Proximus: A Victim Of A Poor IPO Market, Immense Capex Burden

Summary

- Proximus had put quite a lot of hope into Telesign, which made a value case for the company's compressed multiple, but the IPO failed.

- We are beginning to see a pickup in IPO activity, but things are still highly uncertain, and capital markets remain wary of growth stories. No catalyst yet.

- Additionally, the capex burden is a concern.

- While Proximus trades cheaply, the dividend is not actually sustainable on business performance. We think that this in addition to the Belgian state involvement is the problem for the valuation.

- While the dividend remains at risk, and with IPO markets still rather shut, the case for Proximus is difficult. Only on an IPO market recovery could the stock be revisited, and even then, capex is still an issue.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Alexandros Michailidis/iStock Editorial via Getty Images

Proximus PLC (OTCPK:BGAOF) is Belgian's telco company. Like many others in Europe, it is undergoing massive capex to modernise its copper networks and bring fibre to the people. This capex is a massive overhang, and they are beholden to it not only for business reasons but also because of the state owning large shares in the company. The dividend is not really sustainable on business performance, which we think is the reason for the increasingly perennial discount on the stock relative to other developed market telco players. Finally, the failure to IPO Telesign has been a disaster for the stock, and that potential catalyst remains locked behind still shut IPO markets. There are many potential headwinds for Proximus and it would be safe to stay away.

Considerations

Let's start with capex. It is growing meaningfully YoY, although a lot more of it is now in things unrelated to fibre. Still, while the fibre investment has gone down since last year, it hasn't decreased by much at all, and with only 23% progress in the fibre rollout there is still a lot more burden to be taken by the company to make the rollout complete.

In our last article on the company we thought that there might be another 3 billion EUR in capex left in store for the company. With every additional 10% or so costing 300 million EUR. We think that there is still about 2.6 billion EUR or so to go. This capex does nothing for their performance, it is merely a duty to improve the infrastructure to match European standards. The majority shareholders of the Belgian State might be happy about that, but it isn't great for shareholders. Of course, we note that regardless of ownership European companies are all doing this sort of rollout.

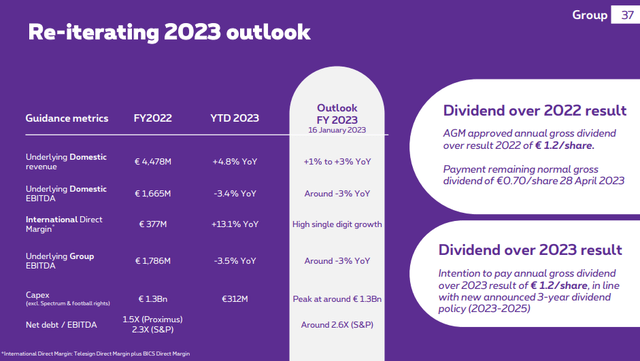

Proximus Outlook (Q1 2023 Pres)

The telco markets aren't bad. There is pricing action across Europe, and mobile plans are a resilient market, as well as broadband plans. It is resilient, and outlook looks favourable. The company is even reiterating the dividend, even though it is unsustainable with FCF well into negative territory just on the fibre rollout capex.

In our last article we pointed out that even when adding on the capex burden, the Proximus EV looked low relative to peers. When considering that they were planning to IPO their Telesign business at a nice valuation, the EV/EBITDA multiple ended up looking even better. The Telesign IPO failed. They couldn't find a primary market for the business in 2022 because interest in growth stocks had completely been destroyed, together with the SPAC boom and other major growth oriented markets. Together with the continued capex burden and dividend questions, the price cratered. Still, even without considering Telesign there was a discount.

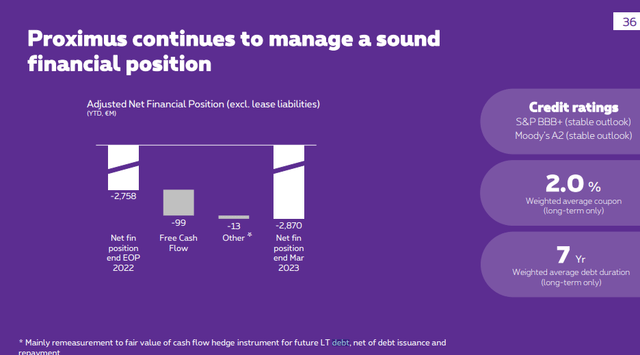

This comes down to the dividend which we think is unsustainable. EBITDA is around 400 million EUR per quarter. Capex is beyond 300 million. D&A shouldn't be ignored, they are real costs on a network that is intended to be grown and kept up to date and will eventually come home to roost. Then there are taxes. Interest is thankfully pretty limited with 7 year maturity profile on fixed coupon 2% debt. Great financial management, but when it comes down to it the earnings are insufficient to keep the dividend going. Net debt grows quarterly by about 5%.

Debt (Q1 2023 Pres)

Bottom Line

The catalysts are Telesign to lend some value to the company as well as an end to the capex burden which will make the dividend sustainable again. The capex burden won't end, which means the dividend remains a question mark. While the company remains consistent with it, we have no faith that they will keep it going when it's growing the company's leverage. They have debt capacity, but it's not a good thing to see, and it would probably be best for them to cut it though many shareholders would have a tantrum.

The other thing is Telesign. We cover the IB and advisory space widely. We have seen that there is an uptick in IPO activity and related capital markets advisory, but it is not broad-based. Some ECM and DCM divisions remain dead, while other companies have managed to win some mandates. It is looking better than the trough H2 of 2022, but it is still not good and there are further recessionary pressures on the horizon to hurt those markets. We do not expect Telesign to be a catalyst, and surely not at a $1.3 billion valuation.

Really there are just too many headwinds and things that could go wrong for Proximus and nothing imminent to help them up, except for their very depressed price. We think they could be cousins to a rally in ECM and DCM activity were they to pursue the Telesign IPO again, but whether they make the effort again anytime soon is very unclear, and we would not expect that to be a catalyst.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.