Inflation Steady, Recession Risk Continues To Fall

Summary

- The consensus opinion is inflation will fall to the 3% range or lower within 18 months or so. The data does not support this thesis.

- The greatest risk for investors is placing a bet that rates will fall when history does not support this outcome.

- Even though the evidence shows there is an economic shift favoring equities, many remain skeptical and continue to fear a recession with expectations of lower inflation and interest rates.

sankai

The consensus opinion is inflation will fall to the 3% range or lower within 18 months or so. The data does not support this thesis.

The history of inflation is correlated with government spending and regulations which thus far indicate the current inflation levels holding until we get a significant reversal of recent government policies.

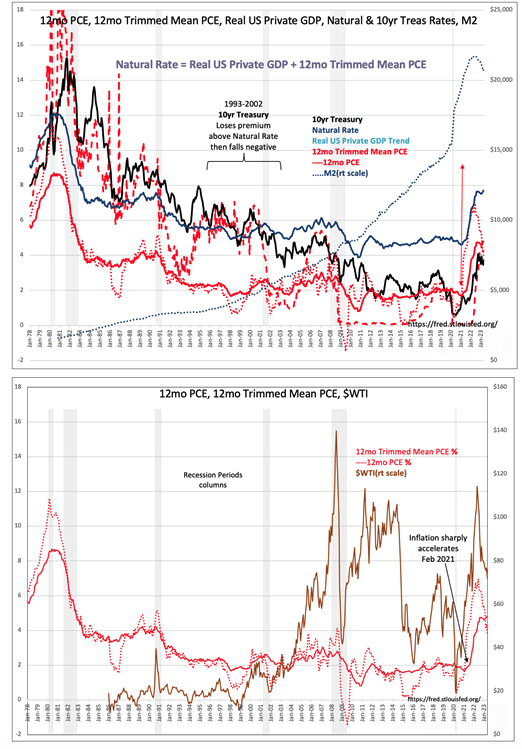

The earliest reversal is not likely till there is a change in the administration and likely requires Congressional changes as well to rein in the already authorized 10yr spending plans. The PCE (Personal Consumption Expenditure) report this morning indicates a slight reduction in inflation that the media heralded but it remains stubbornly between 4%-5%.

Many connect inflation to oil prices, WTI. While there is a correlation, closer examination shows WTI rises as fear of inflation rises or there is an unexpected rise in economic activity. That is, oil does not cause inflation but investors buy/sell oil in relation to inflation or economic swings.

While investors did bid oil higher as the economy recovered from covid and added a push with the Russia/Ukraine conflict, the fall in WTI from mid-$120/BBL to its current sub-$70/BBL has not resulted in a fall in the 12mo Trimmed Mean PCE that the Fed uses to track inflationary pressures.

The greatest risk for investors is placing a bet that rates will fall when history does not support this outcome. In the past, with inflation at 4%-5%, investors have priced 10yr Treasury rates for a 2%-3% Real (inflation-adjusted) return.

With inflation at current levels, this means 10yr Treasury rates in the 7%-8% range. That this relationship was lost with the period of ultra-low rates beginning in the late 1990s is a result of globalization providing emerging market investors access to systems that permitted them to send capital to safer havens i.e., developed markets, where there were better protections for individual property rights.

This flight of capital drove rates lower and continues today with the disruptive behavior of China, Russia and other autocratic/socialist governments that have been on the rise.

The US is a primary beneficiary. However, as these investors gain experience in developed markets and inflation threatens, these investors are likely to turn away from long-held favorites of sovereign debt and real estate whose values erode with higher interest rates.

In my estimation, inflation will persist and 10yr Treasury rates will trend back toward historical inflation premiums as these investors, who have been responsible for ultra-low rates in their desire to escape local financial threats, become more willing to risk equity markets for higher returns.

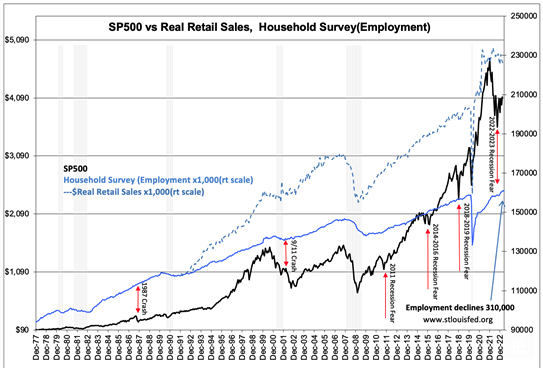

Of course, a shift of this type will only occur if economic activity rises for several years and equities convince all investors that shifting capital into equities offers the better risk/reward option. Even though the evidence shows there is an economic shift favoring equities, many remain skeptical and continue to fear a recession with expectations of lower inflation and interest rates.

This, in my opinion, has been the basis for the recent explosion of the term “Magnificent 7” to describe the 7 largest technology issues as the only viable investment pathway.

Nvidia (NVDA), Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Meta (META) and Alphabet (GOOG) (GOOGL) (both issues), the outperformers during covid, are expected to do the same in recession as rates fall.

Nvidia has already risen 300% from its Nov 2022 low of $108, now $424. A price of $424shr represents 40x Pr/Sales (trailing sales) with analysts calling the forecasted year-end 34x Pr/Sales cheap.

Problematic to the consensus view is the persistent rise in employment, GDP, Real Personal Income and other economic fundamentals that do not support recession forecasts.

Underneath the consensus view represented by the term “Magnificent 7”, is the steady growth of the US industrial economy which has the ability to pass through inflation costs profitably.

These companies remain with significant pent-up demand from the lockdown period. This demand is bolstered by rising consumer incomes. A greater than expected cohort of retired individuals are drawing from retirement accounts and spending on leisure travel and amenities.

Net/net, there is unexpected economic growth. Adding to this is a surge of on-shoring to improve supply chains which requires highly paid individuals with technical expertise and support staffs. Much of this will only be obvious in hindsight but it lays in the daily news items and the quarterly calls of hundreds of smaller US companies.

While those who get to drive the media stories recommend a narrowly select group of extremely-priced issues as the only option, there are thousands of other companies being ignored. It is these companies that have been providing strong guidance the last 12 months that will suddenly surprise to the upside.

Not a surprise for those who have been attentive. Their guidance will be suddenly noticed. Just like when the S&P 500 crossed that 20% rise and is called a ‘Bull Market’, these companies will emerge as sudden favorites and the S&P 500’s rise will come more from the smaller names than the few currently at the top.

Current economic trends and a string of quarterly reports support basic industry and energy-related issues. This is where investors should have the highest concentration of exposure in my opinion.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

This article was written by

Recommended For You

Comments (1)

Lagged shelter/housing rent has yet to fall out of PCE, although high travel spend may continue through Summer.tradingeconomics.com/...I’m hoping you’re right on recession, and last two days of U.S. economic reports support your view. But I’m assuming Fed may drive us to recession.