No Fireworks For Cannabis Stocks

Summary

- The cannabis sector is still in a terrible bear market.

- I think the stocks are very cheap generally, but I am not yet expecting a big improvement in prices in the near-term.

- Each week, I share my views on one stock, but this week I am doing a mid-year assessment of the market for cannabis stocks.

- Looking for a helping hand in the market? Members of 420 Investor get exclusive ideas and guidance to navigate any climate. Learn More »

howtogoto

The 4th of July, one of my favorite holidays, is rapidly approaching. The holiday celebrates the ideas of independence and freedom. Many of us who fight for cannabis legalization understand that these concepts drive our positive views. Of course, there are the medical benefits too, as well as economic reasons to support cannabis legalization.

We are making so much progress with respect to cannabis here in North America. The U.S. kicked it off in late 2012, when the voters in Colorado and in Washington approved adult-use legalization. Both states already had medical cannabis, as did several others. Now, we have 23 states, nearly half of all states, that have approved adult-use cannabis for sale legally. Maryland started 7/1, and Delaware, Minnesota and Virginia are scheduled to implement it ahead. Outside of the U.S., cannabis is fully legal in Canada. Other countries are making progress too.

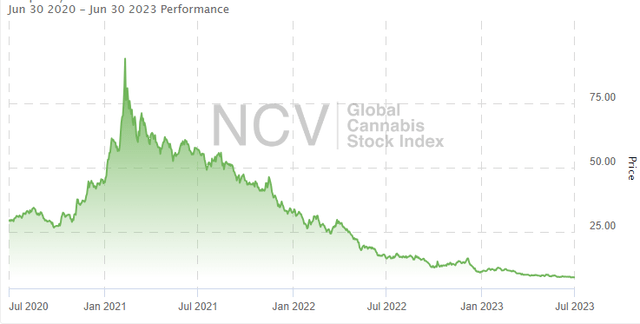

As exciting as it has been to see the move towards cannabis being fully legal, there won't be any fireworks in the air to celebrate. Investors and the operators are struggling tremendously. The stocks have been in a bear market since February 2021, with most stocks down more than 90% from the peaks. The New Cannabis Ventures Global Cannabis Stock Index is down 22.8% so far in 2023, trailing the S&P 500, which is up about 15%, very badly.

Since the peak, cannabis stocks have fallen 9 consecutive quarters. From the top daily close, they have dropped 91.9%:

In this article, I discuss why cannabis stocks are struggling, evaluate how cheap they are and indicate what needs to happen before the next bull market begins.

The Challenges

From my perspective, there are no additional buyers coming into the market, which makes it very difficult for the stocks to advance. It's almost exclusively retail investors that hold the stocks, and volumes are very low. On Friday, only 17 stocks generated more than $1 million of trading value. The Global Cannabis Stock Index has a minimum of $500K trading value on average per day to be included when we rebalance, and the June quarterly rebalancing resulted in only 21 names being included. This was down from 27 that qualified in March. Until we see some new buyers, the market isn't likely to rally.

The overall industry is seeing slower growth in demand. Part of this problem relates to the pandemic, which really surprised folks with how much cannabis demand there was. Income, working at home, and having few places to go during the pandemic to spend money really helped, and we are seeing less demand now. Weaker demand is paired with higher supply. Many operators have scaled up a lot in the past few years. Another problem has been the rise in the illicit market in some states.

Beyond low trading volumes and a demand and supply imbalance, the cannabis companies are struggling with the weak capital markets that hinder their ability to raise capital. This is true in America as well as in Canada and external to North America.

The CBD market has imploded. This is due to FDA failing to step up and regulate, which has hurt the few good operators out there. cbdMD (YCBD), Charlotte's Web (OTCQX:CWBHF) and other CBD operators have plunged this year. Charlotte's Web, which I explained why I do not like it earlier this year, has fallen 66.6%, while cbdMD has dropped 86.3% in 2023.

Certain state markets have had regulatory problems, like California, Illinois, New Jersey and New York. California, which has been described as the largest cannabis market in the world, began adult-use sales in 2018, when it finally started regulating medical cannabis at the state level, and the market has been a disaster. Illinois was very slow to add additional dispensaries, and now some of them are being hurt by Missouri going legal for adult-use. New Jersey, which just went legal for adult-use, has too few stores. Finally, New York has been mismanaged badly as it moves to adult-use. The medical cannabis providers there were abused by the new rules. State-by-state legalization is working, but not as well as it could.

Cheap

I think cannabis stocks are very cheap, but that's what I said a year ago. They have decline a lot over the past year. Investors need to understand that cheap is great, but it's not good enough alone.

Not all cannabis stocks are cheap! I have discussed several in articles here, including Canopy Growth (CGC). Since I called it a not a good stock for cannabis investors in late January, it has declined a stunning 86.2%. I usually am interested in "buying the dip," but this is of no appeal to me now due to potential bankruptcy. It's a bad business with poor management, a terrible balance sheet and negative operating cash flow.

While some cannabis stocks aren't buyable, many are trading at very low levels. My favorite sub-sector right now for bargains is the Canadian LP sector. I really like two that trade way below tangible book value: Organigram (OGI) and Village Farms (VFF). I have written them both up here, and I very recently called Organigram "the best cannabis stock."

The very largest MSOs look expensive relative to peers, and I have written about that several times. An exception is Trulieve (OTCQX:TCNNF), which I think "offers an excellent entry" below $4. I continue to really like some of the other Tier 2 MSOs, like Columbia Care (OTCQX:CCHWF), which trades 48% below the implied deal price with Cresco Labs (OTCQX:CRLBF). I expect the deal to close, but the price could be reduced by 20%. This would imply a return to investors of more than 54% based on the current price of Cresco Labs. I also like Ascend Wellness (OTCQX:AAWH) and Planet 13 Holdings (OTCQX:PLNHF), which I just wrote about last week.

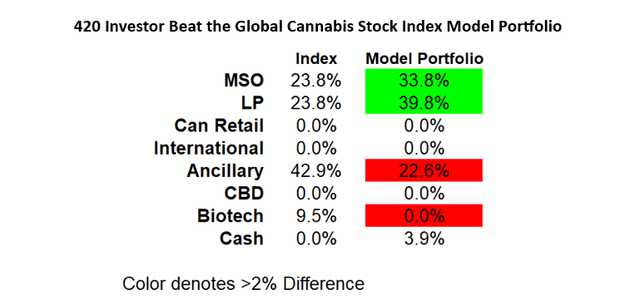

One of the worst mistakes cannabis investors can make it to put their entire cannabis stake into one sub-sector. In my Beat the Global Cannabis Stock Index model portfolio, I am loaded up with MSOs (not the very big ones) and with the two Canadian LPs I mentioned, but I also include some ancillary stocks:

While it looks like I am substantially underweight that sub-sector, REITs make up 19% of the index. I own no REITs, and my non-REIT exposure of 22.6% compares to 23.9% non-REIT ancillaries, which is just a little underweight. I own three non-REIT ancillary names, and I am closely tracking four other non-REITs and two REITs on my Focus List for potential inclusion. Unlike American cannabis operators, these companies can trade on higher exchanges and aren't responsible for the onerous taxes, 280E.

What Really Matters

Speaking of 280E taxation, which taxes cannabis operators at their gross profits rather than net profits, this remains a big challenge, especially at a time when capital is so difficult to raise. 280E wipes out operating cash flow, and eliminating it would be a big help to the market in my view. Will it happen? Yes. Will it happen soon? That is difficult to assess. Pay attention to the Biden plans to evaluate DEA scheduling for the sector, as 280E would get immediately wiped out by a move from Schedule 1 to Schedule 3 or higher or by descheduling.

Another thing that could happen is the move from the OTC to the NASDAQ or NYSE. Already, ancillary companies trade on higher exchanges, but they won't list any American cannabis operators. It's not for legal reasons. Rather, it's their choice not to do so. I am not sure when this will happen, but I am watching for it, as I think it would broaden the investor base substantially.

These are two fundamental changes that I think are really important, but hard to predict in a timely fashion. Another important driver that is hard to confidently project is M&A. There have been some big investments made by companies outside of the cannabis industry into it. The worst has been the Constellation investment into Canopy Growth, but two big ones that have not yet seen follow-on investments have been Altria Group (MO) into Cronos Group (CRON) and British American Tobacco (BTI) into Organigram. If and when a big company buys a big player, this will excite investors and give them confidence to invest.

Conclusion

I have been following cannabis stocks for a little over a decade. In fact, 420 Investor, which transitioned this year to Seeking Alpha, will celebrate its 10th anniversary in August. It's been a blast, but this bear market since February 2021 has been brutal.

As much as I like the long-term opportunities for the cannabis sector, I have learned to fear it in the short-run. Until the volume starts to pick up, I will be skeptical. Excitement over things like SAFE Banking, which I don't think will help the large MSOs by itself (they already have access to banking), worries me too. I am watching for important things, like uplisting to higher exchanges and the end of 280E taxation. Of course, M&A into the space could be a driver too.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

420 Investor launched in 2013, just ahead of Colorado legalizing for adult-use. We are moving to Seeking Alpha and will let our followers know when that occurs. Historically, we have provided great coverage of the sector with model portfolios, videos and written material to help investors learn about cannabis stocks.

This article was written by

Alan Brochstein, CFA, was one of the first investment professionals to focus exclusively on the cannabis industry. He has run 420 Investor, a subscription-based due diligence platform for investors interested in the publicly-traded cannabis stocks that he has moved to Seeking Alpha, since 2013, and he is also the managing partner of New Cannabis Ventures, a leading provider of relevant financial information in the cannabis industry since 2015. Alan is based in Houston. He and his wife have two adult children.

Before focusing exclusively on the cannabis industry in early 2014, Alan had worked in the securities industry since 1986, primarily with the responsibility for managing investments in institutional environments until he founded AB Analytical Services in 2007 in order to provide independent research and consulting to registered investment advisors. In addition to advising several different hedge funds and investment managers, including Friedberg Investment Management, where he participated as a member of its investment management committee, Alan was also a senior analyst for the independent research firm Management CV. In 2008, he began providing a first-of-its-kind subscription-based service for individual investors, Invest By Model, which offered two different portfolios that investors could replicate in their own accounts. Alan also offered The Analytical Trader at Marketfy, where he used fundamental and technical analysis in a disciplined process to offer specific trade ideas geared towards swing traders.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (7)

Maybe one day congress will crap or get off the "pot"... (pun intended)... GLTA...