Billionaire Elon Musk Says 'Sell Real Estate'

Summary

- Billionaire Elon Musk recently warned investors.

- He said that commercial real estate is melting away fast.

- We explain the implications for REITs.

- High Yield Landlord members get exclusive access to our real-world portfolio. See all our investments here »

Win McNamee

In a recent article, entitled "Billionaire Investors Buying REITs With Both Hands," I explained that self-made billionaires Steve Schwartzman and Jon Gray were loading up on real estate investment trusts, or REITs (VNQ). Through their company Blackstone Inc. (BX), they have bought ~$30 billion worth of REITs since the beginning of 2022 and just recently, they announced yet another REIT acquisition (emphasis added):

"We have nearly $200 billion of dry powder to take advantage of dislocation. With stock markets under pressure, we did agree to privatize two public companies in an otherwise muted deployment quarter, including a leading provider of events management software and a logistics REIT in the UK...

"We hold $16 billion of public stock in our private equity and real estate drawdown funds. When markets ultimately stabilize, we are well positioned for an acceleration in realizations."

This sends a strong signal that REITs are now undervalued.

After all, few investors have a better understanding of real estate than they do. They have nearly a trillion dollars of assets under management, made their fortunes in private real estate, and are choosing to accumulate REITs in today's market.

Mid-America Apartment

But not all billionaires share this view.

Elon Musk recently came out with some very bearish statements regarding commercial real estate. Before you discount Elon Musk as someone with little real estate expertise, it is worth remembering that he runs Tesla, Inc. (TSLA) and owns Twitter, which are massive companies with big real estate footprints. So his opinion is certainly worth considering and shouldn't be discounted.

What did he say?

Here is one of his recent tweets:

“Commercial real estate is melting down fast...”

Then he added in an interview that:

“We really haven’t seen the commercial real estate shoe drop. That’s more like an anvil, not a shoe... So the stuff we’ve seen thus far actually hasn’t even — it’s only slightly real estate portfolio degradation. But that will become a very serious thing later this year, in my view.”

Finally, he also said that:

“Almost all cities at this point have record vacancies of commercial real estate.”

Musk had also previously warned that commercial real estate was "by far the most serious looming issue" following the banking crisis.

So his stance is pretty clear!

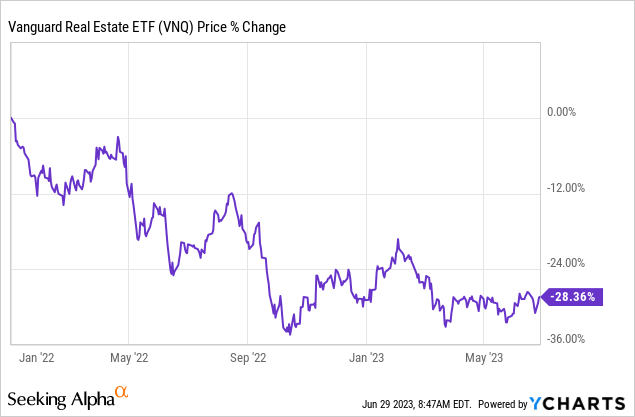

As usual, his statements made a lot of noise, and this led many of you to ask me what I make of Elon's negative comments. Quite a few of you appear to have taken this as a "warning" of more pain to come for REITs - which are down substantially over the past year:

But before you sell your REITs and run for the exit, I would like you to take a closer look at what Elon Musk is really saying.

He keeps talking about "commercial real estate" but it appears that he is really referring to office buildings, not realizing that offices are just one small sub-segment of commercial real estate. He is making the same mistake that CNBC and other media pundits are making by using commercial real estate as a synonym for office.

How do I know that?

His tweet: "commercial real estate is melting down fast..." is a response to a tweet about office buildings. This shows you that he does not understand the real definition of commercial real estate, which also includes things like industrial properties, multifamily complexes, strip centers, cell towers, etc.

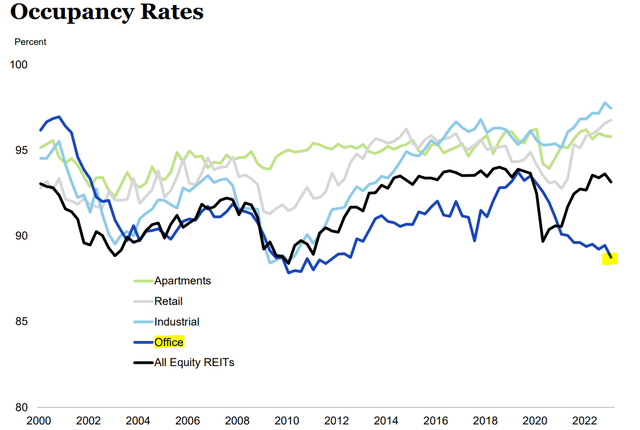

Secondly, he points to "the record vacancies of commercial real estate" in almost all cities. Again, he is not really referring to commercial real estate - he is really referring to offices. Occupancy rates are today actually at near all-time highs for most property sectors. It is only offices that are struggling:

This is a great example of how the misleading statements of an influential investor can quickly lead to a lot of confusion.

He is warning us about office buildings, not commercial real estate, and here's why this matters for REIT investors:

The office sector is tiny, making up only about 5% of the REIT market.

So yes, I agree with Mr. Musk that office REITs are in for some pain in the coming years. The headwinds are real, and this is why we sold our position in SL Green Realty Corp. (SLG) in the $70s last year. It trades at less than half of that right now.

But just because 5% of REITs are struggling does not have any impact on the other 95%, which invest in much stronger property sectors.

Here are some examples:

Industrial properties are today operating at near-100% occupancy and enjoy rapid rent growth because not enough has been built to meet the growing demand coming from Amazon-like (AMZN) e-commerce companies and onshoring. EastGroup Properties (EGP) and STAG Industrial (STAG) are routinely hiking rents by 30% as leases expire at the moment.

Apartment communities are expected to grow their same property NOI by about 5% in 2023, which is above average, and occupancy rates remain historically high. They are doing so well because housing has become unaffordable following the surge in interest rates and construction costs, pushing many to rent longer than they otherwise would. Mid-America Apartment Communities (MAA) and Essex Property Trust (ESS) own properties in very different markets but they are both reporting rapidly growing rents:

Essex Property Trust

Cell towers benefit from the growth of data usage and the deployment of 5G. They enjoy long leases with steady contractual rent hikes and are able to keep adding additional tenants to existing towers. Cell tower REIT giant American Tower Corporation (AMT) has guided that it can achieve a high single-digit annual growth rate in the long run:

These three property sectors are just a few examples, but there are many others:

- Timberland: Weyerhaeuser (WY)

- Manufactured Housing: Equity LifeStyle (ELS)

- Service-oriented strip centers: Kite Realty (KRG)

- Net Lease: NNN REIT (NNN)

- Medical Office Buildings: Physicians Realty Trust (DOC)

- Self Storage: ExtraSpace Storage (EXR)

- Data Centers: Equinix (EQIX)

- Senior housing: Welltower (WELL)

- Farmland: Gladstone Land (LAND)

- Ground Lease: Safehold (SAFE)

- And many others.

The first takeaway here should be that there are 20+ property sectors in commercial real estate, and office is just one of them.

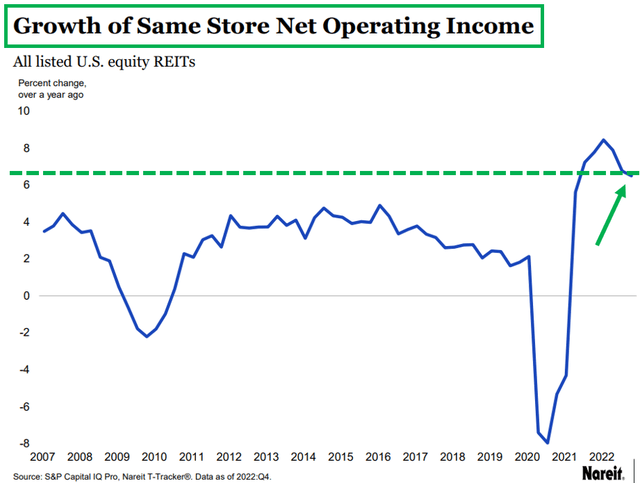

Then the second takeaway should be that most of these 20+ property sectors are today doing very well with growing rents and high occupancy rates. The inflation of recent years led to rapid rent growth and the high-interest rates put new property developments on halt, reducing supply growth.

NAREIT, the representative body of the REIT sector, tracks the growth rates of all REITs and their latest T-Tracker report proves my point: rents are still growing at a rapid pace and commercial real estate sure isn't "melting":

Here's why this is an opportunity:

Because of misleading comments from Elon Musk and other influential investors, including even Charlie Munger of Berkshire Hathaway (BRK.A) fame, we have seen REITs collapse across the board.

They keep referring to offices as "commercial real estate," not understanding that offices represent just one small sub-segment of the market.

Most REITs are doing well today, but they have dropped in association with office REITs and are now priced at historically low valuations even as their rents keep on growing. Blackstone talked about this on their most recent conference call:

"We talked here at the beginning of the call about the massive differentiation across real estate. And now at times you see people just pulling back regardless of the sector they're exposed to." Jon Gray.

This explains why Blackstone has been buying REITs hand over fist.

And it is not alone to see the opportunity.

The private equity giant Starwood has been buying REITs as well, and here is what its CEO said in a recent interview (emphasis added):

"You have to back up. Other than the office asset class, real estate is actually performing really well. Apartments are full. Single family rentals are full. Hotels are REALLY full. There's no overbuilding.

What I would like viewers to understand is that the asset class, commercial real estate is actually in very good shape. We are not seeing declines in rents overall in almost anything...

"...There are some unbelievable bargains in REITs. We did the same thing during the pandemic. We bought a dozen stocks all over the world and we had a 70% IRR on that stuff. We are already buying some stuff in the public market because I do think that rates are going down." Barry Sternlicht

So that's the opportunity in a nutshell.

5% of REITs are struggling (offices) and it has dragged down the valuations of the other 95% of REITs, which are doing just fine for the most part.

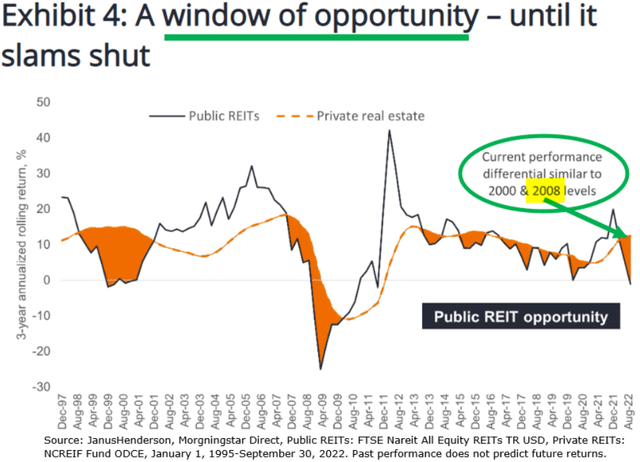

According to a study by the investment firm Janus & Henderson, REITs are today priced at a near 30% discount to NAV on average. This study came out in late 2022, and since then REIT share prices have dropped even further:

Janus and Henderson

As a result, REIT valuations are now reminiscent of the great financial crisis with many trading at literal pennies on the dollar.

To give you a simple example: BSR REIT (OTCPK:BSRTF / HOM.U) owns apartment communities in rapidly growing Texan markets and it is today priced at a 43% discount to its net asset value. This essentially means that you get to buy an interest in its portfolio of apartment communities at 57 cents on the dollar, net of debt. The REIT has a strong balance sheet, its rents are growing, and the management is buying back shares to create value.

I believe that such REITs are the best opportunities in today's market.

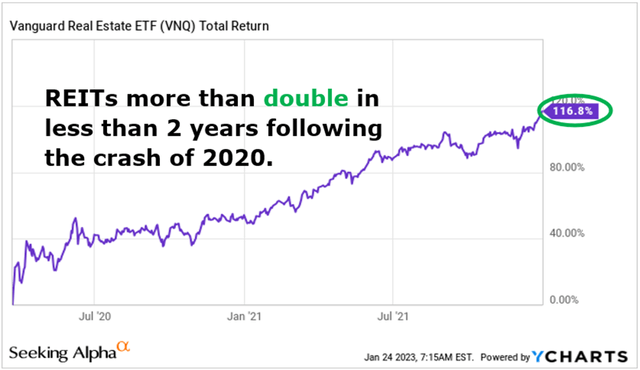

The last time REITs were so cheap was early into the pandemic. They had dropped across the board just like they did recently, but as the market came back to its senses, they then doubled investor's money in the recovery:

We made a little fortune in the recovery because we followed the footsteps of the big private equity groups and load up on REITs in 2020.

Today, are repeating the same strategy and expect to earn large gains in the recovery. We certainly aren't selling REITs because of Elon Musk's warnings about offices.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Landlord for a 2-week free trial

We are the largest and best-rated real estate investor community on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HOM.U; SAFE; STAG; EGP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)