Nestle: Profitability Powerhouse But Growth Problems

Summary

- Nestle is a market-leading FMCGs business.

- Nestle has performed well during the inflationary environment, increasing prices and benefiting from inelastic demand.

- Margins are also strong, despite a recent decline.

- Our concern with Nestle is that growth has been poor over the last 10 years. When this is considered in conjunction with its premium valuation, the business looks expensive.

yalcinsonat1

Investment thesis

Our current investment thesis is:

- Nestle has quality brands that are maintaining and enhancing their current market share. Nestle's response to economic conditions has been strong, with large pricing gains relative to the volume decline.

- Nestle is responding well to industry trends but this is translating to growth, which has been disappointing in the last decade.

- Nestle's margins are good, although have slipped in the last year. Relative to peers, growth is an area of weakness.

- Nestle is trading at a premium to its historical average, which does not look warranted based on the factors above.

Company description

Nestlé S.A. (OTCPK:NSRGY) is a global food and beverage company. Its product offerings span different regions and categories. It provides baby foods, bottled water, cereals, chocolate, and confectionery products, as well as coffee and culinary, chilled, and frozen foods. Nestlé also offers dairy products, drinks, food service products, healthcare nutrition products, ice cream, and pet care products.

Nestle has a rich brand portfolio, including Nescafé, KitKat, Nesquik, and Purina.

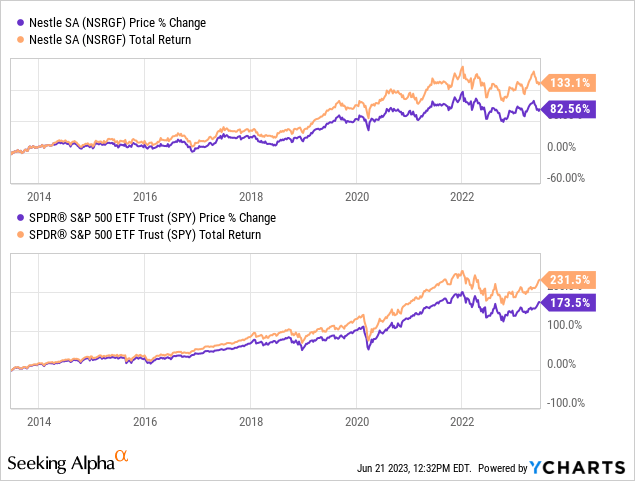

Share price

Nestle's share price has underperformed the S&P 500 over the last decade, as performance softens, but notably, has remained robust. As a mature business, it is unlikely that Nestle will sour past the market average over such an extended period of time.

Financial analysis

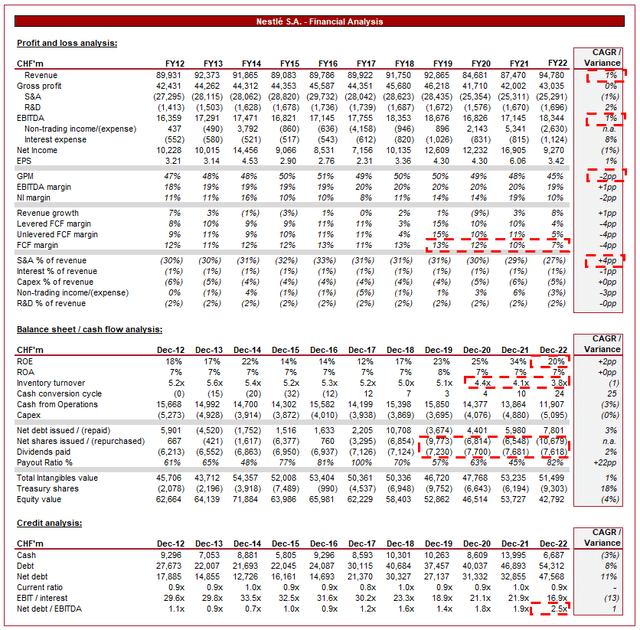

Nestle financial analysis (TIKR Terminal)

Presented above is Nestle's financial performance for the last decade.

Revenue & Commercial Factors

Nestle's revenue has grown at a CAGR of 1% during this period, with 4 fiscal years of negative growth during the period. The average inflation rate during this period was 2-4%, implying a degree of underperformance.

A portion of this is the impact of FX. As a global business, Nestle faces a significant FX risk, both from the supply side and the demand side. For fast-moving consumer goods (FMCGs) businesses, hedging is not an option, leaving the business exposed.

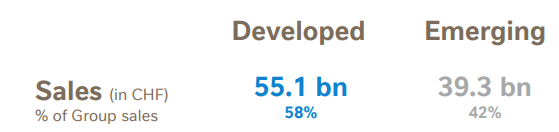

As the following illustrates, Nestle's revenue mix is highly exposed to the FX rates of emerging economies.

Revenue mix (Nestle)

Business model

Nestlé operates in various food and nutrition segments, specializing across the spectrum. The company's vast product range provides it with a competitive advantage and allows for cross-selling and brand loyalty, as well as scale benefits in its supply chain. Nestle's extensive distribution network, strong brand recognition, and continuous investment in R&D contribute to its leading market position. The company is in a positive cycle, where it can either acquire or innovate (through its leading brands) in the markets it currently operates within, allowing the business to consistently maintain or gain market share.

The food and beverage industry is highly competitive, with numerous global and regional players vying for market share. The market can be broadly divided into 3 segments, unbranded (cheapest option), affordable, and premium. Nestle operates primarily in the 3rd bucket, facing competition from the first.

Nestle's primary competitors are Unilever (UL), The Coca-Cola Company (KO), PepsiCo (PEP), and Kraft Heinz (KHC). The main areas of competition are brand strength, product quality, and marketing efforts.

Economic conditions

Current economic conditions have materially impacted many Western nations. With elevated inflation and rising rates in response, we have seen consumers' impacted by a rise in the cost of living. This has contributed to reduced discretionary spending, as well as a focus on cutting costs where possible.

The benefit for Nestle is that FMCGs businesses generally operate well during these conditions. The reason for this is that their demand is inelastic due to the nature of the products sold, allowing Nestle to increase prices to the extent that growth can be maintained.

Although we like FMCGs businesses for this reason, we are concerned by the growing level of competition. Many supermarket-branded products, as well as affordable brands, are less aggressive with pricing increases, causing a greater delta in prices. For this reason, there is a risk that consumers will switch from Nestle-branded products to alternatives.

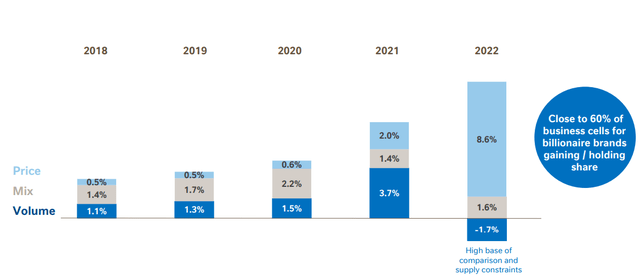

Thus far, the business has performed well, with 8.6% pricing benefits, offset by a (1.7)% decline in volume.

Price / Vol (Nestle)

FY22

Organic growth (Nestle)

As the above illustrates, Nestle has achieved strong organic growth across all of its business segments. This is a reflection of robust demand despite economic conditions, as well as the impact of inflation.

Although this performance is strong, we remain hesitant given the underlying increase in competition from a pricing perspective. We suspect once economic conditions normalize, Nestle may face greater pressure to win back the lost volume.

Food and beverage industry

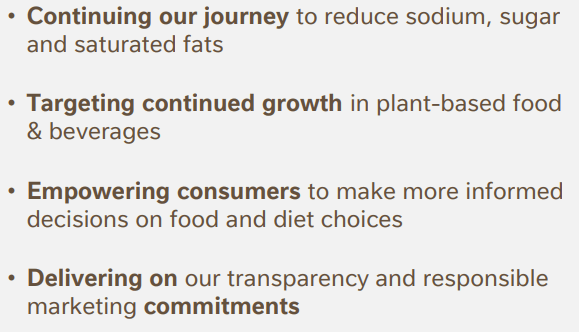

Consumer preferences have shifted towards healthier and more nutritious food/beverage options. This is driven by a greater understanding of diets and social signaling. Further, we have seen changes in legislation, such as the introduction of a sugar tax across many countries. Nestle has focused on this transition in recent years, committed to transitioning its portfolio. Further, the company is looking to exploit growth areas such as plant-based foods, that fall under this "healthier focus" category. We believe this industry trend represents an opportunity, as an increasing number of consumers begin making purchasing choices based on ingredients and contents.

Good For You Campaign (Nestle)

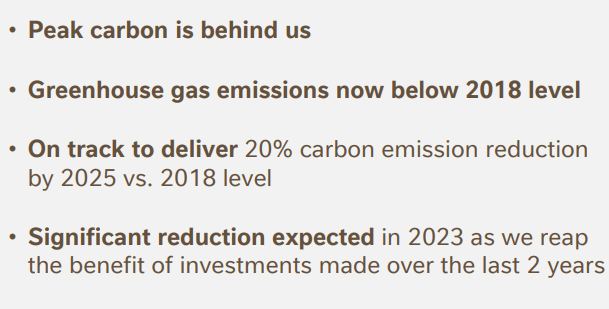

In conjunction with the above point, we are seeing increasing environmental awareness by consumers, forcing the likes of Nestle to adopt sustainable practices across its supply chain. Nestle is committed to responsible sourcing, recycling initiatives, and sustainable packaging aligns with consumer expectations. This does not necessarily represent an opportunity for upside but instead is a requirement to protect against consumer backlash.

Good For The Planet Campaign (Nestle)

Despite the strong penetration, growth across the emerging world continues to be a key opportunity for the business. Rising incomes and changing demographics present new consumer markets, as well as areas of development. This will allow Nestle to utilize its brands and capabilities to easily expand into these regions and expand its addressable market.

Margins

Nestle's margins have quietly trended up in the last decade, with a GPM of 45%, EBITDA-M of 19%, and a NIM of 10%.

The improvement has been driven by scale economies, pricing action, and a change in product mix toward higher-margin products.

The most recent erosion is due to inflationary pressures, with GPM declining by 3%. Management has done well to offset the impact of this somewhat by reducing S&A spending. Although this is disappointing, margins are generally sticky and we suspect Nestle can win back the c.1% at an EBITDA level once inflationary pressures subside.

Balance sheet

Inventory turnover has disappointingly declined in recent years, with a consistent >5x level falling to 3.8x. Given the scale of the business, this will materially drag on FCF, as illustrated by the metric declining below 10% for the first time in a decade. Management indicates this is a purposeful decision but the degree to which inventory has been accumulated looks unusual.

Nestle's ND balance has gradually increased over the historical period, as Management funds significant distributions alongside M&A and Capex. Currently, the business has an ND/EBITDA ratio of 2.5x, with our belief that 3-3.5x is a healthy maximum.

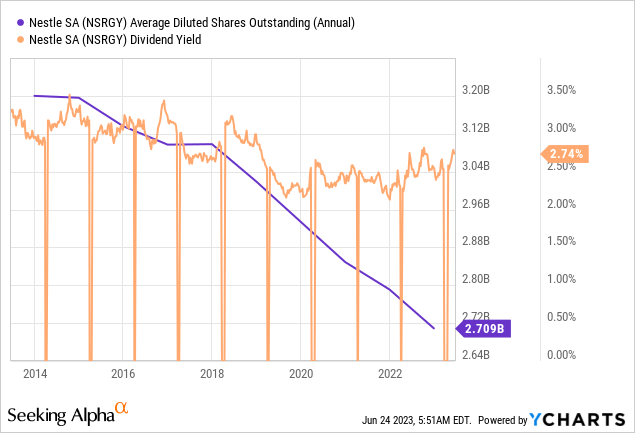

Distributions have been healthy and consistent, although the level of buybacks looks unsustainable given the sharp reduction in cash and continued investment in Capex. Further, although the dividend yield is attractive, the growth in payment is underwhelming.

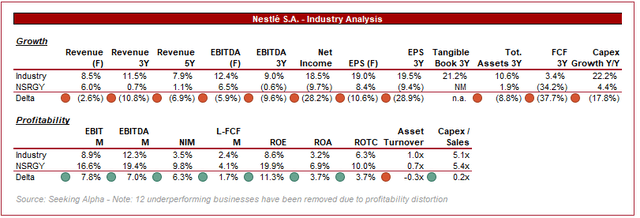

Industry analysis

FMCGs industry (Seeking Alpha)

Presented above is a comparison of Nestle's growth and profitability to the average of its industry, as defined by Seeking Alpha (43 companies).

From a growth perspective, Nestle underperforms the industry average. This is a reflection of the softening demand but also the mature position of the business. This metric will always be somewhat biased by the growing companies included within the metric.

Nestle's profitability is far better, with the business above average in all metrics. of the 43 companies, there are only 6 with a higher EBITDA-M than Nestle.

Our view is that Nestle's relative attractiveness is high. Profitability will materially drive value into the future, with the focus remaining to improve growth. If this succeeds, Nestle would be a very good choice.

Valuation

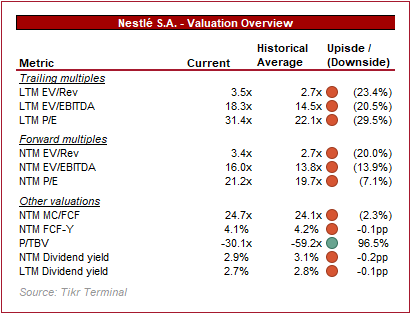

Valuation (TIKR Terminal)

Nestle stock is currently trading at 18.3x LTM EBITDA and 16x NTM EBITDA, which is a premium to its historical average multiple.

The premium compared to the historical level is justifiable based on the following factors:

- Greater scale in conjunction with continued strong market share across its key markets.

- Slight margin improvement, which at its scale generates a noticeable improvement in cash flow.

- A successful response to key industry trends.

- Strong response to economic conditions with a small decline in volume relative to pricing gains.

The bear arguments implying a reversion to the mean, if not a discount, are:

- Slowdown of growth which is currently only driven by price.

- The recent decline in EBITDA-M and FCF-M.

- Accumulating debt that is reaching a maximum.

- Risk of a slowdown in distributions compared to current levels.

Our view is that the bear argument is strong, primarily due to revenue weakness. Nestle is clearly attractive on margins but the lack of underlying growth is concerning.

Final thoughts

Nestle is a classic leading FMCGs business. It has a range of leading brands, is conducting M&A to expand and protect its position, and has good inelasticity. The issue it faces is similar to that of many of its peers, it seems to have hit a growth wall.

The near-term issues, such as margins and FCF slippage, are an annoyance but not a fundamental issue. We are primarily concerned with growth.

Based on this, we do not believe Nestle can justify a premium valuation relative to its historical average.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.