My Oh My, 3 Strong Buys (The 4th Of July Weekend Edition)

Summary

- The cold, hard reality is that Mr. Market knows nothing.

- He’s simply the product of the collective action of thousands of buyers and sellers.

- Whenever Mr. Market fails to recognize fundamental values in share prices, the investor’s margin of safety is high.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Monty Rakusen

This article was published at iREIT® on Alpha on Friday, June 30, 2023.

As most of my 110,000+ followers know, I’m not a market timer.

And I have no interest in being one.

There’s absolutely zero evidence to prove that market timing works, which is why I insist on fundamental analysis to build my retirement nest egg.

The cold, hard reality is that Mr. Market knows nothing, since he’s the product of the collective action of thousands of buyers and sellers…

And most of the participants are not always motivated by investment fundamentals.

As most readers know, a market downturn is the true test of an investment philosophy.

Stocks that perform well in a strong market are usually those for which investors have had the highest expectations. And when these expectations are not accomplished, the stocks usually plummet.

Whenever Mr. Market fails to recognize fundamental values in share prices, the investor’s margin of safety is high.

Always Insist on Quality

When I analyze a REIT, my very first step is to research fundamentals. I don’t even look at the price of the company until I spend time analyzing the business.

I first focus on the revenue drivers of the business, because without income to run the company, there is no hope of achieving profits.

I look hard at the tenants that are paying the rent as well as occupancy to make sure that the properties are leased.

I always question the source of revenue as well as the strength of the underlying business model. For example, I recently wrote on cannabis REITs in which I examined the strength of the operators and the demand drivers for the sector.

Similarly, our team is in the process of researching the Life Science sector to debunk the claim that these properties aren’t as valuable today due to an increase in work-from-home participants.

Once again, technicals (Mr. Market) don’t tell us anything, so it’s extremely important to examine the underlying earnings drivers…

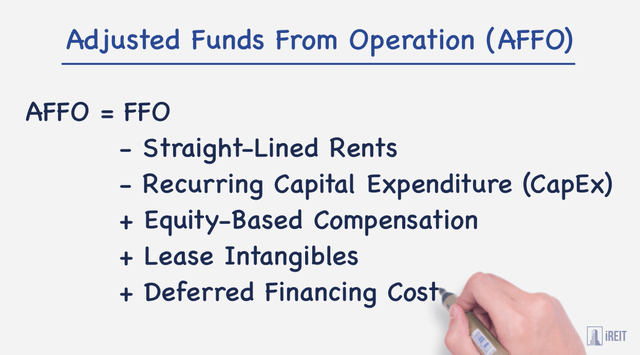

Speaking of earnings, we also spend considerable time researching the historical, real-time, and forecasted earnings for the business, which in REIT terms means Adjusted Funds from Operations ("AFFO").

Then, we dig deeper into what I consider the most important metric when it comes to REITs: DIVIDENDS.

We dissect the dividend, paying very close attention to the historical dividend performance (or under-performance), the current payout ratio (using AFFO, or adjusted funds from operations), and the future prospects for dividend growth.

As I pointed out in an article this week,

“Dividends play a significant role in returns that investors have received during the past 50 years… (while) companies that don’t pay dividends or cut their dividends suffered negative consequences.”

Of course, management also plays a critical role in our decision making, which is why we focus on capital allocation, which is a key driver of investment success. In addition to analyzing earnings and dividends, we pay very close attention to leverage and liquidity.

While most market timers are preoccupied with how much money they can make (not at all with how much they may lose) value investors focus on risk as well as return.

Always Insist on a Margin of Safety

Once we determine whether the stock is worth buying, in terms of quality, we then consider price. Importantly, value in relation to price, not price alone, must determine your investment decisions.

As Ben Graham defined it, the margin of safety constitutes a “favorable difference between price on the one hand and indicated or appraised value on the other.”

A margin of safety is achieved when shares are purchased at prices sufficiently below their underlying value to allow for human error, bad luck, or extreme volatility. As Columbia finance Professor Joel Greenblatt framed it (in a 2011 Barron’s interview), “it’s about figuring out what something is worth, and then paying a lot less for it.”

Now, with further ado, let me provide three of my highest conviction picks…

Alexandria Real Estate Equities, Inc. (ARE)

Alexandria Real Estate is a real estate investment trust (“REIT”) in the office sector that specializes in Class A life science properties. Since their formation in 1994, ARE has been the pioneer in life science properties that are located in AAA innovation cluster campuses in Boston, New York City, San Francisco, San Diego, Seattle, Maryland and the Research Triangle.

ARE’s portfolio includes 64 operating properties and properties under development with a total asset base in North America that covers 74.6 million square feet. While Alexandria is in the office sector, they are unique with a primary focus on life science properties, which are largely immune from the work-from-home movement.

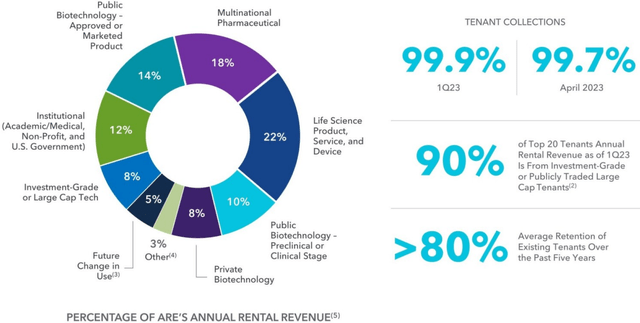

Their properties contain laboratories for drug development and other health-related research facilities that are leased to approximately 1,000 tenants including pharmaceutical and biotechnology companies, digital health and medical device companies, as well as medical and government research institutions. 90% of their top 20 tenants are either publicly traded large cap companies or companies that have an investment grade credit rating.

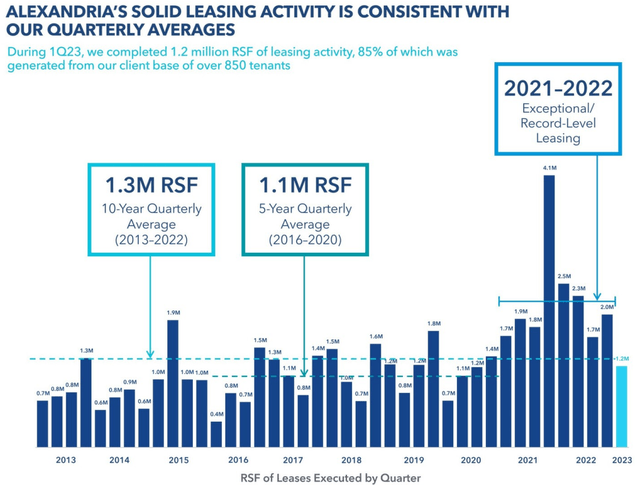

As previously mentioned, ARE distinguishes itself from other office REITs by the type of properties they own. While many office peers have struggled to maintain new and renewal leasing, ARE has had record leasing levels over the past few years.

In the first quarter of 2023 ARE completed 1.2 million square feet of leasing activity, which exceeds their 5-year quarterly average (2016-2020) of 1.1 million square feet.

Additionally, they have enjoyed record rental rate increases with rental rates increasing 48% in the first quarter of 2023, which represents the highest quarterly increase in the company’s history.

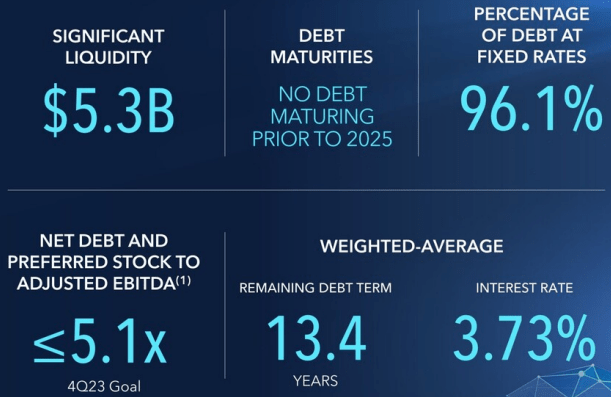

Alexandria has a BBB+ credit rating and a fortress balance sheet with a net debt and preferred stock to adjusted EBITDA of 5.3x, a long-term debt to capital ratio of 39.53%, a debt and preferred stock to gross assets ratio of 28%, and a fixed-charge coverage ratio 5.0x.

Their debt is 96.1% fixed rate and has a weighted-average interest rate of 3.73% and a weighted-average remaining debt term of 13.4 years. Additionally, they have $5.3 billion in liquidity and no debts maturing before 2025.

ARE - IR

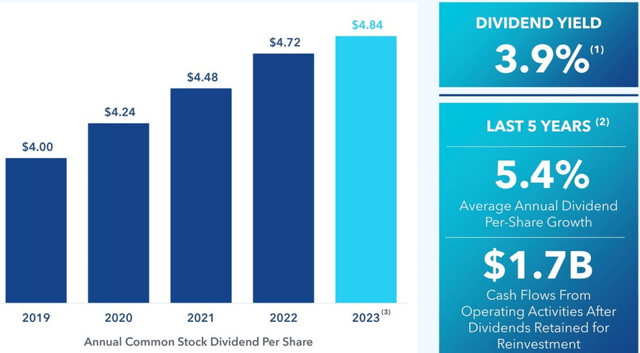

ARE pays a 4.41% dividend yield that is well covered with an adjusted funds from operations payout ratio of 72.17%.

Over the last 5 years, they have had an average annual dividend growth rate of 5.4% and have retained $1.7 billion in cash that can be used to pay down debt or for future property investments.

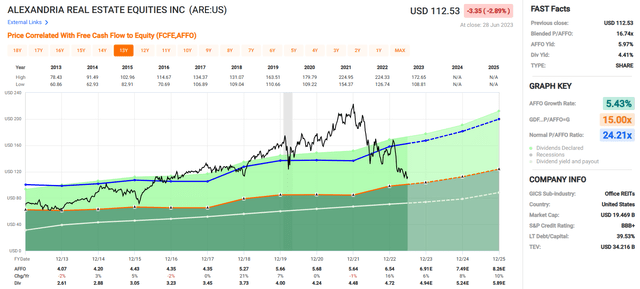

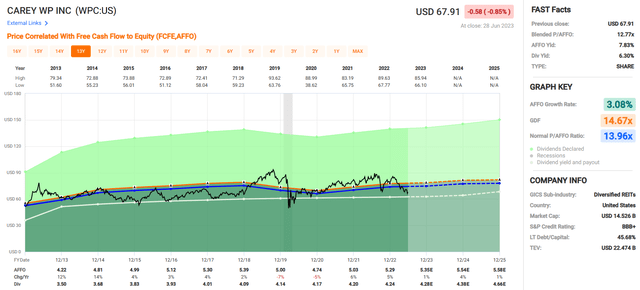

Over the past 10 years, ARE has had an average AFFO growth rate of 5.43%, and it grew AFFO by 16% in 2022. Analysts expect AFFO growth of 6% in the current year and 8% and 10% in the years 2024 and 2025, respectively.

While ARE’s earnings growth in the next several years is expected to exceed their 10-year average, the stock price has fallen approximately 22% over the last year.

Due to the recent price action, ARE is currently trading at a P/AFFO of 16.74x, which is significantly below their normal AFFO multiple of 24.21x. At iREIT®, we rate Alexandria a STRONG BUY.

W. P. Carey Inc. (WPC)

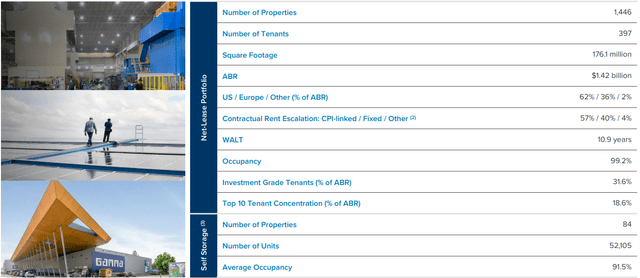

WP Carey is a diversified net-lease REIT with a portfolio of 1,446 net-lease properties that encompass around 176 million square feet and a portfolio of 84 self-storage properties that contain 52,105 storage units.

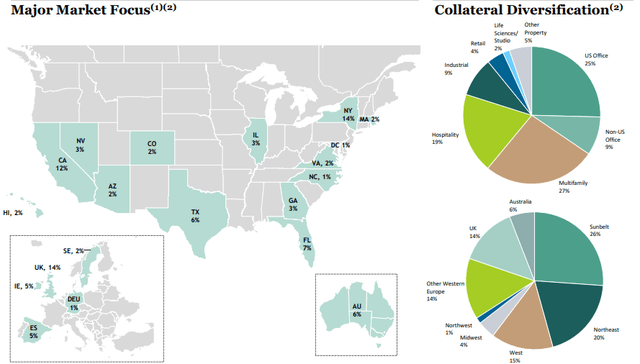

Their diversified net-lease portfolio consists of multiple property types including industrial, warehouse, office and retail properties that are located in the United States and Europe. The properties are primarily single-tenant buildings that are leased on a long-term basis with built-in rent escalators.

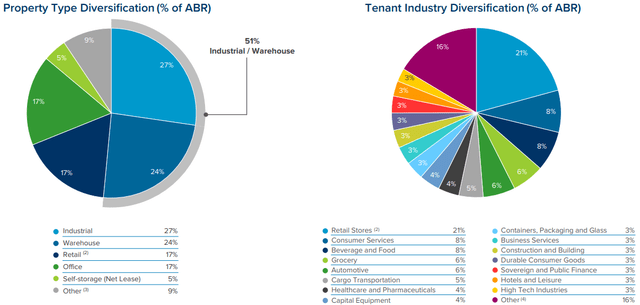

Measured by their annualized base rent (“ABR”), 51% of their net lease portfolio consists of industrial or warehouse properties, 17% consists of retail, 17% consists of office, and 5% consists of net lease self-storage properties. 9% of their ABR is derived from multiple property types including a hotel, student housing, funeral homes and outdoor advertising.

WPC’s net-lease properties serve 397 tenants, 31.6% of which are investment grade, and have a weighted average lease term (“WALT”) of 10.9 years. In addition to owning multiple property types, WPC is geographically diversified with 62% of their ABR coming from the U.S. and 36% coming from Europe.

Additionally, they have a well-diversified tenant base with 18.6% of their ABR coming from their top 10 tenants. Their net-lease properties have an occupancy rate of 99.2%, while their self-storage properties have an average occupancy rate of 91.5%.

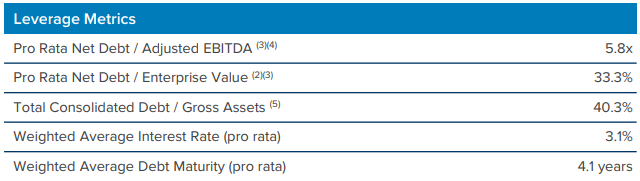

WP Carey is investment-grade with a BBB+ credit rating and has solid debt metrics with a pro rata net debt to adjusted EBITDA of 5.8x, a total consolidated debt to gross asset ratio of 40.3%, a long-term debt to capital ratio of 45.68%, and a fixed charge coverage ratio of 5.4x.

Their debt has a weighted average interest rate of 3.1% and a weighted average debt maturity of 4.1 years. Additionally, WPC has minimal debt maturities in 2023 and when including $385 million of forward equity, they had $1.7 billion in total liquidity as of the end of the first quarter.

WPC - IR

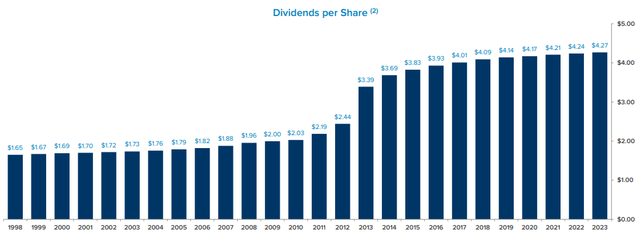

WPC has a very solid dividend track record and pays a 6.30% dividend yield that is well covered with an AFFO payout ratio of 80.19%. They have increased their dividend each year since going public in 1998, and have an average dividend growth rate of 6.29% over the last 10 years.

Over the last 10 years WPC has delivered very consistent earnings with positive AFFO growth in all but two years (2019 & 2020). They have had an average AFFO growth rate of 3.08% over this time period and analysts project 1% AFFO growth in the current year and 4% AFFO growth in 2024.

Currently, the stock trades at a P/AFFO of 12.77x, which compares favorably to their normal AFFO multiple of 13.96x. At iREIT®, we rate WP Carey a Strong BUY.

Blackstone Mortgage Trust, Inc. (BXMT)

Blackstone Mortgage Trust is an externally managed mortgage REIT (“mREIT”) that specializes in originating senior loans that are secured by commercial real estate located in North America, Australia, and Europe.

BXMT has a $26.7 billion senior loan portfolio that consists of 199 loans with a weighted average origination loan-to-value (“LTV”) of 64%. The properties securing their loans are well diversified by location and by property type.

Their collateral is located in 12 U.S. states and Washington D.C., the United Kingdom, multiple countries in Europe, and Australia. By property type, 27% of their loan exposure comes from multifamily, 31% comes from office, 19% comes from hospitality, and 9% comes from Industrial properties.

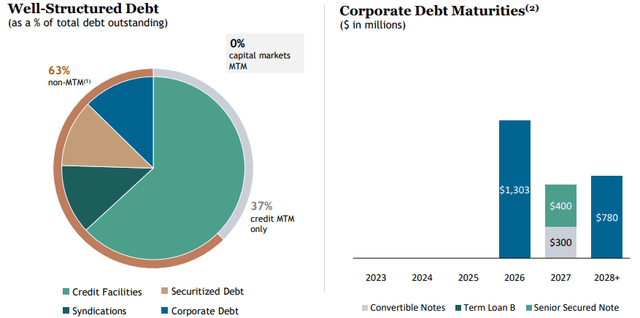

BXMT’s balance sheet is well positioned with $1.6 billion of liquidity and no debt maturities until 2026. Their debt is well structured with no capital markets mark-to-market (“MTM”) provisions and limited credit MTM debt. In total, 63% of their debt is non-MTM and only 37% of their credit facilities debt is MTM.

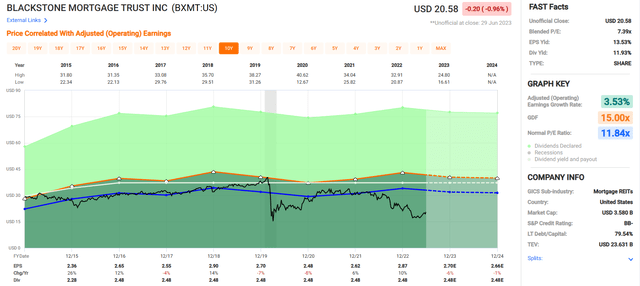

BXMT’s first quarter distributable earnings came in at $0.79 per share, which represents a first quarter year-over-year growth rate of 27%.

They pay a 11.93% dividend yield that is well covered with a dividend payout ratio of 78.5% based on first quarter distributable earnings. BXMT has been very consistent with their distributions, paying $0.62 per share for 31 consecutive quarters.

Blackstone Mortgage Trust’s stock has declined by 25.62% over the past year, which has pushed their earnings yield up to 13.53% and priced the stock at a significant discount to the normal trading multiple.

Currently, BXMT trades at a P/E of 7.39x, well below their normal P/E ratio of 11.84x. Additionally, BXMT is trading at a 21.5% discount to their book value per share of $26.28. At iREIT®, we rate Blackstone Mortgage Trust a BUY and assign it a Tier 1 Rating.

In Closing…

Ben Graham observed,

“You are neither right nor wrong because the crowd disagrees with you. You are right because the data and reasoning are right.”

Many investors overpay for stocks because they invest according to the latest fad or they rely solely on technical analysis.

By investing when you see a wide margin of safety, you avoid making decisions based on hype and generate long-lasting wealth so you can sleep well at night.

Good luck and happy SWAN investing!

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 165,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College, and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of ARE, BXMT, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (22)