Paylocity: No Visible Weakness

Summary

- PCTY has shown impressive growth, profitability, and cash flow generation, despite the ongoing macroeconomic situation.

- The company has no debt and is benefiting from the increasing demand for its solutions. Risk remains minimal.

- I continue to assign an overweight rating on the stock. Currently trading at ~$179, PCTY appears undervalued based on my target price model.

Andrii Yalanskyi/iStock via Getty Images

Paylocity (NASDAQ:PCTY) is a leading cloud-based provider of human capital management / HCM and payroll software solutions targeting mostly SMBs and mid-size businesses.

I covered PCTY almost 3 years ago when I assigned a buy rating on the stock on the basis of its solid fundamentals. Since then, PCTY has been living up to my expectation, as growth, profitability, and cash flow generation have improved considerably. Though the stock is currently trading at ~$179 per share, down from the all-time high of ~$300 in 2021, it is still up about 23% from my initial coverage price.

I maintain an overweight rating on the stock. PCTY’s business has accelerated in recent times, and the current outlook suggests a high chance of continued growth followed by steady profitability. Downside risk remains minimal in the near term.

Catalyst

There does not appear to be any visible weakness in PCTY. The business has been accelerating over the past few years and seemed unaffected by the ongoing tough macro situation. Growth, profitability, and cash flow generation have been solid and the company also has no debt today.

I would also expect PCTY to continue benefiting from the increasing demand for its solutions, driven by the broader core necessity of HCM and payroll management, shift from legacy HCM tools offered by players like ADP (ADP) or Paychex (PAYX), and the strong go-to-market and product development executions. Overall, these should help PCTY maintain its strong fundamentals.

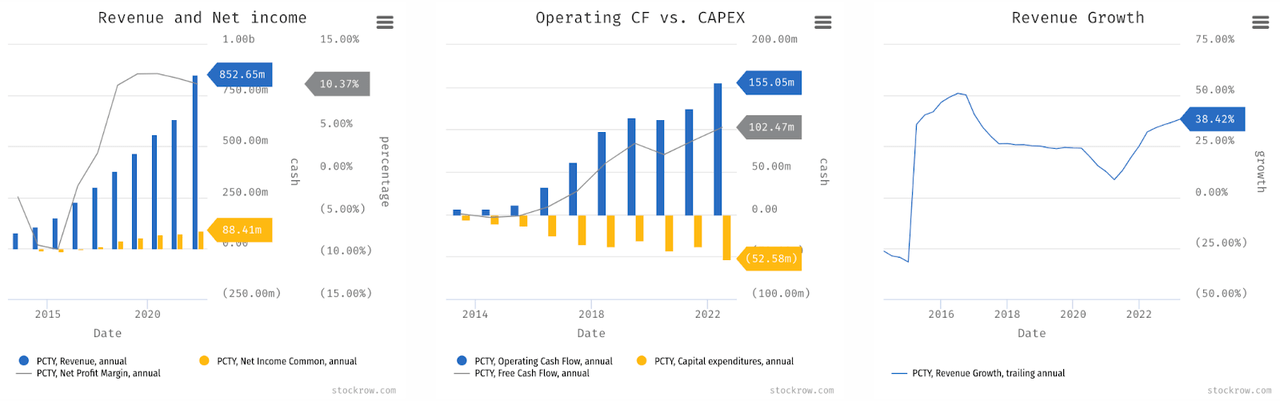

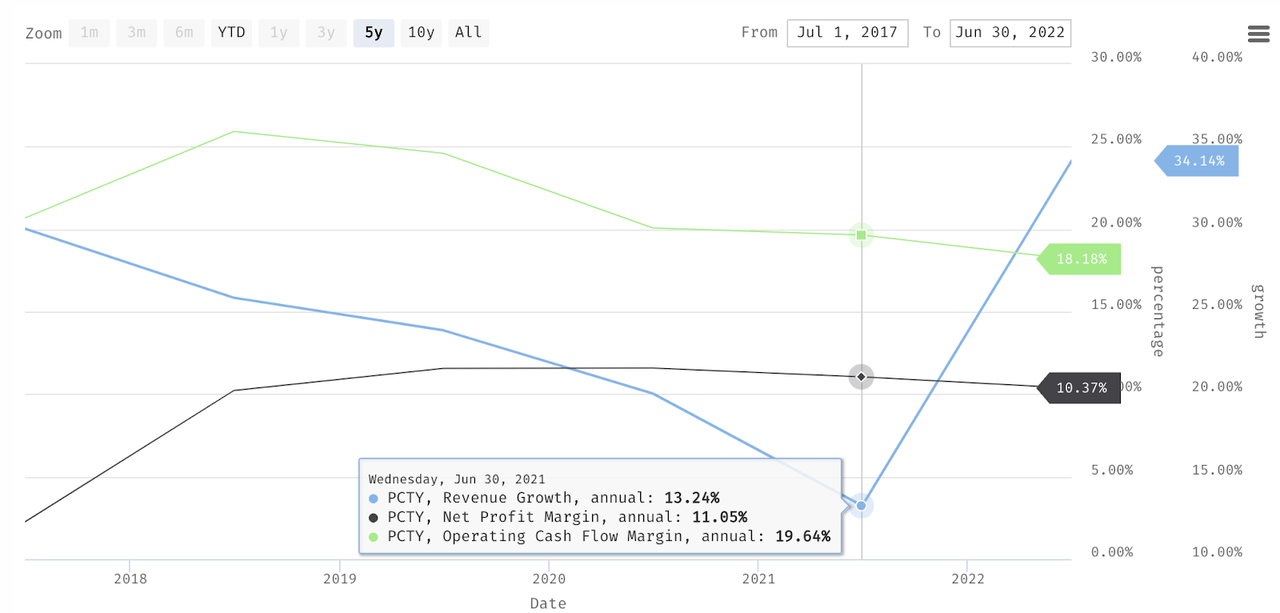

PCTY turned net profitable in 2017. Since then, it has been maintaining a steady 10% - 11% net margin. With the exception of 2020 due to COVID-19, revenue growth has also been steady between 20% - 30%. In the last few quarters, we even saw growth accelerate to 38%. Meanwhile, the operating cash flow / OCF margin has been steady between 18% - 20% over the past few years.

Given the current context, I just don’t see PCTY experiencing a growth slowdown or margin contraction. Even during COVID-19, which was probably its lowest point in the last five years, PCTY still managed to post double-digit growth and maintained healthy margins.

Having learned of PCTY’s strong Q3 results, the momentum will likely continue throughout FY 2023 and beyond. In my observation, cloud-based HCM and payroll companies like PCTY often benefit from the mission-critical nature and high switching costs of their offerings. Employers use these tools to manage their employees’ data and process payroll, while employees also access them to file or claim benefits and to check in or out. As such, migration to a different platform may be costly.

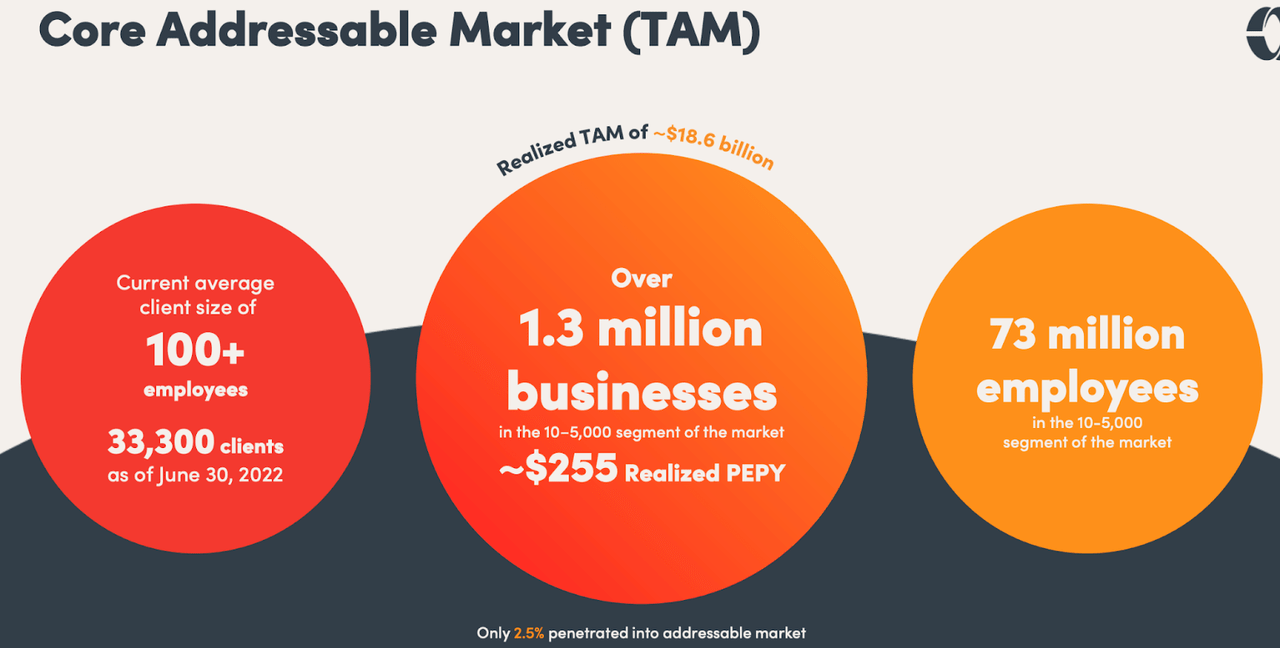

However, while mission-criticality and high switching cost may play a key role in enabling PCTY’s outperformance over the years as an HCM and payroll tool, I would also attribute a lot of its success to its strong execution across sales and product development against a very large TAM. I think that $18.6 billion of TAM seems not only attractive but also realistic. Virtually, businesses of all sizes and verticals would require HCM or payroll tools as part of their daily operations.

PCTY has been doing very well to capture that opportunity. It appears that sales productivity remained strong in Q3, as highlighted by the ~38% revenue growth following an 18% increase in the number of reps YoY. I expect growth to continue, especially as PCTY is hiring and ramping up more reps into FY 2023:

So this is the time of year that we’re hiring reps. We typically start kind of after the last quarter. We just kind of completed, we ramp up throughout the spring and then we try to get ourselves to kind of a target number of quota carriers going into the fiscal year.

Source: Q3 earnings call

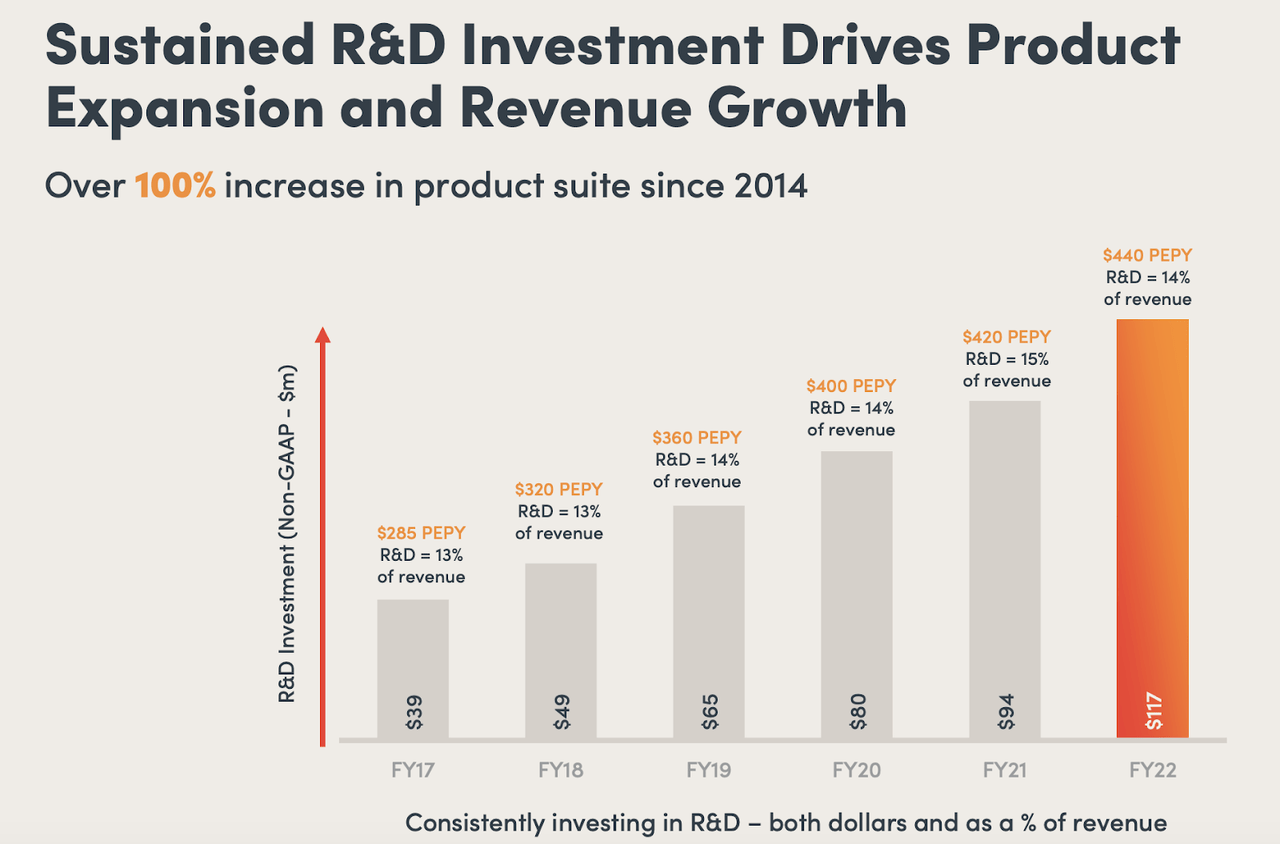

Another key part driving PCTY’s growth is its strong focus on product development. In Q3, PCTY did not seem to experience lengthened sales cycle and noticeable churn in its existing client base, suggesting a strong product-market fit. PCTY has also maintained its 92% annual revenue retention rate since last year.

Furthermore, product expansion has been solid. We learned how the number of client employees on the platform had been flat since January despite PCTY posting a 38% revenue growth in Q3, suggesting that the key growth driver was likely an increase in product adoptions within existing and new clients. As per its 10-Q, the majority of PCTY’s revenue comes from the recurring fees from the use of its cloud-based offerings, driven by three factors - a base fee, number of client employees, and number of products used.

Risk

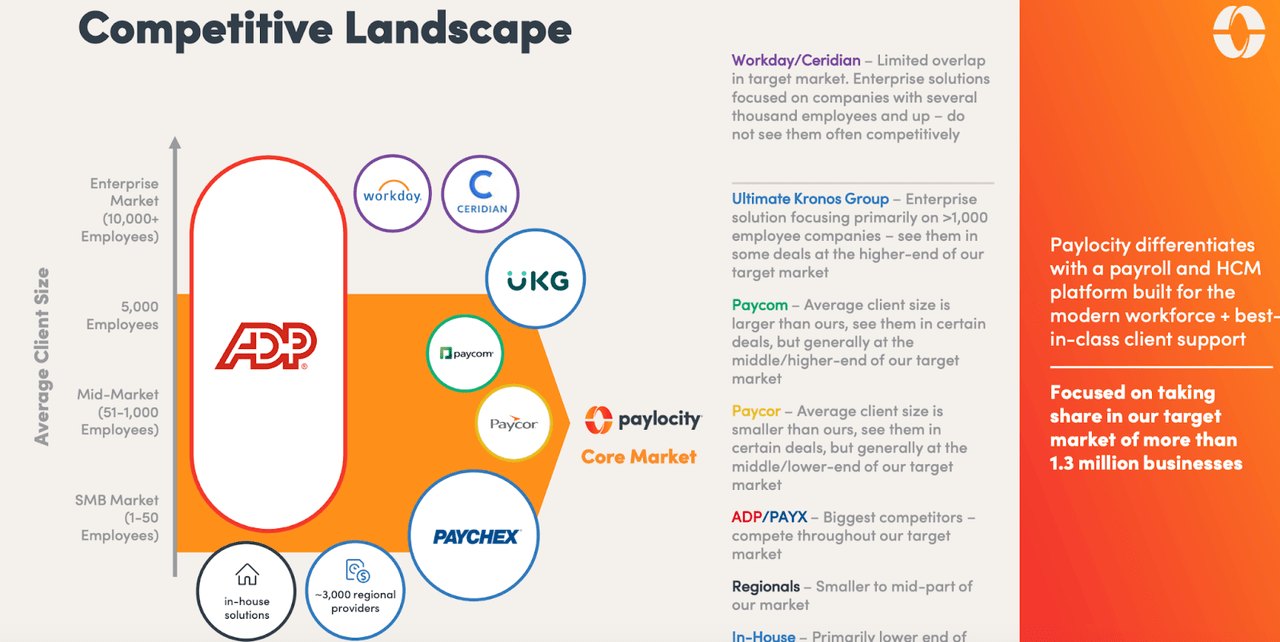

Downside risk remains minimal today. As a side note, though, competition may be a factor worth considering, especially when it comes to new customer acquisitions.

The consequence of the large TAM is the presence of various competitors looking to address demand across different niches to capture some of those opportunities. While PCTY may continue to see customers switching to its solution, especially from those of ADP and Paychex, I tend to believe that the reverse may also happen from time to time. For instance, there is a possibility of PCTY’s clients migrating to Paycom or UKG - which seems to be a better fit for larger companies - as they grow in size.

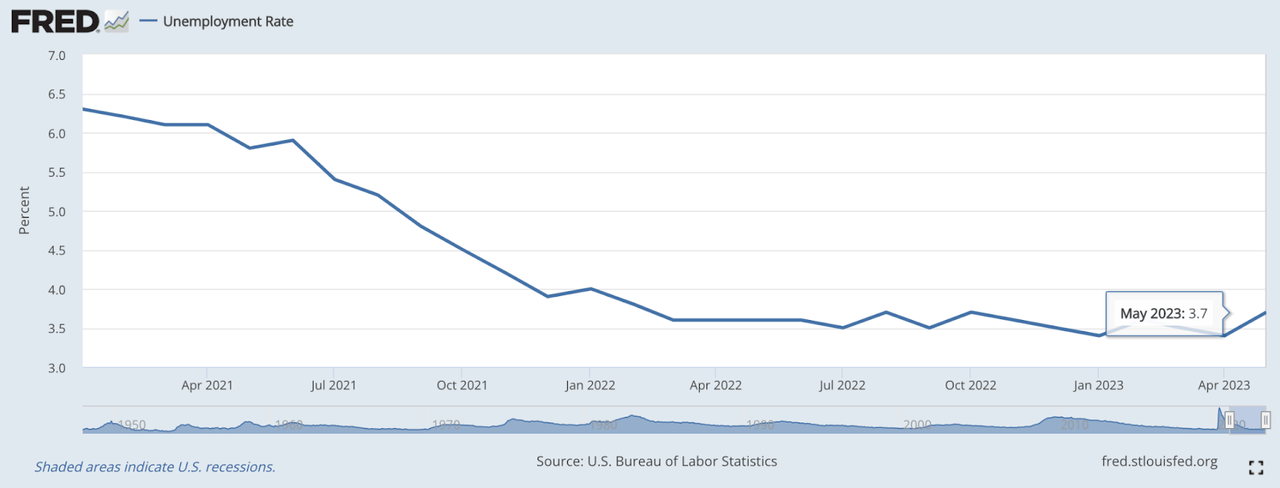

Another potential risk that PCTY may be exposed to is the slight uptick in the US unemployment rate in May to 3.7%. Generally, any reduction in the client workforce will impact PCTY’s revenue. While there remains uncertainty on what the unemployment hike entails, I feel that the impact on PCTY’s business may probably be minimal. Revenue growth has been steady from the beginning of the year up to Q3, for instance, including when unemployment rate was 3.6% in February, a similar level to May. As we zoom out further, revenue growth was also in the mid-teen double digits even when the unemployment rate surged to the highest levels in the last ten years in 2020 - 2021 during COVID-19.

Valuation / Pricing

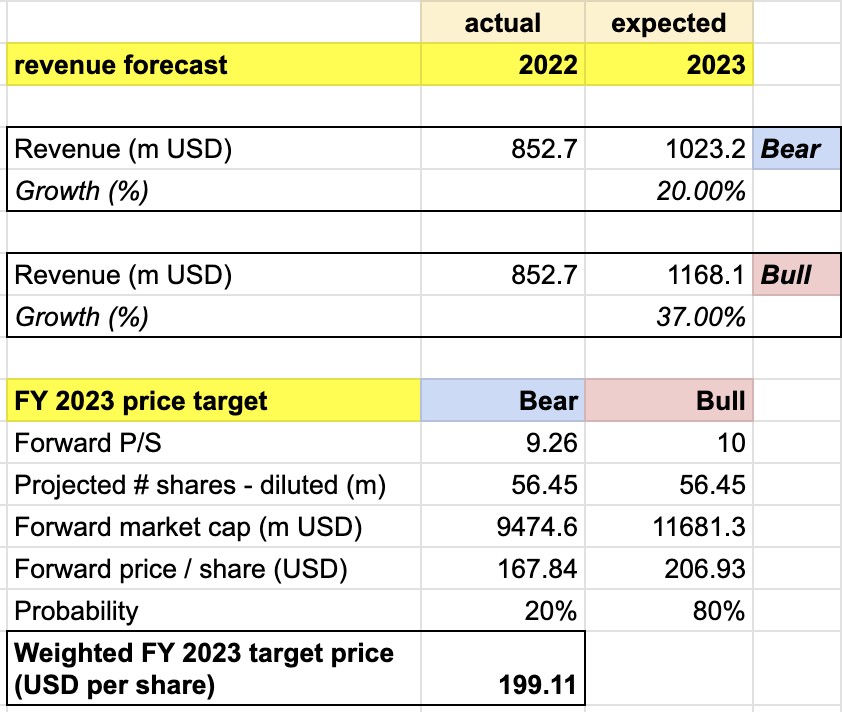

My target price for PCTY is driven by the following assumptions for the bull vs bear scenarios of the FY 2023 target price model:

Bull scenario (80% probability) assumptions - PCTY to finish FY 2023 with a revenue of $1.168 billion (37% growth YoY), consistent with its highest-end of the guidance.

Bear scenario (20% probability) assumptions - PCTY to finish FY 2023 with a revenue of $1.023 billion (20% growth YoY), missing its estimates by quite a lot and implying that PCTY will have a lackluster Q4. At 20% growth, this means PCTY will revisit its FY 2020 (fiscal year ending in June 2020) level, when the business just started to see the early impact of COVID-19.

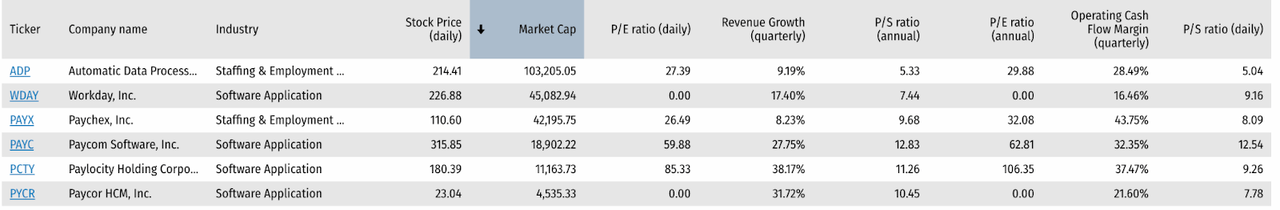

I assigned PCTY a P/S of 10x under the bull scenario, an expansion from 9.26x P/S today. It seems to be a fair valuation for PCTY, which trades at a discount to its peer PAYC, whose P/S is ~12x but has inferior growth and OCF margin to PCTY. For the bear scenario, I assigned PCTY a P/S of 9.26x, where it is trading today.

author's own analysis

Consolidating all the information above into my model, I arrived at an FY 2023 weighted target price of ~$199 per share. With PCTY trading around $178 per share recently, the stock appears undervalued by ~11%.

At this level, PCTY seems to be a strong buy. It is important to note that PCTY will end its FY 2023 next quarter in Q4 while the company has posted steady ~38% growth for the last three quarters, including in Q3. This means that my bear case scenario is extremely conservative since suggesting that PCTY will only grow its revenue in FY 2023 by 20% will imply a negative growth in Q4. Even as I assumed a 20% chance of that happening, my target price model still pointed to an ~11% upside from today’s price.

Conclusion

PCTY has shown impressive growth, profitability, and cash flow generation, remaining unaffected by the ongoing macro situation. With increasing demand for its solutions, PCTY is well-positioned in the HCM and payroll management market. The company's strong go-to-market strategies and product development further contribute to its success. While a slight uptick in the US unemployment rate poses some risk, PCTY has demonstrated resilience with mid-teens revenue growth during previous high unemployment periods in 2020 - 2021. I give the stock an overweight rating.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.