AstraZeneca: Today's Hit On Lung Cancer Data - Justified Or Overblown?

Summary

- AstraZeneca stock has been on a long bull run but took a hit today after the company released data from a key lung cancer study.

- The study involves datopotamab deruxtecan - an antibody drug conjugate the company has high hopes for.

- AZN reported the study met one of its primary endpoints - but the market appeared to be concerned by a lack of detailed data and some Grade 5 safety events.

- This drug is the "next ADC off the rank" after the success of Enhertu - like Enhertu it's a joint collaboration with Japanese Pharma Daiichi.

- Peak sales of Enhertu and "Dato-DX" could be >$4bn, forming the cornerstone of AZN's thriving oncology division. I discuss the data and speculate about whether today's selloff was justified.

- Looking for a helping hand in the market? Members of Haggerston BioHealth get exclusive ideas and guidance to navigate any climate. Learn More »

Mikhail Konoplev

Investment Overview

AstraZeneca (NASDAQ:AZN) shares have been enjoying a strong bull run ever since falling to a low of $55 in mid-October last year - their lowest value since April 2021. Across a five-year period, overall performance has been strong, with shares gaining in value by just over 90%, outperforming the overall S&P 500 index which has gained 61% across the same period.

Today, however, shares have been sliding on "mixed" results from a Phase 3 study of one of AstraZeneca's lead portfolio assets - datopotamab deruxtecan - in patients with locally advanced or metastatic non-small cell lung cancer ("NSCLC") treated with at least one prior therapy.

AstraZeneca itself touted the results as "positive," stating in a press release that:

datopotamab deruxtecan (Dato-DXd) demonstrated a statistically significant improvement for the dual primary endpoint of progression-free survival ("PFS") compared to docetaxel, the current standard of care chemotherapy.

For the dual primary endpoint of overall survival (OS), the data were not mature and an early trend was observed in favor of datopotamab deruxtecan vs. docetaxel that did not meet the prespecified threshold for statistical significance at this interim analysis. The trial will continue as planned to assess OS with greater maturity. The investigators and participants will remain blinded to the results.

The market's reaction was decisively negative however - in trading today so far, AstraZeneca stock has fallen in value by >8%, to a value of $66 at the time of writing. Prior to the news, the stock price traded at an all-time high. Current market cap is $222bn.

In this post I'll provide some background on Dato-DXd, speculate about why the market has reacted the way it has to today's data announcement, and also speculate about what it may mean for the drug, and AstraZeneca's share price, going forward.

Background - AstraZeneca, Antibody Drug Conjugates and The Hype Around Dato-DXd

AstraZeneca has one of the pharma industries strongest oncology divisions, with four blockbuster (>$1bn per annum) selling drugs - lung cancer therapy Tagrisso earned $5.4bn of revenues in FY22, and lung-cancer targeting programmed death-ligand 1 (PD-L1) blocking antibody Imfinzi - which has a similar mechanism of action to Merck's (MRK) >$20bn (in 2022) selling Keytruda, earned $2.8bn of revenues, also in non-small cell lung cancer ("NSCLC").

Two other blockbusters, Lynparza, a poly ADP ribose polymerase (PARP) inhibitor indicated for ovarian cancer, and Calquence, a leukemia / lymphoma therapy, earned $2.6bn and $2.1bn respectively last year. The entire division earned $14.63bn, representing nearly 35% of AstraZeneca's $43bn of revenues earned in 2022.

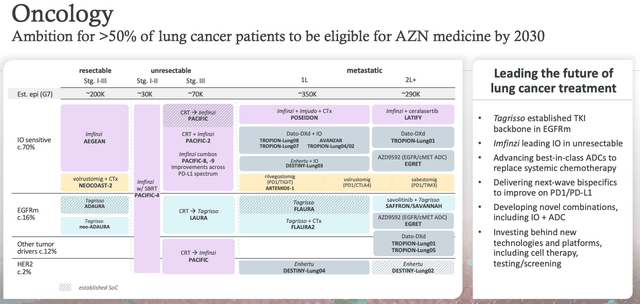

In Q123, the oncology division showed excellent growth, with sales of Tagrisso, Lynparza, Imfinzi, and Calquence up by 15%, 10%, 56%, and 31%, respectively. AstraZeneca says that its ambition is for its medicines to be able to treat >50% of all lung cancer patients by 2030. Lung is the largest of all cancer markets, although Merck's Keytruda remains the best-selling and most effective therapy.

AstraZeneca oncology franchise expansion (AZN Q123 earnings presentation)

As shown above in a slide from AZN's Q123 earnings presentation, Dato-DXd features prominently in the company's expansion plans as a potential therapy for first and second line metastatic lung cancer, for immuno-oncology sensitive patients, and for those expressing EGFR - practically the entire metastatic population.

Dato-DXd is a type of drug known as an antibody drug conjugate, defined by Nature.com as follows:

Antibody–drug conjugate ("ADC") is typically composed of a monoclonal antibody (mAbs) covalently attached to a cytotoxic drug via a chemical linker. It combines both the advantages of highly specific targeting ability and highly potent killing effect to achieve accurate and efficient elimination of cancer cells, which has become one of the hot spots for the research and development of anticancer drugs.

There are 12 ADCs approved for commercial use in the US - to illustrate the value the big pharma industry attaches to this field of drug development, Pfizer (PFE) recently spent $43bn acquiring Seagen (SGEN), a company responsible for four of the 12 approvals.

Although ADC's are not yet blockbuster sellers, Seagen's portfolio generated ~$1.4bn of revenues last year, and clearly the market and the pharma industry expect these numbers to grow significantly in the coming years. AstraZeneca, in partnership with Japanese pharma Daiichi Sankyo, also secured approval for an ADC, marketed and sold as Enhertu and approved to treat HER2+ NSCLC, gastric cancer, and breast cancer. The drug is expected by analysts to generate between $2.5bn - $4bn in revenues by 2024.

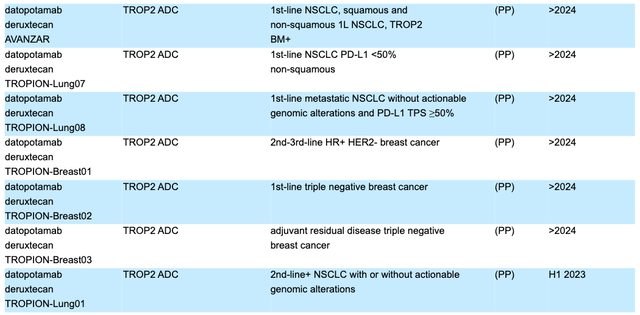

Dato-DXd - another Daiichi Sankyo partnered ADC - is progressing through no fewer than seven pivotal Phase 2 or Phase 3 studies, according to AZN's 2022 20F submission (annual report), detailed as follows:

Dato-DXd pivotal studies (AZN 2022 20F submission)

Dato-DXD targets a protein known as TROP-2, describes as follows in an abstract published in the National Institute of Health's ("NIH") National Library of Medicine:

Trop2 is a transmembrane glycoprotein encoded by the Tacstd2 gene. It is an intracellular calcium signal transducer that is differentially expressed in many cancers. It signals cells for self-renewal, proliferation, invasion, and survival. It has stem cell-like qualities. Trop2 is expressed in many normal tissues, though in contrast, it is overexpressed in many cancers and the overexpression of Trop2 is of prognostic significance.

Gilead Sciences (GILD) Trodelvy is a TROP-2 targeting ADC, approved to treat metastatic triple-negative breast cancer and metastatic urothelial cancer. The drug earned a slightly underwhelming $680m of revenues in FY22, although it is also in development for NSCLC.

Why Did The Market Punish Dato-DXd Data?

Today's results from the TROPION-Lung01 study appear to be the market's first look at how Dato-DX is performing in any of its pivotal clinical trials to date. Details of the trial are described as follows in AZN's press release:

TROPION-Lung01 is a global, randomised, multicentre, open-label Phase III trial evaluating the efficacy and safety of datopotamab deruxtecan (6.0 mg/kg) versus docetaxel (75 mg/m2) in patients with locally advanced or metastatic NSCLC, with or without actionable genomic alterations, treated with at least one prior therapy. Patients without actionable genomic alterations were previously treated, concurrently or sequentially, with platinum-based chemotherapy and a prior PD-1 or PD-L1 inhibitor. Patients with actionable genomic alterations were previously treated with platinum-based chemotherapy and targeted therapy as approved for their detected genomic alteration.

The dual primary endpoints of TROPION-Lung01 are PFS as assessed by blinded independent central review (BICR) and OS. Key secondary endpoints include investigator-assessed PFS, objective response rate, duration of response, time to response and disease control rate as assessed by both BICR and an investigator, and safety.

TROPION-Lung01 enrolled approximately 600 patients at sites in Asia, Europe, North America and South America.

The chemotherapy in question is Docetaxel, and analysts had speculated that Dato-DX would need to show at least a two-month advantage in median PFS in order to be viewed as a success. If the figure showed a substantial enough improvement, the drug could even replace chemo as standard-of-care, opening up a substantial market opportunity. The first problem with AZN's announcement today, then, was that it did not provide any actual figures.

The press release does discuss a "statistically significant improvement" in PFS compared to docetaxel, but if the data were genuinely compelling, surely AZN would have shared a detailed breakdown of patient's conditions?

AZN also did not share any overall survival ("OS") data either, with management stating that the data were still immature. Perhaps a larger concern, however, picked up on by analysts, is that some Grade 5 safety events were observed - a Grade 5 event is defined as a fatal adverse event resulting in death.

The ADC's developed by Daiichi - which has partnered with AZN on Enhertu and Dato-DX, but has several other proprietary assets in development, have been associated with cases of interstitial lung disease ("ILD") - Enhertu itself carries a boxed warning for the disease.

If Dato-DX data reveals that the drug carries a high risk of toxicity that could lead to patient deaths, its efficacy profile would have to be outstanding to establish a benefit risk profile. The market's interpretation of today's data is that it may not be efficacious enough, hence the sell-off.

Should Shareholders Be Worried About The Effect Of The TROPION-LUNG-01 Data On AstraZeneca's Long-Term Share Price

It's far from easy to make any kind of definite judgment on the success or otherwise of Dato-DX based on today's announcement alone. It may be wrong to conclude that the drug has a safety problem - many of the patients in the study had been heavily pre-treated and their conditions potentially untreatable - and it may also be premature to come to the conclusion that efficacy is under question because AZN used the term "statistically significant" when investors were hoping for "clinically meaningful."

With that said, very positive results are usually accompanied by detailed data and the absence of such data is arguably concerning. On the other hand, AZN could simply be playing the long game, waiting for more mature data before presenting it fully to the market, to appropriately manage expectations.

AstraZeneca's partnership with Daiichi already has delivered a drug in Enhertu that could become a mainstay of AZN's oncology franchise for a decade or more, although access to the Daiichi drugs has not come cheap. AZN paid Daiichi $1.35bn upfront for the rights to Enhertu, and another $1bn for the rights to Dato-DX.

Analysts have speculated Enhertu drug could achieve >$2bn in peak annual sales, and if the drug does shake off efficacy and safety concerns, those figures could apparently grow much higher, although my understanding is that profits on net sales will be split 50/50 with Daiichi for both Enhertu, and Dato-DX, if approved.

AZN has advanced further with Dato-DX than any of its rivals, at least in NSCLC - Merck has an ADC in a Phase 3 study, although this is in breast, not lung cancer. There's also other data suggesting that Dato-DX could be effective. In August last year, results from the Phase 1b TROPION-Lung02 study in which Dato-DX was used in combo with Keytruda, and as a triplet with keytruda and docetaxel showed an objective response rate ("ORR") of 62% in the doublet arm, which is superior to studies of Keytruda alone.

The concern is that Dato-DX does not prove to be the "slam dunk" that Enhertu arguably was, despite its safety issues, and that the drug does not make it to market. That would be a significant blow for AZN, but in the pharma industry late stage trial failures are not uncommon and almost every major company has to shelve drugs they once believed would become blockbusters. Even if lighting does not strike twice and Dato-DX turns out to be a dud, Enhertu itself remains in 15 late stage clinical studies.

AstraZeneca is much more than an oncology company - currently, 65% of its revenues are generated in other fields. Heart disease therapies Farxiga and Brilinta earned $3bn and $1.5bn of revenues in 2022, Crestor another $1bn, while the Respiratory and Immunology division earned $6bn of revenues, and the rare disease division - thanks to AZN's $39bn buyout of Alexion Pharma in 2021 - another $3bn. Acid Reflux therapy Nexium still generates >$1bn per annum.

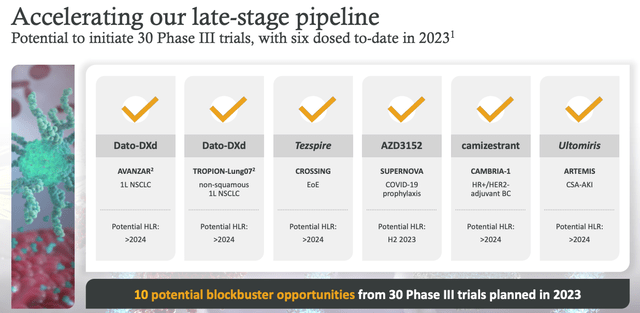

AZN targeting 10 blockbuster approvals (AZN Q123 earning presentation)

As we can see above, AZN is targeting 10 blockbuster opportunities from 30 Phase 3 studies. Dato-DX is undeniably a major part of that strategy. In conclusion, then, we can probably say that if Dato-DX does not make it to market, shareholders will suffer, although the damage could be limited to a ballpark figure of a $10 - $15bn hit to the market cap valuation. Significant, but recoverable.

Concluding Thoughts - Despite Today's Sell-Off, The Sensible Option May to Be to Wait For More Dato-DX Data

As mentioned, AZN stock has been on a long bull run, and today's sell-off should probably be viewed in the context of that. Although it was certainly related to Dato-DX data, investors may have been influenced by the opportunity to make a good gain when selling.

AstraZeneca pays a dividend yielding 2% at the time of writing, and the dividend rises if the share price falls, providing some downside protection. We do not know - but can only speculate - what the longer-term Dato-DX data may look like - perhaps investors will eventually get the coveted "clinically meaningful" description of study results they crave, in PFS and OS - it's likely too early to tell.

As such, although today's news was not what the market may have hoped for, it does not spell disaster for AZN, which has been a thriving company and has shown strong growth in recent years, growing top-line revenues from $21bn in 2016, to $44.3bn last year. Perhaps investors can afford to be more trustful of the management team and the Daiichi partnership.

One other concern I would point to is AZN's debt - as of Q123 total cash and investment reported was $6.5bn, while current liabilities were $25bn, and long-term debt $27bn. If AZN were to lose its investment grade debt rating the company's share price would tumble much more severely than it has today.

That puts a lot more pressure on management to make sure the pipeline delivers the value it's supposed to, and helps to further explain some of the market's jitters today.

If you like what you have just read and want to receive at least 4 exclusive stock tips every week focused on Pharma, Biotech and Healthcare, then join me at my marketplace channel, Haggerston BioHealth. Invest alongside the model portfolio or simply access the investment bank-grade financial models and research. I hope to see you there.

This article was written by

I write about Biotech, Pharma and Healthcare stocks and share investment tips. Find me at my marketplace channel, Haggerston BioHealth - model portfolio + 4 exclusive stock tips every week. I'm on twitter @edmundingham

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.