Universal Display Corporation: An Interesting Opportunity When Valuation Compresses

Summary

- Universal Display Corporation, a developer and manufacturer of advanced OLED technologies, is expected to face a challenging short-term period.

- The company's financial state is solid, with no long-term debt and a strong cash position of $150 million.

- The valuation for OLED right now seems quite rich and until the valuation compresses I don't think it could be rated a buy.

Anatoly Morozov/iStock via Getty Images

Investment Rundown

Universal Display Corporation (NASDAQ:OLED) is a company at the forefront of developing and manufacturing advanced organic light-emitting diode technologies and materials. These innovative products are utilized in various consumer electronic devices, ranging from smartphones and tablets to televisions and lighting fixtures. Universal’s proprietary phosphorescent PHOLED technology offers a clear edge over conventional OLED technology by providing brighter, longer-lasting, and more energy-efficient displays. As a result, Universal is well-positioned to continue to be a major player in the OLED market and drive innovation in the industry.

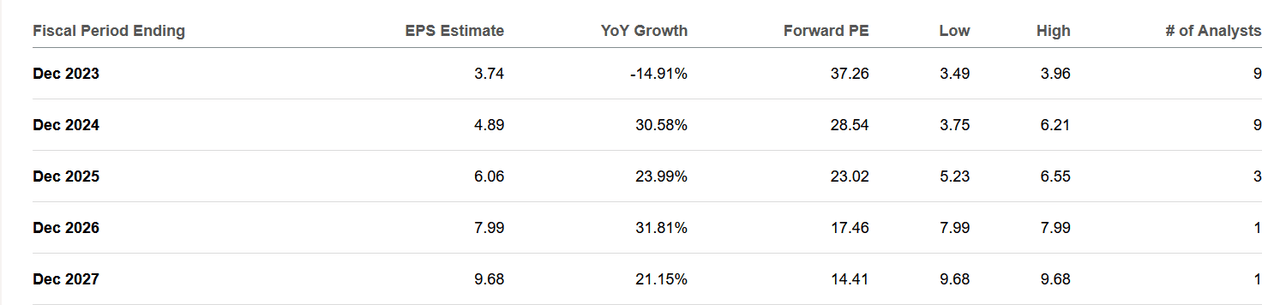

Earnings Estimates (Seeking Alpha)

The company has like many other tech companies seen a slight decline in the revenues to start of 2023 compared to 2022. The management noted macro uncertainties as a reason for the drop in revenue and perhaps a softer market too. This hasn't stopped the company from making both acquisitions and announcing dividends. The balance sheet is in fantastic shape with assets heavily outweighing the liabilities, and margins are not too shabby either with net margins around 33%. The quality of the company can't be understated but that doesn't necessarily make it a buy all the time. The forward earnings multiple sits quite high at 37 right now. It wouldn't be until 2026 that OLED would have a valuation more in line with the industry and be at a price I feel comfortable investing. This makes me rate it a hold for now. A buy case could be made when the valuation compresses into something more realistic.

Growth Opportunity

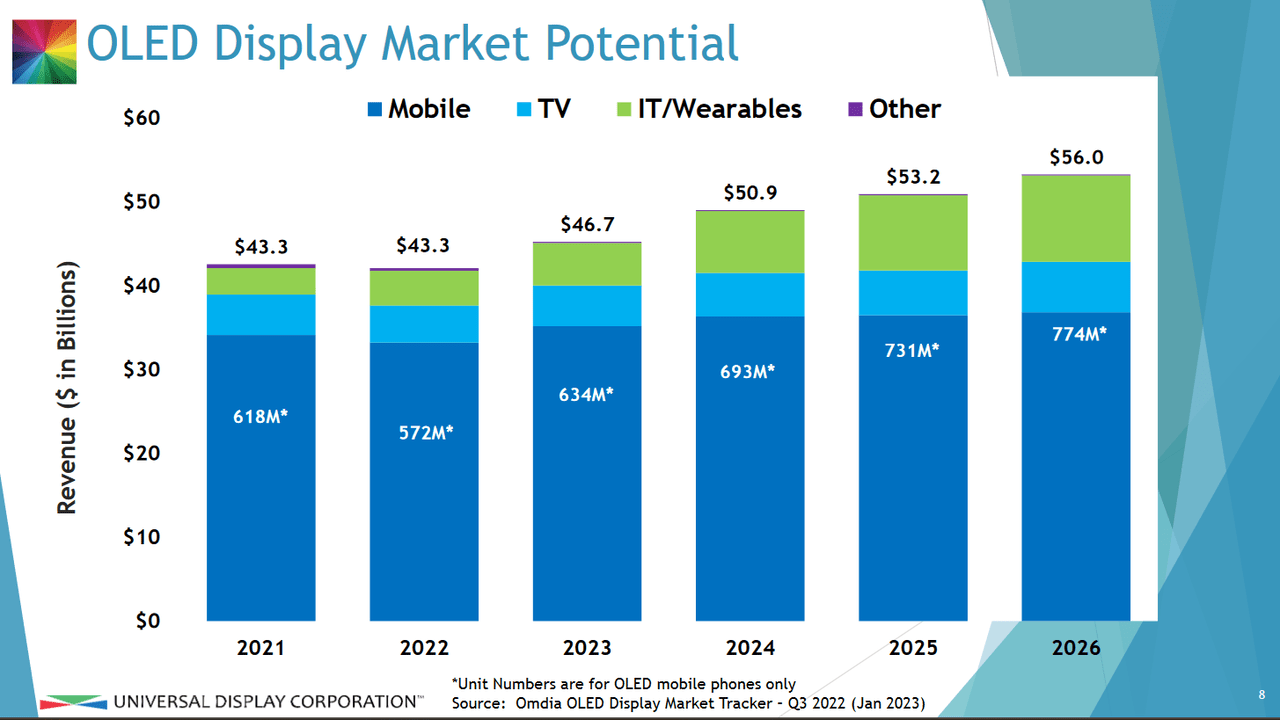

Looking at the potential for the OLED market it is quite significant. Universal has been able to enter into strong partnerships and supply display screens to some of the largest companies in the world. But I do fear there is the possibility of disruption coming as Apple has announced they will begin making their own screens in-house. Limiting the TAM heavily for a company like OLED.

Market Potential (Investor Presentation)

Despite that though, OLED is expecting its TAM to be around $56 billion in 2026. Where I am worried is that sales of smartphones are declining in 2023. I think these short-term pains will have some effect on the order backlog for OLED but it remains to see if this trend is sticking or not. As mentioned before though, the balance sheet of the company is very strong and I don’t expect it to put up any troubles. Instead, the company has the opportunity to continue making acquisitions and set itself up for success when the tide turns and demand resumes once again.

The Financial State

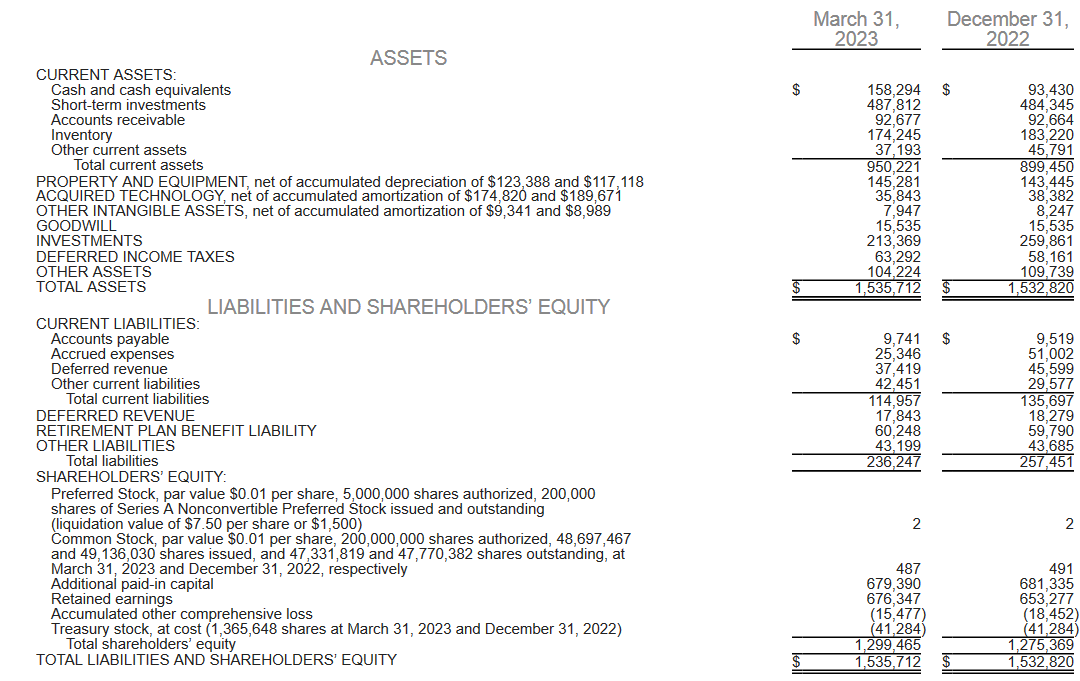

As mentioned previously was that OLED is in a fantastic financial position right now where long-term debt is nonexistent and the cash position is very strong at $150 million. In my opinion, with no debts, the cash position size doesn't play an as important role to create a cushion for when debt maturities would happen. Instead looking at the cash flows would be better. The TTM levered FCF margin sits at 14% right now which is quite good but think there could be a downside here in my opinion, as a slowdown in the market is very possible. Recent reports from companies suggested that sales were declining which lowers the demand for production and in turn the products that OLED makes.

Balance Sheet (Earnings Report)

What OLED can do in the meantime is continue with its acquisitions and partnerships to set itself up as the leader in the market. The assets outweigh the liabilities by 6.5x which unfortunately still doesn't mean you are getting a great deal at these prices. The p/b still sits at a high of 4.73.

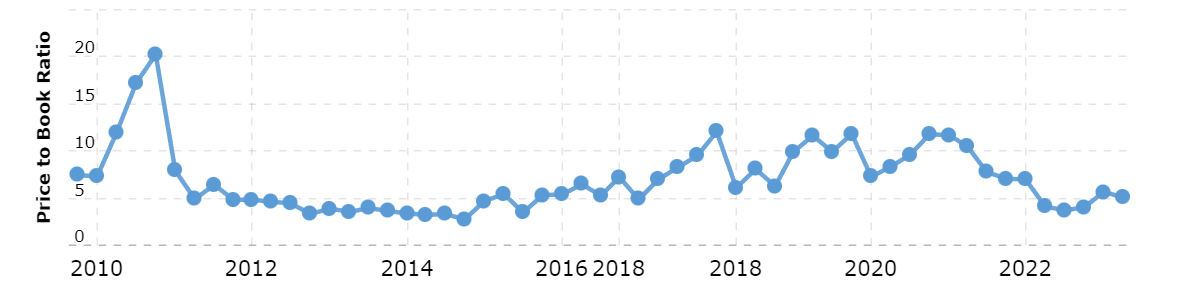

P/B Ratio (Macrotrends)

Historically the company hasn't necessarily been trading at a low p/b multiple either. 3.3 seems to have been the lowest back in 2014. The industry does have a generally quite high p/b multiple with the forward one sitting around 3.56 right now. I think this displays further why I am not comfortable investing in the company right now. The valuation doesn't scream a deal exactly. With 2023 expected to be quite difficult for many companies, I think it's better to wait on the sideline to see the development of OLED.

Investment Risks

I have said at the beginning of the article that the sales of smartphones and tech that uses OLED screens seem to be decreasing. This places a risk that revenue and orders are going to decrease for Universal. This means the current valuation might be even higher as we see the coming quarter pan out. If sales continue to decrease like they did in Q1 of 2023, I don’t see anything holding up the share price. it's trading a fair bit over the industry and even though growth is expected to be strong up until 2026, and then taper off to around 10% annually, the 37x earnings multiple is quite high, and compression down to 19 is not impossible. That would put the share price around $71 using the estimated EPS of $3.74 for 2023. As an investor, I never want to take on unnecessary risk for my portfolio, and right now I think that is what OLED is offering unfortunately.

Final Words

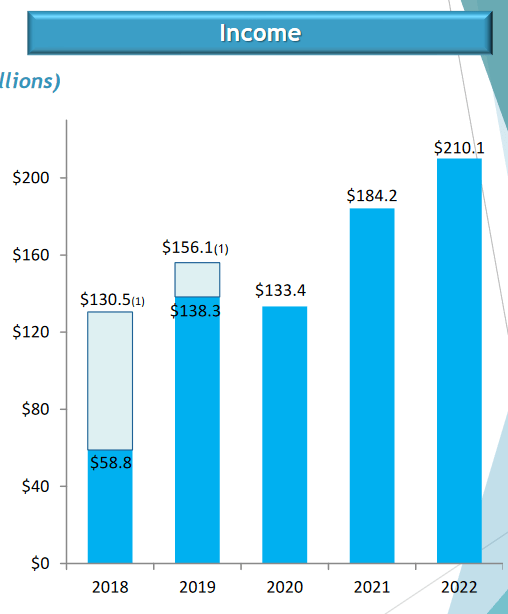

Universal Display Corporation has a massive $56 billion market to take in 2026 as per their own estimates. The company has been growing immensely over the last few years as they are entering into more and more important partnerships with companies and signing long-term contracts to secure revenues.

Income History (Investor Presentation)

But as valuation matters, paying 37x forward earnings is quite high even though the company has had fantastic margins historically. I think the disruption that Apple is causing by them making their own screens in-house will carry on to other companies too. This hurts the long-term prospects of OLED and makes the future uncertain about the impact it will have on revenues. Normally that would mean a very low multiple would be applied to the company, but the opposite is true for OLED right now. My view is that OLED is a hold for now and perhaps could become a buy when the company trades similarly to the sector and we have some earnings results come out to give some insights about how the revenues are affected.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.