Yatsen Holding: Poised For Next Leg Of Growth, Initiate At Buy

Summary

- Yatsen Holding has seen a turnaround in its fortunes with the lifting of Covid-19 restrictions, driven by robust skin care sales and improvement in colour cosmetics.

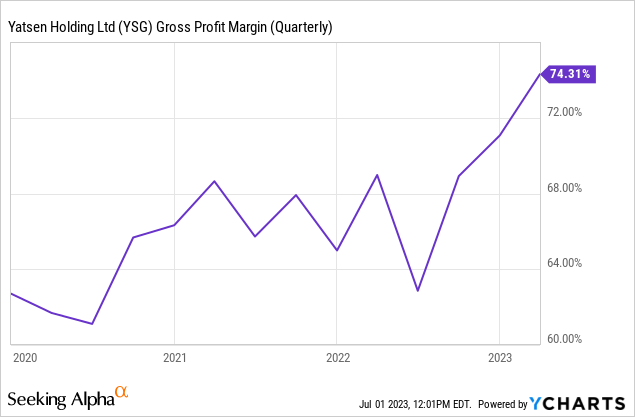

- Gross margins were at record high driven by higher margin products and pricing policies.

- PD's turnaround could soon be nearby post store optimisation and focus on new and improving existing product lines.

- At current valuation, YSG appears cheap. Initiate at Buy.

JohnnyGreig/E+ via Getty Images

Investment Thesis

Yatsen Holding (NYSE:YSG) is the largest local cosmetic player in China with ~8% market share in cosmetic sales and 4th largest overall behind global giants L’Oréal, LVMH and Estee Lauder. It has been at the brunt of China's zero covid policy amidst the pandemic leading to declining sales and eroding profits. However, China's lifting off of the restrictions leapfrogged the company's dwindling fortunes along with the overall retail sector with beauty sales growing 10% YoY during Jan-May period. We believe its robust gross margins driven by skin care products with high repeat value and cost optimisation, continued improvements within colour cosmetics brands and improving consumer confidence as a result of reopening puts YSG in a perfect position to capitalise the next stage of growth. We initiate at Buy as a result of improving operations and valuation comfort.

Earnings Corner

YSG reported a 14% YoY decline in revenue in Q1 as a result of 29% decrease in the colour cosmetics brand partially offset by increase of 34% YoY in the skin care brand. Robust revenue growth within the skin care brand over several quarters led them to grow its pie to 32% of the total sales (up from ~20% share a year earlier). Revenue growth beat its own guidance of 20-30% decline driven by continued sequential improvement within the colour cosmetics and outperformance of the skin care segment.

Gross margins for the quarter continue to improve with margins expanding a massive 530 bps YoY driven by increasing contribution of high margin skin care products, disciplined pricing policies along with cost optimisations across portfolio. This also remains the highest ever gross margins reported by the company reflecting its constant efforts and success in brand building, product development, and cost optimisation, despite an overall increasingly competitive beauty market.

SG&A expenses decreased substantially as a result of the ongoing efforts to optimise costs by outsourcing warehousing and logistics costs leading to substantial reduction in fulfilment costs as well as optimisation in selling and marketing as a result of closure of non-performing offline stores. Adjusted net loss per share narrowed to ($0.01) after posting profit in Q4 demonstrating colour cosmetics is making positive strides while skincare segment remains robust as ever.

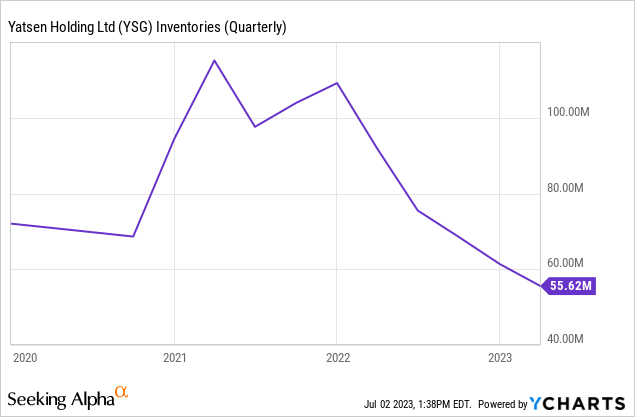

Balance sheet strength is evidenced from the $364 mn in cash and short term investments with no debt. Its prudent lean inventory management has led to consistent improvement in inventory turnover ratios with inventory levels at the lowest driven by improved off-take of skincare products along with continued improvement in the colour cosmetics segment.

Management had guided for Q2 revenues to go down by 10 - 20%, however, the same is expected to be significantly better as Chinese retail sales in cosmetic products remained robust for the months of April and May, up 24% and 12% respectively compared to 5.9% growth in Q1, according to National Bureau of Statistics.

Is Turnaround Around the Cards?

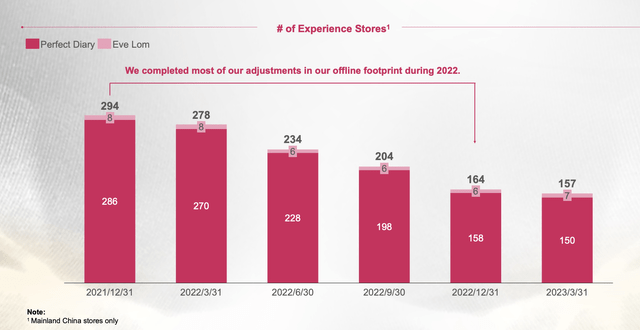

Colour cosmetics had been an increasingly challenging business amidst an increasingly competitive landscape. Its investments in PD experience stores several years back failed to perform as a result of China's zero covid policy that led not many people going out looking for beauty products, while the fixed costs of operating store dwindled its cash balances. However, it adopted a leaner approach amidst the pandemic reset and closed half of the total PD experience stores which were underperforming.

We believe with the store optimisation completed, its focus on top-line growth with the launch of new foundation products, new colours of its traditional hero products of lipstick and eyeshadow palette and its fashion designed colour products would continue to drive sequential improved amidst a recovering retail sales environment post pandemic.

Valuation

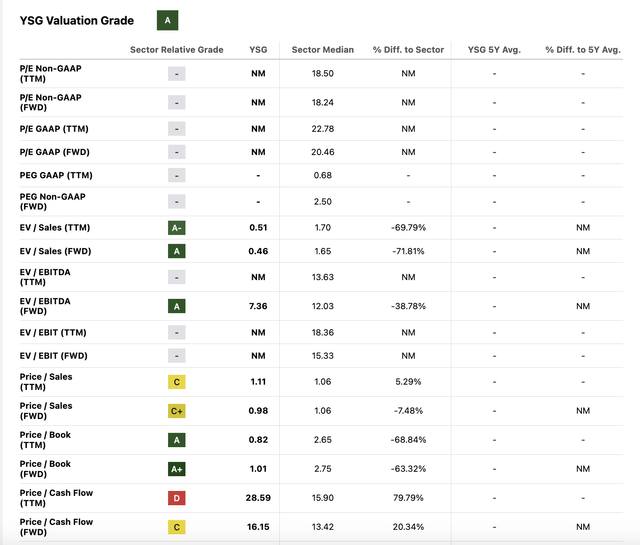

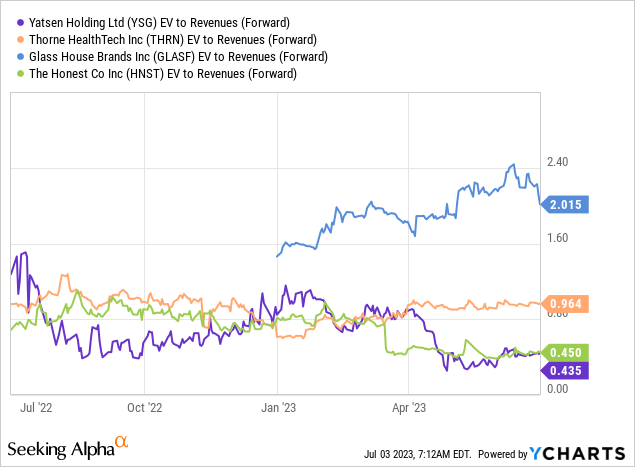

YSG is trading at dirt cheap valuation of 0.4x EV/ Revenue, significantly lower than its peers. We believe at current valuation along with an ongoing improvement in the financial profile and operating performance, the risk reward is significantly favorable on the upside. We initiate at Buy valued at 0.7x EV/ Revenue, factoring a discount of 40% to its peers, given its exposure to China and assign a target price of $1.35 (factoring cash/share of ~$0.6), still implying a significant upside.

Seeking Alpha Valuation Grade rates it as 'A' demonstrating the valuation comfort.

Risks to Rating

Risks to rating include 1) Any change in government policy as a result of any COVID strain leading to lockdowns would have a pronounced effect on the consumer spending and company's performance as witnessed during the last several quarters 2) Increasingly competitive landscape would lead to continued underperformance of its colour cosmetics segment, in particular PD brand and recovery of the segment could be prolonged and 3) continued investments in growing the new brands could drag profitability in the near term while its flagship brands such as PD takes time to turnaround

Final Thoughts

YSG is a leading player in Chinese beauty industry and has strong brand resonance amongst its consumers offering entire breadth and depth of portfolio across price points. Its focus on multi-brand strategy pivoting swiftly to a leaner model in colour cosmetics as well as growing skin care portfolio through a string of acquisitions in past years have helped them weather the storm amidst the lockdown. We believe the current gross margins would likely be plateaued but sustainable as a result of increasing repeat purchases within skin care and sequential turnaround in PD. At under 0.5x EV/ 1Y Fwd revenue, we believe the risk-reward ratio is favourable. Initiate at Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.