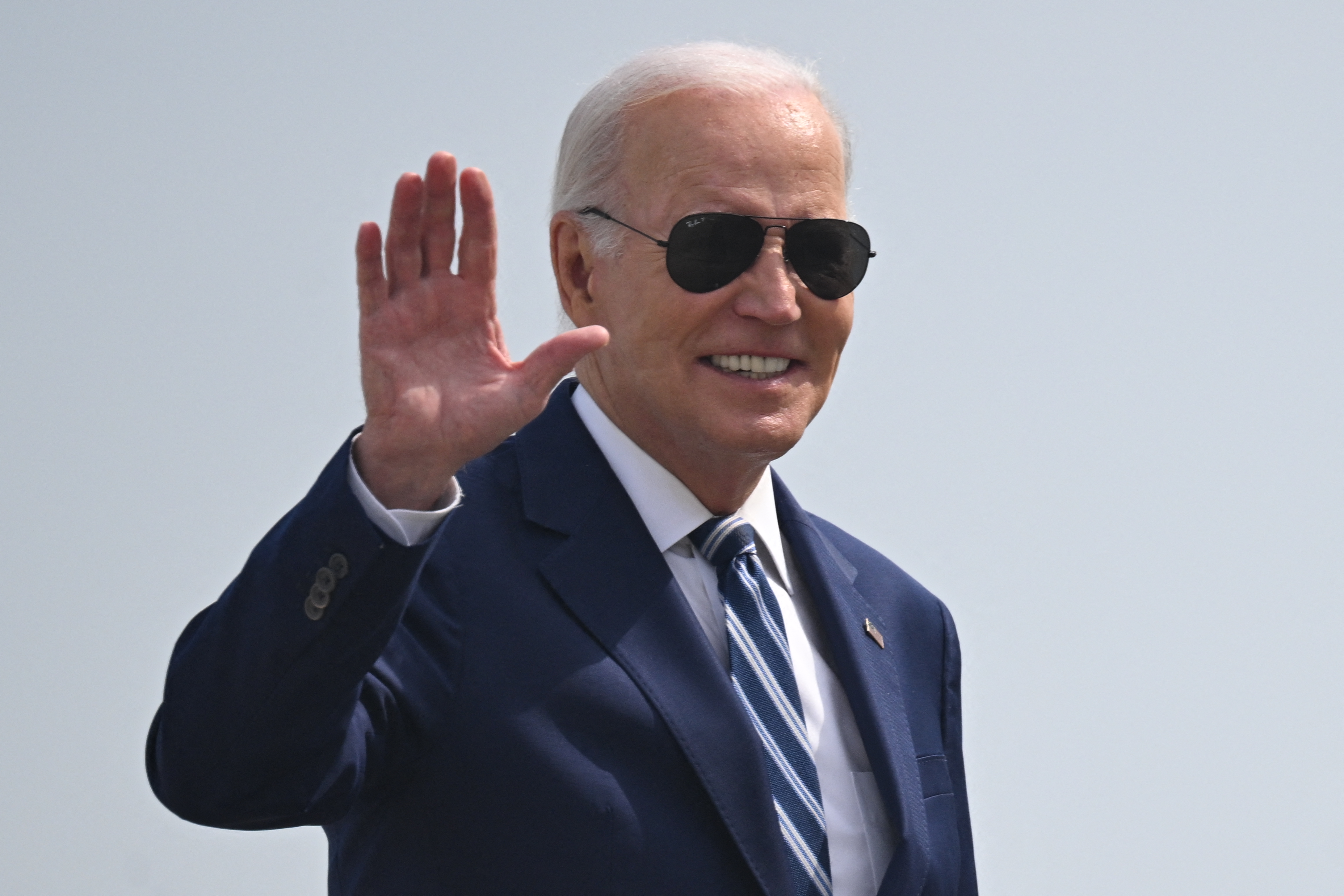

The U.S. Supreme Court on Thursday struck down President Joe Biden's student loan forgiveness plan that sought to cancel debt for millions of borrowers.

The court ruled against Biden's plan, which was to cancel up to $10,000 in debt for borrowers making $125,000 or less and up to $20,000 for Pell Grant recipients. The pause on payments is set to end in October. Interest on the loans is also expected to resume on September 1.

The ruling came during the court's final week of the current term as the justices are making decisions on some contentious issues.

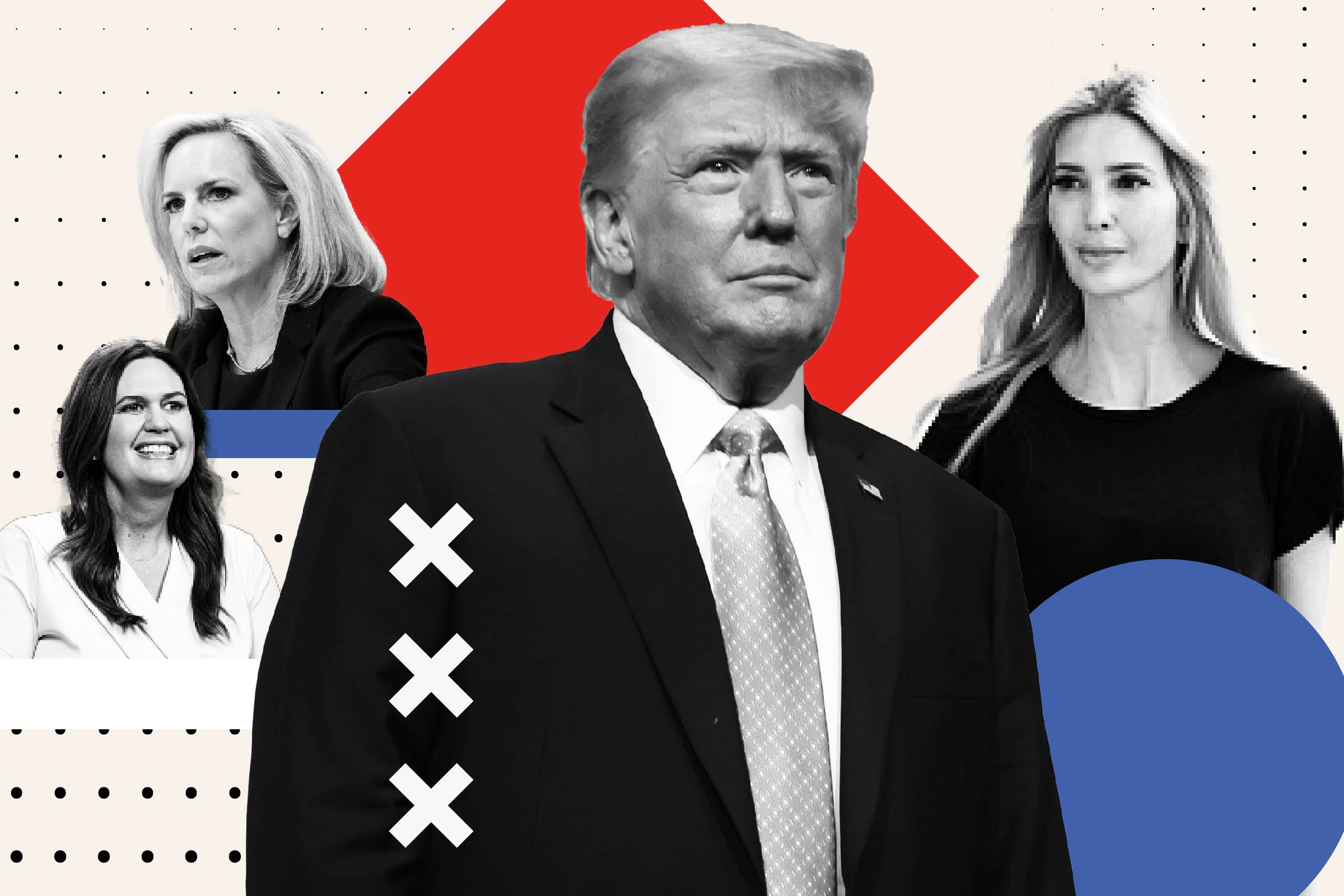

In a 6-3 decision, the Supreme Court sided with Republican-led states which argued that Biden exceeded his authority by enacting the student loan forgiveness plan. Biden's debt forgiveness plan has been held up while the Supreme Court heard arguments in the case.

The court this week ruled against the independent state legislature theory in the Moore v. Harper case brought by Republicans in North Carolina. The justices ruled 6-3 that the North Carolina Supreme Court had authority to strike down a new congressional map that had awarded 10 seats to Republicans and four to Democrats.

The Supreme Court is also set to make a decision in the Students for Fair Admissions v. University of North Carolina and Students for Fair Admissions v. Harvard College cases, which argue affirmative action and the consideration of race by colleges in the admissions process. On Thursday, the Supreme Court sided with Students for Fair Admissions and struck down affirmative action and the consideration of race in college admissions.

Six Republican-led states argued that Biden's loan forgiveness plan excluded some Americans who didn't qualify and that Biden exceeded his authority with the plan. Two students who didn't qualify for Biden's plan also filed a lawsuit that was brought to the court.

The White House has said that the plan would help up to 43 million borrowers facing debt. Roughly 20 million Americans would have their debt fully canceled under Biden's plan.

This month, the Becker Friedman Institute for Economics at the University of Chicago published a report on the pause on federal student loan debt that found that borrowers who paused their payments experienced more "mortgage, auto and credit card borrowing" compared to those who continued payments.

"By the end of 2021, these paused borrowers had an additional $1,500 in outstanding student loan balances relative to those that did not see a payment stoppage," the report found, noting that no additional debt was found for specific borrowers who continued payments.

This is a breaking news story and will be updated when more information becomes available.