SJNK: The 7%+ Yield That No One Is Talking About

Summary

- The SPDR Bloomberg Short Term High Yield Bond ETF is the unsung hero in short-term fixed-income exposure.

- High yield, low volatility, and a highly diversified portfolio.

- Minimize the impacts of future unexpected rate hikes by keeping the duration short.

Andrei Sauko

Thesis

We're currently in a set of economic uncertainties that are leaving investors puzzled. Interest rates continue to be ratcheted-up by central banks, inflation is playing a game of chicken, equity valuations remain high and volatility is sending unpleasant rumbles through everyone's bellies. There are very few certainties at the moment. Investors know they need to outpace inflation but long term yields are less than short term, pushing investors to cash or money markets.

Today we present an investment idea that limits long term interest rate exposure, captures additional return (read risk) and in our view has symmetrical upside/downside scenarios. We are talking about SPDR Bloomberg Short Term High Yield Bond ETF (NYSEARCA:SJNK). SJNK is the short term portion of the high yield index and is offering a credit spread that juices returns just shy of mouthwatering.

Overview

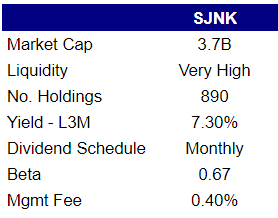

SJNK is an ETF that tracks the Bloomberg US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index, having been established in 2012. The ETF has hit critical mass with 3.6B in assets though does come with a price tag of a 0.4% management fee. This fee is somewhat expected and somewhat understated. Expected, in the sense that the effort to manage the less liquid underlying does require more work and understated in the sense that transactions on high yield fixed income instruments have costs not captured here (larger spreads and trading costs).

SJNK brings a very attractive yield (7.3% when annualizing the last 3 monthly distributions) due to its underlying assets providing a credit return. The big attraction to SJNK is the additional return (from taking on additional risk) but in an extremely diversified manner (890 underlying holdings). Together the funds also provides a good source of equity diversification with a beta of 0.67, another advantage in these volatile markets.

Author's Analysis

Credit Spread

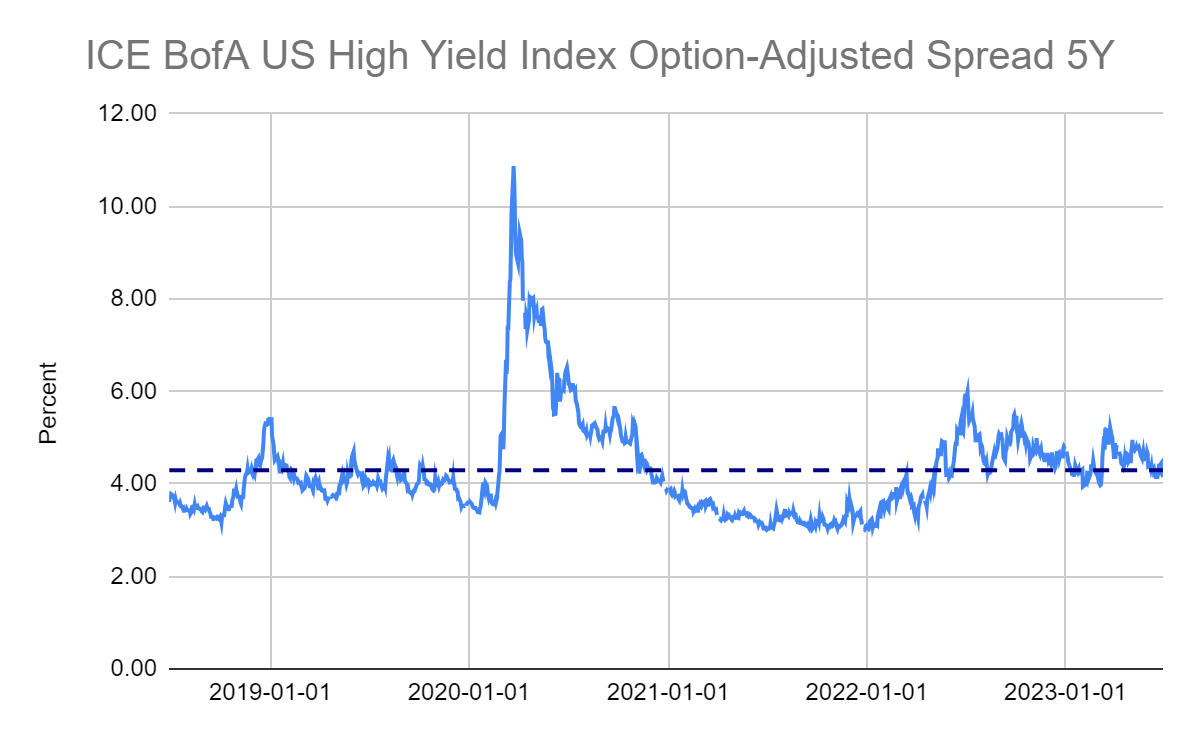

The whole idea behind investing in high yield assets is to get compensated a higher return for taking on additional risk. The chart below is the 5 year historical level of option adjusted spread between fixed income instruments below investment grade and the spot treasury curve. Right now we are at a very average credit spread when compared to the last 5 years. A change in spread can add/subtract from the return of holding high yield securities. A compression will provide additional return on an existing position while an expansion will reduce return. The average reflected below is 4.29% against a June 30th value of 4.14%.

Author's Analysis

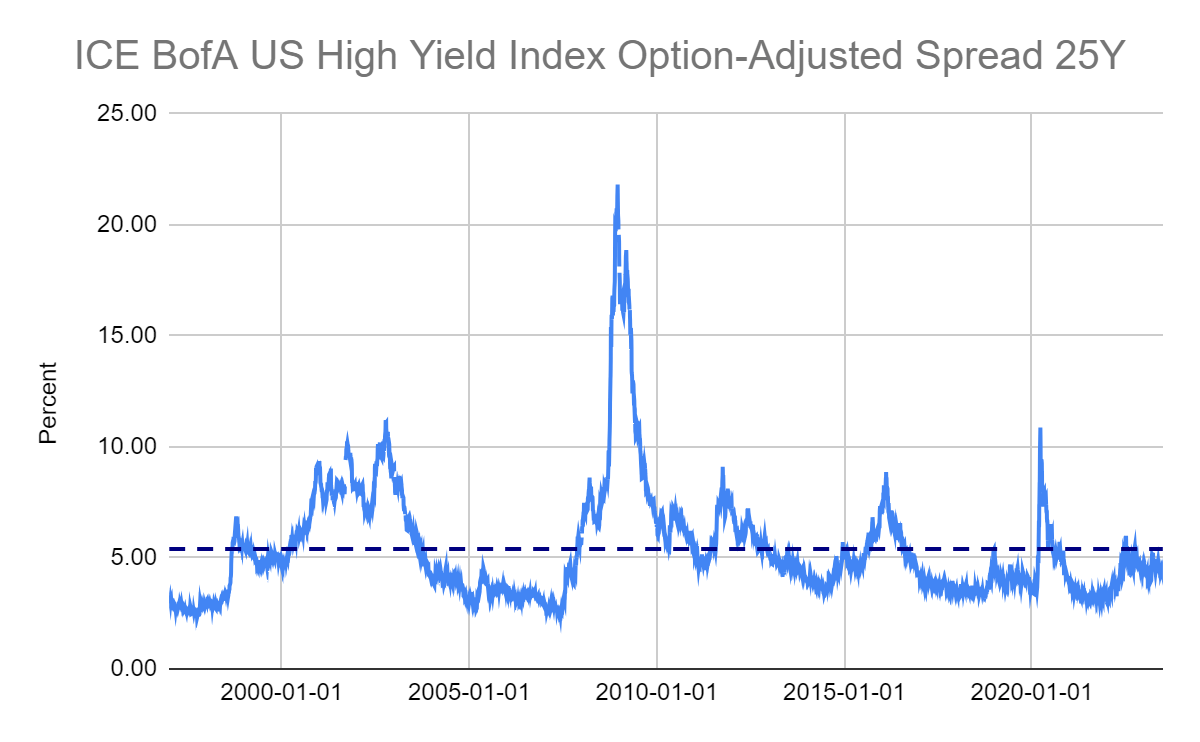

Going back further, as 5 years is a relatively short time period for evaluating the fluctuations in the credit spread we see additional spouts of volatility. Since 1996 the average spread is 5.40%, 136 basis points higher than the current level, although certainly skewed upwards by the global financial crisis. In our opinion, the current level makes a compelling case for an entry into the position for investors. However, given the uncertainty we would suggest a partially sized position with the intention of averaging down should the spread expand to a more attractive level.

Author's Analysis

Interest Rates

Since the 80s the decline of interest rates has been a significant driver of fixed income return, up until last year when central banks aggressively started their rate hike journey. In our view there is far too much uncertainty on where that will head as inflation is still out of control. Current indications suggest we have not peaked in terms of interest rate and the expected timeline of when rates will start to decline continues to push right. Given these conditions, our view is that the short term side of the fixed income curve is far more attractive for the time being.

SJNK, by focusing on the short term market, helps minimize the exposure to unexpected future hikes and conversely unexpected cuts. In our view, the volatility is just too high and inflation too rampant to justify taking a view on interest rates. Instead we search for returns that can enhance performance while containing exposure.

Portfolio

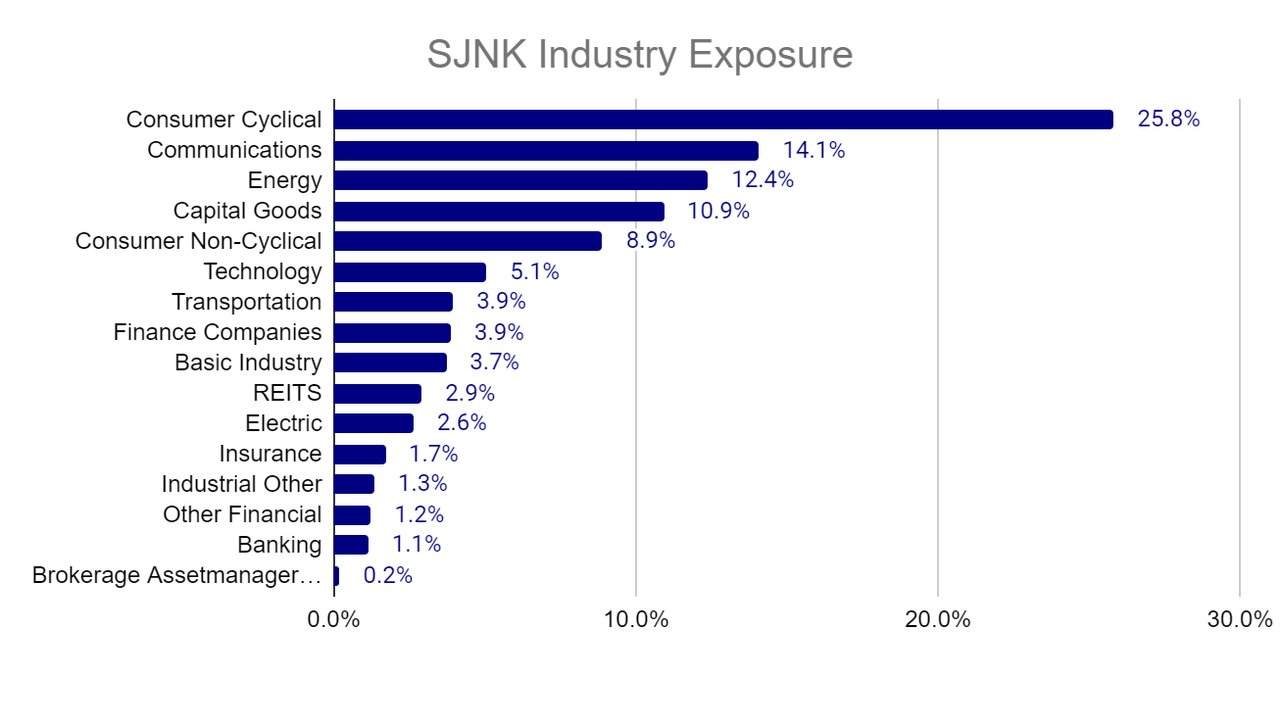

As expected with a high yield fund, the industry exposure is not the safest grouping. A natural exposure to more cyclical industries is likely and certainly the case of SJNK. Consumer cyclical, energy and capital goods are all very cyclical in nature and the underlying likely have a leveraged exposure to the economy as a whole.

Investing in any of these individual securities would bring a high level of inherent risk. However, the largest individual position in SJNK represents only 0.77% of the portfolio, with every position beyond the top 10 representing less than 0.5%. An extremely diversified portfolio, which safely removes individual company risk but maintains our credit exposure (the source of the additional return).

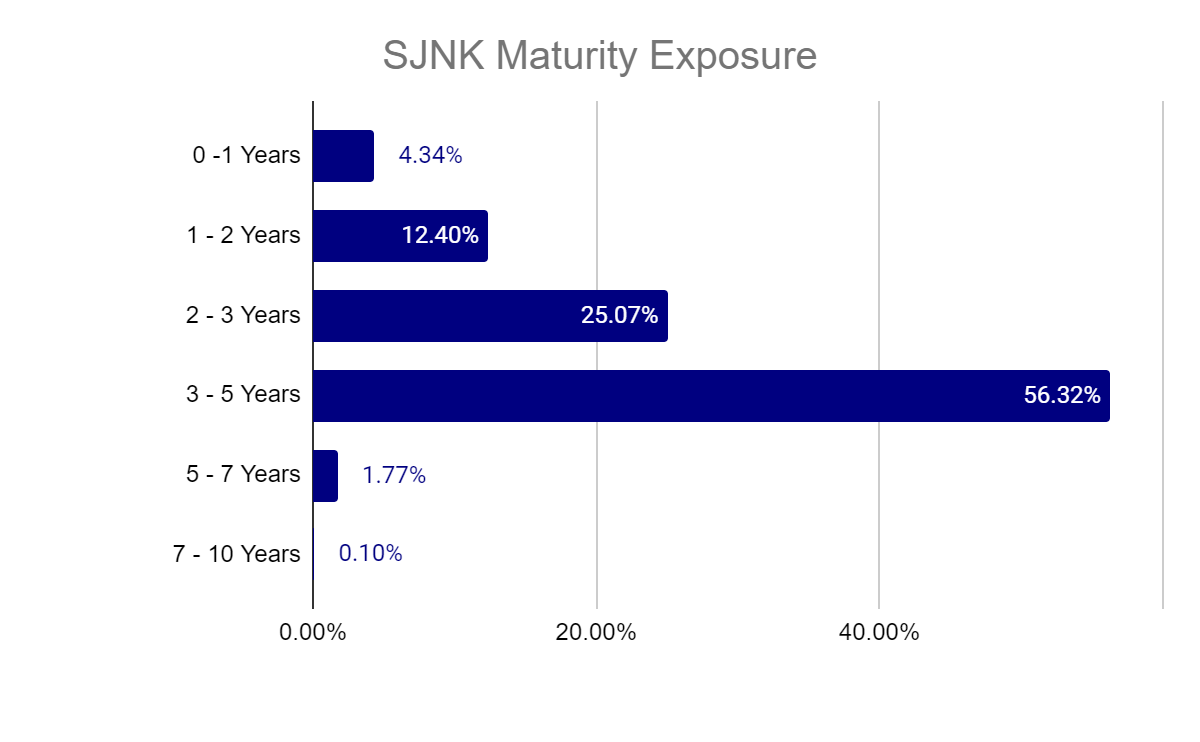

Although SJNK is a short term focused ETF, it is not on the same level as a money market fund. The majority of holdings sit with a maturity greater than 3 years, though the exposure beyond 5 years is nominal. The greater the duration the greater the interest rate risk, so while SJNK has mitigated much of the interest rate exposure of its full maturity ETF sibling JNK, it is by no means eliminated. Average duration of the ETF is 3.27 years.

A duration of 3.27 is not immune to interest rate moves, especially rapid ones. This is shown by the funds -5.50% return performance in 2022. However, it is very muted when compared to the -12.20% that JNK experienced over the same time period.

Author's Analysis

Risk

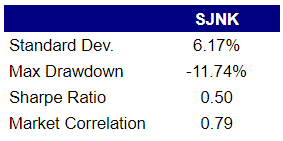

SJNK is a great asset not because it is risk free but because it is very specific in its risk exposures. Standard deviation and max drawdown remain very attractive as a diversified asset.

Author's Analysis

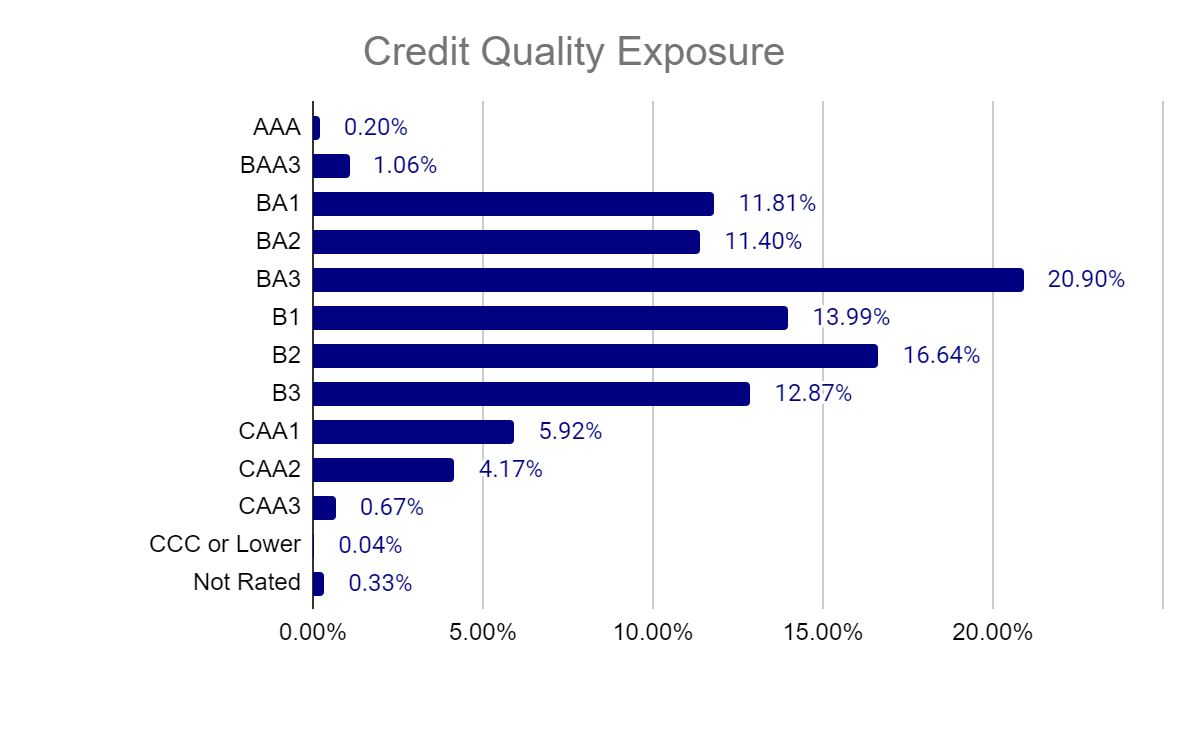

A high yield fund wouldn't be high yield without the exposure to sub-investment grade bonds. And this is where the source of risk and additional return are generated from.

Author's Analysis

Increasing Defaults

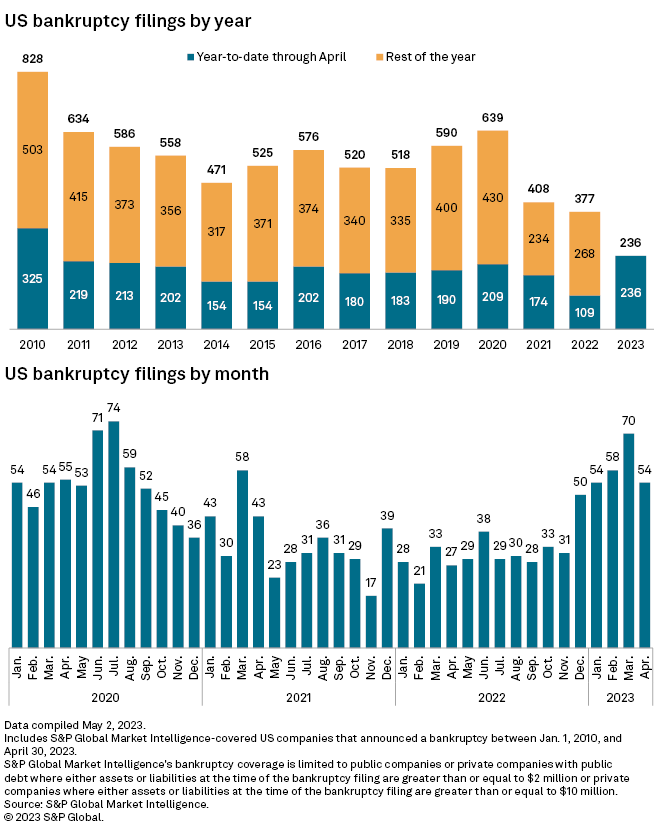

US corporate bankruptcies are on the rise in 2023, the highest first four months in the last decade. Higher interest rates will continue to put pressure on overleveraged companies and those that are unable to pass inflation cost increases on to their customers. With rates still climbing after the first four months and likely further into this year, it would be of no surprise if we continue to see defaults outpace recent years and potentially rival or even surpass 2010.

S&P Global

Downside

Ultimately SJNK faces three major sources of downside:

Rapid expansion of credit spread, likely caused by global recession or economic event. In this scenario, expect the price to drop quickly and yield to grow. Likely followed by higher defaults within the portfolio. May also prove to be an attractive second entry point.

Interest rates reverse direction. While this would provide additional return to SJNK, it would certainly pale in comparison to the return boost that longer maturity funds would experience.

Increased defaults. As mentioned, defaults are on the rise and high yield instruments are more exposed to that then typical investment grade; widespread defaults would drag down the portfolio's return as individual securities lose value.

Upside

The upside of SJNK really is that market conditions continue to move sideways and investors are compensated with additional return via high yield and not heavily exposed to downside risks. Collecting 7-8% yield will be one of the few ways to keep up with inflation at a very reasonable risk level.

Conclusion

In our opinion, SJNK offers a great value proposition for investors seeking to add additional income to their portfolios. The lower interest rate exposure provides some protection against further rate hikes and the high diversification mitigates the specific risk of holding individual positions. We would certainly recommend SJNK over individual overleveraged or unstainable payout positions that likely introduce far more volatility to investor's portfolios than what they are being compensated for.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.