Occidental Petroleum: Time To Deal With The Preferred

Summary

- Preferred redemption appears to be the new priority over debt reduction.

- The balance sheet is in far better shape after the redemption of very roughly $10 billion in long-term debt.

- Well, design improvement and other advances have steadily increased well productivity.

- Cash flow is lower than last year, but still within a comfortable range.

- The company has a lot of low-cost well-site locations.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

bjdlzx

Occidental Petroleum (NYSE:OXY) management has shifted their attention to the preferred stock after paying down debt considerably over the past fiscal year. While I would not mind seeing the debt levels come down more, I understand the need to begin the preferred redemption process. Preferred stock is more expensive than debt for shareholders because the rate paid is not tax-deductible. From the common shareholder viewpoint, the preferred also counts as financial leverage that increases the risk of investment in the common stock.

Therefore, the announcement of the redemption of preferred in the current quarter was welcome. However, the current rate of redemption, if maintained, would indicate that a few years will be needed to complete the redemption of the preferred stock.

Nonetheless, the balance sheet is in far better shape than it was a year ago. Management repaid very roughly $10 billion in debt in a year to save hundreds of millions of dollars in interest going forward. The same thing will likely happen as the preferred stock gets redeemed. The result of these actions is to lower the company's breakeven point as the deleveraging proceeds.

Occidental Petroleum First Quarter 2023, Cash Flow And Free Cash Flow Calculation (Occidental Petroleum First Quarter 2023, Earnings Press Release)

The reported cash flow from operating activities is definitely not at the level of the previous fiscal year. But it is more than enough for the company to continue its deleveraging activities. It is important for management to gain as much financial flexibility as possible before another cyclical downturn causes the company to use some of that flexibility.

The combination of financial deleveraging and operational improvement of the acquired properties should allow an expanding margin at a wide variety of industry commodity price levels. The result should be profit growth throughout the industry business cycle for some years to come.

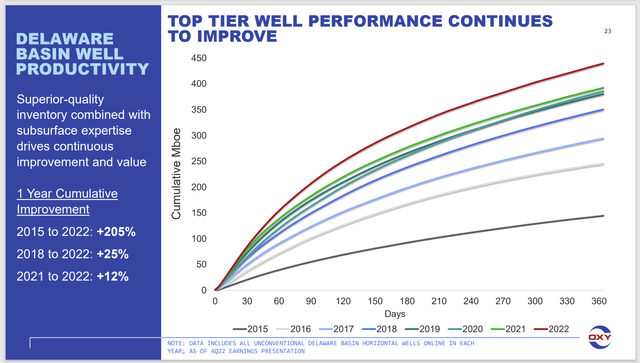

Occidental Petroleum Trend Of Well Production Improvement As Technology Advances (Occidental Petroleum First Quarter 2023, Earnings Conference Call Slides)

The reason that profits are likely to improve for several years is shown above. As new wells come online with more profitable designs, the older wells still produce. They do not magically disappear. It takes time for enough more profitable wells to have an effect on overall company results.

Even if well, improvements and operational improvements ceased "tomorrow". The current version of well design and operational improvements would likely lead to improving company results for some time to come as older, costlier production slowly declines (and the wells eventually are abandoned).

But the continuing well design improvements and operational improvements are likely to continue for years to come. Therefore, the replacement of older higher cost production with new production using the latest techniques should lead to a lower corporate breakeven cost as long as technology advances.

The latest wells that produce more than 300,000 barrels of oil within the first-year break even at very low commodity prices. In the current environment, those wells likely return the money it cost to drill and complete them in months rather than years. That can lead to a very fast cash flow build when the company decides to grow production. In the current situation where deleveraging and preferred stock retirement are the priorities, that fast payback allows a relatively low capital budget to maintain production because some money can be used for two wells in the same fiscal year (thanks to that fast payback).

A side issue is that many acquisitions and mergers do not allow for technology improvements. Yet, operational improvements throughout the industry continue at an impressive pace. Should that pace continue (and that is far from guaranteed), there is every chance those improvements turn the acquisition into a screaming bargain a few years from now, even if there are disappointments elsewhere.

Just look at the graph above and see that well production has at least doubled over the course of the years covered. That changes acquisition numbers dramatically if it continues.

Occidental has an acreage cost advantage because Occidental operated an EOR business in the Permian long before unconventional was even a thought. Therefore, this company was among the early players to be able to pick up acreage long before there was a mad rush for Permian acreage.

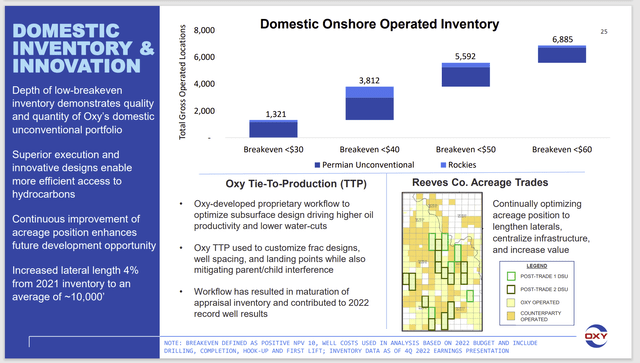

Occidental Petroleum Commercial Drill Locations' Breakeven Points (Occidental Petroleum First Quarter 2023, Earnings Conference Call Slides)

The result of all this improvement is a fair amount of low-cost breakeven well locations, as shown above. Management keeps adding to the potential locations by swapping acreage as shown above to take advantage of new wells designs and completion techniques. Advancing technology likely adds to the Tier 1 acreage position on a steady basis.

Over time, the industry locations of low-cost wells keep at least maintaining industry future prospects. Many years actually show a growth of low-cost prospects. The chances of us running out of low-cost oil any time soon are very slim as long as technology keeps advancing. This industry constantly aims to maintain or increase "Tier 1" acreage, although the definition of that desirable acreage has changed considerably over time.

The one thing that did happen from the acquisition of Anadarko was materially increased exposure to the Rockies. As shown above, that acreage appears to have some slightly higher, though still desirable breakeven locations, than is the case for the Permian. However, management is likely to improve upon the breakeven prospects of the Rockies in the future.

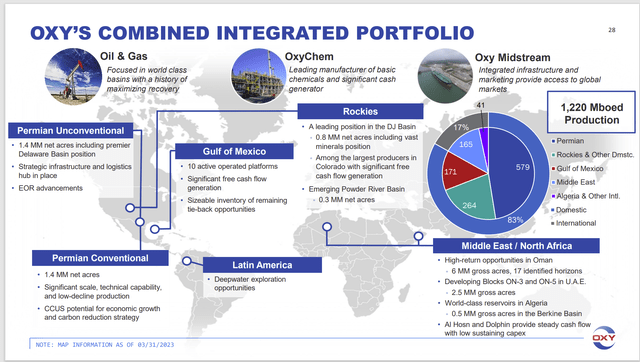

Occidental Petroleum Description Of Operations (Occidental Petroleum First Quarter 2023, Earnings Conference Call Slides)

Occidental Petroleum remains a largely upstream player in the industry. The company does not have the ability to upgrade production in the way that a major like Exxon Mobil (XOM) would. The chemicals division remains a relatively small part of the company business.

Owning midstream does help reduce costs. But in many ways, it will not reduce the upstream exposure to industry cycles.

Even when it comes to basins, the company is remarkably concentrated in the Permian and the Rockies for the majority of its production. There are other areas with some potential to dominate production in the future, like Colombia and possibly the Gulf of Mexico. But right now, such a scenario is years away at best.

Summary

In the last year or so, Occidental has materially deleveraged from the debt incurred in the acquisition. Still, in the eyes of shareholders, there is more deleveraging to accomplish because the preferred stock claims rank ahead of the common just like debt. While management has begun that process, it could take a few years at current commodity price levels.

Occidental has long been at work to improve operating results. But it takes time for enough of those improved operating solutions to have a material effect on quarterly results.

Between the deleveraging and the operational improvements, this company could show improved profitability for years to come, even if production does not grow. At some point, though, production will likely resume growth to add yet another dimension to an improving future.

The company, for me, remains a strong buy consideration based upon the continuing improvements well into the future from potential production growth, technology advances, and deleveraging. There is some financial risk because there is still a fair amount of debt and preferred outstanding. Still, Occidental has done well so far despite all the challenges since the acquisition. The path forward is now a lot easier.

I analyze oil and gas companies like Occidental Petroleum and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have a beneficial long position in the shares of OXY XOM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

He sounds like a smart investor.