A Hot June Job Report Could Put Rates On A Path To New Highs

Summary

- The jobs report is likely to show the labor market remains very tight.

- The PCE report last week showed core inflation is still too high.

- Rates on the long-end of the Treasury curve are likely to break out this week as a result.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

wildpixel

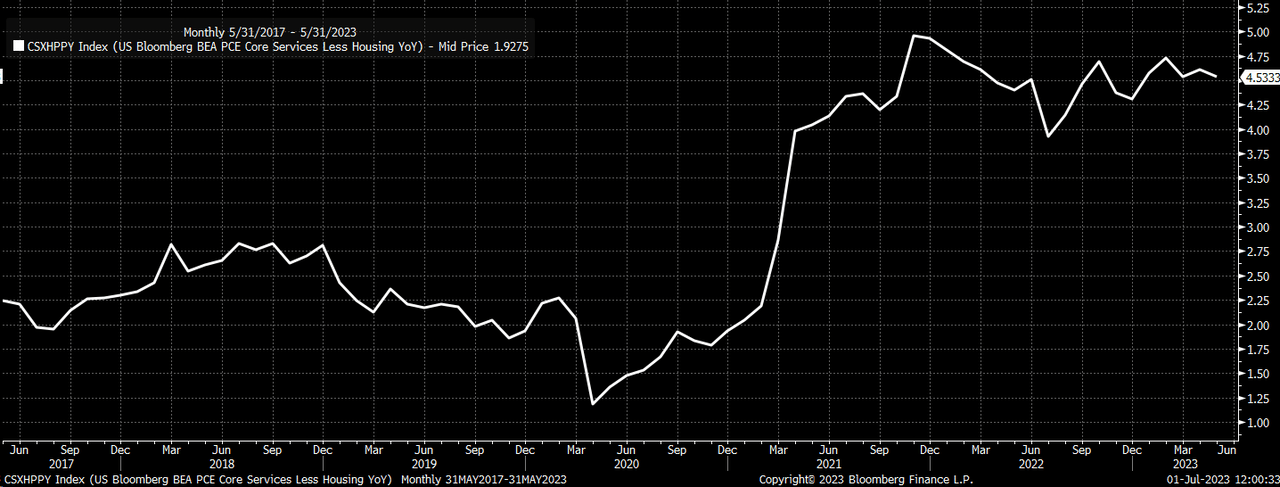

This was a big week for rates which rose sharply following the better-than-expected jobless claims. Additionally, PCE data came in roughly within expectations, while core PCE ex-housing was up 4.5% y/y, down from 4.6% in April. There just hasn't been much improvement in this subsector of inflation, and this is one of the subsectors that Fed Chairman Jay Powell keeps focusing on.

This week the attention will shift from inflation to the job market. This report can move rates on the 10- and 30-year up, along with the US dollar.

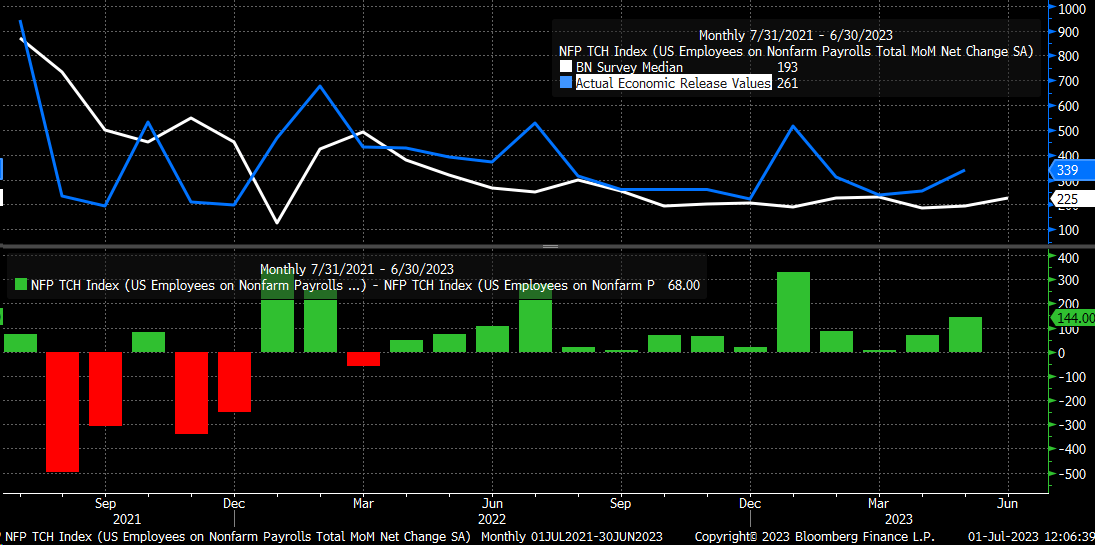

The jobs report has been better than expected 14 months in a row and estimates this month are for a gain of 225,000 jobs to have been created.

Bloomberg

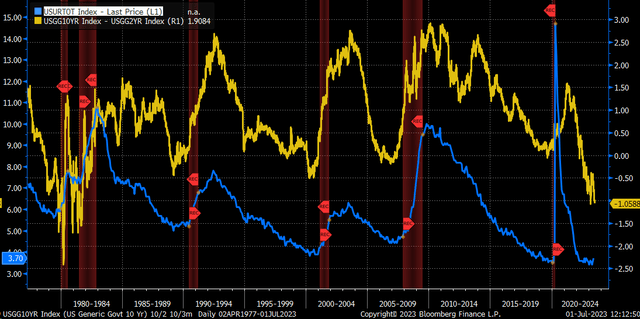

The bond market already knows that the job market is strong. The inversion of the yield curve tells us that the labor market remains firm, and the market doesn't seem to think there is a cooling in the labor market coming. The spread between the 10-year and the 2-year rate is back to -105 bps, and typically the yield curve begins to re-steepen when the unemployment rate rises. The job market will likely remain strong based on the current yield curve inversion.

The stronger than-expected economic activity has primarily been responsible for the Fed continuing to push rates higher despite numerous calls by investors for the Fed to be done. As long as core PCE remains high and the labor market remains tight, then it seems likely the Fed will continue to tighten policy until there are some signs of at least softening, and to this point, these signs are just not present.

This will mean outside of a horrible job report, which doesn't seem likely, another rate hike is probably coming in July. The market is now pricing an 81% chance of a rate hike at that meeting in July.

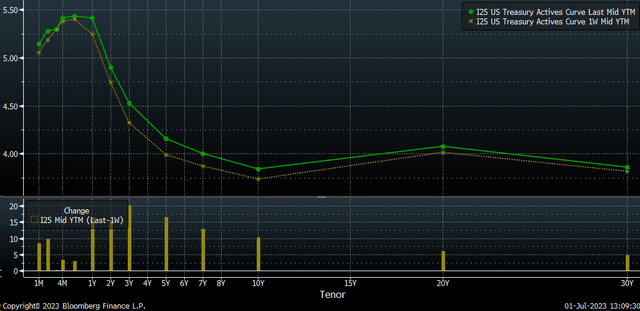

So the combination of a strong US economy and another rate hike from the Fed should push rates on the long end of the Treasury curve higher from their current level. This past week, there was a big move higher in the 2-, 3-, 5-, and 7-year rates, while the 10-year and the 30-year moved closer to potentially breaking out to higher levels.

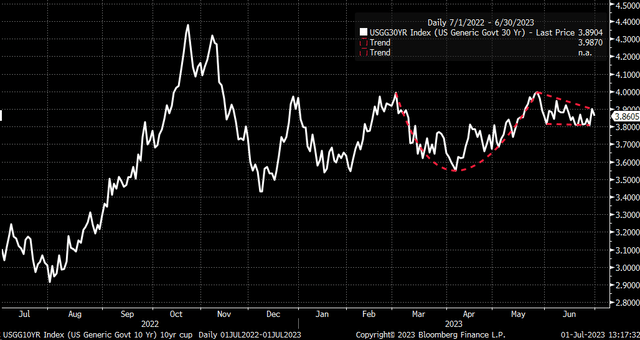

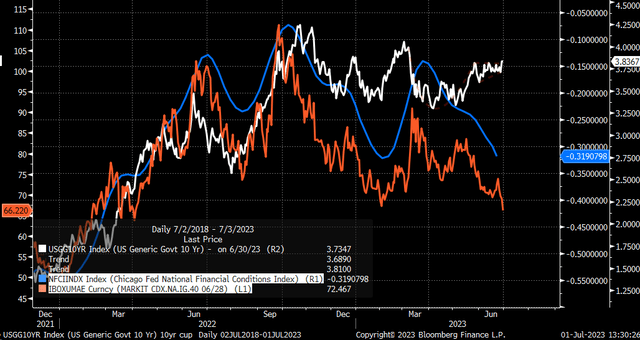

That breakout could come this week if the job report continues to surprise to the upside and the rest of the economic data continues to come in strong. The 10-year appears to be positioned for such a move higher as well, from a technical basis with a cup-and-handle pattern, which is a bullish pattern. A breakout in the 10-year could lead to the yield moving beyond its early March highs.

The same pattern is present in the 30-year rate Treasury rate, and also, like the 10-year, a better-than-expected jobs report could very well lead to the 30-year rate moving sharply higher.

A move higher in rates on the longer end of the curve is really what is needed to start tightening financial conditions again, which is what is required to restrain and slow the economy enough to get the Fed to see growth slow and soften the labor market, to bring inflation back into imbalance.

Since mid-March, rates have more generally moved sideways, and the sideways move in rates has allowed credit spreads to narrow and financial conditions to ease. The easing of financial conditions and the narrowing of spreads have allowed equities to respond positively.

When rates steadily rose throughout 2022, financial conditions had been tightening, which were working to constrain equity prices. But once the issues with the banks arose and investors shifted their attention to the coming "recession," rates fell in response, easing financial conditions and helping boost stocks.

The easing of financial conditions allowed spreads with corporate and high-yield debt to narrow, allowing for the expansion of the PE multiple in stocks despite the weak prospects for earnings growth. The NASDAQ has been similarly acting as any debt instrument, with an earnings yield declining as financial conditions eased, allowing the spread to narrow to Treasuries like every other corporate bond and high-yield asset.

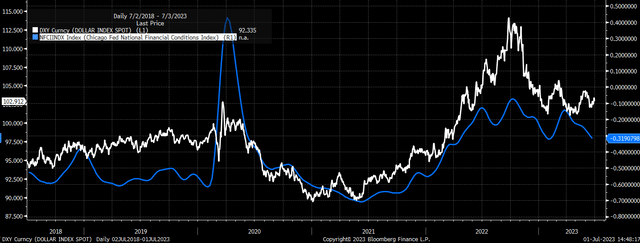

But suppose rates should break out, and the dollar should strengthen again. In that case, this will result in financial conditions tightening, and credit spreads begin to widen again, especially as the dollar moves higher. A strong dollar is one of the most significant contributors to tightening financial conditions. Being that the Fed is still in a tightening cycle, a perception that the Fed will need to hike rates further and that the US economy is more robust than expected is only likely to cause the dollar to strengthen, especially against the euro, yen, and yuan.

More recently, the dollar has only started to strengthen and is likely to intensify further if the jobs data shows that the Fed has more to do, helped by rising US interest rate differential and wider credit spreads.

The June job report is likely to show that the labor market remains very tight and that Fed isn't done raising rates, and that is likely to be enough to get rates on the long end of the curve to break higher and for the dollar to follow, which will start the process of financial conditions tightening again.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, and looking for opportunities.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (4)