Did Carrier Just Become A Must-Own Stock? The Potential Behind The Viessmann Acquisition

Summary

- Carrier Global Corporation has agreed to acquire German-based Viessmann Climate Solutions in an EUR 12 billion cash/stock deal, strengthening its business.

- The acquisition adds a geopolitical layer to the bull case as Europe pushes hard to achieve climate goals, potentially leading to the mandatory adoption of heat pumps.

- With the purchase of Viessmann, Carrier is positioning itself as the leading supplier in this trend, enhancing its growth outlook.

romaset/iStock via Getty Images

Introduction

On April 11, I covered Carrier Global Corporation (NYSE:CARR) from the point of view of a dividend growth investor. Back then, we discussed the company's ambitious growth outlook, secular tailwinds, and other market opportunities.

Since then, the company added another layer to the bull case when it agreed to buy German-based Viessmann Climate Solutions in a EUR 12 billion cash/stock deal.

Not only does this move further strengthen Carrier's business by adding a wide range of high-quality products and services, but it also adds a geopolitical layer to the situation.

Carrier knows that Europe is pushing hard to achieve its climate goals, which could soon result in more aggressive (mandatory?) adoption of heat pumps to reduce natural gas and other resources.

By buying Viessmann (at a very attractive price), the company is essentially becoming the go-to supplier in this trend.

In this article, we'll discuss all of this and assess the risk/reward of buying CARR at current prices.

So, let's get to it!

An Impressive Transformation & Innovation

Whenever I add new investments to my long-term (dividend growth) portfolio, I want companies with a strong footprint in certain businesses. Companies that are hard to replace. This includes aerospace/defense, companies that are key in certain transportation segments (connecting supply chains), healthcare companies, and others.

Carrier has now become one of these companies.

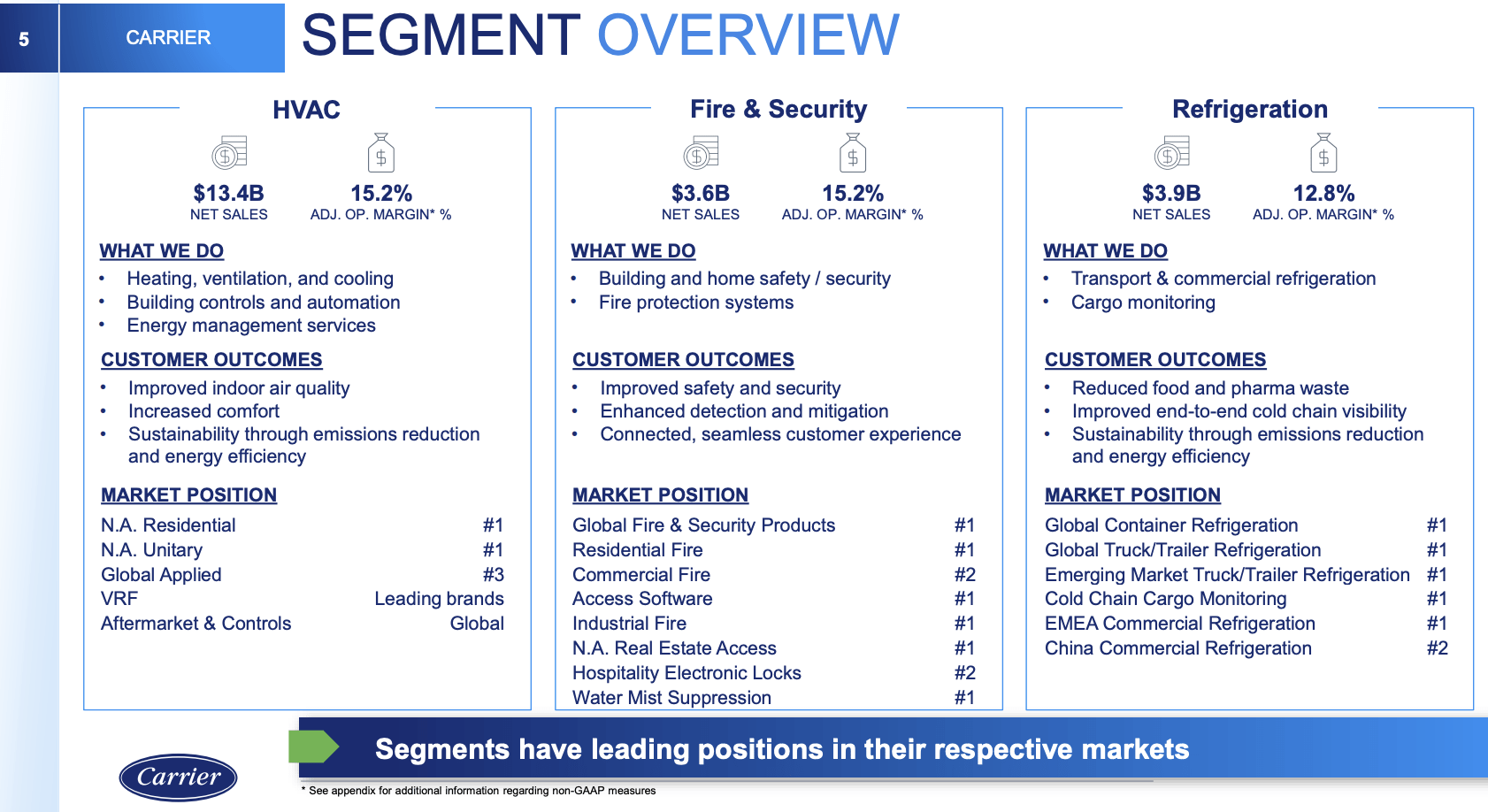

Prior to the Viessmann announcement, the company was already a major player in HVAC, fire/security, and refrigeration, with a leading market position in most sub-segments. After all, Carrier goes back to 1915. It has built a name for itself and figured out what works and what doesn't work. Please note that both F&S and Refrigeration will be spun off in 2024 to support the Viessmann acquisition and streamline the company.

Carrier Global

Now, the company wants more. It has witnessed major secular trends that go well with its existing capabilities.

During last month's 2023 Bernstein Annual Strategic Decisions Conference, the company said that it identified energy efficiency and climate-friendly solutions as compelling secular trends.

To solidify its position:

- Carrier acquired Toshiba's variable refrigerant flow technology to address a critical gap in the Asian market.

- To recognize the growth potential in Europe's residential heating space, Carrier decided to combine with Viessmann Climate Solutions, a premier company in Europe with a strong presence, superior technology, and a comprehensive product portfolio.

Especially the last move allowed Carrier to establish a focus on its core strengths while divesting non-core businesses, such as the stationary refrigeration business and the Fire & Security business. The proceeds from these divestitures would be used to pay down debt and potentially fund share buybacks.

What's interesting is that the Viessmann deal goes well beyond adding new HVAC capabilities to Carrier's portfolio.

The combination with Viessmann positioned Carrier as a leading player in the residential energy solutions market, which allows the company to compete with companies like Tesla (TSLA) and Enphase (ENPH).

Essentially, Carrier's goal is to provide end-to-end solutions for homeowners and commercial customers, integrating solar PV, batteries, heat pumps, and a unifying digital tool that interfaces with utilities.

By connecting the dots between these systems and offering comprehensive energy management solutions, Carrier believes it has a competitive advantage over other residential HVAC players.

I agree with that and believe that CARR is building a framework of solutions and services that competitors cannot compete with. Or at least not without having to engage in major diversification deals.

Having said that, we're also dealing with a geopolitical issue. When the news broke that Carrier was about to buy Viessmann, it was all over the news in Germany. After all, Germany is dealing with significant de-industrialization risks due to sky-high energy costs and other unfavorable government measures.

Not only is Germany losing a crown jewel to a foreign investor, but the company would lose this asset during a major energy transition. The EU is pushing hard for heat pumps, as it estimates that replacing a third of all traditional residential fossil fuel boilers could reduce final energy consumption by 36%.

However, the German government isn't looking to block the Viessmann deal to protect its own interests.

As reported by the major German newspaper WELT shortly after the takeover announcement, the German federal government welcomed the decision of the Hessian company to sell its heat pump division.

The government sees it as a positive development that demonstrates German manufacturers' expertise in future technologies and their ability to attract international investment.

However, Federal Minister for Economic Affairs Robert Habeck, a member of the Green Party, has announced that he will examine the sale to ensure it serves the German economy and business location. Habeck believes that investments in German know-how are essential for the energy transition.

The government aims to ensure that value creation, employment, and jobs remain in Germany.

Hence, it should be no surprise that Carrier expects significant growth in the replacement of existing HVAC systems with heat pumps, as they are sold at higher prices, which is a bonus on top of higher expected volumes.

While the regulatory environment and the timing of fossil fuel bans may vary, the long-term trend toward heat pump adoption remains strong. Carrier anticipates sustained, predictable hyper-growth in Europe.

Furthermore, one issue is often overlooked, which goes beyond Viessmann's products: its distribution channels.

- According to Carrier, Viessmann possesses the best channel in Europe, offering direct access to installers and homeowners, which sets them apart from other companies that rely on wholesalers and additional intermediaries. This provides revenue synergy opportunities, such as introducing Carrier brands or Toshiba products as secondary offerings through Viessmann's installer network.

- Carrier, on the other hand, has an extensive dealer channel in the United States, which can be leveraged to introduce Viessmann's technology and brands to the American market.

In addition to that, it's fantastic news for aftermarket sales. CARR aims to achieve significant growth in aftermarket sales, with a target of increasing these sales from $4.5 to $7 billion over a five-year period.

The addition of Viessmann's aftermarket sales will compensate for the aftermarket sales lost through divestments in fire and security and commercial refrigeration. Viessmann's aftermarket sales are expected to grow even more than the sales from the divested businesses.

At this point, I also need to mention that Carrier is adding next-gen technologies like AI to its business solutions. During the aforementioned conference, the company updated investors on its digital initiatives, specifically Abound, Lynx, and BlueEdge.

- Abound, Carrier's digital platform for commercial buildings has experienced significant progress. Starting with just 100 buildings, Carrier has now expanded its reach to 200 buildings, with more than one billion square feet under contract.

- Abound serves as an enabler, offering a wireless and cost-effective installation that allows customers to monitor real-time carbon emissions across their global building portfolio. Through the integration of artificial intelligence and other tools, customers can take corrective actions to improve energy efficiency.

I believe these developments are fantastic, as Carrier is essentially building a new product/service network in North America and Europe that competitors cannot compete with. When adding AI capabilities to its increasing installed base, the company is adding a whole new layer of aftermarket sales and services to its portfolio.

Growth Targets, Balance Sheet & Valuation

Despite recent developments, including announced divestitures, the company maintains its long-term growth target of 6-8%.

The company believes it can sustain 8% growth (the higher end of its guidance) due to the inclusion of Viessmann and favorable market conditions.

Viessmann, known for its consistent under-promising and over-delivering, is expected to bolster Carrier's growth, especially with the market transition to heat pumps, boilers, solar PV, batteries, and digital enablement.

Furthermore, the company believes that seamless integration of the Viessmann business can keep future growth rates elevated.

With that said, CARR is paying EUR 12 billion (roughly $13 billion) for Viessmann, including debt. EUR 9.6 billion of this will consist of cash. The Viessmann founding family will take 20% of the transaction value in Carrier equity. CARR paid a 13x 2023E EBITDA multiple for the company, which I believe is a terrific deal.

Based on this context, Carrier's cash position at the end of 1Q23 was $3.3 billion, which is expected to grow to about $4.5 billion by the end of this year, excluding the impact of the acquisition.

The company has fully committed financing in place for approximately EUR 7 billion and has hedged the cash portion of the euro-based purchase price.

Furthermore, Carrier aims to retain solid investment-grade credit ratings and recently received reaffirmation of its current investment-grade ratings from Moody's, S&P, and Fitch.

Following the Viessmann transaction, Carrier plans to quickly deleverage, targeting a net leverage ratio of about 2x by 2025, after which management expects to resume share repurchases.

In other words, the business transformation will keep the company from repurchasing stock for a while. It will also likely keep dividend growth low.

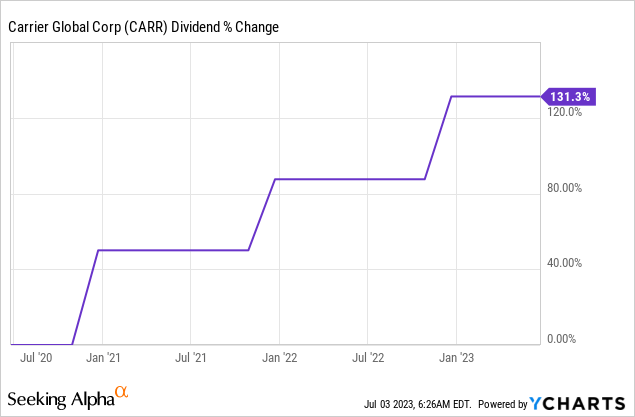

Since its spin-off from United Technologies, dividend growth has been impressive. On December 7, 2022, the company hiked its dividend by 23%. A year prior to that, it hiked by 25%. 12 months prior to that, it hiked by 50%.

The company currently yields 1.5% with a 29% payout ratio.

With that said, investors have shown their enthusiasm by pushing the stock price to $50, which translates to a one-month performance of 22%. The stock is now up 21% year-to-date and 50% above its 52-week low.

CARR is now trading at 13x forward EBITDA, which is fair and roughly the same multiple it paid for the Viessmann deal.

Analysts seem to agree with my assessment of a fair valuation, as the current consensus price target is $49. On June 8, Morgan Stanley (MS) downgraded its price target from overweight to equal weight (PT $49 -> $47).

Hence, investors interested in buying CARR might be better off waiting for a correction before jumping in.

On a long-term basis, I expect CARR to outperform the market - especially if the company is able to restart buybacks after 2024.

Takeaway

Carrier Global's recent acquisition announcement of Viessmann Climate Solutions has positioned the company as an upcoming leading player in the residential energy solutions market.

This move not only strengthens Carrier's business by adding high-quality products and services but also allows the company to capitalize on the growing trend of heat pump adoption in Europe.

By becoming the go-to supplier in this area, Carrier is building a framework of solutions and services that competitors cannot easily match.

Additionally, the Viessmann deal provides access to valuable distribution channels and aftermarket sales opportunities.

Furthermore, Carrier expects sustained growth and aims to leverage its digital initiatives and next-gen technologies like AI to further expand its product/service network.

With a solid balance sheet and a fair valuation, long-term investors may find CARR a compelling choice, especially if buybacks resume after 2024.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (2)