Walgreens Boots: Discounted To 2010 Lows - Is It A Value Trap Here?

Summary

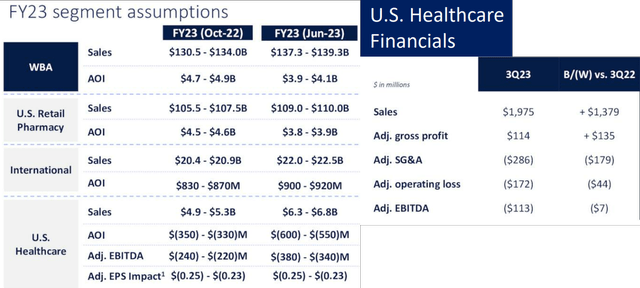

- Walgreens' lowered FY2023 guidance has triggered the drastic plunge in its stock prices, especially worsened by the underwhelming FY2024 commentary.

- It appears that the US Healthcare segment continues to underperform, with widening EBITDA losses due to the lower patient visits and increased clinic footprint.

- However, since the segment's sales continue to grow, investors need not worry yet, especially aided by its stellar balance sheet.

- WBA has also expanded its transformational cost management program savings to $4.1B by 2024, with more locations to be eliminated in the near term.

- Then again, given the stock's underwhelming total returns thus far, investors that add here must also calibrate their expectations accordingly.

Nodar Chernishev

The WBA Investment Thesis Remains Robust Here

We previously covered Walgreens Boots (NASDAQ:WBA) in February 2023, suggesting that the stock was a great buy at that time, due to the highly competent leadership, top and bottom-line expansion, and consistent dividend growth.

WBA 4M Stock Price

Unfortunately, the WBA stock continued to slide since then, while plunging after the underwhelming FQ3'23 earnings call.

The company recorded a bottom line miss for the latest quarter, while lowering its FY2023 adj EPS guidance to $4.025 (-19.6% YoY) at the midpoint, thanks to the tightened discretionary spending and lower contribution from the COVID-19. This was against the previous FY2023 adj EPS guidance of $4.55 (-9.1% YoY) at the midpoint.

WBA further worsened the pessimistic sentiments, with the management's unsatisfactory FY2024 commentary, with the "adjusted operating income growth expected to outpace adjusted EPS," suggesting another year of impacted profitability.

The rising inflationary pressure likely had also contributed to this cadence, since the company recorded declining gross margins of 18.6% (-1.6 points QoQ/ -1.6 YoY) and expanding operating expenses of $7.12B (+5.1% QoQ/ +2% YoY) by the latest quarter.

Combined with the elevated interest rate environment triggering the increase in its interest expenses to $173M (+22.6% QoQ/ +66.3% YoY), it was unsurprising that the minimal expansion in its top-line to $35.41B (+1.5% QoQ/ +8.6% YoY) had not helped to contain the burgeoning costs.

However, we believe these issues do not affect only WBA, with CVS Health (NYSE:CVS) experiencing similarly impacted margins and normalization post-pandemic-vaccines, naturally explaining the decline in both stock prices thus far.

In addition, WBA had shown much restraint in its inventory management at $8.16B (-6.7% QoQ/ -4.2% YoY) by the latest quarter, thanks to its highly efficient micro fulfillment centers.

The company had also sustainably deleveraged its balance sheet with long-term debts of $8.84B (inline QoQ/ -17.1% YoY). With the $5.5B opioid related claims also written off in FY2023, there may be more clarity in its near-term execution.

Meanwhile, WBA is also set to complete its transformational cost management program savings of $3.3B much earlier by the end of 2023, against the original goal of 2024.

Therefore, due to the management's prudence and stellar cost efficiency thus far, it is unsurprising that the goal has been further raised to $4.1B instead, with at least $800M to be completed in 2024.

This cadence is impressive indeed, given WBA's acquisition of VillageMD, Summit, Shield, and CareCentrix, without having to rely on additional debt and/ or dilute shareholders as CVS has, with the latter reporting long-term debts of $56.45B (+15% QoQ/ +8.4% YoY) in the latest quarter.

WBA's US Healthcare Segment

However, investors may want to pay attention to VillageMD and Summit Health in the near term, since they largely contributed to WBA's weaker adj EBITDA performance in the US Healthcare segment at -$113M by the latest quarter (-1614% YoY). This cadence also pulled down the company's total adj EPS by approximately -$0.24 at the same time.

Then again, we are not overly worried for now, since the segment's overall sales continues to grow to an annualized sum of $7.88B (+20.8% QoQ/ +22% YoY) by the latest quarter, with the underperformance mostly attributed to lower patient visits and new clinic expansions.

WBA has already taken immediate steps to reduce the cash burn as well, by prioritizing "better engagement and lower cost of care" through "new virtual and asset light models," instead of rapidly expanding its clinic footprints.

Lastly, we expect to see more cost and capex optimizations, as the management eliminates another 450 Walgreens locations in the near term, or the equivalent of 3.4% of its existing 13K locations globally.

These efforts are promising indeed, since it may optimize WBA's operating expenses, while triggering the expansion of its bottom line once the macroeconomic headwinds lift by 2025, if not earlier by the end of 2024.

So, Is WBA Stock A Buy, Sell, or Hold?

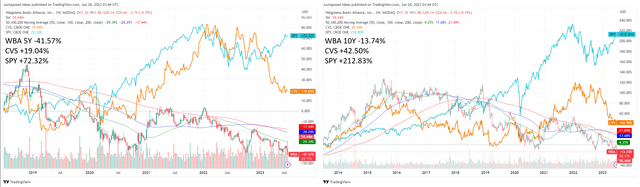

WBA 5Y and 10Y Stock Returns Including Dividends

While we had previously rated WBA as a Buy, it appears that Mr. Market did not agree with our assessment, since the stock continued to underperform against CVS and the wider market since February 2023.

The same trend had been visible for the past ten years, with WBA generating total returns of -13.74%, against CVS at +42.5% and the SPY at +212.83%, with 5Y total returns of -41.57%, +19.04%, and +72.32%, respectively, even after adjusted for dividends.

WBA 1Y Stock Price

Given the massive pessimism embedded in its stock prices, it seems that WBA may be a value trap at these levels, with it now drastically moderated to its July 2010 levels.

We suppose part of the bearish sentiments is attributed to its perceived dividend safety, due to the impacted cash from operations of -$20M in FQ3'23. This number is a drastic difference compared to the $746M reported in FQ2'23 and $1.62B in FQ3'22. This cadence may be worrying indeed, attributed to its supposed dividend aristocrat status.

However, we believe WBA's dividends remain safe, with the management's FY2023 EPS guidance suggesting an adj. net income of up to $3.47B (-20.4% YoY) based on its current share count of 863.8M.

Based on its historical FCF margin of 1.6% in FY2022 and annualized revenues of $138.2B (from the past three quarters), we may see the company generate approximately $2.21B of cash flow (+2.3% YoY), sufficient to cover the annualized dividend payout of $1.66B by the latest quarter.

Therefore, we believe that income investors need not worry about a dividend cut, a cadence we have previously observed with many other income stocks, such as Intel (INTC) and Paramount (PARA). In addition, these depressed levels offer opportunistic investors with an improved forward dividend yield of 6.08%, compared to its 4Y average of 4.30% and sector median of 2.42%.

Then again, while we may rate the WBA stock as a Buy for long-term income investors looking to dollar cost average here, they must also weigh their priorities while balancing a (preferably) well-diversified portfolios, due to the underwhelming total returns thus far.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

There's basically two big pharmacies in America.....WBA and CVS. Most of their business is prescriptions and given the big pharma lobbyists, I think it will stay that way for awhile.

Even in Canada with universal health care, you still have to get the prescription filled at a drug store.