AOA: Diversified But Not That Safe In A Rate Hike Environment

Summary

- AOA is an ETF that is diversified not only across assets but across asset classes.

- Where it has bond exposures, it's too high duration, and there are legitimate concerns around IVV performance.

- Otherwise, the other developed market exposures look alright, but the concerns in Europe are legitimate.

- There's nothing particularly compelling about AOA.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Kativ

The iShares Core Aggressive Allocation ETF (NYSEARCA:AOA) is composed of some other broad ETF allocations, major ones including the iShares Core S&P 500 ETF (IVV) and the iShares Core MSCI International Developed Markets ETF (IDEV). There are also bond exposures that make the AOA very diversified across the major asset classes. There is nothing 'aggressive' about it though in the traditional sense, except perhaps the duration in the iShares Core Total USD Bond Market ETF (IUSB). Ultimately, these wide bets don't make much sense in a global economy that is so rife with bifurcations, as all sorts of factors and considerations now come to the fore. We think broad based US exposures are possibly overbought, and we don't think Europe is all that fantastic either. High duration also continues to be a concern. AOA is not for us.

AOA Breakdown

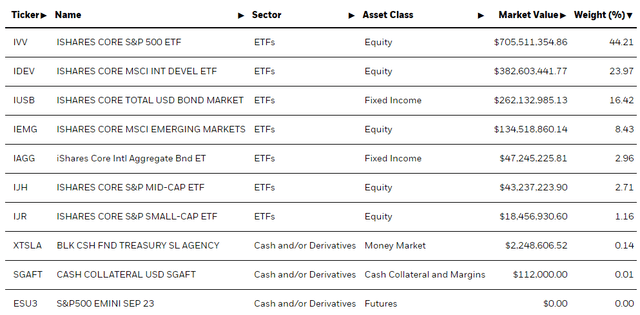

Let's have a quick look at the top holdings, which include in large part the ETFs we mentioned above.

AOA Top Holdings (iShares.com)

Our concerns with the IVV are pretty simple. The US economy is being belligerent to the rate hikes. We think it's coming from pent-up boomer demand that cannot be hurt by rate hikes as much as millennial wealth and income. Still, aggregate demand is too high, and aggregate supply remains a little impaired although the Ukraine issues have largely been digested by supply chains. Rate hikes will continue, and while that will be good for the dollar, it will be bad for costs of capital. Strong economic numbers are good for business fundamentals, but the skew of US markets to tech makes cost of capital a greater concern than economic fundamentals. Moreover, long-term rate expectations are still pretty low. If the current situation persists and the US economy can take a lot more rate hikes till inflation is at policy level, assets still have a lot of space to be priced down especially on the horizon values.

Europe is similarly seeing inflation re-accelerate. Some geographies like Italy are doing better and seeing further abating, but others not, specifically Germany which was most in bed with the Russians prior to the sanctions, which the Germans were not crazy about at all. While this will keep the EUR competitive with the dollar, Europe has stickier wage regimes due to tighter employee protection. The economy there is also generally weaker and less self-reliant in terms of supply chains. While this is reflected in the Europe dominated IDEV, it's still a worse set of circumstances for the geography where rate hikes might have to become more aggressive due to the stickier wage situation.

Finally, the bond allocations are high duration at 6 years. With the US economy belligerent there is more downside if rates continue to hike. At least the debt ceiling issue has been cleared.

Bottom Line

The net expense ratio is 0.15%, and when waivers expire at the end of 2026 it'll be back at 0.2%. Compared to global allocations ETFs, and other maximally diversified ETFs, it is actually a decent ratio. The issue is you can get cheaper rates on ETFs that don't compound costs by in turn holding other ETFs, like just buying the IVV directly. Most egregiously though, if you take the average expense ratio of the top 3 component ETFs you end up with a much lower rate below 0.1%. AOA isn't great in the expense department on that basis, but the bigger issue is that it just doesn't appear to be the right exposures in the current regime of persisting inflation and rate hikes.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.