Patriotic Profits: 7+% Yielding Dividend Aristocrat July 4th Bargain Buys

Summary

- July 4th is America's independence day, and high-yield dividend blue-chip stocks are a great way to declare your financial independence.

- The dividend aristocrats are the bluest of blue chips, the quintessential freedom stocks for this holiday weekend.

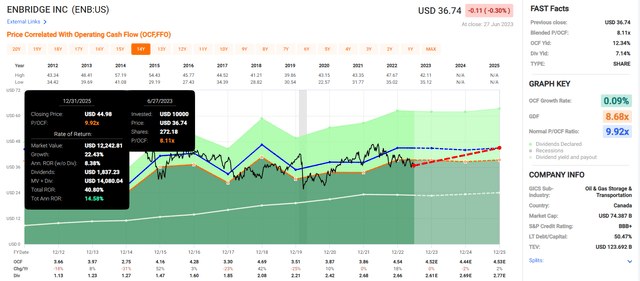

- Enbridge and Altria Group are two 7+%-yielding dividend aristocrats that offer 12% to 13% long-term return potential and market-crushing returns in the next few years.

- As you celebrate BBQ, beer, and fireworks this weekend, let's raise a toast to the world's safest ultra-yield world-beater blue chips.

- From everyone at Dividend Kings, I want to wish you and your family a healthy, joyous, and dividend filled 4th of July. Live long and prosper.

- Looking for a portfolio of ideas like this one? Members of The Dividend Kings get exclusive access to our subscriber-only portfolios. Learn More »

Nerthuz

This article was published on Dividend Kings on Wed, June 28th.

---------------------------------------------------------------------------------------

As the fireworks light up the sky this 4th of July, it's time to let your portfolio sparkle too.

This weekend we celebrate not only the birth of our nation but also the potential for financial independence through smart investing.

Today, I want to share with you two stars of the stock market - 7+% yielding dividend aristocrats that can help you declare your financial independence.

These bluest of blue-chips are legendary for their consistent and growing dividends.

They are the stalwarts of the market, a beacon of hope and reliability in the shifting tides of this weakening economy.

Just as our founding fathers signed the Declaration of Independence 247 years ago, declaring their freedom from tyranny and oppression, I invite you to declare your financial independence with these 7+%-yielding dividend aristocrat bargains.

So, as we celebrate with barbecues, parades, and fireworks, let's also make a toast to financial prosperity and the opportunities that lie in our star-spangled market.

Let the spirit of Independence inspire your investment journey as we explore the world of ultra-high-yield dividend aristocrats together.

How I Found These July 4th Aristocrat Bargains In 60 Seconds

Here is how I found the best 7+% yielding aristocrat bargains for this 4th of July using the Dividend Kings Zen Research Terminal.

This runs off the DK 500 Master List, 500 of the world's best blue chip stocks, including:

- all dividend aristocrats

- all dividend champions

- all dividend kings

- all foreign dividend aristocrats and kings

- world-beater blue-chip future aristocrats and kings.

| Step | Screening Criteria | Companies Remaining | % Of Master List |

| 1 | Dividend Champions List | 133 | 26.60% |

| 2 | Reasonable Buy or better (nothing overvalued) | 80 | 16.00% |

| 3 | Non-Speculative (No Turnaround Stocks, investment grade) | 66 | 13.20% |

| 4 | 10+% LT return potential | 41 | 8.20% |

| 5 | Sort By Yield | 0.00% | |

| Total Time | 1 minute |

Dividend Kings Zen Research Terminal

There you have it, the highest-yielding non-speculative aristocrats you can buy today with 10+% long-term total return potential.

So here's why you might want to declare your financial independence by purchasing some Altria Group, Inc. (MO) and Enbridge Inc. (ENB) today.

Altria: An 8.6% Yielding Dividend King

Further Reading

Why Altria Is Attractive Today

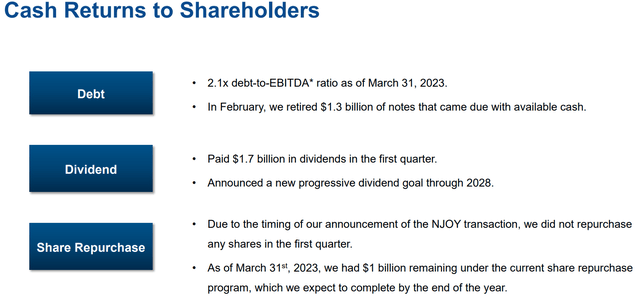

MO's leverage is well below the 3X debt/EBITDA ratio rating agencies want to see for this industry, and the company's progressive dividend policy (what makes it an aristocrat) remains in effect.

Buybacks are on hold as MO acquires NJOY, though the company expects to buy back $1 billion in stock by the end of the year.

Management is confident that its long-term reduced-risk product plans, its strategy to achieve a 100% smoke-free future within the next 20 years, remains on track.

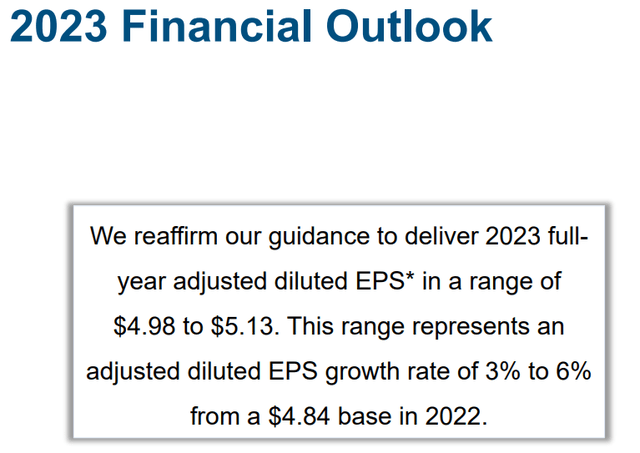

This year management is guiding for 4.5% EPS growth; long term, it believes 4% to 6% growth is sustainable. Analysts agree, expecting 5.2% growth.

Fundamental Summary

- DK quality score: 100% medium risk 13/13 Ultra SWAN dividend king

- DK safety score: 100% very safe dividend (1% dividend cut risk in severe recession)

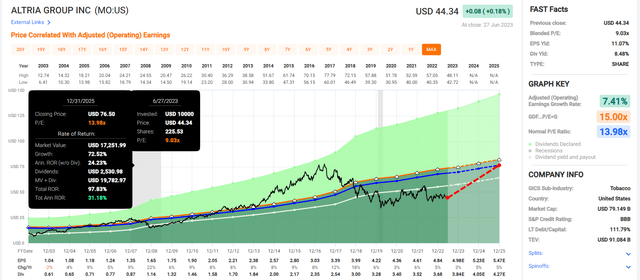

- Historical fair value: $59.68

- Current price: $44.34

- Discount to fair value: 26%

- DK rating: potential very strong buy

- Yield: 8.5%

- Long-term growth consensus: 5.2%

- Consensus long-term return potential: 13.7%.

Altria could double your money within 2.5 years while you enjoy the safest 8.5% yield on Wall Street.

Enbridge: The Ultimate Buy And Hold Forever Midstream Aristocrat (And An Honorary American;)

- tax implications

- 15% dividend tax withholding taxable accounts

- no withholding in retirement accounts

- tax credit available for taxable accounts to recoup the withholding.

Further Reading

Why Enbridge Is Attractive Today

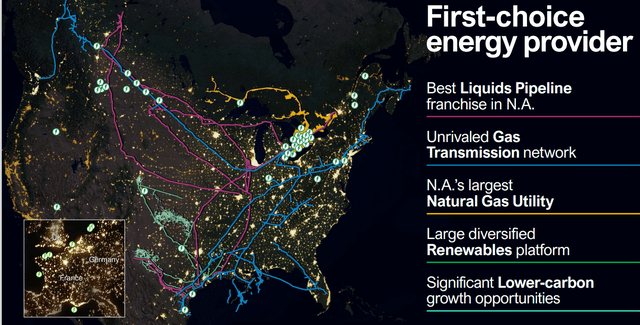

Enbridge was founded in 1949 and is built to last. The bond market literally expects it to outlive us all, with bond investors willing to buy its bonds that mature in 2112!

ENB isn't just the continent's largest oil & gas pipeline operator; it's also Canada's largest natural gas utility and a world leader in renewable energy.

Enbridge says it has a clear growth plan of around $4 billion per year in growth projects for decades to come, capable of driving 5% to 7% long-term growth.

S&P considers its long-term green energy transition plan so good that it rates ENB in the 96th percentile in global risk management...for all companies.

According to S&P, ENB isn't just a leader in long-term risk management among midstream companies but is in the top 320 countries in the world at managing and adapting to its risks.

Fundamental Summary

- DK quality score: 100% very low risk 13/13 Ultra SWAN global aristocrat

- DK safety score: 100% very safe dividend (1% dividend cut risk in severe recession)

- Historical fair value: $46.37

- Current price: $36.74

- Discount to fair value: 21%

- DK rating: potential strong buy

- Yield: 7.1%

- Long-term growth consensus: 5.0%

- Consensus long-term return potential: 12.1%.

Bottom Line: Altria And Enbridge Can Help You Achieve Your Financial Independence

This 4th of July, let's reflect on the opportunities that lie before us.

Altria and Enbridge embody the spirit of dependability, resilience, and growth that we celebrate today. They stand as testaments to the power of smart investing and the promise of financial independence.

Is it a bit ironic that one of the greatest symbols of financial freedom this 4th of July is a Canadian company? Not at all! America is a nation of immigrants where those that share our values and love of freedom and dividends are always welcome;)

As far as I'm concerned, Enbridge is a symbol of quintessential American values, including perseverance, liberty, and hard work. It is as American as the stars, stripes, apple pie, and baseball.

Like the enduring symbols of our nation, these high-yield dividend aristocrats offer stability and dependability in troubled times.

They are a beacon of light guiding us toward a prosperous future. As you watch the fireworks light up the night sky, remember that each burst of light could represent a step towards your financial freedom.

And so, as we celebrate our nation's independence, let's also celebrate the potential for our own financial independence. Let's carry forward the spirit of this day into our portfolios, guided by the steady light of our dividend aristocrats.

From everyone at Dividend Kings, I want to wish you and your family a safe, healthy, and joyous Independence Day.

May your portfolio flourish and your dividends flow. Live long and prosper:)

----------------------------------------------------------------------------------------

Dividend Kings helps you determine the best safe dividend stocks to buy via our Automated Investment Decision Tool, Zen Research Terminal, Correction Planning Tool, and Daily Blue-Chip Deal Videos.

Membership also includes

Access to our 13 model portfolios (all of which are beating the market in this correction)

my correction watchlist

- my family's $2.5 million charity hedge fund

50% discount to iREIT (our REIT-focused sister service)

real-time chatroom support

real-time email notifications of all my retirement portfolio buys

numerous valuable investing tools

Click here for a two-week free trial, so we can help you achieve better long-term total returns and your financial dreams.

This article was written by

Adam Galas is a co-founder of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 5,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) The Intelligent REIT Investor (newsletter), (2) The Intelligent Dividend Investor (newsletter), (3) iREIT on Alpha (Seeking Alpha), and (4) The Dividend Kings (Seeking Alpha).

I'm a proud Army veteran and have seven years of experience as an analyst/investment writer for Dividend Kings, iREIT, The Intelligent Dividend Investor, The Motley Fool, Simply Safe Dividends, Seeking Alpha, and the Adam Mesh Trading Group. I'm proud to be one of the founders of The Dividend Kings, joining forces with Brad Thomas, Chuck Carnevale, and other leading income writers to offer the best premium service on Seeking Alpha's Market Place.

My goal is to help all people learn how to harness the awesome power of dividend growth investing to achieve their financial dreams and enrich their lives.

With 24 years of investing experience, I've learned what works and more importantly, what doesn't, when it comes to building long-term wealth and safe and dependable income streams in all economic and market conditions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I own MO via ETFs.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (3)

I’m very ready for a 12-13% rebound

Happy 4th DS

God Bless America