5 Signs You Will Never Be A Successful Investor

Summary

- Do you consider yourself fiscally responsible? Are you saving and investing for your financial future?

- Investing is a discipline that must be geared towards realistic goals.

- It is good to study success, but wise to learn from failure.

- Looking for more investing ideas like this one? Get them exclusively at High Dividend Opportunities. Learn More »

Daniel Megias

Co-authored with "Hidden Opportunities."

Success stories are easy to find and read. There are volumes of published books, articles, and videos describing famous investors and their successful methods and outcomes over the past decades. In fact, you will find a lot of discussions around their practices and preferences that are irrelevant to improving your investment skills; for example – some writers copied Warren Buffett’s eating habits and explained their takeaways from the experience.

While success stories are inspirational and insightful, reviewing failures and how we can protect ourselves from the same fate is equally essential. From our experiences and observations, we identify five signs that won’t result in success in investing.

1. You Think the Media Provides Actionable Information

While it’s normal to keep a pulse on the overall economy, investors are easily swept into the excitement, doom, and gloom of it all. A plethora of information surrounds the markets, and trying to follow along in real-time can lead you to do excessive trading with your portfolio. You will be better off leaving your investments alone for the long haul.

It is important to remember that the news only gives today’s perspective and conveys nothing about the future. Investing is not about predicting the future but instead preparing for it. Investors should focus on risk management and long-term value creation while avoiding being overly reactionary to the news of the day.

Social media is an exciting platform that is increasingly looked upon for actionable insights. While meme stock frenzies have made serious money for some traders, many more investors were left holding the bag. Investors must do their due diligence and not mindlessly rely on the words of "finfluencers," celebrities, friends, and family.

"Thousands of experts study overbought indicators, head-and-shoulder patterns, put-call ratios, the Fed’s policy on money supply…and they can’t predict markets with any useful consistency, any more than the gizzard squeezers could tell the Roman emperors when the Huns would attack.” - Peter Lynch.

Constantly educate yourself, but know that the news is mainly entertainment, not education.

2. Not Knowing What You Own

Frequently, I hear or read people making comments conflating investing in the stock market with "gambling." This is often a direct consequence of mindlessly making investment decisions.

"Stocks aren't lottery tickets. Behind every stock is a company. If the company does well, over time the stocks do well, and vice versa. You have to look at the company — that's what you research." - Peter Lynch.

Mr. Lynch also says that investors must know what they own and why they own it. As a shareholder, you own a fraction of the company. Whether you own $1 worth of stock, or $1 million, at minimum, you must know how your company makes money, its position in the market, the competitive landscape, and the regulatory framework surrounding the business.

If investing feels like gambling, you are doing it wrong. Yes, stock prices will swing, and often it is difficult to discern any particular reason for price movements in the short term. Yet, at the end of the day, a business is either making a good profit or it isn't. When you buy businesses that are making good profits, eventually, the market will come around and the price will rise.

3. You Think You Need to Hit Home Runs

It may surprise everyone, but successful investing does not mean you must "beat the market." Let me say this – money has value only because it gives us the freedom to pursue things that make us happy. For an investor, it is critical to understand what you're working towards, how much money is needed to reach those goals and identify your timeline. Nothing else matters as long as your investment plan helps you achieve those personal goals along your desired timeline. Investing is not a competition, and it is not a game. You have financial needs, and your financial needs will be different than others.

Trying to hit home runs by picking hot stocks before they jump or timing market swings are activities more aligned with speculating than investing. These may decrease your chances of meeting your goals, as aggressive speculation carries a higher risk of negative returns.

Investors should focus on consistency. Even if you consistently hit singles or doubles, it can add quite a few changes to your life! Ultimately, success is less about swinging for the fences and more about staying out of trouble.

4. You Don't Know the Risks of Your Investments

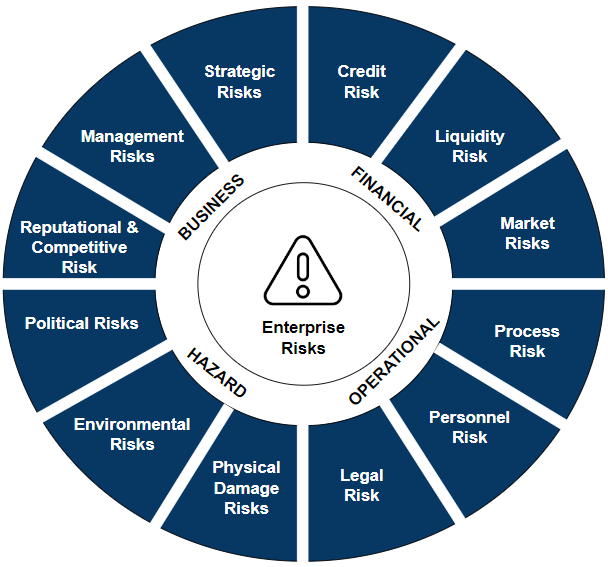

Speaking of trouble, risk is any uncertainty that could cause an investment's actual gains to differ from an expected outcome or return.

Monitoring the risk is not synonymous with staying glued to the price charts and news feeds. And the risk isn’t just about the investment price drop tolerance. One must maintain an understanding of what factors drive a company's earnings and how those factors might change over time.

If your company operates internationally, there are additional considerations, and the relationship between nations and the geopolitical scene is noteworthy. It is also wise to keep a pulse on your company's competitive advantage and if new players can emerge and give it a run for its money.

Economic parameters surrounding the company, such as inflation and interest rates, are also essential to gauge your investment's profitability and dividend sustainability.

Author's Creation

Not understanding the risks of your investment will almost always catch you off guard, as the investment will fail to meet your objectives. All investments carry risks, but the type of risks might vary considerably.

You can never eliminate risk, but you can take steps to mitigate risks. Never assume you can predict the future. This is why, at HDO, we adopted an "agnostic" stance towards interest rates. We own companies that have seen their earnings rise due to higher interest rates, and we own companies where higher interest rates are a headwind.

5. You Love To Spend More Money Than You Make

This should ideally have been the first point, but it has been repositioned since it has less to do with investment techniques and more with general financial literacy.

Your investments may perform well, and your household income may be the best in the league. But if your expenditures exceed your income, you will slowly accumulate debt, creating a cycle of interest payments and hindering your ability to invest and build wealth over time.

If you make mindless purchases, you’re likely facing an empty bank account and severe buyer’s remorse by the end of the month. Overspending is a psychological behavior that spins off from a variety of factors such as emotional issues (shopping to tackle a bad mood), family upbringing (the fact that you are now able to afford things your family never could), or even lifestyle inflation (splurging in the event of a pay raise). I encourage you to take some time to budget your spending, assess your behavior, and determine your needs vs. wants.

It is worth noting that even billionaires have frugal spending habits. If you learn to live below your means, save money, and invest it for the future, you are on the path to achieving your long-term financial goals. If retirement at a reasonable age is your objective, becoming fiscally responsible is your first step.

Once you are retired, this aspect doesn't change. The only thing that changes is the source of your income. Instead of getting a paycheck from work, you can get a paycheck from your portfolio. One of the greatest strengths of an income investment style is that you know what your income is and can then plan to live within your budget. If you are selling stocks to fund your lifestyle, you have to constantly reassess to make sure you aren't selling too much or too little and living within an unnecessarily strict budget.

Conclusion

Money is an exciting topic that sparks controversy, debate, and desire. Wealth is seen as a universal symbol of success but remains elusive for many. While there is a lot we can learn from successful individuals, it is essential to pay attention to those signs that indicate that your path will not lead to financial success.

"Investing is not about beating others at their game. It’s about controlling yourself at your own game" – Benjamin Graham.

Investing is a discipline that requires you to be realistic and clear with your objectives and expectations. At High Dividend Opportunities, we seek to transform our portfolio into a machine that produces cash flow predictably and reliably. Our portfolio diversification is intentional to mitigate the effects of income shocks due to market and economic risks. Our “model portfolio” has +45 holdings with an overall +9% yield. Most importantly, we study the fundamentals of our companies and make risk-based decisions to protect our income stream.

Can you explain your portfolio in 30 seconds or less? If not, you exhibit one of the red flags discussed in this article and must act fast to prevent irreparable damage.

If you want full access to our Model Portfolio and our current Top Picks, join us at High Dividend Opportunities for a 2-week free trial.

We are the largest income investor and retiree community on Seeking Alpha with +6000 members actively working together to make amazing retirements happen. With over 45 picks and a +9% overall yield, you can supercharge your retirement portfolio right away.

We are offering a limited-time sale get 28% off your first year. Get started!

Start Your 2-Week Free Trial Today!

This article was written by

I am a former Investment and Commercial Banker with over 35 years of experience in the field. I have been advising both individuals and institutional clients on high-yield investment strategies since 1991. I am the lead analyst at High Dividend Opportunities, the #1 service on Seeking Alpha for 6 years running.

Our unique Income Method fuels our portfolio and generates yields of +9% alongside steady capital gains. We have generated 16% average annual returns for our 7,500+ members, so they see their portfolios grow even while living off of their income! Join us for a 2-week free trial and get access to our model portfolio targeting 9-10% overall yield. Our motto is: No one needs to invest alone!

In addition to being a former Certified Public Accountant ("CPA") from the State of Arizona (License # 8693-E), I hold a BS Degree from Indiana University, Bloomington, and a Masters degree from Thunderbird School of Global Management (Arizona). I currently serve as a CEO of Aiko Capital Ltd, an investment research company incorporated in the UK. My Research and Articles have been featured on Forbes, Yahoo Finance, TheStreet, Investing.com, ETFdailynews, NASDAQ.Com, FXEmpire, and of course, on Seeking Alpha. Follow me on this page to get alerts whenever I publish new articles.

The service is supported by a large team of seasoned income authors who specialize in all sub-sectors of the high-yield space to bring you the best available opportunities. By having 6 experts on your side, each of whom invest in our own recommendations, you can count on the best advice. (We wouldn't follow it ourselves if we didn't truly believe it!)

In addition to myself, our experts include:

3) Philip Mause

4) PendragonY

We cover all aspects and sectors in the high yield space including dividend stocks, CEFs, baby bonds, preferreds, REITs, and more! To learn more about “High Dividend Opportunities” and see if you qualify for a free trial, please check out our landing page:

High Dividend Opportunities ('HDO') is a service by Aiko Capital Ltd, a limited company - All rights are reserved.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, PendragonY, and Hidden Opportunities all are supporting contributors for High Dividend Opportunities.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (37)

Basic fundamentals that need to be clearly understood by all beginning with mandatory courses teaching these principles in high school and beyond.

AMEN. That's why I like dividends as proof of cash flow. Of course management can be poor and "hide" behind a high dividend (ATT,) but in most cases, dividends are "show me" confirmation of strong company operations.

This article should be read and understood by all.

Kudos Rida

The accuracy of information presented to investors is something seldom addressed.

It should be.

www.1hdo.com/...