Coinbase Global: An Anti-Cyclical Bet On The Crypto Market

Summary

- Bitcoin and Ethereum have shown strong year-to-date returns in 2023, which could positively impact the earnings prospects of the cryptocurrency platform Coinbase Global.

- Coinbase Global's revenues have suffered due to a decline in cryptocurrency popularity in FY 2022. However, the recent recovery of these cryptocurrencies could attract retail traders back to the platform.

- The biggest risk for Coinbase Global is regulatory intervention, as the SEC has sued Coinbase Global for the alleged sale of unregistered securities.

- Despite these risks, I believe investors have an opportunity to position themselves for the next bull run in cryptocurrencies.

kaedeezign

Bitcoin (BTC-USD) and Ethereum (ETH-USD) have produced strong year-to-date returns as both cryptocurrencies recovered from oversold sentiment and attracted new buyers in 2023. Strong recovery gains for the two largest digital currencies could also bode well, in my opinion, for the earnings prospects of cryptocurrency platform Coinbase Global (NASDAQ:COIN), especially if the marketplace were to see a return of retail traders... which in 2022 turned their backs on the company as well as on the broader crypto market. While regulatory headwinds are real, the still out-of-favor status of the cryptocurrency sector could indicate a long term buying opportunity, in my opinion!

Strong recovery gains bode well for Coinbase Global's Q2'23 earnings

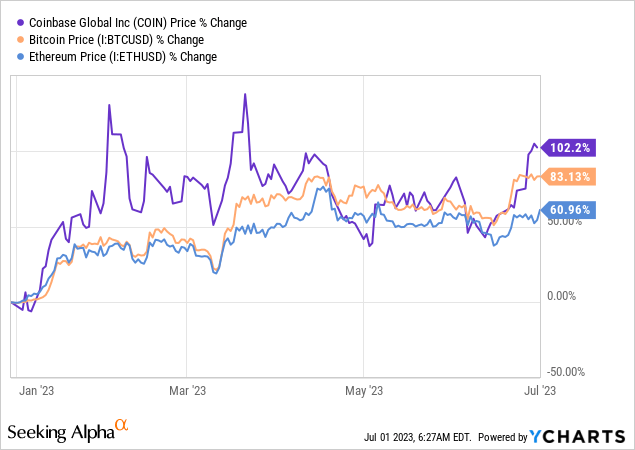

The prices of Bitcoin and Ethereum have risen strongly in 2023. Year-to-date, Bitcoin has seen a price gain of 83% while Ethereum is 61% more expensive than at the beginning of the year. The strong price increases witnessed in major digital currencies, in my opinion, could lead to new capital flowing back into the cryptocurrency sector and a strong earnings report for Coinbase Global's second-quarter.

Since cryptocurrencies have declined in popularity in FY 2022, negatively impacting investor sentiment, a lot of investors likely didn't participate in the bull run of Bitcoin and Ethereum in the first six months of the year. However, prices of BTC and ETH are positively correlated with the stock price (and earnings prospects) of cryptocurrency trading platform Coinbase Global... which obviously earns more money when volatility is high and users trade a lot in and out of positions. Coinbase Global's stock prices mirrors the movements of major digital currencies and the platforms' shares have generated a more than 102% return year-to-date.

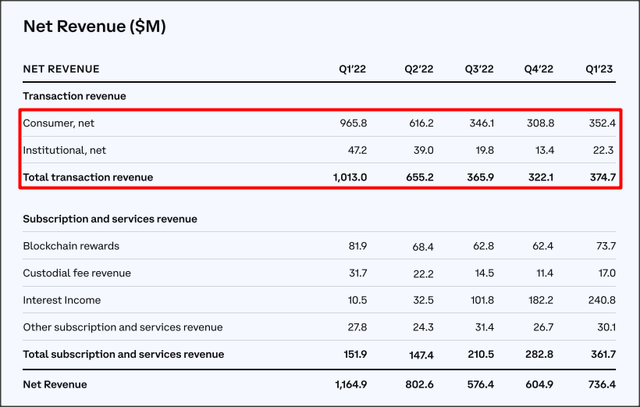

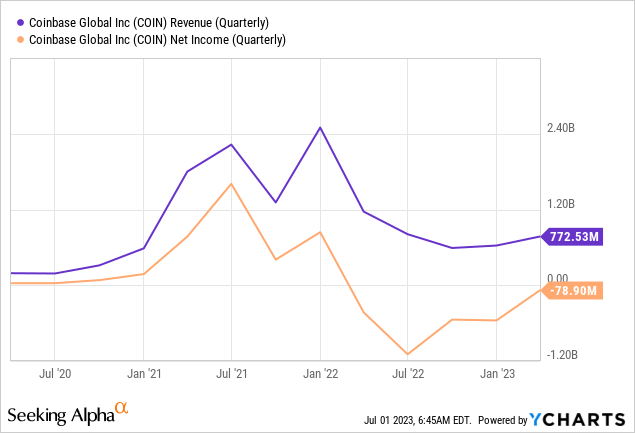

Throughout FY 2022, Coinbase Global's net revenue trend has reflected the conditions in the cryptocurrency market. With both Bitcoin and Ethereum falling to new yearly lows in 2022, Coinbase Global suffered a material contraction in its revenue base, as one would expect. Total transaction revenues in Q1'23 were only $374.7M, showing a decline of 63% compared to the year-earlier period. Compared to Q4'21, Coinbase Global's record quarter resulting from unprecedented cryptocurrency adoption, the platform's transaction revenues decreased 84%.

Retail traders continue to be the most trading-happy customer group on the platform and generated 94% of all transaction revenues in the last quarter.

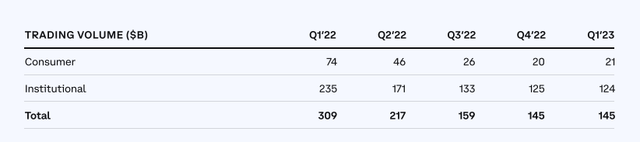

What is interesting to me is that the trading volume of retail investors has seen a significantly larger decline than the trading volume of the "smart money", namely institutional investors: in the last quarter, retail investors accounted for just $21B of Coinbase Global's trading volume, representing a trading share of only 14% (it was 32% in Q4'21). Retail trading declined 72% in the last year and 88% since Q4'21.

Institutional investors have also seen declines in trading volumes, but to a much smaller extent: institutional trading in Q1'23 was down 47% (Y/Y) and 66% relative to Q4'21. The smart money accounted for 86% of the entire trading volume on Coinbase Global in Q1'23 (it was 68% in Q4'21). In other words, I believe the most recent bull-run in cryptocurrencies has largely benefited the smart money while many retail traders have likely missed the rally. Retail traders are often the last to catch on to trends and since the smart money still seems to be interested in cryptocurrencies, I believe crypto-investors are potentially confronted with an anti-cyclical investment opportunity here.

Focus on cost-cutting actions, realignment of cost structures during the last crypto winter

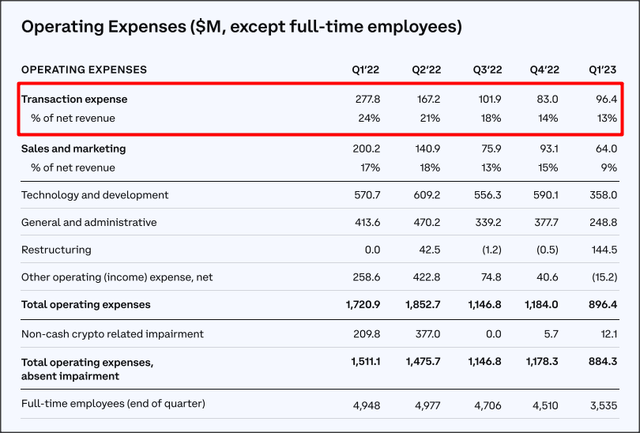

Coinbase Global reacted to the crypto-winter last year by cutting expenses and laying off staff, resulting in sharply down-trending expenses in the last four quarters. Transaction expenses declined from 24% of net revenues in Q1'22 to just 13% in Q1'23, showing an 11 PP year-over-year decline. And the company announced in January that it was going to cut 950 jobs off its payrolls, which was approximately 20% of its headcount. In total, Coinbase Global reduced the number of its full-time employees by 29% from Q1'22 to Q1'23.

Coinbase Global, however, did not achieve profitability in FY 2022 or in Q1'23... which is a direct reflection of deteriorating cryptocurrency market conditions.

Coinbase Global's cyclical earnings potential

Coinbase Global has a fundamentally unpredictable earnings profile because its potential depends chiefly on the health of the cryptocurrency market. As in other markets, higher prices for assets tend to attract more capital, which is why I believe Coinbase Global could benefit from a return of investment capital to the sector, and especially the return of retail traders which continue to account for the majority of the platforms' transaction revenues.

Coinbase Global, however, was a deeply profitable enterprise in 2021 when the cryptocurrency market reached, for the first time ever, a market cap of more than $2T. Because of strong price gains for Bitcoin and Ethereum YTD, I believe Coinbase could see a re-acceleration of its top line and earnings growth in the second-quarter. While the cryptocurrency platform may still lose money, the earnings prospects have fundamentally improved with the rising prices of BTC and ETH, in my opinion.

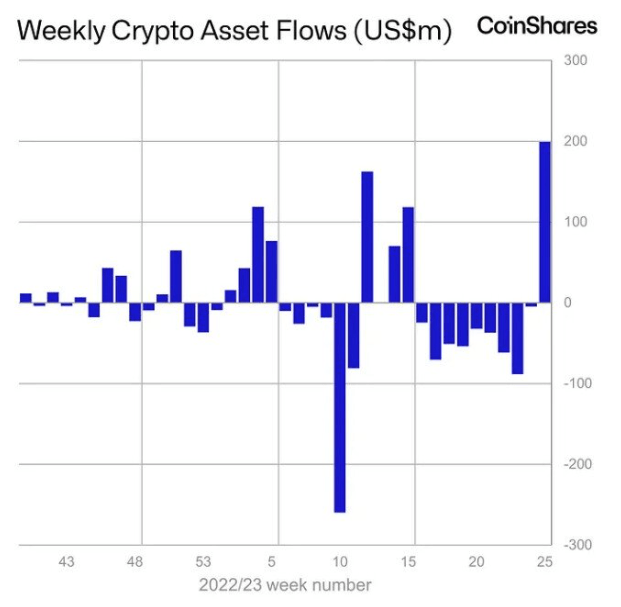

This point is supported by the fact that asset inflows into the crypto sector have increased after BlackRock filed paperwork for its Bitcoin ETF last week... which also caused Bitcoin to soar and climb (shortly) above $31 thousand. With major digital asset prices soaring in the first half of FY 2023, I believe more capital could flow back to the crypto market in the coming quarters, potentially resulting in additional demand for major cryptocurrencies. Coinbase Global's second-quarter earnings, if sufficiently robust, could also help shine a new light on the sector and result in renewed interest in cryptocurrencies. Any kind of turbulence in the U.S. financial system, including new bank failures, could also help the crypto market stage a rebound.

Source: CoinShares

For the current year, Coinbase Global is not expected to be profitable and earnings estimates should be taken with a grain of salt. A sudden burst in volatility could fundamentally change Coinbase Global's earnings prospects in a very short period of time. Right now, analysts project the cryptocurrency platform to lose $2.00 per-share and slightly more in FY 2024.

However, if cryptocurrency market conditions continue to improve and prices continue to climb, Coinbase Global could return to profitability much more quickly than consensus estimates currently indicate. Coinbase Global earned $14.50 per-share in FY 2021 (a record year). I am not saying that the marketplace could immediately realize its full profit potential, but if the company achieves only half of this profitability during the next crypto-market upswing, then the marketplace is valued at a P/E ratio of 9.9X... which I consider to be a bargain for the world's largest publicly-traded cryptocurrency exchange.

Risks with Coinbase Global

The biggest risk for Coinbase Global and other cryptocurrency-trading platforms is regulatory intervention on the part of the Securities and Exchange Commission. The SEC has sued Coinbase in June and alleged that the marketplace operated as an unregistered securities exchange, broker and clearing agency. Coinbase is contesting this claim and prepared to fight this assessment legally. Regulatory headwinds, a volatile earnings profile and the unpredictability of cryptocurrency movements are three key risk factors that investors should be aware of.

Closing thoughts

I believe investors have an opportunity here to position themselves for the next bull-run in cryptocurrencies. Bitcoin and Ethereum already performed extremely well with a YTD return of 83% and 61%, which likely will be reflected in robust transaction revenue growth for Coinbase Global's second-quarter. Strong price increases for the two largest digital currencies are likely to attract new investor capital back into the crypto sector, a trend Coinbase Global would stand to benefit from. Since Coinbase Global's shares could be seen as a diversified bet on the crypto market, I believe the risk profile is skewed to the upside!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of COIN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.