U.S. Airlines Are Too Cheap, Why This Rebound Looks Real

Summary

- The US airline industry is expected to regain pre-pandemic profitability due to lower oil prices and higher utilization rates.

- Airlines trade at a historically cheap multiple of revenue to enterprise value.

- Growing demand and rationalized competition should lead to better returns on capital in the future.

- Spirit Airlines, Alaska Airlines, and Southwest are identified as the most interesting airlines based on their average return on invested capital and cumulative revenue growth from 2015-2019.

RichVintage/E+ via Getty Images

Thesis

Last week Delta (DAL) provided bullish guidance for the rest of the year. Since the entire US airline industry has been surging. While you might think you missed the boat or plane, airlines still have a long way to go before reaching their 2019 valuation multiples.

Airlines have struggled to regain profitability for the last 2 and a half years. But the problems that hurt them, high oil prices and low utilization, are largely behind us now. Once airlines regain their pre-pandemic profitability I believe they should boast 20%+ earnings yields in an industry that is not as bad as most investors believe.

A recipe of growing demand and rationalized competition can fuel airlines to a strong next eighteen months and beyond in my view. While the industry will remain capital intensive I expect airlines to earn above their cost of capital over the next 10 years just as they did the 10 years before COVID.

Airlines, am I crazy?

It is a common refrain among investors that airlines are bad businesses. Many avoid the industry altogether, considering airlines giant capital incinerators. But is a US airline actually a bad business?

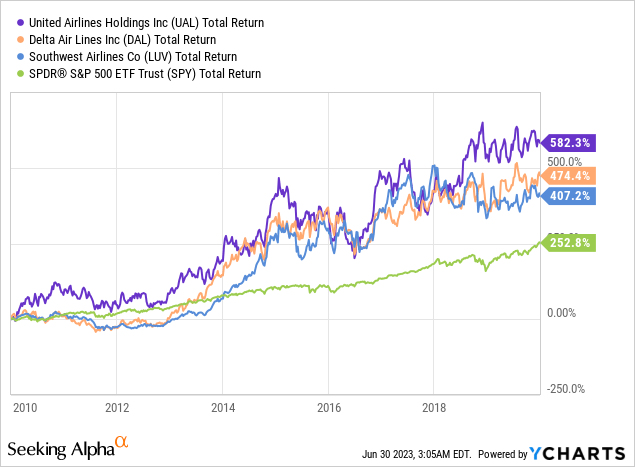

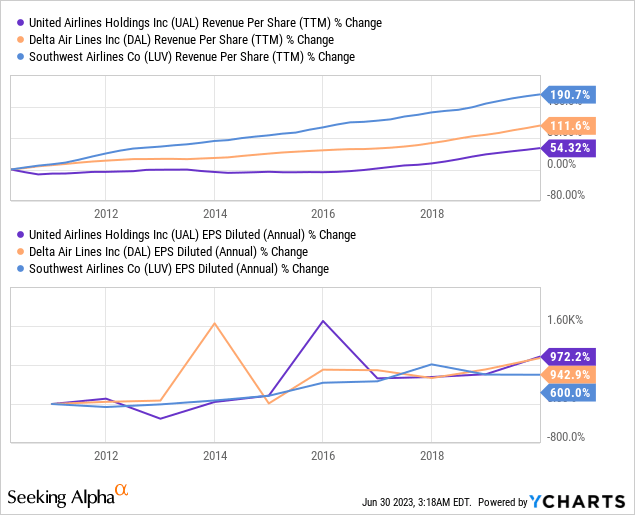

The three airlines that were in the S&P 500 for the ten years leading up to COVID all strongly outperformed the index. There is survivorship bias in this sample but, there is no reason a well-run airline cannot perform well. This outperformance was not a result of multiple re-rating. Improvements in the stock prices were largely attributable to improvements in fundamentals on a per-share basis.

Investors have missed the rationalization of the industry. Compare this chart of major commercial US airlines in 1980, shortly after de-regulation.

Major US airlines 1980 - Annual passenger miles in millions (American Business History Center)

To the same chart from 2019 right before COVID.

Major US airlines 2019 - Annual passenger miles in millions (American Business History)

Increased competition between airlines and new entrants is also limited by airport capacity. The US has not added a new major airport since 1995. While there are constant projects to upgrade existing airports many are running out of space while travel demand continues to grow. Airlines with existing slot assignments at high-value congested airports are advantaged against new entrants to the market.

Growing demand

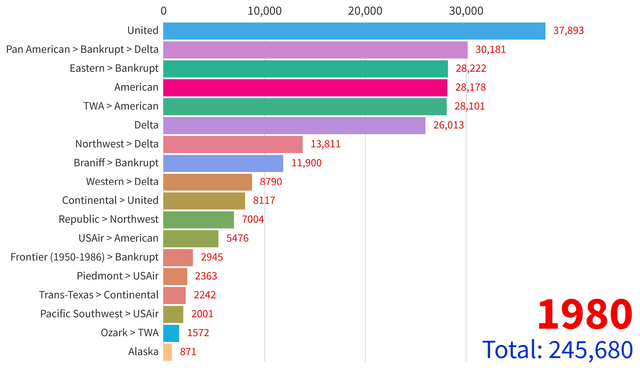

Consumer demand for air travel has been in secular growth since consumer air travel has been available. Total US plane embankments grew at a 2.7% CAGR between 2002 and 2019 while the US population grew at only a .9% CAGR. Combine this growing demand with a continuously smaller number of competitors and we have the set up for a more profitable industry. One way to see this is the improving utilization rates of US airlines over time. The following graph shows the number of available seat miles divided by how many of those seat miles were actually sold

Available seat mile utilization rate (FRED economic data)

Since selling an additional seat on an already scheduled flight is almost 100% incremental revenue, this trend leads directly to more profitable operations for airlines. The difference between a 70% utilization rate and a 90% utilization rate is huge.

While there is a long-term trend towards higher utilization rates in the short term this trend may be even more pronounced. The industry is facing a shortage of both planes and pilots. If demand continues to grow but airlines cannot keep up for the next several years, profit margins could exceed pre-pandemic levels.

Oil prices, a critical variable

2022 was supposed to be the year that airlines re-emerged but an explosion in oil prices ruined the party. About 25% of an airline's operating expenses are fuel. It is the most volatile part of their cost structure. The volatility is especially painful because airlines sell many of their tickets in advance. If an airline pre-sells a ticket 6 months in advance and the price of oil rockets higher it can wipe out the entire profit margin of the flight.

The good news is we are seeing the opposite happen so far in 2023. Oil prices have collapsed this year while the fares paid by passengers for flights have remained elevated compared to 2019.

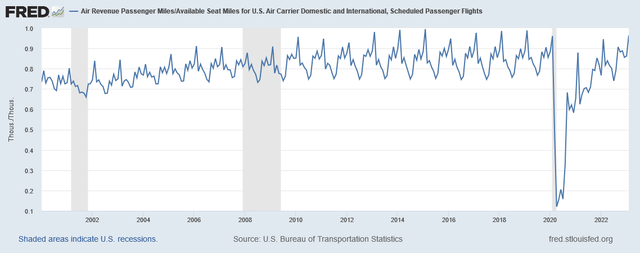

Cost of airline tickets compared to the price of Jet Fuel indexed to 2000 (FRED economic data)

The cost between jet fuel prices and passenger fares has a large impact on the profitability of airlines. 2016 was a banner year when it came to airline profit margins for this reason. So far 2023 looks like 2016 when it comes to the relationship between jet fuel prices and airline passenger fares.

While the near term looks positive for this price spread the longer term picture is more complicated. An investor needs to have some sort of view of oil's medium-term price range. If oil's medium-term average price is over $100 a barrel it could cause issues for airline profitability. In my mind, this is the most significant risk to the thesis. Investors can help address this risk by having some energy exposure in their portfolio. A pairing of oil and airline stock will likely see one or the other outperform with plenty of room for both sides to do well thanks to low valuations on both sides of the pairing.

Picking favorites

A simple way to play improved performance for airlines would be the US Global Jets ETF (JETS). However, we can try to do better by looking at historical performance and current valuations for US airlines.

Below I've charted the average return on invested capital from 2015-2019 vs cumulative revenue growth from 2015-2019. Ideally, we'd like airlines that grow while earning good returns on invested capital.

Data per YCharts/Visual author's work

Based on this chart Spirit Airlines (SAVE), Alaska Airlines (ALK), and Southwest (LUV) look the most interesting.

Next, let's take a look at the relative valuation of Airlines in 2019 compared to their current valuation. Data per YCharts.

| 2019 EV to Revenue | TTM EV to Revenue | |

| AAL | 0.716 | 0.677 |

| ALGT | 2.065 | 1.397 |

| ALK | 0.947 | 0.633 |

| DAL | 0.976 | 0.85 |

| HA | 0.471 | 0.282 |

| JBLU | 0.777 | 0.507 |

| LUV | 1.187 | 0.721 |

| SAVE | 1.017 | 0.716 |

| SNCY | N/A | 1.49 |

| UAL | 0.734 | 0.645 |

| ULCC | N/A | 0.49 |

Every airline trades at a lower valuation compared to 2019. SAVE, ALK, and LUV all look cheap based on this snapshot, having room for at least 40% multiple expansion to get back to 2019 levels. For those interested in dumpster diving Hawaiian Holdings (HA) and Frontier Holdings (ULCC) both look dirt cheap on a trailing revenue basis.

A large part of the disconnect between the current valuation and the 2019 valuation is driven by poor profitability over the past few years. As covered in this article I believe airlines should see improved profitability over the coming 18 months. Let's take a look at current operating margins compared to 2019 operating margins. Data per YCharts.

| 2019 Operating Margin % | TTM Operating Margin % | |

| AAL | 8.03 | 7.26 |

| ALGT | 12.04 | 8.65 |

| ALK | 12.61 | 6.45 |

| DAL | 14.08 | 7.49 |

| HA | 11.56 | -5.79 |

| JBLU | 10.06 | 0.053 |

| LUV | 13.19 | 3.56 |

| SAVE | 13.55 | -0.72 |

| SNCY | N/A | 9.32 |

| UAL | 10.51 | 7.85 |

| ULCC | N/A | 2.33 |

We can see that DAL, United (UAL), American Airlines (AAL), and Allegiant Travel (ALGT) have done the best job of recovering their pre-pandemic profitability. This roughly corresponds with the airlines that have recovered most of their valuation multiples.

Final thoughts

The valuation work here is backward looking. I'm assuming that airlines will revert to their growth patterns and margin structure from before COVID. This is a reasonable place to start but we still need to dig deeper into the individual names to make sure their growth and margin profiles have not been permanently impaired.

I currently own LUV. Their cost structure doesn't look meaningfully different to me. They still have a lower cost structure than the legacy carriers, UAL, DAL, and, AAL while offering a better service than the ultra-low-cost carriers SAVE, ULCC, Sun Country (SNCY), and ALGT. Growth may be challenging going forward due to pilot and plane shortages in the short term. In the longer term, there are geographic areas of the US LUV hasn't penetrated and they can continue to add to their international routes.

I'm going to look more closely into ALK, ULCC, and SAVE. ALK dominates a high-value and capacity-constrained airport in Seattle. They also have their traditional flights all over Alaska itself which is a unique business. However, their results leading into the pandemic were already starting to show some weakness. ULCC and SAVE both look quite cheap compared to their historical growth rates. I question if they can continue to grow at the same rate since there are more entrants in the ultra-low-cost carrier area and they'll have to deal with the pilot and plane shortage. SAVE also currently sports a huge merger arbitrage spread if they can close their merger with JetBlue (JBLU).

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LUV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.