VICI Properties: Not Many REITs Have Such A Wide Moat

Summary

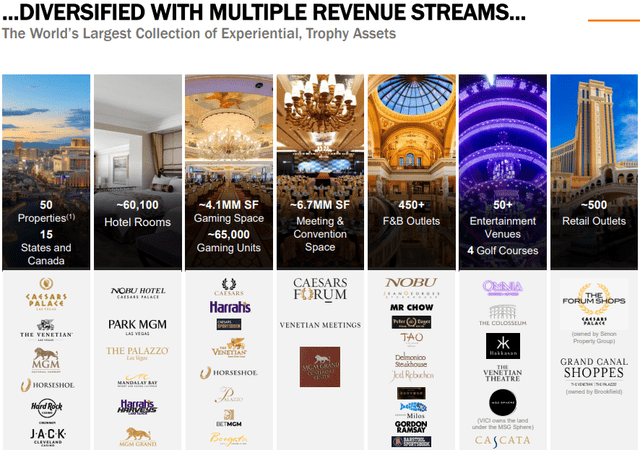

- VICI Properties, the leading gaming REIT and owner of iconic assets like Caesar's Palace, The Venetian, MGM Grand, and Mandalay Bay, provides investors with a unique opportunity.

- Unlike most REITs, VICI has a wide moat and possesses a significant competitive advantage in the form of a cornered resource.

- As Las Vegas is booming and VICI's portfolio steadily appreciates in value, the company has significant pillars for continued growth, through international expansion, non-gaming ambitions, and existing portfolio enhancements.

- The company is fairly valued at around a 14.9 forward P/FFO and a 5.0% dividend yield. Yet, investors can still expect a safe high-single-digit annual return through dividends, rent increases, and deleveraging.

- Therefore, I rate the stock a Buy.

Ivan Grabilin

VICI Properties (NYSE:VICI) has something, not too many other REITs have - a wide moat. Its current portfolio of assets is of such high quality, even if VICI stopped expanding and just kept on holding to existing assets it would probably be able to provide investors with a decent return.

With 100% occupancy rates and 100% rent collection even throughout the pandemic, it's no surprise VICI was one of the best-performing REITs in the S&P 500 in the last years.

The resiliency of the gaming industry and the shining lights of Las Vegas aren't showing any sign of fading away, and VICI's future appears just as strong.

For REIT investors, I find VICI a must-have in your portfolio.

Performance

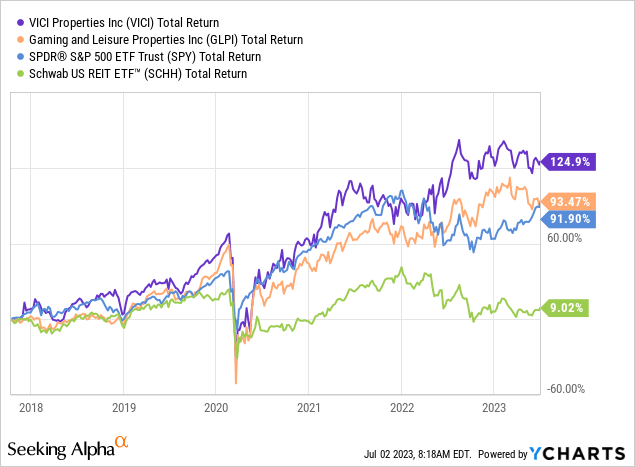

Led by Edward Pitoniak, VICI was able to achieve remarkable accomplishments in the ~6.5 years since its formation in 2017. To name a few, VICI became an S&P 500 constituent, received an investment grade rating, significantly diversified its tenant portfolio, deployed over $34B, and grew its AFFO per share at a 7.8% CAGR, well ahead of its peers.

Past performance doesn't promise anything for the future, but since its IPO, VICI has outperformed the market, other gaming REITs, and the REIT index.

Let's try to explain what led to VICI's outperformance, starting with understanding its business model.

Business Model

VICI's business model, like any other REIT, is quite simple. It pools large amounts of capital from debtors and investors and buys income-generating experiential real estate.

For VICI's business model to succeed, it needs to generate returns above its cost of capital, which is a mix of its cost of equity and cost of debt. This means it needs to buy high-quality assets, with steady occupancy rates and a growing rental income stream. So far, VICI has been more than able to do so. For example, VICI's latest transactions reflected cap rates in the range of 7.5%-8.5%, whereas its current effective cost of debt is around 4.3%.

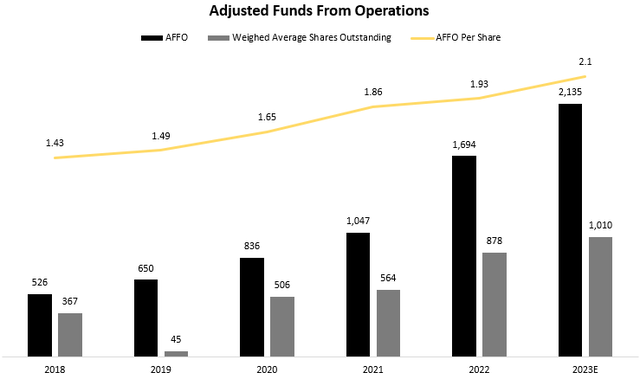

From the investor's point of view, the simplest way to track the performance of VICI's operation is by following the growth of its adjusted fund from operations (AFFO), and more specifically, the growth of its AFFO per share.

AFFO is the most important line item for REITs, as it is the best indicator of the underlying recurring operations. In simple words, it should demonstrate how much cash the company is generating from existing, operating assets. However, as we said above, REITs, including VICI, heavily rely on shareholder dilution to fund their acquisitions, and thus, we need to take those dilutions into account.

Business Results

Created and calculated by the author using data from VICI financial reports and presentations.

As we can see, VICI's AFFO per Share is heading in the right direction. Although shareholders are significantly diluted each year, management is providing investors with accretive investments which are immediately contributing to AFFO per share.

In 2023, we should expect growth to accelerate to 9.6%, after a lower year in 2022 with just 3.8% growth.

High-Quality Portfolio - How is VICI Different From Most REITs

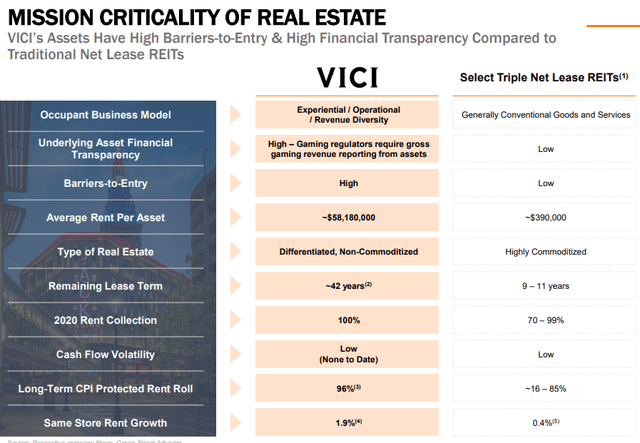

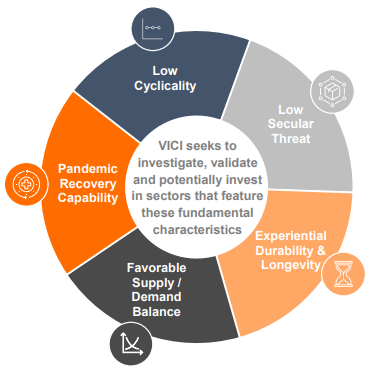

Personally, I have never invested in REITs. I believe most of them don't have a real competitive advantage, as they all share a similar capability of collecting capital and buying assets. If we assume there are many managers who can manage such capital decently, there really isn't that much qualitative difference between REIT A and REIT B. That being said, I believe VICI is a different type of REIT, and the reasons are pretty much summed up in the following slide.

VICI Properties 2023 Investor Presentation

Unlike most REITs, VICI owns non-commoditized, iconic assets like Caesars Palace, The Venetian, The Mirage, Mandalay Bay, and MGM Grand. These are assets that are not only extremely difficult to build, they are located in the most attractive locations in the world, and most of them are right on the Vegas Strip.

VICI Properties 2023 Investor Presentation

While I do understand that other REITs might provide a higher upside than VICI at opportune times, I believe that not too many REITs can provide investors with such a steady and reliable cash stream, and 99% of the credit should go to VICI's unique portfolio.

Growth Prospects

For a company that owns so many assets in the world's most attractive locations, it could be argued that VICI has limited room for additional high-quality growth. However, I find VICI's growth prospects extremely attractive.

VICI categorizes its growth avenues under six pillars. Let's go over them one by one.

VICI Properties 2023 Investor Presentation

Embedded Growth Pipeline

Beginning with the embedded growth pipeline, this pillar refers to contracted put or call options VICI possesses to increase or reduce its stake in different assets. As of Q1-23, this pipeline includes the right to call Harrah's Hoosier Park, Horseshoe Indianapolis, and Caesars Forum Convention Center at a 13.0x multiple (7.7% cap rate); Rights of first refusals regarding Horseshoe Casino Baltimore, 2 assets near the Vegas Strip, and a land in Virginia; The right to call the real estate assets associated with any BigShots Golf facility; The right to call the real estate assets of Canyon Ranch Austin; and other not as material options. Definitely not a short list.

Property Growth Fund

VICI collaborates with its tenants to develop same-property upside. Picture a renovation project, for example, allowing the tenant operator to generate a new revenue stream.

Roll-Up / Roll-Out

This essentially refers to sale & leaseback deals, as well as collaborating with tenants in finding potential new assets. Think about it, through this model, before almost every asset VICI buys it already knows in advance who is going to be the tenant and how much is the tenant going to pay. That reduces the risk to a huge extent.

Gaming Opportunities (Geographic Expansion)

Today, 100% of VICI's assets are located in North America. Gaming is strong all over the world, and VICI's tenants are already operating outside North America. Logically, it's only a matter of time before VICI expands to new continents and geographies.

Leisure & Experiential (Non-Gaming Assets)

This is a bit contradicting to what we discussed. I believe VICI generates strength from its focus on gaming, and diversifying into new categories could quickly turn into a snowball of bad decisions. However, VICI has set clear criteria for its non-gaming framework.

VICI Properties 2023 Investor Presentation

So far, VICI's management has demonstrated great judgment, and aside from gaming, it invested only in golf courses. I think the most important aspect of VICI's framework is the favorable supply/demand balance, seeking assets that are difficult to build, subject to regulatory control, and dominated by "rational" competitors not prone to over-investment.

Strategic M&A

Lastly, VICI talks about its ability to leverage its large scale for additional strategic M&As, similar to what we saw with MGM Properties. While I think there are M&A opportunities out there, I doubt we'll see an acquisition as significant as MGM Properties. Furthermore, VICI is arguably reaching a point where the regulator might interfere with big moves like that.

Balance Sheet

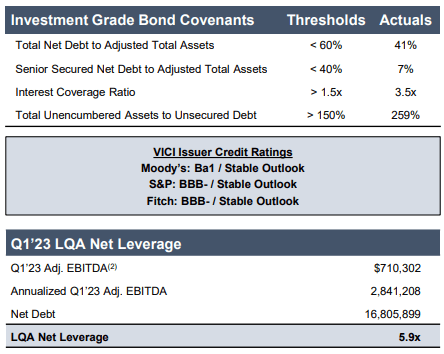

VICI's balance sheet is as strong as it's ever been, and it's far above its covenant thresholds, with 41% debt to total assets and a 3.5x interest coverage ratio.

VICI Q1-23 Investor Presentation

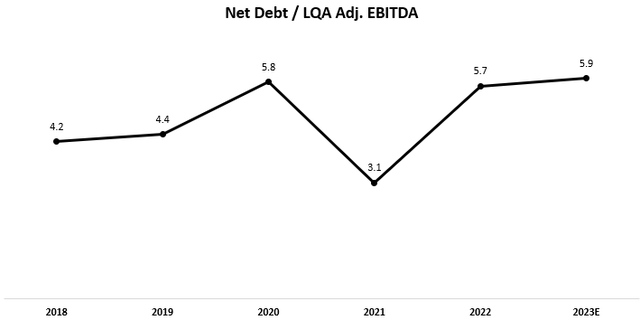

Another important metric to look at is Net Debt / LQA Adj. EBITDA, which is defined as Total Debt less Cash, Cash Equivalents & Short-Term Investments divided by the last quarter's annualized Adjusted EBITDA.

Created and calculated by the author using data from VICI financial reports and presentations.

As we can see, the leverage ratio is at the high end of VICI's range since its IPO, but that is due to a temporary debt spike as a result of the MGM Properties acquisition. I expect that VICI will return to the mid-range shortly.

Valuation

Based on management's guidance, VICI currently trades at a forward P/AFFO of 14.9, which is slightly above Gaming and Leisure Properties (GLPI) and in line with other considerably high-quality REITs like Realty Income (O) and Iron Mountain (IRM). Before 2022, a year in which VICI significantly outperformed, it traded at 15.6.

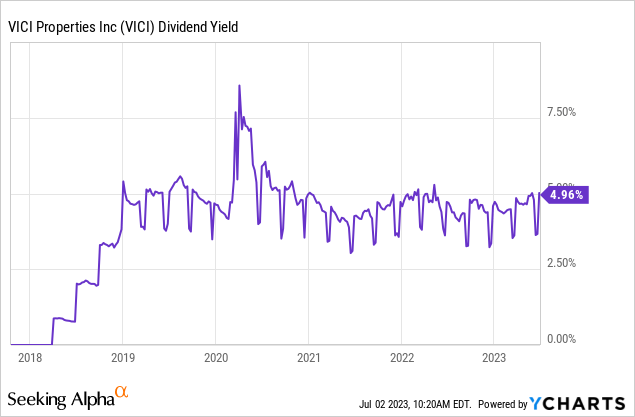

Looking at VICI's yield, it's clear that right around the 5.0% threshold is where it usually trades. Thus, I find VICI to be fairly valued. However, here's where the benefits of VICI's business model come to fruition.

Conclusion

Not many REITs have a moat as wide as VICI's. With the strength of its portfolio, even if we assume no multiple expansion, no renegotiated rent agreements, and no new acquisitions, VICI should provide at least a 7% annual return through a combination of dividends and legally-binding rent increases.

And as VICI deleverages, I certainly expect a multiple expansion as well. Thus, I believe a fair valuation is a great time to buy VICI and rate the stock a Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)