Rocket Recovery With Expected Increase In Home Buying

Summary

- The real estate market could see higher demand as inflation declines, benefiting Rocket Companies, Inc. and its programs like BUY+ and SELL+.

- Interest rates are approaching their peak, which may lead to a recovery in the real estate market and increased demand for mortgages.

- Despite risks associated with Rocket's ONE+ program, improving macroeconomic conditions and potential rate cuts in 2024 make RKT a potential investment.

Feverpitched/iStock via Getty Images

With improving macroeconomic conditions in the US, the real estate market could see higher demand as inflation declines. Rocket Companies, Inc. (NYSE:RKT) - a fintech company consisting of mortgage, real estate, and financial service businesses - offers multiple programs like BUY+ and SELL+ which could experience increasing demand as a result.

It's worth noting that Rocket has taken a risk with its new ONE+ program which allows eligible homebuyers to put as little as 1% down for a conventional loan. Despite this, I think Rocket is a buy ahead of expectations that the Fed will start cutting interest rates in 2024 since it is the largest US mortgage lender in terms of loans originated.

Company Overview

Rocket has a diverse business model, but it mainly operates in real estate and mortgage lending. Over the last few years, Rocket and the real estate market were hit very hard by the Fed’s interest rate hikes to combat rising inflation. The interest rate hikes led to a decline in new mortgage requests which in turn led RKT to report declining revenues and losses for the last two quarters.

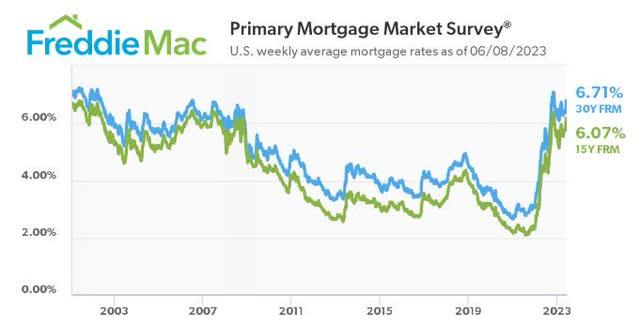

Interest Rate Approaching Its Peak

Chairman Powell made it clear that despite the decision to pause interest rate hikes in June, more rate hikes are expected later this year. Yet, the pause does indicate that the interest rate is approaching its peak. This is supported by CPI numbers approaching pre-pandemic levels as well.

I believe the real estate market should see a recovery since high mortgage rates have been one of the reasons potential homebuyers decided against buying homes. As is, mortgage rates reached their 20-year high in November 2022 at around 7.08.

Mortgage applications dropped 1.4% in early June, even with mortgage rates decreasing. I believe mortgage applications could pick up following June's decision to pause rate hikes since it will give more certainty to home buyers as the market appears to stabilize. In this case, as the largest US mortgage lender in terms of loans originated, RKT could benefit the most.

Bankrate.com

Rocket’s New Programs

Rocket has offered multiple new programs to incentivize home buying amidst the cooling real estate market in an effort to mitigate its declining revenues.

With its BUY+ and SELL+ programs, Rocket is trying to kill two birds with one stone. BUY+ aims to incentivize people to buy new homes by offering a credit equal to 1.5% of their loan amount, which can be put toward their closing costs. Meanwhile, SELL+ aims to solve the supply problem by offering sellers a rebate check for 1% of the sale.

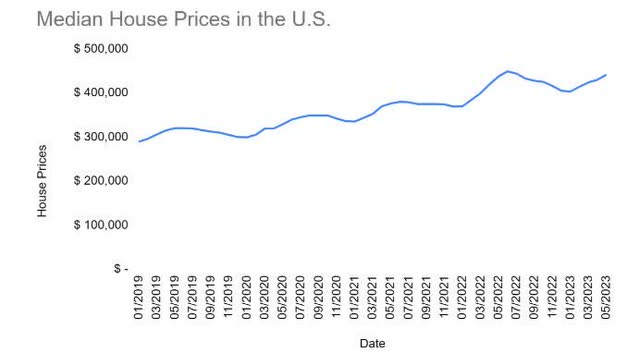

While demand for houses has fallen significantly, the drop in supply was more apparent since the average active listing count dropped in 2022 by more than 64% compared to 2019. This led to further increases in house prices, dampening demand. While existing home sales saw a 4.3% decline MoM, the market appears to be on track for recovery following the mid-2022 drop.

The high price of homes was likely the trigger for RKT's ONE+ program. While I believe the ONE+ program will increase demand for Rocket mortgages, I also believe it poses a significant risk to the company which I will explain in detail later in this article.

As is, I believe Rocket’s new programs will bear fruit in Q2 and Q3. This and a slowly recovering housing market in 2023 will put RKT in a strong position for 2024. Since the Fed is expected to start cutting interest rates next year, this will be an important catalyst for Rocket and other mortgage companies.

Undervalued Despite the Headwinds

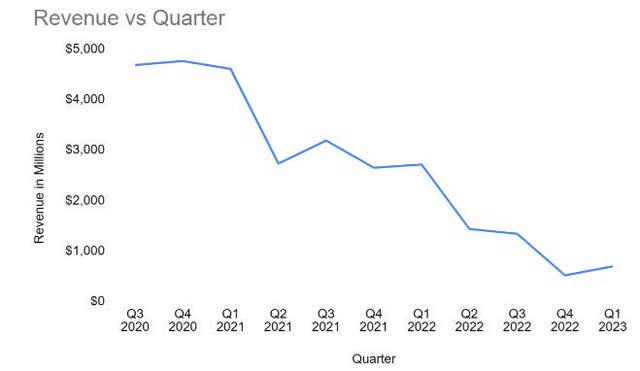

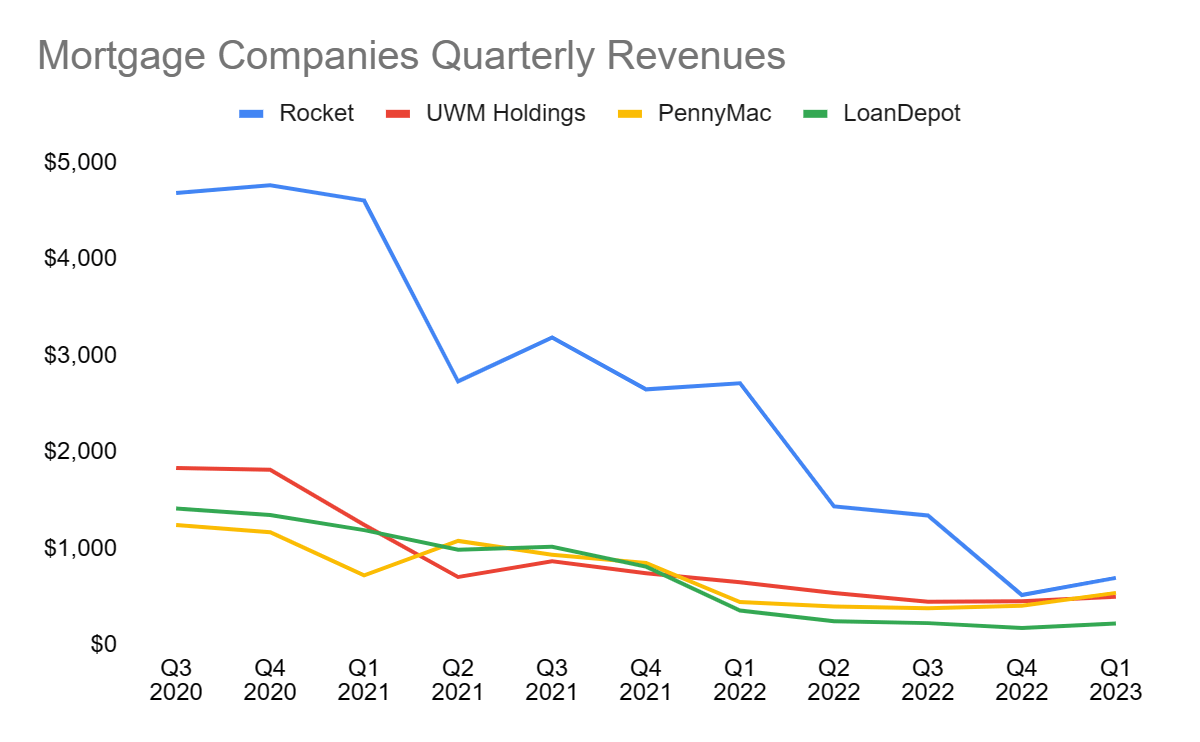

Revenues in Millions ($) (Company Filings)

While Rocket still maintains the highest loan origination of any mortgage lender, it has certainly been hit the hardest in terms of revenue compared to other mortgage companies like UWM Holdings (UWMC), PennyMac (PFSI), and loanDepot (LDI) since Rocket has lost more than 85% of its revenues realizing only $695 million in Q1 2023. Rocket has also recorded losses for the past two quarters after reporting a profit every quarter since its IPO in 2020.

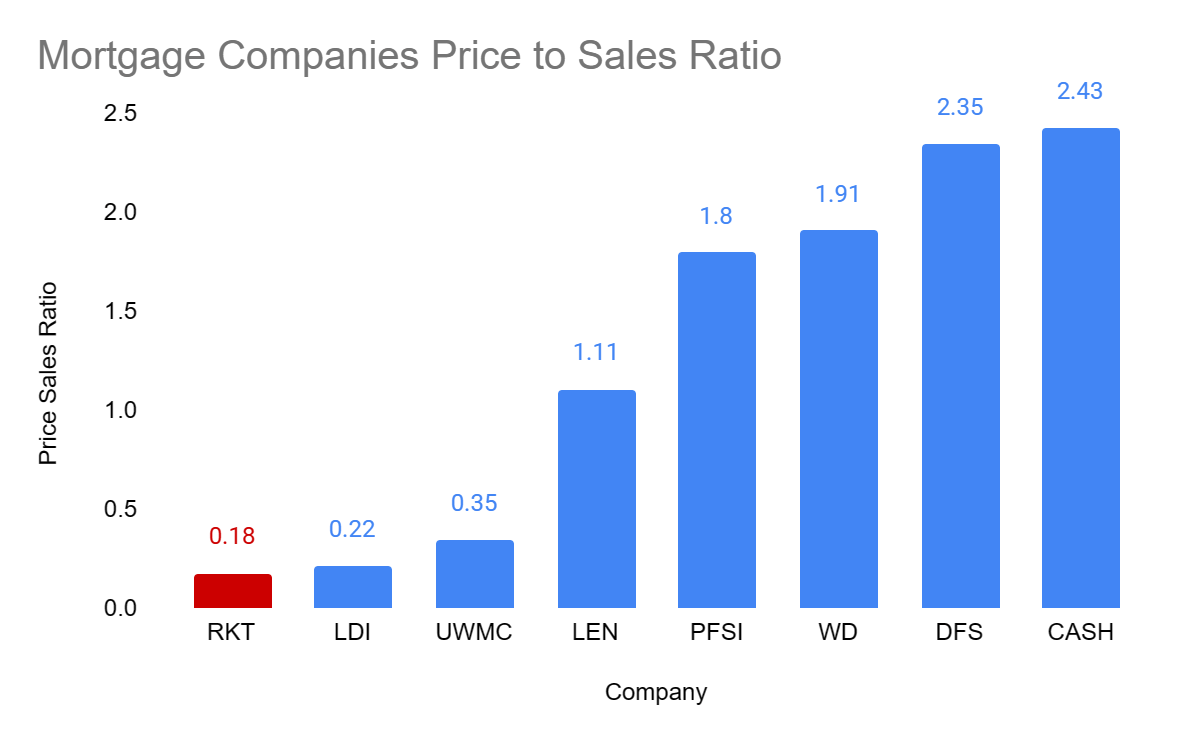

Despite that, Rocket still has one of the best P/S ratios amongst the mortgage companies, which means that RKT could be undervalued compared to other mortgage companies.

Company Filings

Risks

While most of Rocket’s new programs are designed to incentivize homebuyers and sellers, its ONE+ program causes some concern. Since the ONE+ program requires home buyers to make a down payment of 1% instead of the minimum 3%, the remaining 2% will be paid by RKT.

This presents considerable risk since the recommended down payment for a house is 20% and the average down payment in the US is 16% - a far cry from the 1% Rocket requires.

A down payment of 1% means that home buyers will pay more than 10% in monthly payments and total interest paid. This puts a lot of strain on the buyers' financials, especially since the program is aimed at low and middle-income Americans. As a result, there may be a higher risk of default for the ONE+ program users - exposing Rocket to more risk.

Technical Analysis

Looking at the daily timeframe, RKT stock is currently trading in a sideways channel between the upper trendline at $9.55 and the lower trendline at $6.30. RKT is trading above the 200, 50, and 21 MAs. The 200 and 50 MA formed a golden cross in February, signaling a trend shift.

RKT increased by as much as 18% since the end of May and the RSI is currently at 54. The stock has been consolidating in a wedge and will likely break in either direction as the price action becomes more constricted.

RKT stock is closely tied to the real estate market. While the Fed expects to finish its rate hikes in the second half of this year and prepare for rate cuts next year, it's possible that rate cuts will begin prematurely. This would be an important catalyst for RKT stock and bullish investors could take a position ahead of this potential shift in policy.

For this reason, I believe investors have an opportunity to take a position in RKT ahead of improving macro conditions which is why I recommend far-out calls or leaps.

Conclusion

Rocket's performance is closely tied to the country's macroeconomic situation. Therefore, high inflation, supply chain issues, and tightness in the labor market have all influenced the housing supply. With the improving macroeconomic climate, decreasing inflation, and rate cuts expected in 2024, demand for mortgages may increase. For this reason, I believe investors should consider Rocket as a potential investment going into 2024.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.