QQQ: Further Upside Is Likely (Technical Analysis)

Summary

- The Invesco QQQ Trust ETF offers a diversified investment portfolio, reducing the risk associated with individual AI stocks.

- QQQ has recovered over 50% from the 2022 correction, suggesting the potential for sustained price increases, as indicated by the yearly chart.

- Despite the volatility associated with emerging technologies, the QQQ ETF emerges as a compelling consideration for future-focused investors.

Torsten Asmus

Artificial Intelligence (AI) is the cornerstone technology, poised to see huge industry growth in the coming years. This growth in AI has sparked a boom in AI stocks, attracting investors eager to leverage the industry's future. Nevertheless, the challenge lies in identifying the right AI stocks due to the volatility linked with emerging technologies. In this light, the Invesco QQQ Trust (NASDAQ:QQQ) Exchange Traded Fund (ETF) offers an intriguing solution. This ETF provides a diversified investment portfolio, reducing the risk associated with individual AI stocks. QQQ focuses on substantial, successful tech stocks, including AI leaders Microsoft Corporation (MSFT), Alphabet Inc. (GOOG), and NVIDIA (NVDA). It's an appealing option for those interested in capitalizing on the AI boom without excessive risk, offering significant returns at a reasonable cost. This article extends the previous discussion on the QQQ ETF by offering a technical analysis to forecast its subsequent trajectory. It observes that while QQQ is nearing the projected target of this rally, its appeal remains undiminished. The manifestation of bullish candlesticks and inside bars at the $365 resistance level suggests a likelihood of price escalation.

A Prudent Choice for AI Investments Amidst Market Volatility

AI has established itself as the defining technology of this decade, with global industry growth projections reaching nearly $2 trillion by 2030, according to Statista. This staggering growth potential has fueled a surge in AI stocks, with investors keen on capitalizing on the industry's future. However, identifying the right AI stocks to invest in presents a significant challenge, largely due to the volatility and unpredictability associated with emerging technologies. This is where the QQQ ETF comes into the picture. The tech boom of the late 90s and early 2000s showcased the risks associated with investing in emerging technologies. While companies like Amazon (AMZN) thrived, others, such as Pets.com, failed spectacularly. The lesson learned was clear: technology investing is a risky business. With AI now in a similar stage of development, the same risk factors apply. However, the QQQ ETF offers a solution to this problem by providing a diversified investment portfolio that lessens the risk of betting on individual AI stocks.

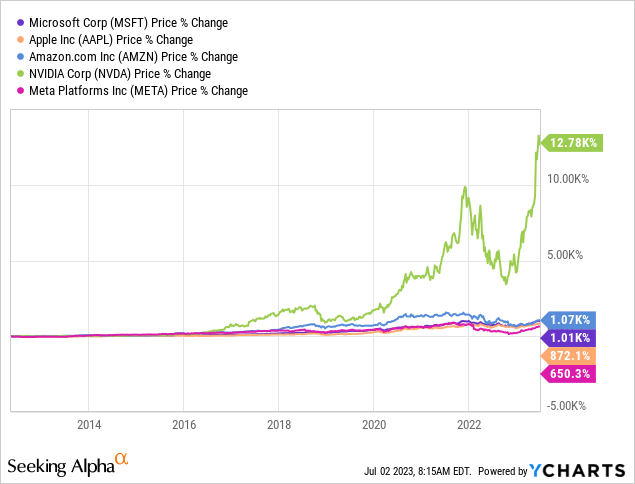

QQQ ETF is curated by fund managers and offers exposure to a wide variety of stocks within a specific sector or industry. This ETF focuses on large, successful technology stocks, with top holdings that include AI frontrunners Microsoft, Apple Inc. (AAPL), Amazon, Nvidia, and Meta Platforms (META). The fund currently has a healthy composition of nearly 58.75% tech stocks, providing ample exposure to AI advancements.

Investing in the Invesco QQQ Trust ETF offers a strategic entry point into the market's high-growth sectors, as demonstrated by the robust performance of its top five holdings over the last decade. A glance at the percentage change in the price of these holdings reveals a significant rally, underscoring the compelling growth potential of this ETF. By investing in the QQQ ETF, investors get exposure to these flourishing stocks, ensuring a diversified portfolio that mitigates risk while capitalizing on the substantial gains these stocks have to offer. This impressive track record, coupled with the projected forward earnings growth, makes the QQQ ETF a solid investment choice for those looking to benefit from the tech and AI boom.

Long-Term Projections Suggest Higher Price Movements

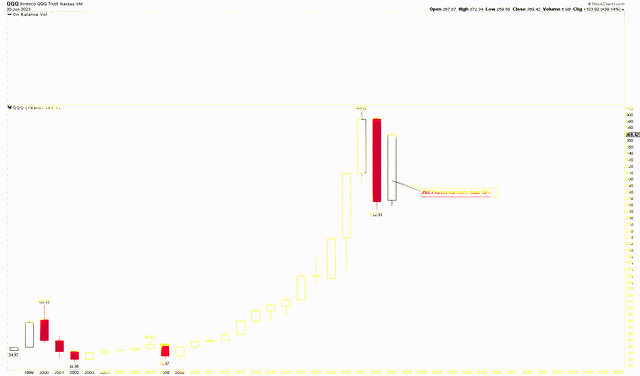

As reflected in the yearly chart below, the QQQ ETF exhibits a robust bullish perspective in the long term. Originating from 2008 low of $21.97, the price has soared to unprecedented highs of $404.02. A correction from these record highs took place in 2022, yielding a bearish candlestick and marking a low at $252.91. The ETF has now rebounded from this support region, recouping over 50% of the 2022 correction as depicted by the 2023 candlestick. This surge indicates that the correction phase for QQQ has ended and the ETF is gearing up to retest its all-time highs, setting the stage for the next rally.

QQQ Yearly Chart (stockcharts.com)

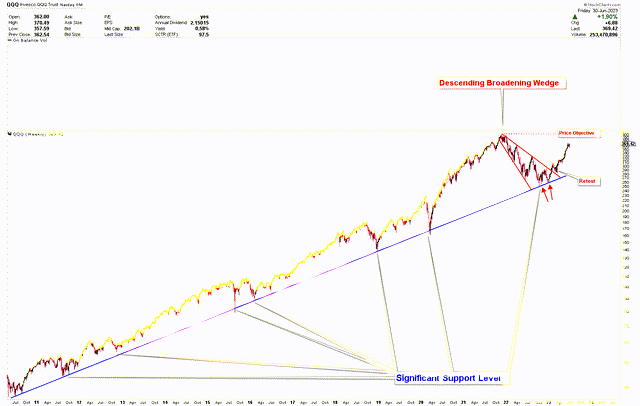

The previously examined weekly chart underscores the resilience of the blue support line. Every test of this support has resulted in the price breaching new record highs. The downward trend in 2022 shaped a broadening wedge pattern, which has since been broken, and the ETF is now on an upward trajectory. The target of this rally is the beginning of the broadening wedge, approximately aligning with the all-time highs depicted in the chart below. Currently, the QQQ price is moving toward this target.

QQQ Weekly chart (stockcharts.com)

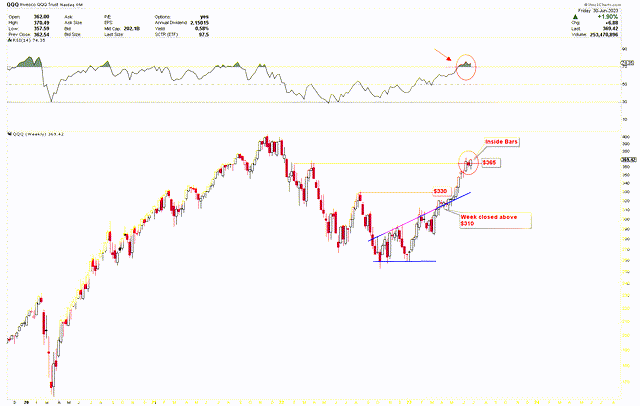

On another note, a previously discussed chart illustrated a short-term target of $365, which was surpassed last week as the weekly candlestick closed above this level. Last week's bullish candlestick also represented an inside bar, suggesting market price compression and implying that breaching the highs of the previous week could trigger a further rally. Although the RSI has entered an overbought phase indicating a potential price correction. However, a price correction is not expected until the ETF reaches the target of the broadening wedge. Once this milestone is achieved, a lower correction is anticipated, which could present another opportune buying window for long-term investors.

QQQ Weekly Chart (stockcharts.com)

Moreover, another weekly chart highlights the ETF price breaking through the $365 threshold of the inverted head and shoulder pattern. The appearance of an inside candle at this pattern's neckline denotes market buying pressure. Following the breach of this pattern, the price is expected to rally toward all-time highs. Despite the RSI indicating an overbought phase, the price behavior suggests that investors could continue to capitalize on this ETF in anticipation of further price appreciation.

Key Takeaways and Bottom Line

Artificial Intelligence stands at the forefront of technological advancement, presenting enticing growth prospects and potential market capitalization. However, the volatility associated with emerging technologies complicates direct investment in AI stocks. QQQ ETF offers a viable solution, reducing the risk with a diversified portfolio and exposure to significant tech companies including AI leaders such as Microsoft, Alphabet, and Nvidia. The anticipation of fast earnings growth in the long term, driven by the transformative power of AI, could make investing in the QQQ ETF a strategic move. The technical outlook underlines the bullish perspective of QQQ ETF, indicating the potential for further price appreciation. At present, the price is piercing through the $365 resistance level, paving the way for additional gains. As previously discussed, the ultimate goal of this current rally is to reach an all-time high. Despite the overbought conditions, it's anticipated that this target will be met before any significant correction occurs. Notably, an inside bar has formed at the crucial $365 resistance point, signaling the possibility of a substantial rally should the price exceed last week's levels. Therefore, investors may consider adding more buy positions at this stage in expectation of future price increases.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.