Royal Gold Adds Brazilian Royalties

Summary

- Royal Gold is buying a royalty package on two base metal mines in Brazil.

- The acquisition will facilitate the IPO of a new base metal mid-tier miner.

- We look at the details, and attempt a valuation.

- Looking for a helping hand in the market? Members of Itinerant Musings get exclusive ideas and guidance to navigate any climate. Learn More »

Stefan Lambauer/iStock via Getty Images

Private equity funds associated with Appian Capital Advisory have been avid investors in base metal mines in recent years, picking up and turning around distressed producing assets, and transforming development projects into operating mines. The acquisition of the Rosh Pinah mine in Namibia is only the latest point in case in a string of similar transactions. However, Appian's efforts to sell the Serrote and Santa Rita mines in Brazil have marked a notable shift towards monetizing parts of the fund's portfolio. These efforts hit an early snag when Sibanye Stillwater (SBSW) terminated a purchase agreement regarding these two mines at the start of this year (leaving it up to the British High Court to decide whether Sibanye's claim of material adverse effects has merit). Notwithstanding this snag, it hasn't taken long for another buyer to step up and acquire these two mines, for the exact same conditions as quoted in the terminated Sibanye agreement. The new buyer goes by the name of ACG Acquisition Company, a vehicle backed by Glencore (OTCPK:GLCNF), La Mancha, and car-makers Volkswagen (OTCPK:VWAGY) and Stellantis (STLA).

ACG will purchase the Serrote and Santa Rita mines for a total of $1.065B, rename itself into ACG Electric Metals, and launch a public offering to raise $300M with a $50M backstop from Appian in the wake of this transaction. All this to arrive, in a long-winded way, at the final piece of this transaction -- namely the proposed $250M royalty agreement between ACG and Royal Gold (NASDAQ:RGLD) -- to complete the funding for this transaction.

We are Royal Gold shareholders, and thus our interest in this deal stems mainly from the angle of the new royalty package to be included in Royal Gold's portfolio (which is not to say, that we won't be following the ACG IPO very carefully). And without much further ado, here is our take on this deal from the perspective of Royal Gold.

Technical reports on the two mines in support of the described deal are available for download from the ACG website, and much of the following considerations are taken from these two reports. Both mines have been held privately by subsidiaries of Appian without the need for NI43-101-compliant disclosure, and thus these reports are called "Competent Person's Reports". Nevertheless, these reports represent feasibility-level of detail to the best of our judgment, unless otherwise stated.

The Serrote Mine

The Serrote copper-gold deposit is located in northeast Brazil in the State of Alagoas. As with most Brazilian projects, Vale (VALE) had owned the project at some point, but left development to a series of junior miners, some of them with existing public records. Digging through some historic documents filed on SEDAR we have pieced together the following: in 2012 Aura Minerals (OTCQX:ORAAF) released a feasibility study for the Serrote project, outlining annual open pit production of 66M lbs of copper and 13Koz of gold. Further development encountered various obstacles, and in 2015 development of the Serrote project was suspended when Aura found it was "unable to raise additional financing to maintain the ongoing development status or to fund the construction of the Serrote Project". Aura Minerals sold the Serrote project to Appian in 2018 for $40M, i.e. more or less at cost considering the book value of $24.5M at the time of the sale and the impairment charges registered against the project.

Appian re-engineered the project, built the mine, and reached commercial production in early 2023, guiding for the production of 55M lbs of copper and 9K oz of gold in 2023 according to this news report.

The 2021 mineral reserve of 46.7M tonnes at a copper grade of 0.58% and a gold grade of 0.10g/t supports a mine life until 2034 for an NPV(8%) of $540.3M; however, with a resource of more than twice the reserve tonnage future mine life extensions are more than just far-fetched speculation. In fact, a pit expansion study is apparently in progress, and early studies for certain satellite deposits are also in the works. Cost guidance for 2023 is for C1 cash cost of $1.50/lb and $1.60/lb, and all-in sustaining costs of $1.85/lb, pointing to a highly profitable operation. Q1 production already significantly exceeded guidance, and beat cost guidance by a healthy margin.

Royal Gold is purchasing a gross smelter return (or GSR) royalty of 85% of the payable gold from the Serrote mine until achievement of a royalty revenue threshold of $250 million from this royalty, and 45% thereafter; plus a GSR on the copper production ramping to 1.1% in 2025, and dropping to 0.55% after reaching a revenue threshold of $90M.

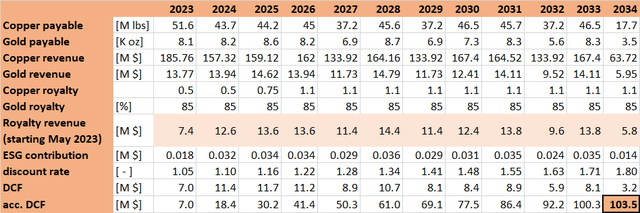

Using the data gleaned from the mine plan in the technical report, and plugging these data points into a DCF spreadsheet yields an NPV(5%) of $103.5M for the royalty (using the price deck shown in the caption).

Serrote royalty DCF model @ $1,700/oz gold & $3.60/lb copper (Author's work)

The Santa Rita Mine

The Santa Rita project was worked by a series of Brazilian companies, and put into production in 2009 by an Australian mining company going by the name of Mirabela Nickel. This company went into voluntary administration in 2015, and operations at the Santa Rita mine were suspended in 2016. Appian bought Mirabel out of bankruptcy in 2018, renamed its newly acquired subsidiary into Atlantic Nickel, and recommenced mining operations in 2020.

The Santa Rita mine is a large open pit nickel mine, with significant gold, copper, and PGE metals by-products. The technical report outlines an open pit mine life until 2028 for an NPV(8%) of $570M; plus there is also a PEA-level study available documenting an underground operation with an additional 27 years of mine life and an NPV(8%) of $812M. Pleasingly, Q1/2023 performance was well ahead of the predictions in the technical report (and in this context, we can't help but wonder about Sibanye's claim of material and adverse impacts affecting the mine).

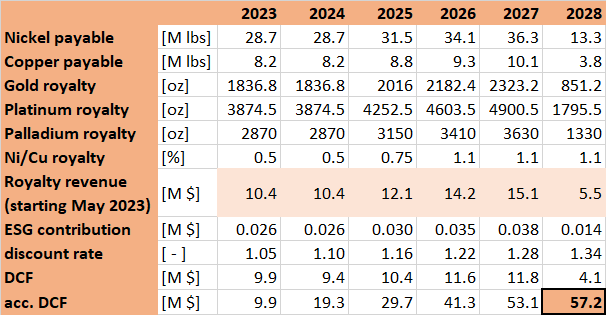

Royal Gold will receive 64oz of gold, 135oz of platinum, and 100oz of palladium for each 1M lb of payable nickel produced from the Santa Rita mine. The platinum and palladium royalty will terminate after the achievement of a royalty revenue threshold of $100M. Additionally, the same base metal royalty as for the Serrote mine will apply. The spreadsheet below puts numbers to this royalty agreement, again using the mine plan outlined in the technical report (open pit only) and the price deck shown in the caption. The resulting NPV(5%) amounts to $57.2M.

Serrote royalty DCF model @ $1,700/oz Au, $3.60/lb Cu, $8/lb Ni, $800/oz Pt & $1000/oz Pd (Author's work)

Royalty Valuation

If we use the numbers computed in the two spreadsheets above, the total NPV(5%) of the royalty package purchased by Royal Gold comes to ~$160M. Royal Gold is paying $250, or a 56% premium. On surface, this looks like a costly acquisition. However, we believe that in this case, it's worth circling back to the company's April 2023 Investors' Day, reminding ourselves of a comment made by Vice President Mr Alistair Baker:

DCF is our principle valuation tool, but it does have some limitations. These limitations are most obvious when looking at Day 1 evaluations of assets with multi-decade potential, and those are the assets that we covet the most. Not only does the time value of money concept understate the intrinsic value of long reserve lives on the day the investment is made, it also minimizes the impact of mine life extensions and production increases. And because these assets provide long-term exposure to a volatile commodity price, DCF valuations with flat pricing assumptions disregard the value of a price variability, which increases with time.

Yes sure, talk of "Blue Sky exploration potential" and "leverage to metal prices" is ubiquitous in conference calls following royalty acquisitions in a sellers' market. And we usually give little credit to these assertions, especially when the royalty is on a small mine, operated by a cash-strapped miner. However, the above argument gains credibility when it comes to large operations with a clear runway to a long mine life, and when access to capital necessary to develop and expand the mine is not a problem. In such cases, we believe that valuation by cash flow multiples is more appropriate. Judging from the available technical data we have a very strong suspicion that the present deal represents exactly such a case. And noting the cash flow projections detailed in the tables above, the acquisition comes at ~10x forward cash flow -- a very reasonable price tag, and a deal we can wholeheartedly commend Royal Gold's management team on.

Summary & Investment Thesis

The Serrote and Santa Rita mines have been right-sized and brought back into commercial production by Appian. They are about to be sold to a newly minted base metal miner which will IPO in the near future. This mid-tier miner to be will be well-capitalized, and it will be led by a respected management team well capable of operating these two assets, and crystallizing the underlying value.

Opportunities for the creation of such royalties are rare. In our view, Royal Gold has identified such an opportunity with the going-public preparations of ACG, and Royal Gold has been able to negotiate very reasonable conditions to add another potential flagship asset to its portfolio. We are very happy shareholders indeed, and we believe this deal will be viewed as highly accretive in the fullness of time.

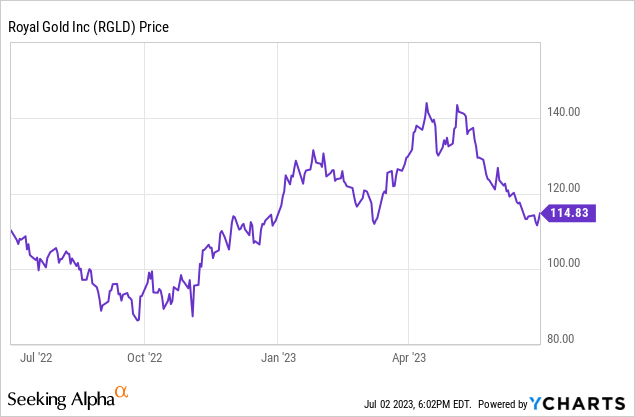

The share price has come down ~20% from the recent high and looks attractive at $115 at the time of writing. It may well drop further in the short term, depending on cues taken from the gold price, but we submit that starting a position at the current price will most likely represent a profitable investment in the longer term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

And Before We Go...

Please consider a free trial subscription to Itinerant's Musings.

In this service we offer

- Exclusive access to our small and mid-cap ideas;

- A lively community of like-minded investors;

- Regular commentary and outlook on metal prices;

- One-on-one contact with the author.

- Plenty more.

We'd love to have you on board.

This article was written by

Some of my work is available free of charge on Seeking Alpha. If you have come to like these offerings, then please consider joining my Marketplace service called Itinerant Musings where I usually present my best ideas and provide personalized interaction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RGLD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.