Catalyst Pharmaceuticals: A New Catalyst Tilts The Scales - Just Barely

Summary

- This is a follow-up to my previous concerns about Catalyst Pharmaceuticals' over-dependence on FIRDAPSE, as expressed in my April 2023 article.

- I previously discussed Catalyst's acquisition of FYCOMPA in December 2022.

- The current article will revisit my thesis and discuss recent developments, including Catalyst's Q1 2023 performance.

AlSimonov/iStock via Getty Images

This is my fifth Catalyst (NASDAQ:CPRX) article following 04/2023's "Catalyst Pharmaceuticals: Fixing Its Misnomer Is No Easy Task". My concern with Catalyst is expressed as, "I have long chafed at Catalyst's over-reliance on FIRDAPSE". I also discussed its 12/2022 FYCOMPA acquisition.

In this article I will revisit my thesis in light of recent developments as reflected in Catalyst's:

- 05/11/2023 earnings call (the "Call");

- 05/10/2023 10-Q (the "10-Q");

- 06/02/2023 Catalyst presentation (the "Presentation").

- 06/2023 Santhera corporate presentation (the Santhera Presentation).

Catalyst has two established therapies which generate revenues for it.

General

Catalyst's 10-Q includes the following quarterly report of its net income as part of its statement of operations (p. 4):

seekingalpha.com

Its product revenues are generated by two products:

- FIRDAPSE (amifampridine) Tablets 10 mg for the treatment of adults with Lambert-Eaton myasthenic syndrome [LEMS];

- FYCOMPA (perampanel) CIII, a prescription medication used alone or in combination with other medicines to treat focal onset seizures with or without secondarily generalized seizures in people with epilepsy aged four and older and with other medicines to treat primary generalized tonic-clonic seizures in people with epilepsy aged 12 and older.

These are discussed in greater detail below.

FIRDAPSE

FIRDAPSE was first approved by the FDA in 2018. Catalyst has worked diligently to establish and extend its FIRDAPSE franchise by:

- obtaining approval by Health Canada in 2020 and setting up a license and supply agreement with KYE Pharmaceuticals for its distribution in Canada;

- in Q3 2022 obtaining an sNDA for expansion of the FIRDAPSE label to include pediatric patients (ages six and older);

- resolution of disputes with Jacobus Pharmaceuticals over its RUZURGI version of amifampridine (3,4-DAP), for the treatment of pediatric LEMS patients (ages 6 to under 17) and acquisition of rights to RUZURGI;

- expanding disease awareness, including physicians treating LEMS patients with small-cell lung cancer (SCLC);

- plan to file sNDA in 3Q 2023 to increase the FIRDAPSE maximum daily dosage from 80mg to 100mg;

- expansion into Japan through DyDo Pharma 06/2021 deal, as stated in Presentation slide 12 phase 3 LEMS study completion expected by YE 2023, anticipate Japanese NDA submission in Q2 2024 with expected 10-year market exclusivity upon approval.

FYCOMPA

The 10-Q, p. 7 describes the transaction whereby Catalyst acquired FYCOMPA as a backup revenue earning product:

- On December 17, 2022, Catalyst entered into an asset purchase agreement with Eisai Co., Ltd. (Eisai);

- it granted rights to FYCOMPA (perampanel) CIII, a prescription medication used alone or in combination with other medicines to treat focal onset seizures with or without secondarily generalized seizures in people with epilepsy aged four and older;

- it also granted rights to use FYCOMPA with other medicines to treat primary generalized tonic-clonic seizures in people with epilepsy aged 12 and older.;

- the transaction closed on January 24, 2023.

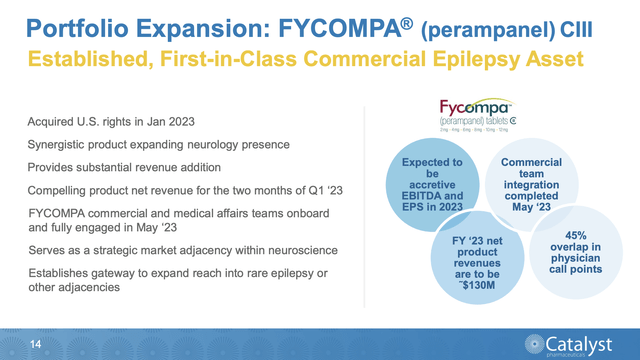

Presentation slide 14 describes the attractions that drew Catalyst towards FYCOMPA:

A sterling therapy acquisition to be sure, but did management pay a fair price or did it overpay? In my previous article I urged that it might have overpaid. Yes, it pegs FYCOMPA as generating revenues in 2023 of $130 million. During the call, it advised:

Q1 net revenues were $27.8 million for the approximately two months that we owned the U.S. rights to the product, which adds further confidence towards achieving our FYCOMPA full year 2023 net product revenue forecast of $130 million. Adding FYCOMPA to our portfolio is an ideal strategic fit for our existing commercial infrastructure with a 45% overlap in FYCOMPA and FIRDAPSE physician [indiscernible] and an increased share of voice that will benefit both franchises in driving growth.

So it is performing just as expected, what is the problem? The previous article points to Eisai's (OTCPK:ESALF) ~$84,000 annual direct costs associated with its FYCOMPA revenues. Catalyst will need its FYCOMPA program to be more efficient if it wants to generate an attractive return on its >$160 million acquisition expenses.

Catalyst only has a limited time with which to work before its patent exclusivity ends. Presentation slide 15 notes that this protection may not extend even for another full two years, albeit with potential for extension into 2026.

Catalyst new acquisition will finally give it a pipeline

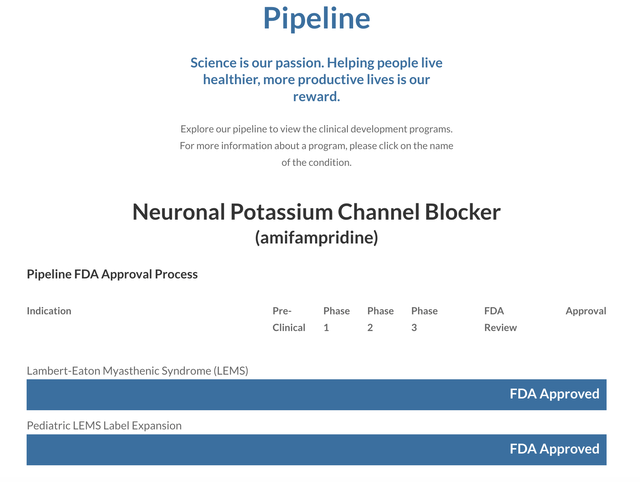

Typically, biotechs like to strut their pipelines as precious gems. Check out Catalyst's Presentation. It makes no mention of any pipeline. An oversight perhaps? Check out its website. Now we're talking. Catalyst has a pipeline! I set it out below:

What about clinical assets? Its discussion of its clinical trials references only its completed clinical trials that supported its approved amifampridine. This lack of a pipeline speaks to gradual future revenue strangulation as its existing products (FIRDAPSE and FYCOMPA) fade into senescence.

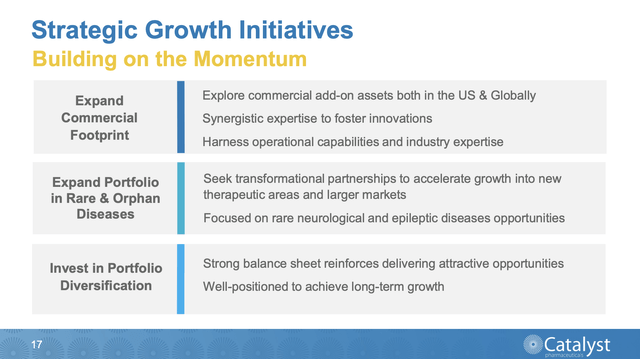

Catalyst has no intention of resting on its laurels. Its Presentation slide 17 sets out its strategy for growth:

To its credit, it is not only talking the talk when it comes to deals, it is also walking the walk. On 06/20/2023 it announced an in-licensing deal with Swiss biopharma, Santhera Pharmaceuticals Holding (OTC:SPHDF). Under the deal Catalyst is paying $75 million out front for exclusive rights to commercialize vamorolone in North America.

The deal also calls for:

- an equity investment of $15M from Catalyst;

- additional regulatory and commercial milestone payments;

- royalties linked to vamorolone sales.

Santhera's website includes its helpful 06/2023 presentation. This Santhera Presentation includes the following slides, among others that describe vamorolone and the deal terms:

- Santhera Presentation slide 5 - Lead asset vamorolone in DMD close to regulatory decision US NDA… for potential approval in Q4-2023 (US FDA PDUFA date Oct 26, 2023);

- Santhera Presentation slide 6 - Exclusive North America License for vamorolone to Catalyst Pharmaceuticals [setting out deal points in greater detail than listed above];

- Santhera Presentation slide 8 - [Duchenne muscular dystrophy] DMD offers attractive opportunity in well-defined orphan disease market;

- Santhera Presentation slide 9 - the need for a better foundational steroid therapy in DMD;

- Santhera Presentation slides 11 - 28 - Miscellaneous slides describing vamorolone's clinical trials and comparing vamorolone to prednisone in treatment of DMD.

Catalyst can likely handle its anticipated Santhera deal without a hitch

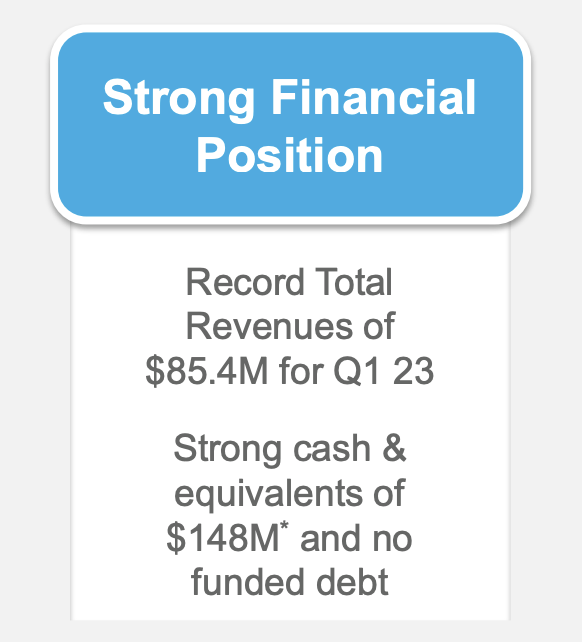

Catalyst's financial position panel below from its Presentation Slide 4 shows how its anticipated Santhera deal fits comfortably within its financial profile:

ir.catalystpharma.com

Catalyst has sufficient liquidity to handle not only its $75 million out front commitment and its $15 million investment but also its $36 million in approval related milestones in my view.

Conclusion

In the Call, Catalyst confirmed its 2023 revenue guidance from its Q4, 2022 earnings call. In terms of its value proposition, the most significant recent change is its price. When I wrote the previous article back on 04/19/2023, Catalyst traded at ~$17.50. I listed it as a hold. As I write on 07/02/2023 Catalyst last closed at ~$13.44.

This new lower price plus its new DMD opportunity make it a more attractive opportunity. I have taken a small position in Catalyst and rate it a buy for those who want to place a speculative bet on a near-term PDUFA.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CPRX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.