Brookfield Renewable Partner's Recent Weakness Is A Time To Jump

Summary

- Brookfield Renewable Partners has underperformed recently as its dividend becomes less enticing in a high interest rate environment.

- The fund is uniquely positioned to take advantage of a massive cycle of investment in renewable energy.

- The funds pass-through to its parent combined with the massive amount of capital moving into the sector present risks.

- We expect the company to continue generating double-digit returns though perhaps not as high as its targets.

- The Retirement Forum members get exclusive access to our real-world portfolio. See all our investments here »

Justin Paget

Brookfield Renewable Partners (NYSE:BEP) is a large renewable pure-play giant. The company has seen its share price drop more than 40% over the last 2.5 years as its 4.5% dividend yield has become much less enticing in a high interest rate environment. As we'll see throughout this article, the company's recent weakness makes now a good time to invest.

Brookfield Renewable Partners Overview

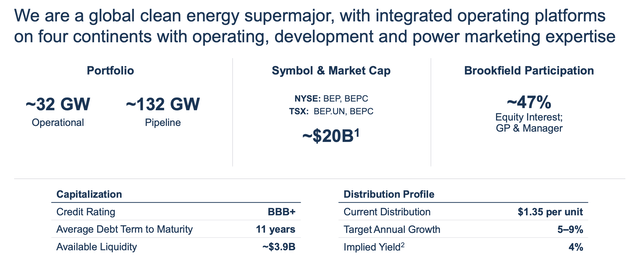

Brookfield Renewable Partners is a global clean energy company with a combined (K1 + Corporate) valuation of just under $20 billion.

The company has a staggering 32 gigawatts operational. 132 gigawatts remains in the pipeline, or more than 4x its operational portfolio. That shows the massive opportunity the company has. The company opportunistically uses debt with an 11-year term to maturity and just under $4 billion in liquidity to continue investment.

The company has a strong distribution that it is targeting 7% annualized growth for, which we optimistically think it can achieve.

The company's portfolio is well distributed, and especially in solar it's rapidly ramping up growth. Hydro is currently its second-largest business, but it has the least development for growth. The company's wind business, its largest, has 26 gigawatts under development. Its utility-scale solar business is expected to expand by a factor of 10x, and its storage business is growing too.

All of this together is a massive renewable portfolio that we expect growth to continue with.

Renewable Industry Growth

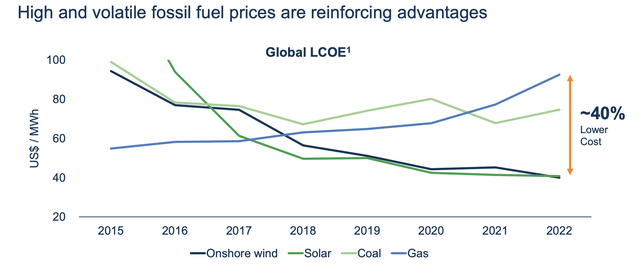

The renewable industry offers a lower breakeven, which helps to support its long-term viability.

As natural gas prices have gone down and coal prices have slowly trended down, renewable costs have dropped dramatically. More importantly, renewable energy can be much more localized, with many more countries having the appropriate resources, versus coal and natural gas that tend to be export localized.

Europe, for example, is a continent that we expect to heavily embrace renewables to reduce its reliance on Russian Gas and Oil.

Brookfield Renewable Partners Returns

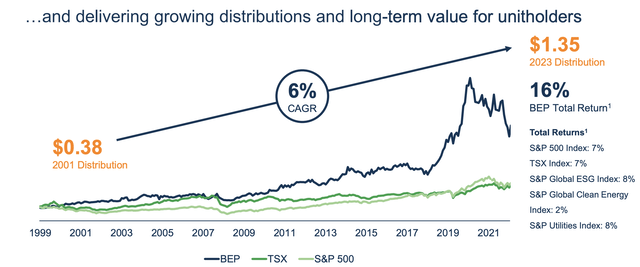

The company does have a strong history for distribution growth, but we think it's perhaps a bit optimistic.

The company, since inception in the late-90s, has managed to grow distributions at 6% annualized. However, its total returns have outperformed at 16%, as its equity has continued to increase. In our view, a large part of that, is continued substantial demand for renewable energy ETFs, as a way for companies to partake in the renewable energy business.

In that sense, we can see Brookfield Renewable Partners being an interesting acquisition opportunity for a much larger electricity or energy company who wants the existing renewable assets.

Sending Cash Up

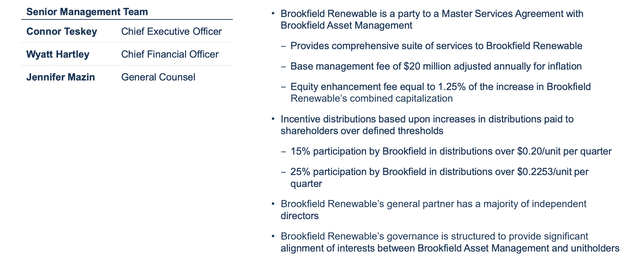

A big downside to Brookfield Renewable Partners is the company sending cash up.

The base management fee is $20 million adjusted for inflation, which is mostly negligible. The expensive fees are the equity enhancement fee of 1.25% of the increase in market cap. Even that alone is manageable for most investors, it's not a cheap fee to give up on the upside. For 5-6% in annual market cap growth ($1.2 billion) it's another $15 million.

The fee that costs the most though is the incentive distributions based on thresholds. At Brookfield Renewable Partner's level, 25% of dividends over $0.2253 / unit are incentive. At the current time, that's all-distribution increases. Of course, unlike the management fee, that number isn't adjusted for inflation at all.

That means if the company wants to increase dividends by 6%, 1.5% of that goes as a fee. That's a strong restriction on the company's ability to continue mid-single digit dividend increases. Brookfield Asset Management receives hundreds of $ millions from Brookfield Renewable Partners, a fee rate of almost 2% that'll only go up.

That's very high versus any active fund or ETF. It's a continued risk to the company's ability to perform.

Thesis Risk

The largest risk to our thesis is the incentive structure. Brookfield Renewable Partners' agreement incentivizes strong returns to Brookfield Asset Management as a major investor. However, fee-based income is even more incentivized to flow up, as it is pure high-valuation management profit for Brookfield Asset Management.

That, combined with the dividend pass-up especially, could hurt future growth for the company.

Conclusion

Brookfield Renewable Partners has some of the strongest renewable energy assets in the country, highlighting its potential as the largest pure-play vehicle. The recent massive interest in the segment has enabled the company to build up an enormous pipeline, despite its valuation declining substantially from continued interest rate increases.

The company has reliable cash flow and a dividend of more than 4%. At the same time, it's guiding for continued growth of that dividend in the mid-single digits. That continued growth for the company will enable substantial shareholder returns in the double-digits as the industry grows, despite the company's incentive payments, making it a valuable investment.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

But BN brookfield seems to me the better option discount to nav sum of parts and receiving the fees.

The whole renewable sector has become cheaper and there are attractive alternatives like atlantic substainable infrastructure AY