U.S. Supreme Court Dismantles Biden Student Loan Forgiveness: Winners And Losers

Summary

- This week, the U.S. Supreme Court voted 6-3 to block the Biden administration's plan to forgive $10,000+ in student loans per borrower.

- This carries huge implications for inflation, consumer discretionary spending, and the distribution of wealth in the US.

- Analyzing the winners and losers from the landmark ruling.

Andrii Dodonov

This week, the U.S. Supreme Court voted 6-3 to strike down the Biden Administration's plan to forgive $10,000+ in student loans per borrower. Progressives had championed the forgiveness plan as life-changing for borrowers, but moderates and conservatives felt that the plan was incredibly expensive and circumvented Congress. Taking into account the direct costs and future changes in borrower behavior, a University of Pennsylvania study estimated that the eventual loss to taxpayers from student loan forgiveness could top $1 trillion dollars. Critics had long argued that policies like untargeted student loan forgiveness helped fuel the runaway inflation that has come to define the 2020s.

Payments will start on October 1 for roughly 43 million Americans. However, the Biden administration has some new tricks up its sleeve, most recently announcing a potential "grace period" on student loans that Politico reported would last until right after the 2024 election (wink wink). Other creative efforts to effect backdoor student loan cancellation are likely to be challenged in court and fail as well, such as resetting income-driven repayment plans to create hundreds in billions of dollars in losses to the Department of Education. To these points, what will the effect on the economy be from student loans? How will it affect the markets? And who are likely to be the biggest winners and losers? We dig in.

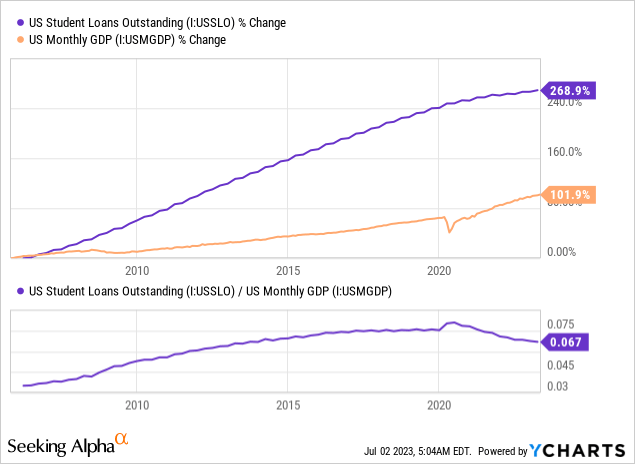

To understand the effect that restarting student loans will have on the economy, you first need to understand who has student loans and why, as well as how much they cost. As it stands, roughly 43 million Americans carry about $1.8 trillion in student loan debt. The rough average for this is a bit under $42,000 per borrower, but the average is skewed by those who take out debt for graduate school. Grad school debt (medical school, law school, etc.) makes up about 40% of the total, and accounts for most of the six-figure debts. If we ballpark here again, we can make an educated guess that principal + interest on average might be a little over 10% annually–or $200 billion per year. That comes out to around $388 per month for 43 million people, on average. Ballpark it again against GDP, and this is about 0.76% of the national income. Student loans are generally paid with after-tax dollars as well, so the true effect on consumer disposable income is likely closer to 1% of national after-tax disposable income.

Now, take a guess at what people were paying when their payments were paused. Not much! A New York Fed study found that only about 10% of borrowers paid anything at all. Separate data shows that savings rates hit record lows last year. Instead of using the pause to pay down debt, student loan borrowers spent heavily on discretionary purchases and chased prices higher for the limited supply of housing and cars during the pandemic.

Essentially, during the 3-year student loan pause, 43 million people had an extra $388 per month to spend on average, and they spent it mostly on consumer discretionary items and travel. With student loans kicking back in, this effect will be a mirror image, crushing demand for the consumer discretionary sector, but also likely bringing inflation back under control. Since heavily indebted young consumers have a high marginal propensity to consume, the effect will not be linear, but there will likely be a multiplier effect on demand and corporate profits of 2x or more than the initial effect. On balance, I'd expect student loans restarting to have a large, negative impact on asset prices and the level of inflation, but a beneficial impact on price stability, consumer choice, and government budget deficits.

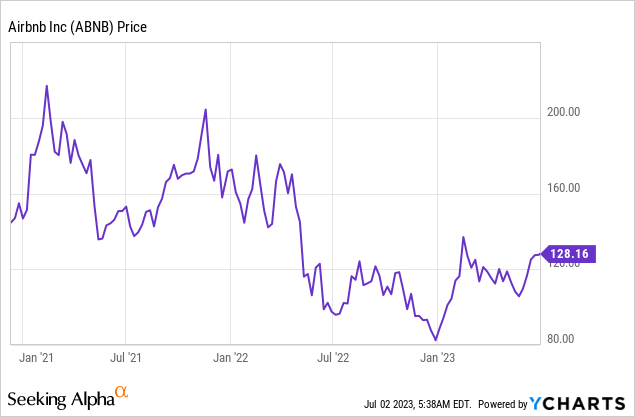

Loser: Airbnb (ABNB)

Airbnb is likely among the biggest losers from student loans restarting. The stock has been on a roll this year off the bear market lows and is up about 51% YTD as of my writing this. It's also very expensive, trading for 37x forward earnings. In May, the company issued soft guidance on revenue and margins, but the stock isn't getting the message.

The idea here is incredibly simple– renting from Airbnb is among the most discretionary purchases consumers can make, so with less money likely to be thrown around on discretionary purchases, Airbnb is likely to see revenue decline. At least in the US, the market is already fairly saturated for Airbnb, with a high-profile real estate consultant recently releasing a report that revenue per listing in popular markets like Austin and Phoenix is down 50%. This is before the student loans kick in, so I would shudder to think about what happens over the winter. Airbnb's revenue soared with student loans paused for 3 years, and with loans kicking back in I'd expect revenue to tank. I don't hate Airbnb as a business, but its valuation is not in line with its fundamentals, and there is now a clear catalyst showing they're likely to get squeezed.

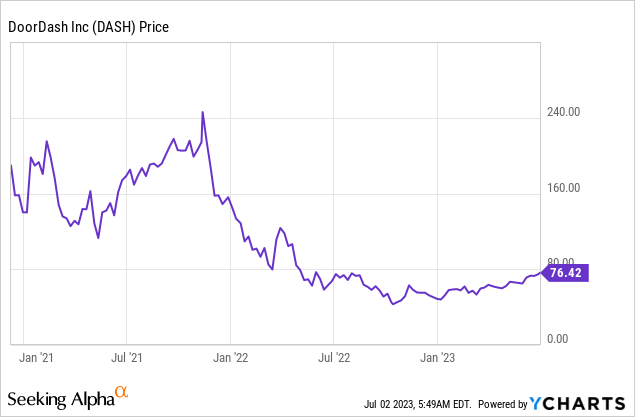

Loser: DoorDash (DASH)

There's nothing quite like paying $30 plus tip for some lukewarm pasta, and DoorDash occupies a similar spot to Airbnb among the most discretionary purchases consumers can make. The demographics of DoorDash's customer base are quite similar to those with student loans– young, urban, and mostly middle class. Plus, we're dealing with a forward P/E ratio of about 80x forward earnings. Uber (UBER) offers a very similar business model to DoorDash with its Uber Eats/delivery service, so I don't see how DoorDash can generate the kind of growth it needs to justify trading for 80x earnings. This is before we even think about student loans kicking back in, which shrinks the size of the market that all the delivery companies are fighting over. With DoorDash up 58% for the year, trading for a nosebleed valuation, and facing a massive headwind from student loans restarting, I think this is an easy call.

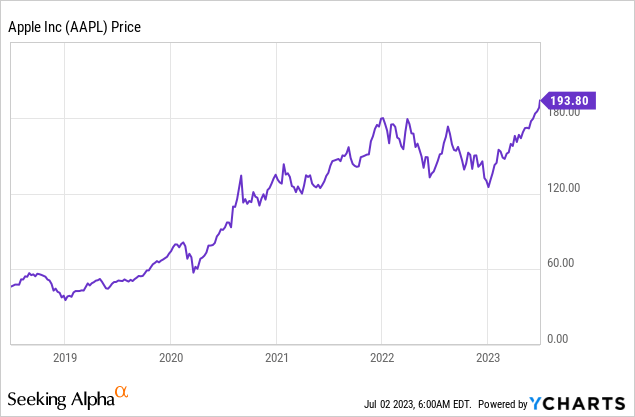

Loser: Apple (AAPL)

Apple's earnings surged during the pandemic after millions of consumers used pandemic stimulus checks to upgrade their iPhones. Of course, the stock increased far in excess of the increase in business profits. Since then, Apple's earnings have started to fall back to earth, but the stock has gone parabolic, up 55% YTD against declining earnings per share. Apple doesn't give earnings guidance, so investors are flying blind about what they may make in the future. The rapidly expanding valuation doesn't make sense on many levels, but there's a clear catalyst to earnings from student loans kicking back in. iPhones drive the vast majority of Apple's profits, and they're highly discretionary purchases.

For example, if consumers upgrade their iPhones every 3 years rather than every 2 years or whatever, then that's a drop in iPhone profits of roughly 1/3 for Apple. Unless you think the pandemic fundamentally made Apple 3x as valuable relative to its earnings from 5 years ago, then it follows that Apple is likely overvalued. You're welcome to pay 33x earnings for declining earnings in Apple if you want, but the bus has left the station on Apple stock being a good value relative to its underlying business. $4,000 less in income for 43 million people in the US, and Apple's earnings are unlikely to maintain the levels seen during the pandemic.

Big Winner: Price Stability

Something good to know is that the data shows that borrowers with student loans have a high marginal propensity to consume. This means that pausing student loans was an effective way to stimulate the economy, but also an effective way to overstimulate the economy. With the Fed still trying to bring supply and demand back into balance, restarting student loans will allow the Fed to go a little easier on interest rates. Student loans restarting is bad for those with student loans, but it's good for the other ~290 million people who don't have student loans. The rest of the population now won't have to compete for goods and services with student loan borrowers (graduate borrowers in particular, who make more money than the public at large) who are getting an extra government subsidy of hundreds or thousands of dollars per month. The downstream effects here mean that everything from rent to mortgages to plane tickets are likely to be cheaper as a result.

Young doctors and corporate lawyers gained the most purchasing power from the payment pause, often earning salaries of hundreds of thousands of dollars per year while avoiding debt service that would cost $2,000 per month or more. I can't say I blame them– if I had $250,000 in medical school debt and was in residency or just coming out of residency, I wouldn't pay a dime. Student loans kicking back in will likely be the catalyst that finally knocks inflation down to around 2% annually. Student loan payments restarting is equivalent to a tax increase of roughly 1% of national disposable income per year, which is roughly what would be economically prescribed on the fiscal side as a first try to help fix inflation.

Bottom Line

The Supreme Court's decision to block the Biden admin's student loan plans is likely to have far-reaching effects on the economy, with clear winners and losers. While the Biden admin is likely to try a couple more Hail Marys to effect backdoor student loan cancellation, payments will start October 1st, and legal action to collect from delinquent borrowers will likely start January 1st. This will cut the budget deficit, reverse some of the redistribution of wealth that has happened in the economy since 2020, and help the Fed stop runaway inflation. However, watch out for a bust in the consumer discretionary sector. What do you think? Share your thoughts in the comments!

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (20)

When the federal government took over the loan program in 2010, President Obama claimed it would turn a profit of $68 billion and that “we are finally undertaking meaningful reform in our higher education system.” Credit where due: a dead loss of hundreds of billions of dollars and tuition costs that continued to soar can fairly be described as “meaningful.”

The scheme’s flaws have been well chronicled.

It’s regressive, rewarding the well-to-do at the expense of the less fortunate. It’s grossly unfair to those who repaid what they borrowed or never went to college.

It’s grotesquely expensive, adding hundreds of billions to a federal debt that already threatens our safety-net programs and national security.

And it’s profanely contemptuous of the Constitution, which authorizes only Congress to spend money.

Of course, much of this unpaid debt would never have been accrued if colleges hadn’t raised their prices at the highest rates of any category in the economy. Thanks to the subsidy gusher, that was easy to do. But it wasn’t right or necessary.

Even a modest percentage of shared liability for non-repayments would have significantly affected schools’ behavior. The financial exposure and potential embarrassment would have driven material changes in the rigor of teaching and the amounts they charged and encouraged students to borrow. Such a system would have amounted to a fair request that institutions stand behind their product.

Student loans are a legal contract. It serves no purpose to cancel this debt.

Student loans don’t get paid back first because the interest rate is low. When students graduate and gain employment, bump up the interest rate to get the debt paid.

If you want something-I was taught, ok then go earn it and work for it. From the information in this article-loan debtors do not have a concept of how to manage money to pay bills.

True story-got in discussion with person who was in go or of the debt forgive as she had paid years on the debt and the government didn’t need it. However, she remodeled her home, bought boat, had dock built, installed a pool and still paying on her debt. Pay your debt then buy something. Raise the interest and it will be paid. Oh, did I mention, she is retiring in3 years at 55!!

The other alternative is to stop all funding!

No, we felt it was just wrong and unfair to people who responsibly paid for their education. Forgiveness teaches irresponsibility.

You took out the loan, you pay for it.

Your article is as good as always Logan, to me you are one of the best writers on SA. Keep up the good work!