Kraft Heinz: 4.6% Yield And Undervalued

Summary

- Kraft Heinz Company has struggled with lackluster stock performance, but offers a 4.6% yield, strong free cash flow, and a fair valuation, making it potentially attractive for income-oriented investors.

- Rising inflation and intense competition pose challenges for consumer staple companies like KHC, with consumers opting for lower-priced alternatives and private labels.

- KHC has shown resilience, reporting strong growth in Q1 2023 across its Foodservice, Emerging Markets, and US Retail GROW Platforms, gaining market share and expanding into new channels.

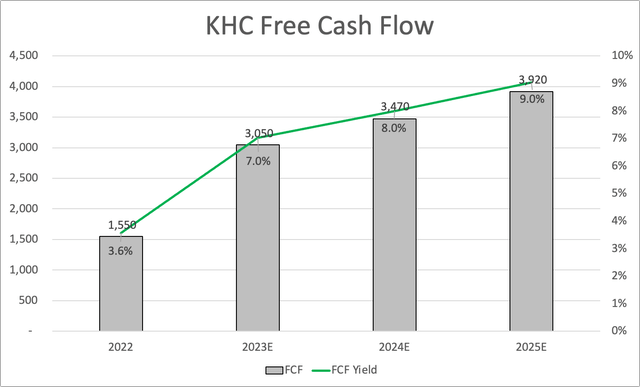

- KHC's positive outlook, improved financials, and expected free cash flow growth support its ability to protect and potentially increase its dividend, with analysts estimating a free cash flow yield of 9.0% by 2025.

Chris Hondros

Introduction

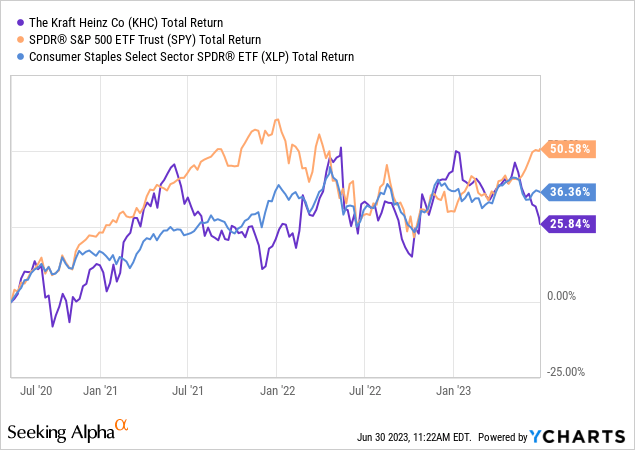

I have a bit of a love/hate relationship with the Kraft Heinz Company (NASDAQ:KHC). I love its products and usually prefer its condiments over generic alternatives. However, I dislike (hate is a bit of a strong word) its stock price performance. The company's performance has been lackluster over the past three years, which includes zero dividend growth.

The good news is that this has pushed the yield to 4.6%, which comes with a boatload of free cash flow, an anti-cyclical business model, and a fair valuation.

In this article, we'll assess all of these things and discuss if buying the KHC ticker makes sense for income-oriented investors.

So, let's get to it!

Lackluster Performance As Headwinds Meet Tailwinds

Consumer staple companies are not in a great spot. Over the past three years, consumer staple stocks (XLP) have underperformed the S&P 500 by roughly 14 points. Kraft Heinz did even worse, as it returned just 26%.

The problem is rising inflation, which is toxic for companies that need to be extremely careful when adjusting their prices. Competition is already fierce without pricing battles. Poor consumer confidence is making pricing even tougher. Not only because consumers are likely to switch to cheaper alternatives but also because high input inflation makes higher prices a necessity to protect operating income.

Hence, headlines like the one below have gotten quite common:

Bloomberg wrote that consumers have become more price-conscious, opting for discount stores and choosing lower-priced private-label alternatives over expensive brand-name products.

Walmart's (WMT) Great Value line and Costco's (COST) Kirkland Signature are examples of private labels that have gained popularity. The competition for consumer dollars is intensifying, and successful grocers and food suppliers will be those that can deliver quality products at competitive prices.

To compete with Walmart, Kroger (KR) and other grocers are under pressure to lower prices and invest in pricing strategies. They are also expanding their private label offerings and modifying package sizes. Dollar stores, such as those partnering with Kraft Heinz Foods and J. M. Smucker (SJM), are ramping up their grocery businesses by selling specialized lower-priced products.

It is truly incredible how many of my friends in the US (I'm based in Europe) go to stores like Aldi and Lidl - especially for generic products.

This is a huge issue for big brands. Only brands with strong pricing power are able to do well in this environment.

How Is KHC Doing?

KHC is holding up quite well.

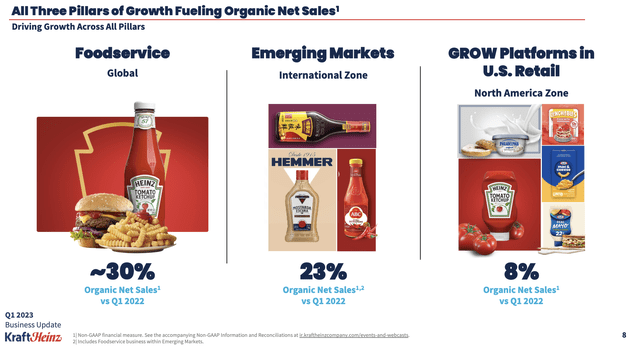

The company reported strong growth in the first quarter of this year, with positive results in all three pillars of their business: Foodservice, Emerging Markets, and US Retail GROW Platforms.

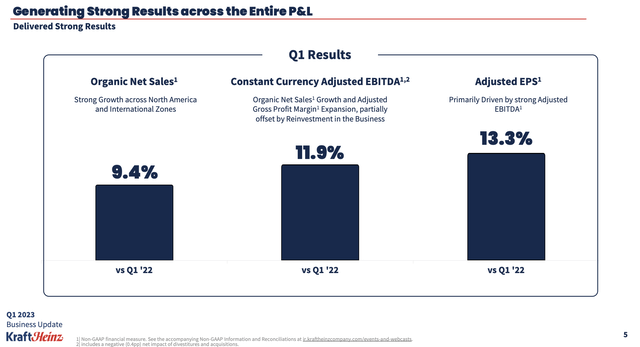

As seen in the overview above, organic net sales grew by 9.4% compared to 1Q22, driven by both North America and International Zone.

Note that these gains were driven by price/mix. Volumes were down, which reflects consumer weakness.

Gross margin expansion and cost efficiencies contributed to an 11.9% growth in constant currency-adjusted EBITDA, with a net negative impact of 40 basis points from divestitures and acquisitions.

Adjusted EPS grew by 13.3%, primarily due to strong adjusted EBITDA performance. The company's adjusted gross profit margin increased by roughly 130 basis points compared to the same quarter last year.

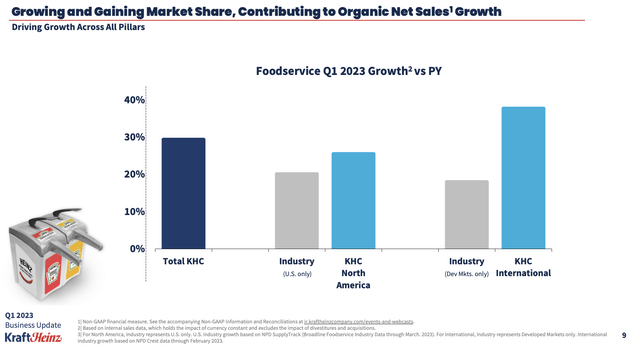

- Foodservice saw significant growth, with North American Foodservice segment sales growing by more than 25% and International Foodservice growing by more than 35%. Furthermore, Kraft Heinz gained market share in both markets and is leveraging its global scale while tailoring strategies for local execution. The company is also expanding into new channels beyond restaurants and bars, such as the education and travel & leisure segments, to tap into additional growth opportunities.

- Furthermore, Kraft Heinz achieved double-digit growth in its Emerging Markets segment, growing organic sales by 23% compared to the previous year. The company's sustainable go-to-market model is driving this growth, and KHC plans to implement it in 90% of its emerging markets businesses by the end of the year. The Emerging Markets segment is becoming a larger part of Kraft Heinz's business, representing approximately 44% of the International Zone's organic net sales in the first quarter.

- Kraft Heinz's GROW Platforms in the US Retail segment grew by 8.1% in the first quarter, driven by Taste Elevation and Easy Meals. These platforms have higher category growth and gross margins than the company's average and represent about two-thirds of the North American business.

With that in mind, the company is achieving market share gains, as it outperformed its industry in both North America and internationally.

Furthermore, it is likely that market share gains will continue based on four key actions:

- Executing joint business plans with retail partners to secure shelf space and merchandising.

- Increasing marketing investments, with a focus on GROW platforms like Philadelphia and Kraft Mac & Cheese.

- Ramp up innovation efforts, including disruptive product launches and line extensions.

- Addressing supply chain issues in categories like Cold Cuts while being selective about the competition to protect profitability.

These actions aim to stabilize the market share and drive sustainable, profitable growth in the US retail market.

Outlook & Dividend

During the first-quarter earnings call, CEO Miguel Patricio emphasized the company's focus on unlocking efficiencies in variable costs and reinvesting in brands to improve profitability. He also stated that the company's strategy is working well, leading to advancements in its transformation journey.

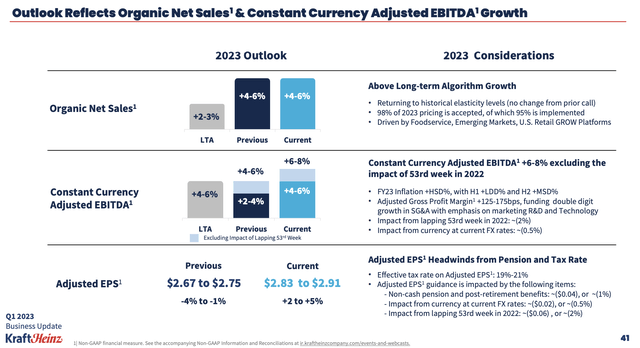

As a result, Kraft Heinz raised its expectations for Adjusted EBITDA and Adjusted EPS for 2023, indicating a positive outlook for the company's financial performance.

However, the company acknowledged that while signs of improvement were emerging, the company still had progress to make before declaring victory in its transformation efforts.

With that said, analysts are buying the company's turnaround. Estimates show that the company is expected to gradually grow free cash flow to more than $3.9 billion in 2025. This would indicate a free cash flow yield of 9.0%.

This is fantastic news for shareholders, as it means the dividend is well-protected.

Furthermore, this year, net debt is expected to fall to $18.2 billion, which would indicate a net leverage ratio of 2.9x EBITDA.

The company currently has a BBB- credit rating after it was upgraded from BB+ last year. In other words, the company has an investment-grade credit rating now.

This means that the company can slowly shift the focus from debtholders to shareholders. Its current dividend yield of 4.6% enjoys a 65% cash coverage ratio (using free cash flow estimates) that is expected to fall to 58% in 2024.

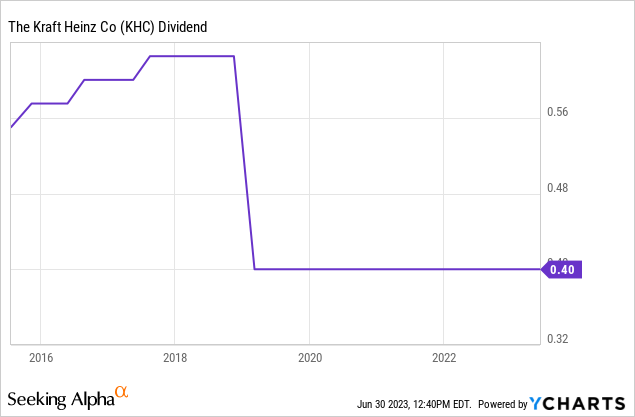

KHC hasn't hiked its dividend since its massive cut in 2019. However, the situation is looking better, which could allow the company to hike its dividend next year.

That is not a promise, but based on its rapidly improving financials - despite industry struggles - KHC is in an increasingly good spot to boost shareholder distributions.

So, what about the valuation?

Valuation

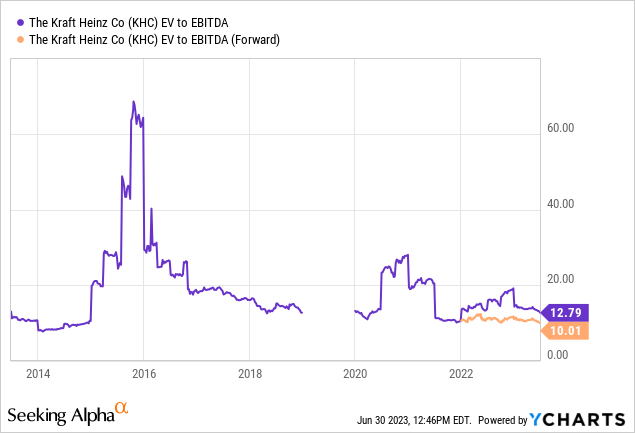

KHC shares are trading at 10.0x 2023E EBITDA, which is based on its $43.4 billion market cap, minority interest, pension obligations, and $18.2 billion in expected net debt.

This valuation doesn't indicate deep value, but it's fair and allows me to maintain a bullish stance on the company.

I believe that once headwinds fade, KHC will likely trade at 12x EBITDA. In this case, it would indicate a 27% upside.

The current consensus price target is $44, which is 26% above the current price.

However, I will not buy KHC, as I have an investment in PepsiCo (PEP), which has a lower yield and less short-term potential for capital appreciation.

Nonetheless, on a long-term basis, I feel more comfortable owning PEP, as it has proven to be a better long-term compounder.

That said, if I were running an active portfolio of undervalued stocks, I would be a buyer of KHC at current levels and sell it once it closes in on $50.

Takeaway

Despite its lackluster stock performance, the Kraft Heinz Company presents an appealing opportunity for income-oriented investors. With a yield of 4.6% and robust free cash flow, KHC offers an anti-cyclical business model and fair valuation.

While consumer staple companies face challenges due to rising inflation and fierce competition, KHC has demonstrated resilience and achieved growth in its key business segments.

Market share gains, expansion into new channels, and successful cost-efficiency measures have contributed to the company's positive performance.

Additionally, KHC's improving financials, including a higher credit rating and declining net debt, indicate the potential for dividend hikes in the future.

Although I favor more consistent dividend growth stocks, KHC is worth considering at current levels, with a potential upside of 27%.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (10)

I think both Heinz & Kraft products are generational. Young people choose ramen etc. over kd and salsa, garlic mayo etc. over ketchup.