Franklin FTSE Mexico: A Lower-Cost Mexican Equities ETF

Summary

- The iShares MSCI Mexico ETF is the most well-known fund for getting exposure to Mexico.

- However, it is not the only option. Franklin FTSE Mexico is also available, and it comes at a lower expense ratio.

- The primary difference between these funds is the lower fees, as performance has otherwise been very similar.

- Looking for a helping hand in the market? Members of Ian's Insider Corner get exclusive ideas and guidance to navigate any climate. Learn More »

Mardoz/iStock via Getty Images

I recently profiled Mexico's most popular ETF, the iShares MSCI Mexico Capped ETF (EWW). I remain bullish on Mexico, and by extension its leading equity ETF. While the ETF is at eight-year highs now, I believe we are in the early stages of a broader bull market for Mexico. I won't rehash the bull case for Mexico in general today as my previous article has that covered.

Instead, I'd like to analyze another entrant in the Mexico ETF space, the Franklin FTSE Mexico ETF (NYSEARCA:FLMX). While the Franklin offering has a far lower assets under management "AUM" figure than the iShares product, long-term investors interested in Mexico should give the Franklin ETF serious consideration as well for their investment dollars.

As I'll demonstrate in a moment, both products are market-cap weighted and have a similar set of holdings. As such, I'd argue that the fees charged by each ETF are the distinguishing factor which will account for much of the difference in performance between the two ETFs.

The iShares MSCI Mexico ETF is charging a 0.50% annual fee compared to just 0.19% for the Franklin FTSE Mexico ETF. With that being the case, that gives Franklin's fund a significant leg up. With that context established, let's dive into a closer comparison between the two funds.

Top Holdings: Both Mexican ETFs Have Exactly The Same Top 10 Companies

Sometimes, ETFs going after a theme differentiate themselves by using a different index composition technique. For example, one product might be market-cap weighted while another is equal-weighted. Or one might prioritized higher dividend payers. There are various ways to create a unique thematic ETF. In the case of the Mexico ETFs, however, both funds appear to use a highly similar indexing format.

Digging into the difference between the two ETFs, you won't find much as far as their top holdings go. I've reproduced their top 10 positions by weight below which is quite easy since both ETFs have the exact same ten companies as their top positions.

Data is as of June 27 for EWW and June 29 for FLMX. Holdings can be found at Seeking Alpha's ETF page for each ETF, such as FLMX holdings here.

| Company | Ticker | % of FLMX | % of EWW |

| America Movil | AMX | 13.1% | 15.0% |

| Banorte | GBOOY | 10.2% | 9.3% |

| Walmart Mexico | WMMVY | 9.0% | 9.4% |

| Femsa | FMX | 8.8% | 9.4% |

| Grupo Mexico | GMBXF | 6.9% | 4.7% |

| Grupo Bimbo | BMBOY | 4.4% | 3.6% |

| Cemex | CX | 4.1% | 4.7% |

| Pacific Airports | PAC | 3.3% | 3.2% |

| Southeast Airports | ASR | 3.0% | 3.8% |

| Inbursa | GPFOY | 2.7% | 2.7% |

There are a couple of tiny differences here. EWW appears to be slightly more top-heavy, having a bigger allocation to its largest position. Also, FLMX owns a lot more Grupo Mexico than EWW whereas EWW owns a bigger stake in America Movil, Femsa, and Cemex, among others.

Besides those modest differences, however, it's hard to find much of anything too notable that would distinguish the composition of these ETFs. Both ETFs give broad exposure to Mexico, with a heavy allocation to the country's largest companies while having minimal exposure to smaller Mexican firms.

Performance: Lower Fees Give Franklin A Slight Edge

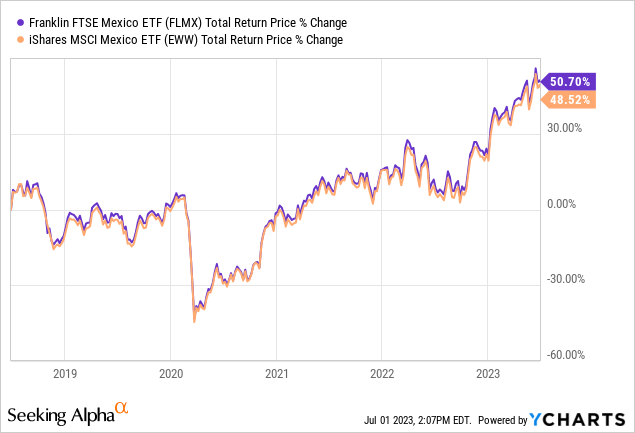

Here are the total returns for these two ETFs over the past five years:

As you can see, these funds have almost identical performance, which is to be expected as the holdings so clearly mirror each other. That said, over the past five years, Franklin's Mexico fund has returned 50.7% compared to 48.5% for the iShares MSCI Mexico ETF.

This is not a massive amount of alpha, but every little bit of extra performance is appreciated. To the extent that Franklin can offer higher returns because it charges a lower expense ratio, this added bit of performance should be repeatable in the future as well.

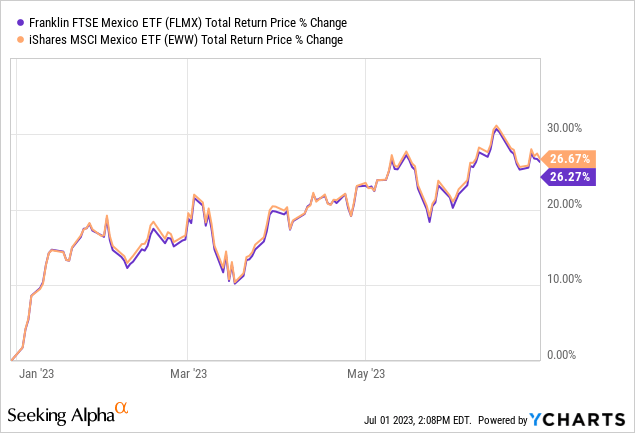

That said, year-to-date, the EWW ETF has ever-so-slight outperformed the Franklin ETF, returning 26.7% versus 26.3% through the first half of 2023:

The slightly different weighting of securities can lead to tiny differences in performance. That said, as the chart shows, correlation here is still exceptionally high and over time, I'd expect lower fees to win out over other factors. This should make Franklin the stronger performer of the two ETFs over a long time horizon.

Franklin FTSE Mexico ETF Verdict

For an investor wanting a buy-and-hold ETF for exposure to Mexico, the Franklin ETF should be the winner as compared to the iShares MSCI Mexico ETF. I believe the selection and weighting of securities is close enough between the two that their performance will be nearly identical over time in terms of gross returns. As such, fees are likely to be the deciding factor, and Franklin Mexico is the winner there.

Why don't I own either the iShares MSCI Mexico ETF or the Franklin FTSE Mexico ETF? I personally see more opportunities picking individual stocks in Mexico. I've been a long-time advocate of the Mexican airport operator stocks, which I see having much greater potential than some of the ETFs' larger holdings such as the banks or telecom companies. Additionally, I own several smaller Mexican companies which are not significant holdings in either of the Mexico ETFs. I believe the Mexican market is structured in a way that rewards individual stock-picking rather than owning the index.

That said, the economic outlook for Mexico is strong, and there is merit in owning the index as well for folks that aren't comfortable owning individual Mexican equities. The iShares ETF is much more liquid and has an active options market, making it more attractive for people wanting to trade frequently or engage in options strategies such as covered calls. However, for a long-term buy-and-hold position on Mexico, the Franklin ETF should deliver slightly higher returns than the iShares MSCI Mexico offering.

If you enjoyed this, consider Ian's Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.

This article was written by

Ian worked for Kerrisdale, a New York activist hedge fund, for three years, before moving to Latin America to pursue entrepreneurial opportunities there. His Ian's Insider Corner service provides live chat, model portfolios, full access and updates to his "IMF" portfolio, along with a weekly newsletter which expands on these topics.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ASR, PAC, FMX, WMMVY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.