Cognizant's Journey In Driving Business Transformation And Profitability

Summary

- The IT Consulting industry is highly attractive and facing tailwinds, as technological development drives demand from businesses to improve operational capabilities.

- Cognizant is positioned well to exploit this, as a highly-regarded firm with scale.

- The company has struggled in recent years, with growth slowing and margins slipping. This said, the company looks oversold.

- With Cognizant trading at a deep discount to peers and its historical average, we consider the strong attractively priced.

Ilya S. Savenok/Getty Images Entertainment

Investment thesis

Our current investment thesis is:

- Cognizant (NASDAQ:CTSH) is an attractively positioned business, with industry tailwinds and technological development driving value.

- The company has issues with margin and growth but we suspect investment in improving in the coming 12-18 months will support the improvement sufficient to improve its current performance.

- Despite the issues, we believe Cognizant is attractively priced, as it is trading at a deep discount to Infosys and its historical average.

Company description

Cognizant is a multinational technology company specializing in digital, consulting, and business process services. With a global presence and a diverse portfolio of services, Cognizant assists organizations in their digital transformation journey by leveraging technology and industry expertise.

Share price

Cognizant's share price has underperformed the market in the last decade, as its strong financial performance was generally priced in by investors. Since 2022, the company has noticeably underperformed, primarily due to unexpected weakness in financial results.

Financial analysis

Cognizant financials (Tikr Terminal)

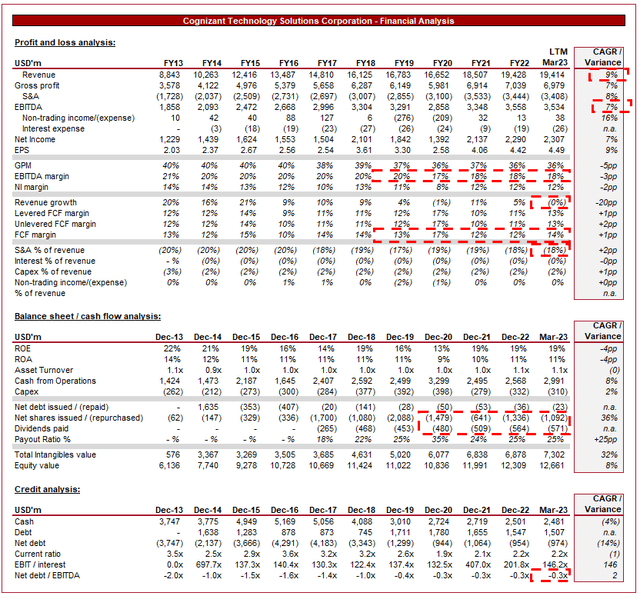

Presented above is Cognizant's financial performance for the last decade.

Revenue & Commercial Factors

Cognizant's revenue has grown at an impressive rate of 9% in the last 10 years, with only 1 fiscal year with growth below 4% (Covid-19 impacted). This is a reflection of the company's resilience, as well as the industry tailwinds propelling the business forward.

Business Model and Competitive Positioning

Cognizant follows a client-centric business model, offering a wide range of services, including digital strategy consulting, IT infrastructure services, application development and maintenance, and business process outsourcing. The company focuses on delivering value to clients through a one-stop-shop approach, both modernizing a business' operations, as well as supporting its ongoing needs and development as it grows. This is a critical development for Cognizant as clients are increasingly demanding a packaged solution, as the complexity of support required means the number of services required has increased rapidly.

Cognizant combines deep industry knowledge, technological expertise, and global delivery capabilities. Through intelligent recruitment, internal innovation, and gradual improvement, Cognizant has developed a quality offering across various technology segments. It is a highly regarded firm in the market, scoring extremely high in rankings, as the following shows. This puts the firm in the Tier 2 category, known for its competitive pricing relative to its comparable peers.

Technology Consulting Industry

A key development in the corporate business environment is the incorporation of cloud-based solutions. Over the last decade, we have seen increased data collection and analytics (With the objective of utilizing this to drive increased sales), as well as the cost of cloud solutions declining. This combination (as well as many other factors) has contributed to a rapid increase in the demand for cloud-based solutions and thus the opportunity for Cognizant to assist clients in migrating their systems and applications to the cloud. Despite the development thus far, we suspect the demand for such services will remain strong in the coming years.

The growing demand for data-driven insights and AI-powered solutions (in particular given the developments in the last 6 months) is driving the need for services that can incorporate these technologies to enhance value for clients. Similar to its peers, Cognizant has been rapidly developing its capabilities, seeking a product that has the ability to provide real-life value. Cognizant recently announced Neuro AI, which is designed to provide enterprises with a comprehensive approach to accelerate the adoption of generative AI technology, with the objective of reducing costs and increasing revenue. The "winner" of the generative AI race will not be known for many years but Cognizant's data analytics capabilities reflect a strong market position.

In conjunction with the two points above, we consider automation of processes through robotics and intelligent automation technologies as a critical area of growth. Following decades of globalization, the scope for exporting costs has likely peaked, and if anything, may be on the rise following various supply-chain issues in the last few years. As a result, the pressure to discover new avenues for cost savings is increasing. We believe the automation is the natural transition, as technological development will improve the services that a computer can provide, replacing overhead investment. Cognizant provides a comprehensive offering from advisory support for frameworks to managed services.

Finally, we consider Cybersecurity to also be a key area of development. The rising number of cyber threats and data breaches highlights the importance of robust cybersecurity solutions and services, with the average breach currently costing a record $4.25m. With an increasing number of businesses incorporating technology into their operations, the demand for cybersecurity support will only grow in parallel. This is an example of related services that provide a natural opportunity for cross-selling.

In conjunction with the above points, M&A represents an opportunity to enhance organic growth. We have seen increased activity in the last decade, as larger businesses acquire smaller boutiques, as a means of increasing their expertise. Cognizant has consistently acquired businesses throughout the historical period and we expect this to continue going forward.

Cognizant faces intense competition from other global IT services and consulting companies in its pursuit of new clients, including the likes of Accenture (ACN), IBM (IBM), Infosys (INFY), and Tata Consulting. We believe this is the reason for the slowing growth post-FY18, despite the strength of tailwinds continuing. In the most recent quarter, sales declined 0.3%, compounding the issue. Our view is that this is a reflection of Cognizant's inability to improve pricing, as well as gain market share beyond its current level. This pricing issue and inability to gain market share will be illustrated later in this report.

Margins

Cognizant has fairly strong margins, with a GPM of 36%, EBITDA-M of 18%, and a NIM of 12%. Over the historical period, margins have declined consistently.

Margin erosion has been driven by two interrelated factors. Firstly, the company has faced talent retention issues, forcing the business to improve compensation and recruit individuals at higher-than-average salaries. Given the industry is based on human capital (and their talent), the company is somewhat exposed to industry developments. Secondly, Cognizant has been unable to pass on these increased costs to clients, implying significant competitive pressures. Although Cognizant is highly regarded, this does suggest weakness in the business model, as its value proposition may not be at the level of comparable firms.

Outlook

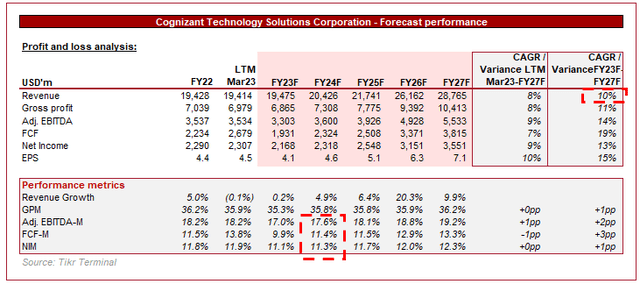

Presented above is Wall Street's consensus view on the coming 5 years.

Analysts are forecasting a tough 3 years for Cognizant, followed by a return to strong growth. This is a reflection of a transitionary period, as Cognizant improves there value proposition.

Margins are also expected to decline, before subsequently improving. Based on the company's current trajectory, this looks to be a reasonable estimate, as an investment in internal improvement initially comes at a cost to the business.

Industry analysis

IT Consulting Industry (Seeking Alpha)

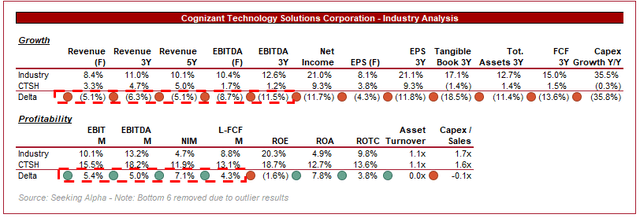

Presented above is a comparison of Cognizant's growth and profitability to the average of its industry, as defined by Seeking Alpha (24 companies).

Relative to its peers, Cognizant is performing well on profitability but is lacking in growth. The revenue issues were identified purely from the financial slowdown compared to the bullish factors in the industry. When compared to peers, it implies Cognizant is losing market share.

Cognizant's profitability is respectable, with a noticeable premium relative to its peer group.

Valuation

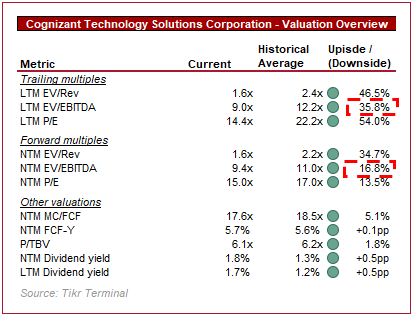

Valuation (Tikr Terminal)

Cognizant is currently trading at 9x LTM EBITDA and 9.4x NTM EBITDA. This is a discount to its historical average.

With Cognizant forecast to decline in the coming year, the NTM metric is a better source for evaluating Cognizant's valuation. Based on this, the company is undervalued by c.17%.

Our view is that a discount is warranted given the issues the company has faced, with slowing demand and margin erosion in recent years. This said, 17% looks large, especially when you consider Infosys and IBM are trading at 14x and 10x respectively. Infosys is better on both growth and profitability but not 49% worth. IBM on the other hand lacks growth.

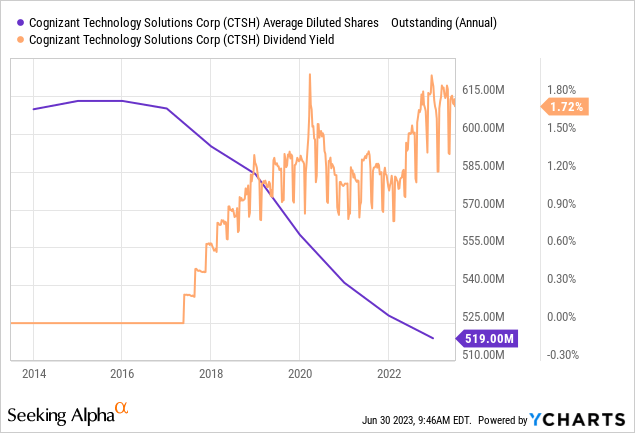

Cognizant's distributions have been attractive in recent years, with consistent buybacks and dividends. Given the cash generation of the business and cash balance, we consider this sustainable.

Key risks with our thesis

The risks to our current thesis are:

- Given the issues in the most recent quarter, the largest risk to our thesis is the "bottom". We concur with analysts' view but there remains an ongoing risk that Cognizant could underperform this level.

Final thoughts

Cognizant is operating in a highly attractive industry, with technological innovation driving Corporate improvement. The business has performed incredibly well in the last decade, although has faced some weaknesses, requiring a period of strategic adjustment.

Given the strength of the performance thus far and the cheap valuation, we believe the company poses an attractive risk-adjusted investment.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.