2023 Market Prediction Contest Mid-Year Update

As 2022 came to a close, we asked Seeking Alpha analysts for their outlook for broad U.S. Stock Markets in 2023. There were plenty of diverging opinions on offer. After all, 2022 saw the worst broad market performance since the onset of the financial crisis in 2008.

To make things interesting, within their research articles we asked authors to present a supported projected closing value for the S&P 500 index at the end of 2023. There's also some prize money at stake. See here for a summary of their viewpoints and expectations.

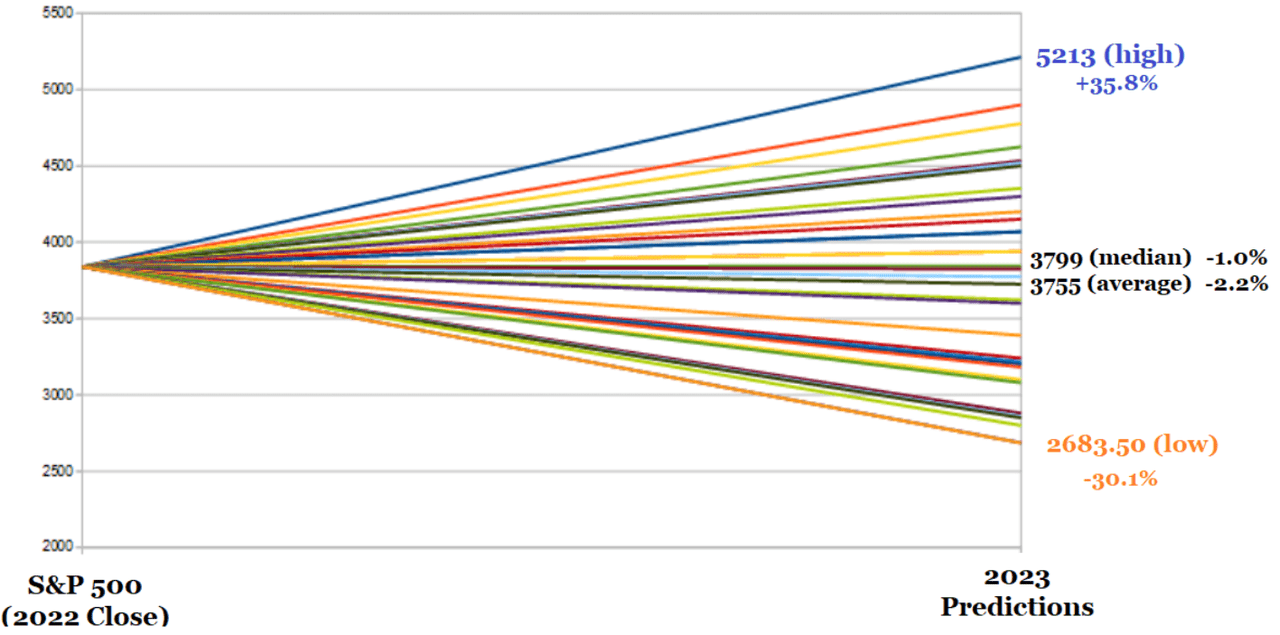

Expectations going into 2023

To recap, the S&P closed 2022 at a level of 3,839.50, nearly 20% lower for the year. For 2023, the most optimistic Seeking Alpha analyst saw the S&P closing at 5,213, for a gain of 35.8%. The most dour forecast was for a further 30% loss for the S&P 500. On average, Seeking Alpha analysts forecasted a small yearly decline for 2023.

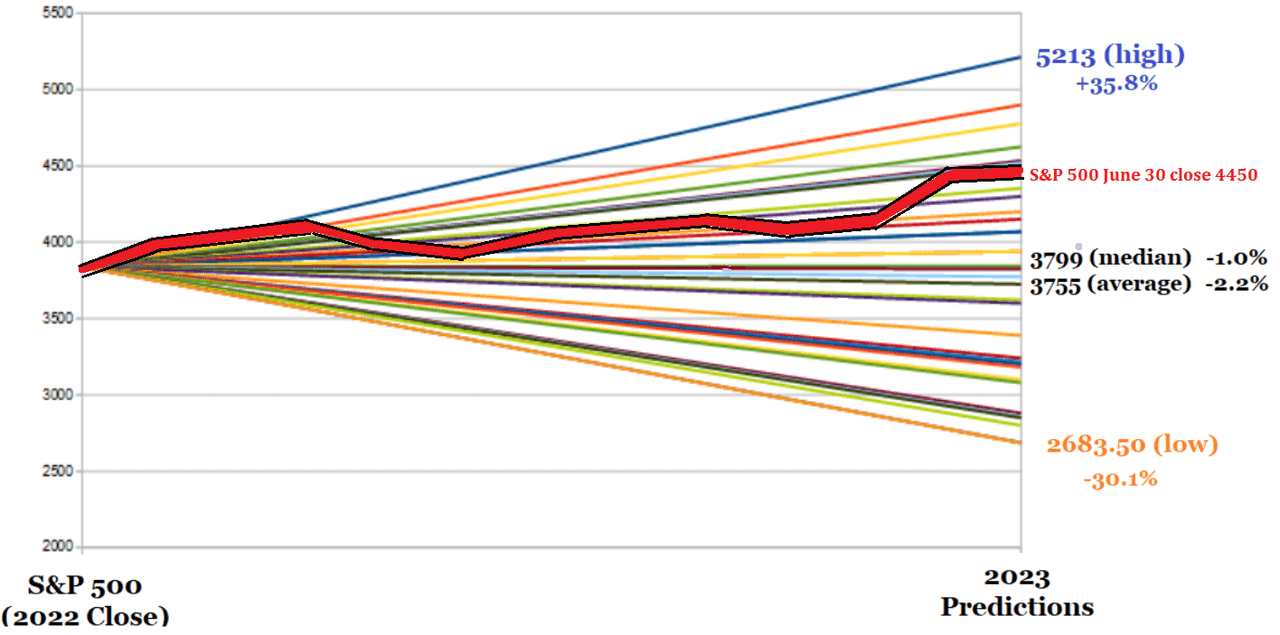

How things have panned out for the S&P 500 Index thus far in 2023

The S&P 500 snapped back early in the year, bouncing back from the sharp slide seen in 2022. The broad market has been showing strength again recently, with the S&P hitting a new 52-week high in mid-June. However, much of the gains so far this year have been concentrated in a handful of megacap names. The index closed June 30 at 4,450.38, for a healthy first-half gain of +15.9%.

Closest forecasts, should the S&P 500 tread water from here

1) Michael Blair, year-end prediction of 4,500

2) Elazar Advisors, LLC, year-end prediction of 4,520

3) Atlas Equity Research, year-end prediction of 4,534

Of course, should the S&P 500 duplicate its 6-month increase in the 2nd-half, Khaveen Investments, who levied the most bullish 2023 outlook, would claim the winner's belt.

Events that could substantially move the markets in H2 of 2023

Along with the lack of breadth, Wall Street has also faced ongoing uncertainty about the Federal Reseve, with markets consistently ignoring the central bank's ongoing hawkish outlook. The FOMC may have paused interest rate hikes in June, but continued to guide for higher Fed Funds rates.

Concerns about a potential hard landing remain sources of worry headed into the second half. Other unknowns, such as where the shifting nature of the Ukraine-Russia war lands, may have an impact on H2.

Looking for updated views of the stock market? Visit our quote page for SPY, the most popular tracking ETF for the S&P 500.

On a consensus basis, SA Analysts have a HOLD rating for SPY, while the Seeking Alpha Quant Ratings are more favourable with a BUY rating.

The Seeking Alpha team looks forward to providing future updates on the status of the 2023 S&P 500 prediction contest. In the meantime, please remember that we're always looking for more terrific market outlook and economic analysis.

If you're not already a Seeking Alpha writer, you can learn more and sign up here.

This article was written by