is headed by Co-founder and Chief Executive Officer, Bill Crager, who was previously a Managing Director at Nuveen.

The company's primary offerings include:

Wealth Solutions

Data & Analytics

Tamarac

MoneyGuide

Retirement Solutions

Portfolio Management Consultants

Trust Services

Insurance Exchange

Advisor Services Exchange

The firm seeks clients among registered investment advisors, broker-dealer representatives, and various types of institutional investors in the U.S. and internationally.

ENV recently announced its plans to expand into the small and mid-size market through offering "data and digital solutions" to business owners by partnering with upSWOT, a platform that connects over 150 SaaS products with SMB clients.

Envestnet's Market & Competition

According to a 2019 market research report by Grand View Research, the global wealth management software market is projected to reach $5.8 billion by 2025, growing at a CAGR of 15.3% between 2019 and 2025.

The main factor driving market growth is the growing need for digital tools that can automate the wealth management process.

The financial advice and management segment is anticipated to grow at the fastest CAGR of 16.0% during the period due to the growing demand for tools to manage finances.

Major competitors that provide or are developing wealth management solutions include:

Fiserv

Temenos Headquarters

Fidelity National Information Services

Profile Software

SS&C Technologies

- SEI Investment

- Finantix

Comarch

AssetMark Financial

Dynasty Financial Partners

Envestnet's Recent Financial Trends

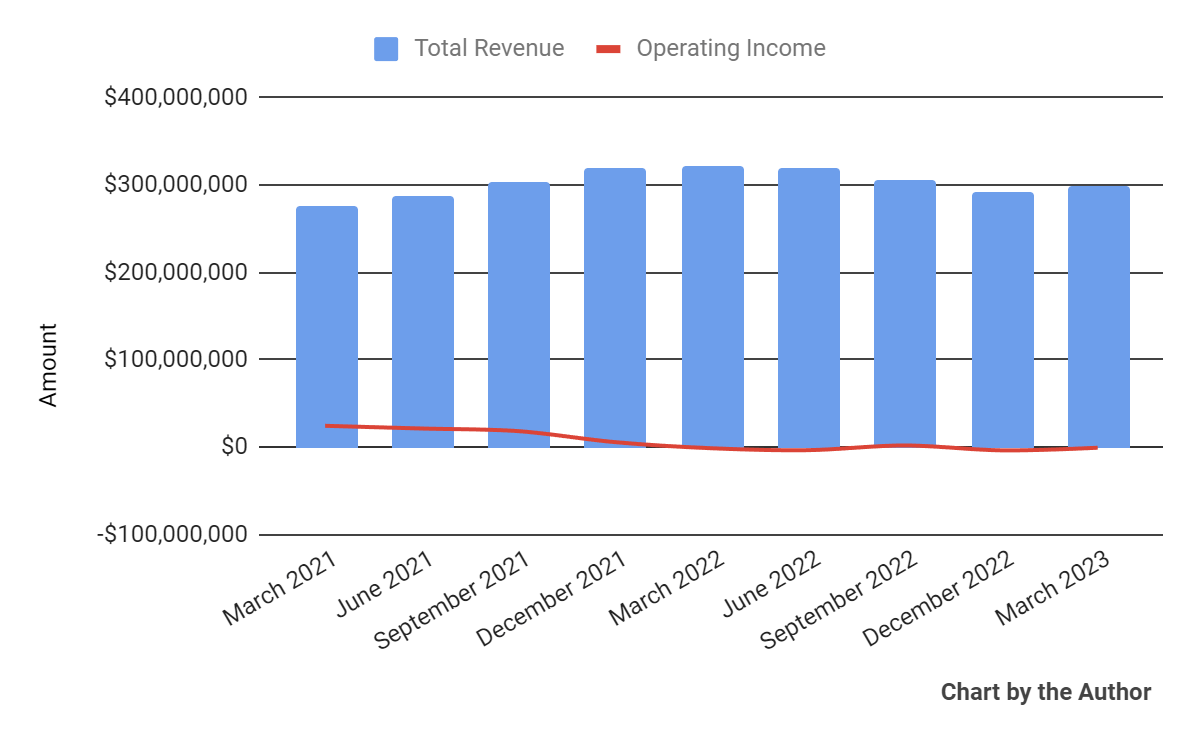

Total revenue by quarter has dropped in recent quarters; operating income by quarter has trended lower more recently.

Total Revenue and Operating Income (Seeking Alpha)

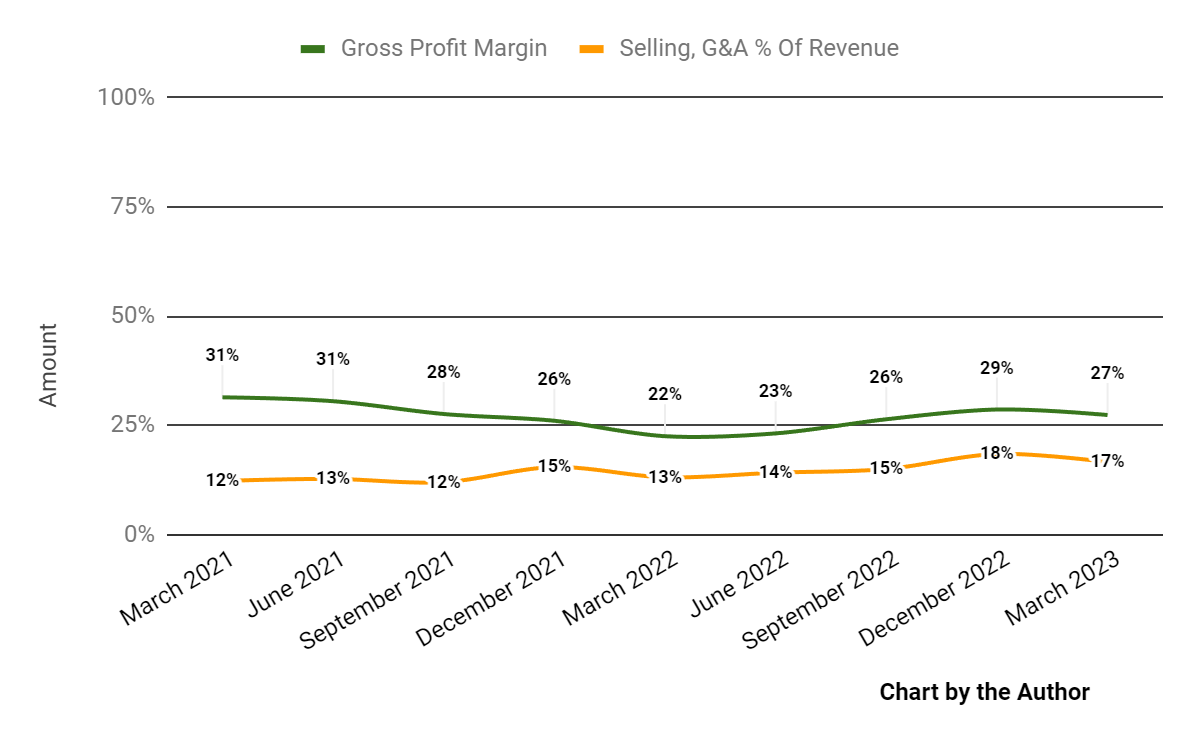

Gross profit margin by quarter has rebounded in recent quarters; Selling, G&A expenses as a percentage of total revenue by quarter have trended higher recently, a negative signal indicating lower efficiency in generating incremental revenue.

Gross Profit Margin and Selling, G&A % Of Revenue (Seeking Alpha)

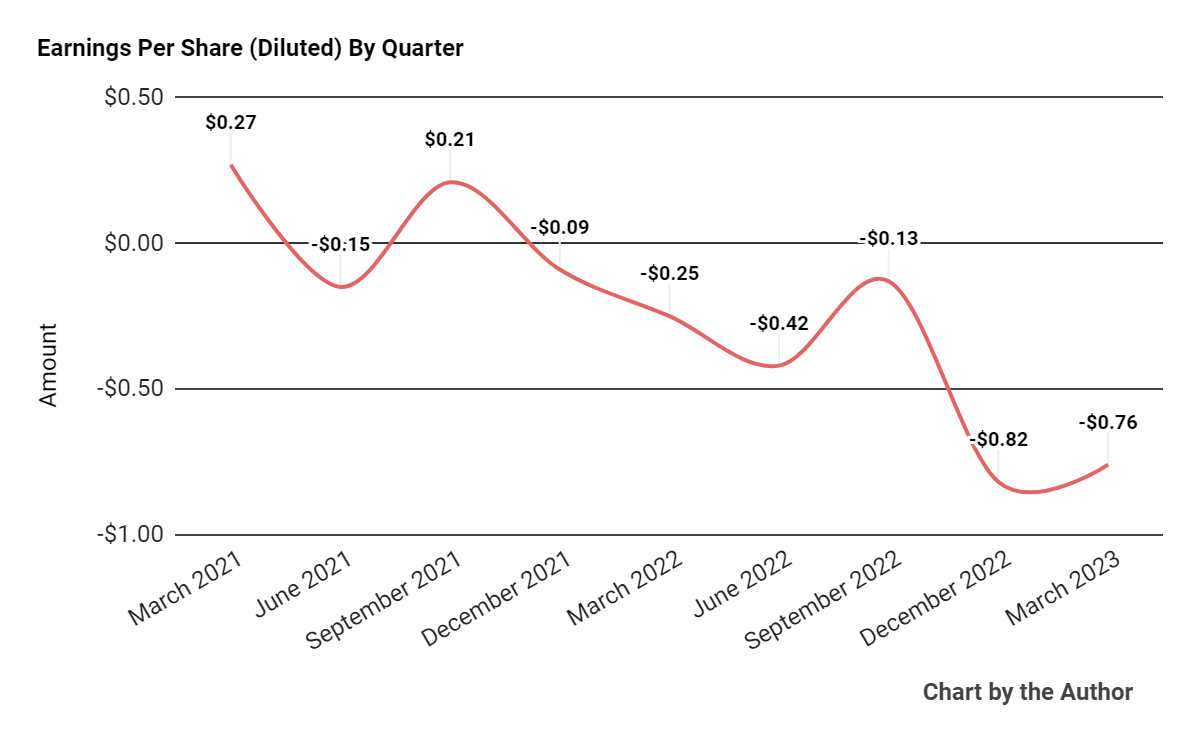

Earnings per share (Diluted) have trended materially lower in recent quarters.

Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

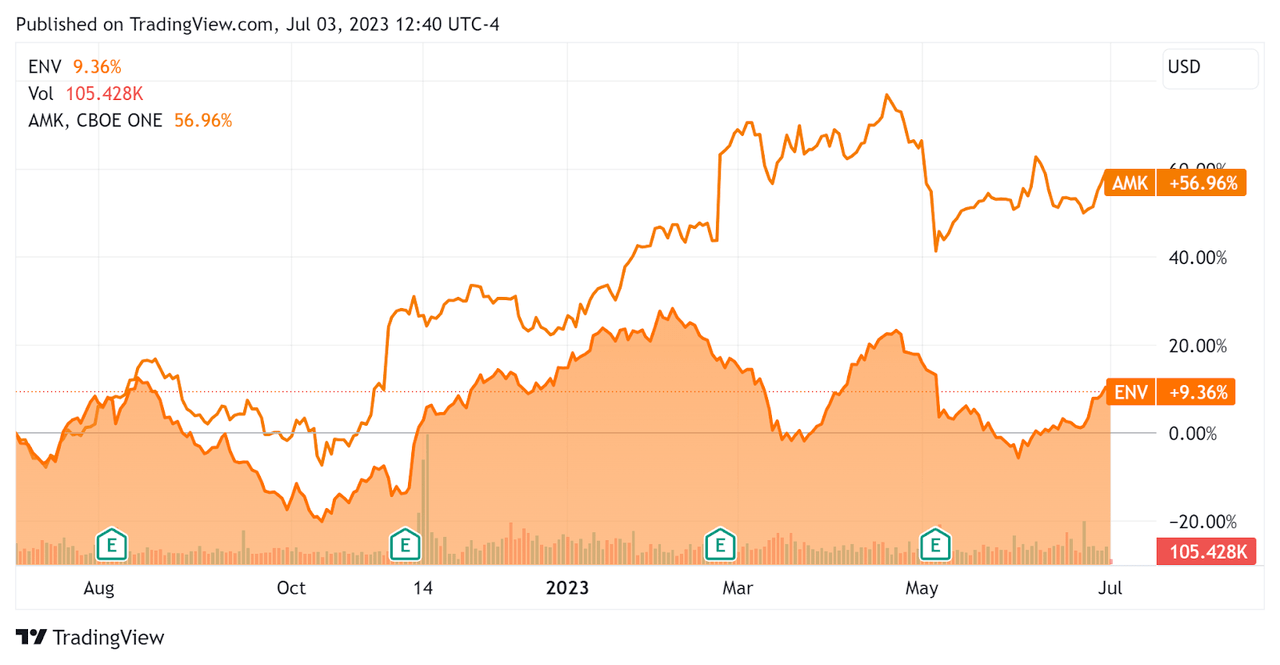

In the past 12 months, ENV's stock price has risen only 9.36% vs. that of AssetMark Financial Holdings, Inc.'s (AMK) impressive rise of 56.96%, as the chart indicates below.

52-Week Stock Price Comparison (Seeking Alpha)

For the balance sheet, the firm ended the quarter with $52.7 million in cash and equivalents and $918 million in total debt, of which $45.0 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was $63.6 million, during which capital expenditures were $16.7 million. The company paid $78.0 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For Envestnet

Below is a table of relevant capitalization and valuation figures for the company.

Measure (TTM) | Amount |

Enterprise Value/Sales | 3.4 |

Enterprise Value/EBITDA | 44.4 |

Price/Sales | 2.6 |

Revenue Growth Rate | -1.3% |

Net Income Margin | -8.9% |

EBITDA % | 7.7% |

Net Debt To Annual EBITDA | 9.2 |

Market Capitalization | $3,160,000,000 |

Enterprise Value | $4,150,000,000 |

Operating Cash Flow | $80,260,000 |

Earnings Per Share (Fully Diluted) | -$2.13 |

(Source - Seeking Alpha)

As a reference, a relevant partial public comparable would be AssetMark Financial Holdings; shown below is a comparison of their primary valuation metrics.

Metric (TTM) | AssetMark Financial | Envestnet | Variance |

Enterprise Value/Sales | 3.4 | 3.4 | 1.2% |

Enterprise Value/EBITDA | 12.4 | 44.4 | 257.7% |

Revenue Growth Rate | 15.5% | -1.3% | --% |

Net Income Margin | 15.2% | -8.9% | --% |

Operating Cash Flow | $154,000,000 | $80,260,000 | -47.9% |

(Source - Seeking Alpha)

Commentary On Envestnet

In its last earnings call (Source - Seeking Alpha), covering Q1 2023's results, management highlighted the firm's current focus on creating operating efficiencies and maximizing expense reduction efforts in the near term.

Q1 revenue was "essentially in line" despite headwinds from its banking customer vertical.

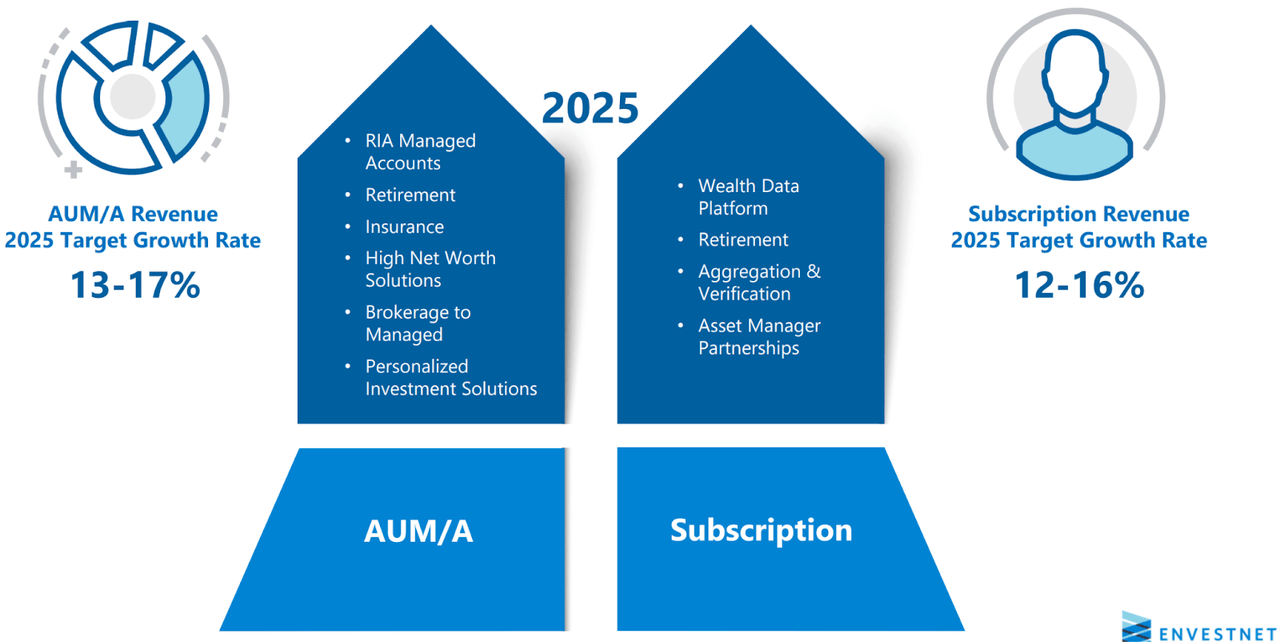

Despite these near-term challenges, management continues to be positive about the long-term growth prospects in the U.S., whether through its asset management platform or wealth data solutions, as its communication below shows:

Segment Growth Targets (Envestnet)

Management did not disclose any company or customer retention rate metrics.

Total revenue for Q1 2023 fell by 7.1% year-over-year, while gross profit margin increased by 4.9%.

Selling, G&A expenses as a percentage of revenue increased 3.5 percentage points YoY, a negative signal indicating reduced selling efficiency while operating losses were pared by 46% YoY.

Looking ahead, for the full year, management guided revenue to $1.265 billion, or approximately 2% topline growth. EPS is expected to be $2.15 for 2023.

The company's financial position is moderate, with some liquidity, significant long-term debt, and reasonably strong free cash flow for its size. ENV's net leverage ratio was 4x EBITDA, and management expects this ratio to be "below 3.5x" by year-end.

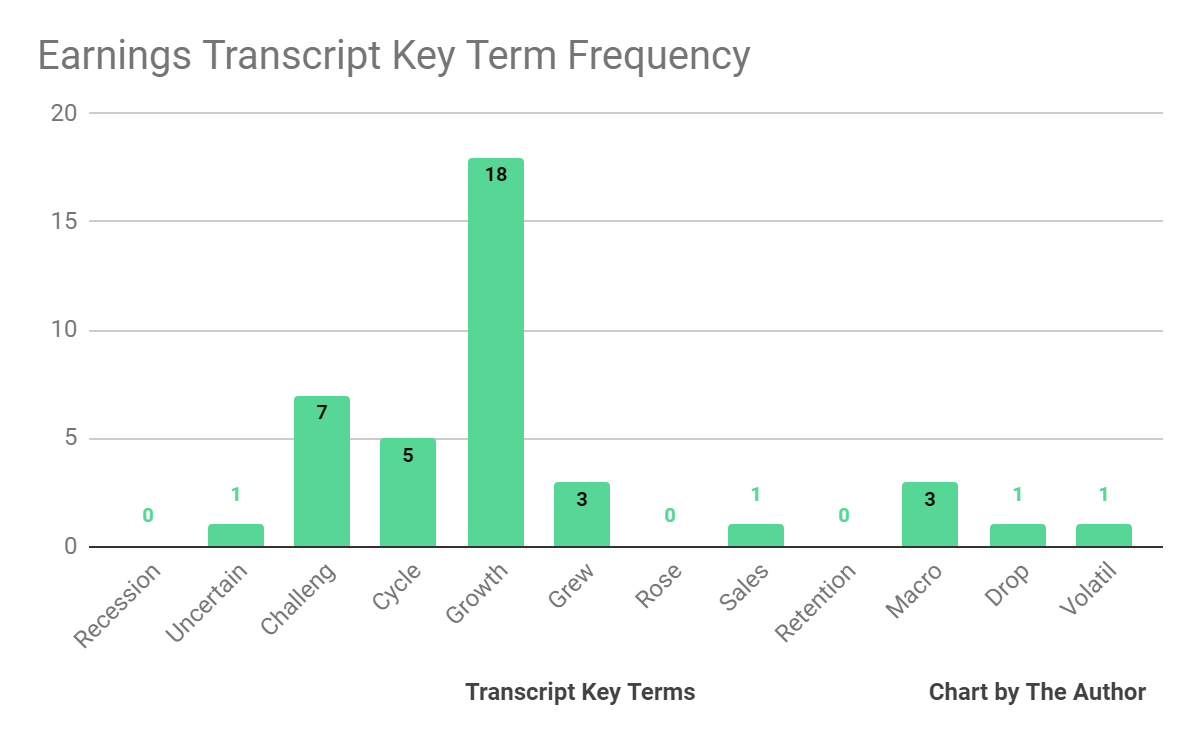

From management's most recent earnings call, I prepared a chart showing the frequency of key terms mentioned (or not) in the call, as shown below.

Earnings Transcript Key Terms Frequency (Seeking Alpha)

I'm most interested in the frequency of potentially negative terms, so management or analyst questions cited "Uncertain" once, "Challeng(es)(ing)" seven times, "Macro" three times, "Drop" once and "Volatil(e)(ity)" once.

The negative terms refer in part to the volatile environment its banking customer base has experienced in the past several months and may continue to experience in terms of deposit flight.

Analysts questioned company leadership about its use of AI technologies. Leadership responded with its lengthy history in surfacing insights for advisors; also, the company seeks to integrate automation processes to reduce regulation compliance costs for its customers.

Regarding valuation, the market is valuing ENV at a much higher EV/EBITDA than competitor AssetMark Financial, despite AMK's revenue growth and positive earnings.

While management is continuing to invest in bringing new capabilities to its suite of offerings, until it proves that it can reignite topline revenue growth, I'm Neutral (Hold) on Envestnet, Inc. stock.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.