Spirit Realty Capital: 6.7% Yielding Preferred Shares Offer An Excellent Risk/Reward Ratio

Summary

- Spirit Realty is a net lease REIT trading at just 11 times the anticipated AFFO.

- The REIT needs just 2% of its AFFO to cover the preferred dividend.

- In a stress test scenario, an overnight jump of the cost of debt to 6.75% would reduce the AFFO by just 25%.

- As Spirit Realty has locked in interest rates for an extended period of time, the interest expenses will likely increase at the same or slightly slower pace than the NOI.

- Buy the preferreds for the safe yield, buy the commons for yield growth and share price appreciation potential.

- Looking for more investing ideas like this one? Get them exclusively at European Small-Cap Ideas. Learn More »

winhorse/iStock Unreleased via Getty Images

Introduction

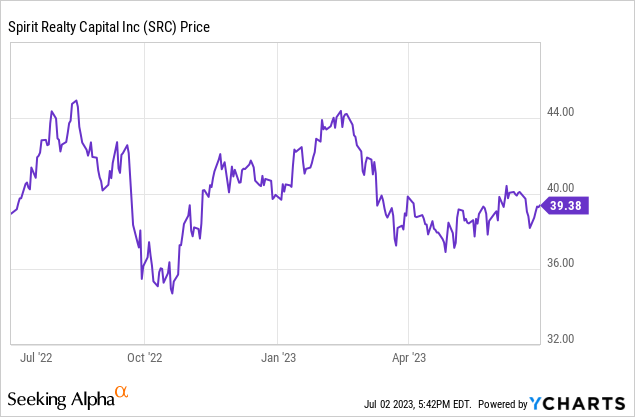

As I expect the series of rate hikes to be close to an end and as I continue to build out my portfolio with fixed income securities, I wanted to have a closer look at the preferred shares issued by Spirit Realty (NYSE:SRC). Other authors have recently published very informative articles on Spirit Realty (here and here) so in this article I would like to specifically focus on an investment in the preferred shares.

A closer look at the financial results from the perspective of a preferred share investor

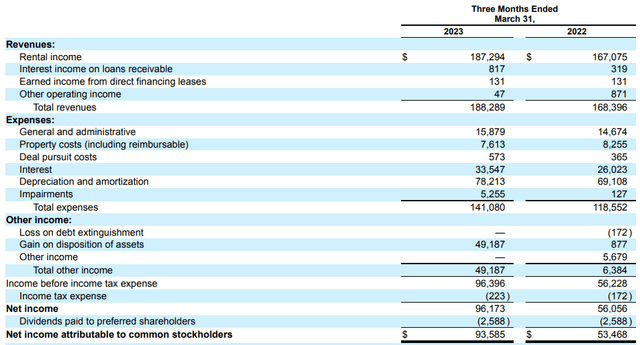

Spirit Realty is a net lease REIT and a substantial portion of the property expenses are paid for by the tenant. This is clearly visible in the REIT’s income statement where there are only $7.6M in property costs versus the $188.3M in total revenue, indicating the total Net Operating income is approximately $181M.

SRC Investor Relations

And while the net income of $93.6M is irrelevant for a REIT investor, it is a relatively important number for two reasons. First of all, the bottom line already includes the impact of the preferred dividend payments ($2.6M per quarter, in this case), and secondly, the net income is the starting point for the FFO and AFFO calculations.

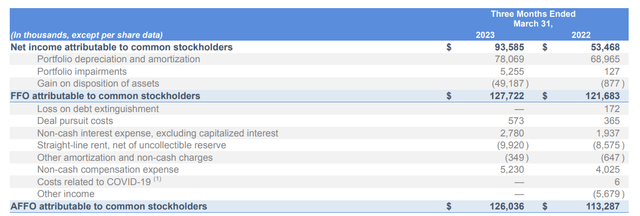

As you can see below, the total FFO came in at $127.7M despite removing the non-recurring gain on the sale of assets from the equation. At $127.7M, the FFO per share came in at $0.90 per diluted share based on the average diluted share count of 141.1M shares.

Spirit Realty Capital: 6.7% yielding preferred shares offer an excellent risk/reward ratio

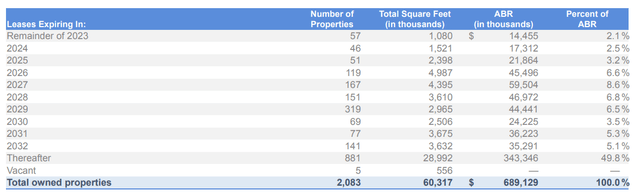

As of the end of the first quarter the REIT had 141.3M shares outstanding so the FFO based on the current share count remains unchanged at $0.90. The AFFO was just slightly lower and came in at $0.89 per share. On an annualized basis, the AFFO is coming in close to $3.55-$3.60 per share and that’s exactly what the REIT is guiding for: when it released its Q1 results, it provided a full-year AFFO guidance of $3.54-$3.60 per share. And considering the common shares are trading at just over $39, the stock is trading at just 11 times the anticipated AFFO which definitely is not bad for a net lease REIT that has to deal with minimal lease expiries in the next few years. As you can see below, 60% of the leases expire only from 2030 on and the average remaining lease term exceeds 10 years.

Spirit Realty Capital: 6.7% yielding preferred shares offer an excellent risk/reward ratio

The FFO and AFFO calculation provide useful information on the coverage levels of the preferred dividends. The FFO and AFFO results already include the $2.6M in quarterly preferred dividend payments which means that the AFFO before making the preferred dividend payments would be $128.5M and the REIT needs to spend just 2% of its AFFO to cover the preferred dividend. A very comfortable situation, that’s for sure.

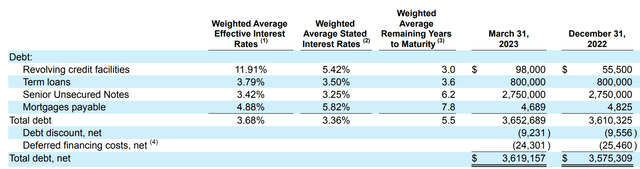

Of course, one of the elements we need to be mindful of is the cost of debt. Fortunately, Spirit Realty has locked in interest rates for 97% of its debt, and this means the REIT is definitely taking advantage of the cheap debt it was able to issue before interest rates started to increase.

Spirit Realty Capital: 6.7% yielding preferred shares offer an excellent risk/reward ratio

According to the financial statements, the weighted average cost of debt is about 3.36%. That is very low, but it also shows that even a sharp increase in the cost of debt shouldn’t put the preferred dividends at risk. Even if the total cost of debt doubles to 6.7%, the AFFO will only decrease by about 25%. And that excludes any potential rent hikes over the next few years while Spirit’s average cost of debt will gradually increase.

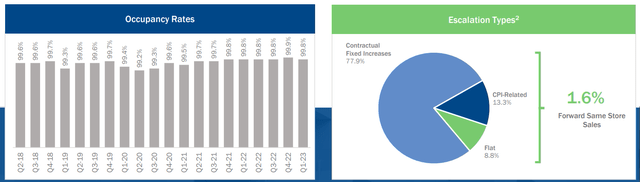

This means that the preferred dividends are well-covered, even at higher interest rates. Spirit’s main task will be to keep the occupancy levels high as the higher interest rates are not a threat.

Spirit Realty Capital: 6.7% yielding preferred shares offer an excellent risk/reward ratio

The details of the Series A preferred shares

Spirit Realty Capital only has one series of preferred shares. The Series A (NYSE:SRC.PA) are cumulative in nature and pay a fixed preferred dividend of $1.50 per year, payable in four equal quarterly payments of $0.375 per share). These preferred shares are now callable at any time (since October last year) but as 6% is pretty cheap for equity and as the preferred dividends are lower than the current dividend yield on the common shares, it makes sense for Spirit to not call the preferred shares. There are currently 6.9M preferred shares outstanding for a total principal value of just under $175M. And as mentioned before, the quarterly preferred dividend payments are costing the REIT about $2.6M.

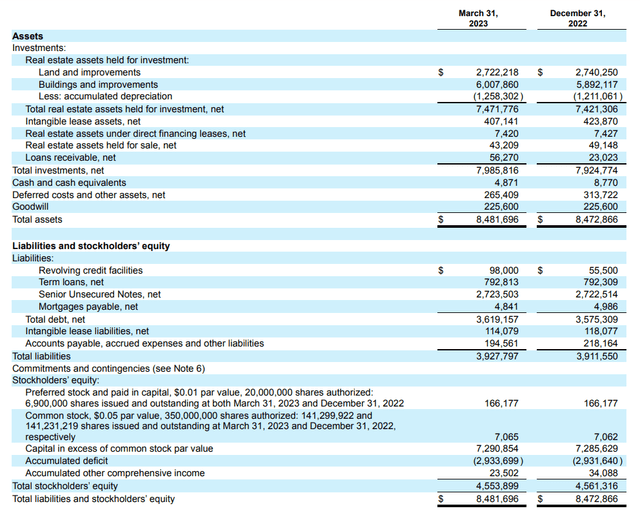

We already discussed the excellent coverage ratio of the preferred dividends, but I’m obviously also interested in the asset coverage ratio. As you can see below, the total balance sheet of Spirit contains $8.5B in assets, of which about $225M is related to goodwill. This means that the total amount of tangible equity is just over $4.3B. Considering the total amount of preferred equity is less than $175M, there’s in excess of $4.1B of equity ranked junior to the preferred shares. That is excellent, even if you would deduct the net difference of $300M between intangible lease assets and intangible lease liabilities.

Spirit Realty Capital: 6.7% yielding preferred shares offer an excellent risk/reward ratio

It's also important to understand whether or not the book value of the assets is fair. We know the Q1 adjusted NOI was approximately $181M which is close to $725M per year. Considering the current book value of the assets is now $7.47B, the implied cap rate (NOI versus book value) is 9.7%. That’s high, too high, for a net lease REIT. Applying an 8.5% cap rate would result in a $1B higher fair value versus the book value and this provides an additional cushion for the preferred shares.

Investment thesis

While it is clear the preferred shares enjoy an excellent asset coverage ratio and the preferred dividends are very safe (even if the interest expenses would double), you could easily make an argument to just buy the common shares. At the current share prices, the preferreds are yielding 6.72% while the common shares are yielding 6.73% while also offering the potential to realize capital gains.

This means a mix of preferreds and common shares could make sense – depending on the specific risk profile of an investor. The preferred dividends appear to be very safe but the potential for capital gains is pretty slim. The common shares are currently trading at just 11 times the AFFO so there is additional upside potential there. And while the preferred dividends are fixed, there’s plenty of potential to hike the distributions on the common shares as the payout ratio is just around 75%.

I currently have no position in either the preferred shares or common shares of Spirit, but I may buy the preferred shares and write put options on the common shares to apply this ‘mixed approach’.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I may initiate a long position in both the common and preferred securities, but I'm in no rush.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)