Lumentum Holdings: Near-Term Pressure On Gross Margin To Keep Stock Rangebound

Summary

- Lumentum Holdings' earnings may be negatively impacted by lower gross margins due to fixed overhead costs in Telecom and inventory issues.

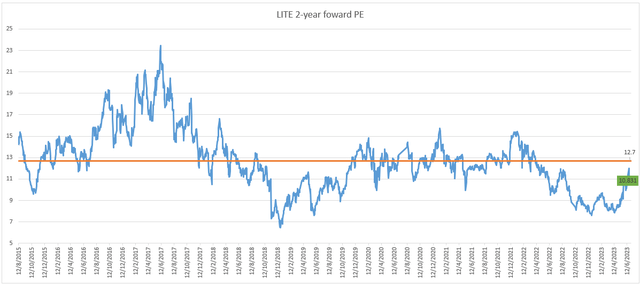

- Despite near-term challenges, LITE shares seem appealing from a valuation perspective, trading at 11x 2-year forward earnings, below the historical average multiple of 13x.

- The growth of AI and its requirement for high-speed optical interconnect could speed up demand for LITE's products, particularly from hyperscalers pioneering AI deployment.

TU IS

Overview

The choice to stay on the side lines in March was a right decision, in my opinion, albeit share price did recover after that 20% dip. With the recent performance, the bull case here is that Lumentum Holdings (NASDAQ:LITE) has troughed and earnings should accelerate in the near-term. Furthermore, LITE is still benefiting from a robust secular tailwind, as I believe the demand for Optical equipment has not changed and is expected to grow in both Telecom and Datacom in the long-run. Therefore, the recovery is only a matter of time, as the macro environment will improve eventually. Although I recognize the merits of the bull case, I believe I am properly setting expectations by zeroing in on the bear narrative that will have a bearing on the near-term value of the stock. In particular, I anticipate earnings to be negatively impacted by lower gross margins in the upcoming quarters due to the fixed cost overhead in Telecom and inventory issues. Another factor that could lead to a decrease in margin is management's decision to keep the operating expense structure largely unchanged despite weak near-term demand across its customer verticals.

However, from a valuation standpoint, LITE shares are appealing because the stock is trading at 11x 2-year forward earnings (normalized earnings), which is less than the recent historical average multiple of 13x. The stock last traded at this level in 2018/19, when there was a risk of Apple churning as a customer, which has a much lower impact today because customer concentration is now less than 10% of revenue.

All in all, I still reiterate my view to stay neutral until demand returns.

Inventory headwinds

The effects of inventory corrections in the telecom end market were painfully apparent to LITE in 3Q23, and the end of the turmoil is not yet visible. Management has stated that problems with customers having too much inventory will continue until at least the beginning of the new year. In my opinion, things are very precarious for LITE right now because their equipment manufacturer clients are sitting on surplus stock. End-market customers, such as telecom service and internet content providers, may also be sitting on surplus stock due to the supply situation in the past (they bought in advance). This is a significant part of the bear case because it is difficult for investors to gauge the level of customer inventory. Management has also historically been inaccurate as they seem to not be able to correctly predict how long it will take for customers to correct their excess inventory levels. For instance, in 1Q23, management's forecast that the Datacom slowdown caused by excess inventory among ICP customers would continue for the rest of FY23 was incorrect. The same thing happened in China two years ago with an EML laser chip oversupply that lasted many more quarters than anticipated. Therefore, I lack confidence in management's assurance that this inventory problem will be resolved by CY23.

AI tailwind

There don't appear to be any major bumps in the long-term demand trend, and in fact, the growth of AI, with its requirement for high-speed optical interconnect, could actually speed up demand. I anticipate this demand will come primarily from hyperscalers, who are pioneering the massive deployment of AI. Management also noted the opportunity to develop a purpose-built optical interconnect for AI applications in collaboration with processor companies, which it anticipates will materialize in CY24. In my opinion, this is just one of many potential partnerships that could help the AI applications market expand.

Valuation

From a valuation perspective, I think the setup is appealing as LITE trades below its historical average. Looking at the historical trading range (with focus post 2017), the stock has traded within a range of 11x to 15x 2-year forward earnings, and the only time it dipped below was in late 2018 and 2019 when the risk of Apple revenue concentration was a major risk. LITE has dipped into similar territory today (and recently) despite the concentration now moderating to below 10%. While I agree the inventory issue is a near-term concern, it is only a matter of timing until these excess inventories are depleted and demand will come back (as secular trend is strong). When that happens, I believe valuation will revert back to the average of 12.7x 2-year forward earnings, which is ~20% increase.

Bloomberg

Conclusion

While there are positive indications of a recovery for LITE in the near-term, it is important to consider the bear narrative and inventory challenges that may impact the company's earnings. The fixed cost overhead in Telecom, coupled with inventory issues and management's decision to maintain the expense structure, could lead to lower gross margins in the upcoming quarters. However, from a valuation perspective, LITE shares are appealing as they are trading below the historical average multiple.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.