Vale: A Promising Future Supported By Strong Financials And Strategic Operations

Summary

- Vale has shown strong financial performance, with a significant increase in operating cash flow and robust free cash flow in Q1, 2023.

- Vale is expected to experience substantial growth in its nickel production, reaching 300 ktpa by 2030, and has operations in key growth regions like Indonesia.

- Vale's valuation metrics, such as its PE ratio and EV-to-EBITDA, suggest that the company is currently undervalued in the market compared to its peer, Rio Tinto.

- Given Vale's strong financials and strategic business operations, the company presents an attractive investment opportunity.

Photon-Photos

Introduction

Vale S.A. (NYSE:VALE) is a global leader in the metals and mining industry, specializing in the production of iron ore, nickel, copper, platinum group metals (PGMs), gold, silver, and cobalt. The company operates extensive logistics systems, including railroads, maritime terminals, and ports in Brazil and other countries. In 2022, approximately 79% of Vale's net operating income was derived from its iron ore production and related services. The remaining portion came from its energy transition metals division. In this analysis, I also include an examination of Vale's financials and market outlook for its production.

Vale’s business and financial outlooks

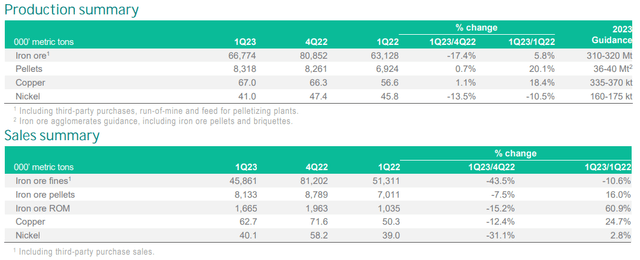

During their 2023 Global Metals, Mining and Steel conference, the company expressed their confidence in the performance of their S11D mine in Minas Gerais. The S11D mine played a significant role in achieving a 6% increase in iron ore production compared to the previous year. Additionally, Vale's pallets production experienced a remarkable 20% year-over-year growth during the first quarter of 2023. This growth can be attributed to improved availability of pellet feed and reduced maintenance activities. Consequently, Vale's upward trend in iron ore production demonstrates their ability to meet the rising global demand for this resource. However, it is worth noting that there was a 7% decline in iron ore fines and pellets sales due to loading restrictions in the Northern System caused by rainy seasons. Despite this setback, the management assured that they will mitigate this impact during the second half of 2023. This compensation will primarily be driven by the recently obtained operating license for the Torto dam. Another project that will contribute to an increase in pellet feed production is the commissioning of the Gelado dam. Additionally, in terms of energy transition metals, the company's copper production has seen a significant 18% year-over-year increase compared to the same quarter in 2022. This growth can be attributed to the successful startup of Salobo, which resulted in a 25% boost in sales. Furthermore, Vale has achieved its highest nickel production in the last five consecutive years. It is worth noting that Vale has also entered into an agreement with global automaker Ford Motor Company (F) for the Pomalaa HPAL project, aimed at promoting more sustainable nickel production in Indonesia. Overall, Vale's participation in diversified production plans has made their assets unique and strengthened their supply chain (see Figure 1).

Figure 1 – VALE’s production and sales by segments

VALE's 1Q 2023 results

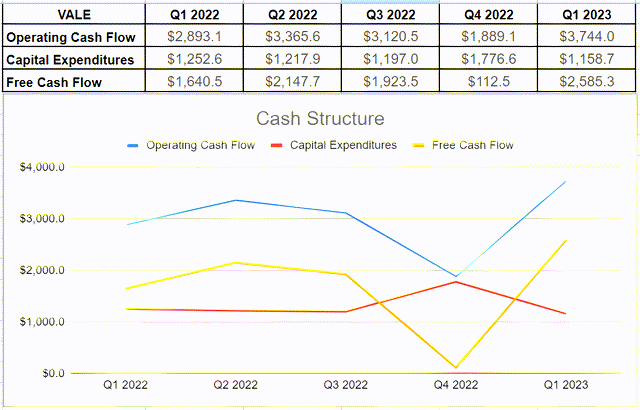

During the first quarter, Vale generated an impressive operating cash flow of over $3.7 billion, a significant increase from the $1.8 billion recorded at the end of 2022. This was further supported by capital expenditures of $1.15 billion, resulting in a substantial free cash flow of over $2.5 billion. This strong financial performance has paved the way for the company's distributions (see Figure 2). It is important to note that this robust free cash flow has significantly boosted VALE's EBITDA to cash-conversion ratio, reaching 62% year over year compared to just 19% in 1Q 2022. This improvement can be attributed to the strong cash generated from sales at the end of 2022. As a result of this positive financial performance, management distributed $1.8 billion in dividends at the end of 1Q 2023. Additionally, they successfully completed 47% of their third buyback program, which was initiated in 2020.

Figure 2 – VALE’s cash structure (in millions)

Authors

Nickel and copper outlooks

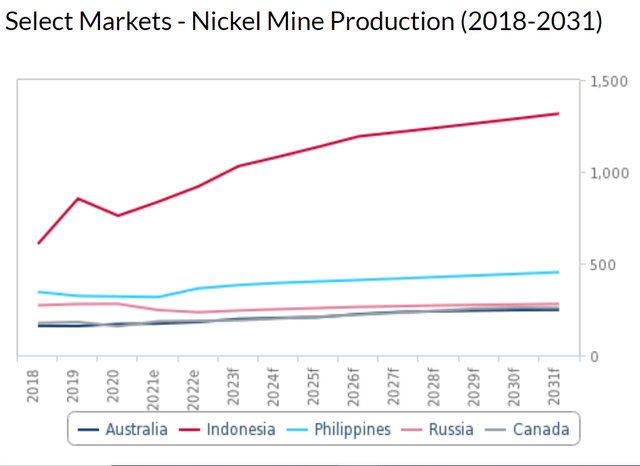

VALE is expected to experience significant growth in its nickel production in the coming years. The management projects that their nickel production will reach 230-245 ktpa in the medium term and increase to 300 ktpa by 2030. According to forecasts, global nickel mine production is anticipated to grow at an average annual rate of 5.1% until 2026, after which it is expected to decline to an average of 1.9% by 2031. Overall, global annual nickel production is predicted to reach 3.15mn tonnes ((mnt)), a 40% increase from the 2.24mnt produced in 2021. It is important to note that Russian nickel remains unaffected by sanctions related to the Russia-Ukraine war, which has created uncertainty surrounding supply chains, particularly for high-grade nickel used in the electric vehicle (EV) industry as battery-grade material. Overall, Russia currently accounts for 21% of global battery-grade nickel production, followed by Canada, Australia, and China at 17%, 14%, and 10% respectively. Figure 3 indicates a significant growth in nickel ore production by the end of 2031, primarily driven by Indonesia and the Philippines. These countries are focusing on developing their downstream sectors to enhance nickel mining, and fortunately, VALE has established operations in Indonesia. Additionally, the demand for nickel is projected to rise by approximately 40% by 2030 due to its increased usage in batteries for electric vehicles. Consequently, the forecasted demand for nickel is estimated to reach 6.2 million tons as a result of the rapid growth in the energy transition.

Figure 3 –

Fitchsolution.com

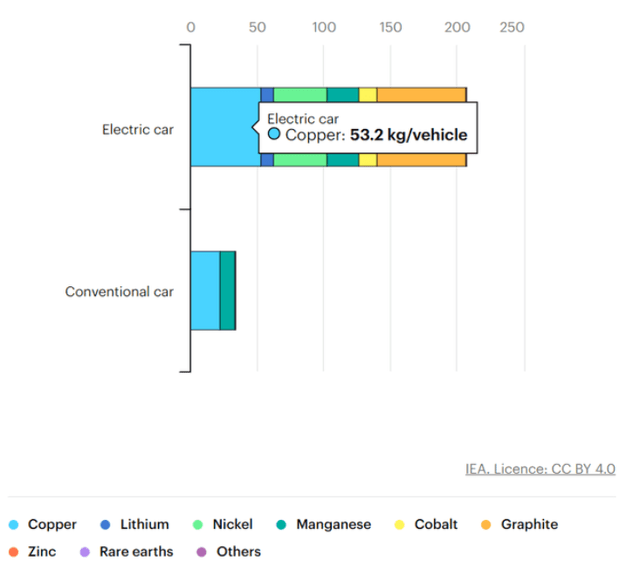

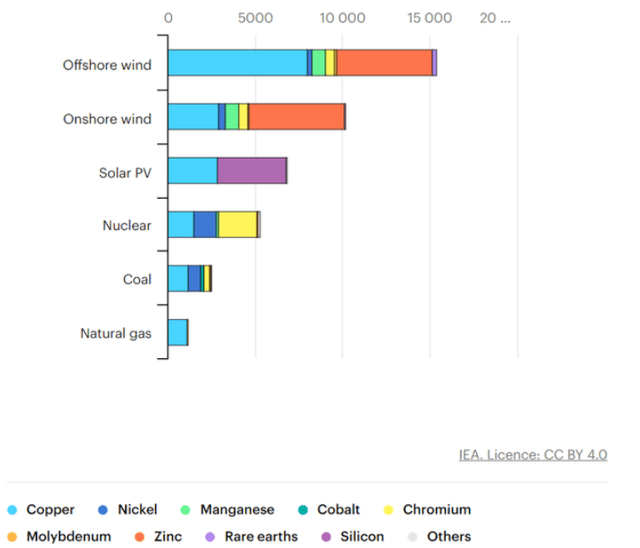

Moreover, the global demand for copper, a crucial component in vehicle batteries and renewable energy systems, is projected to increase by 20% by 2030, reaching 37 million tons. In the long-term, the International Energy Agency (IEA) predicts a significant boost in mineral demand for clean energy technologies by 2050. For example, an electric car requires six times the mineral inputs compared to a conventional car, while an onshore wind plant requires nine times more minerals than a gas-fired plant. Figure 4 illustrates that minerals make up 200 kg of an electric car, with copper accounting for approximately 53 kg directly. Additionally, Figure 5 demonstrates that copper comprises over one third of an offshore wind plant.

Figure 4 – Mineral used in electric cars compared to conventional cars

IEA

Figure 5 – Minerals used in clean energy technologies compared to other power generation sources

IEA

Vale valuation metrics vs. Rio Tinto

In my last analysis of Rio Tinto's (RIO) financials here, I mentioned that RIO is a prominent player in the metals and mining industry. One of their key objectives is to utilize technology in order to minimize their carbon footprint during production. With a robust balance sheet and diversified assets, Rio Tinto has established itself as a successful mining company. Furthermore, the company's leverage and liquidity positions are strong, which bodes well for its future market conditions. As a result, I compared VALE’s financial metrics with RIO’s as one of its main peers. When comparing significant valuation metrics such as VALE's PE ratio and EV-to-EBITDA metrics, it becomes apparent that VALE's EV-to-EBITDA stands at 3.55x, which is 16% lower than RIO's 4.26x. Additionally, VALE's PE ratio of 3.79x is considerably lower than RIO's PE ratio of 8.37x. These valuation metrics indicate an attractive entry point for investing in VALE, as it appears to be undervalued in the market. Moreover, considering VALE's effective business and operational strategies, along with its healthy financials, it can be concluded that investing in this minerals and mining company would likely yield profitable returns (see Figure 6).

Figure 6 - VALE metrics vs. RIO

YCharts

Conclusion

Vale S.A. is a company that provides robust financials, supported by impressive valuation metrics that suggest the company is currently undervalued in the market. Furthermore, recognizing the global increase in demand for nickel and copper metals, Vale's management has taken proactive measures to enhance their production volumes through efficient projects. Considering these factors, it is evident that investing in VALE stock would be a prudent decision within the mineral industry.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)