CGX Energy: More Good News From Guyana

Summary

- CGX announced another discovery.

- Frontera Energy controls much of the common stock.

- Frontera Energy management also sources the company debt.

- There is a going concern statement in the Management Discussion and Analysis statements filed with Sedar.

- Hess is probably likely to outperform this stock in the future despite the higher price.

- This idea was discussed in more depth with members of my private investing community, Oil & Gas Value Research. Learn More »

Jeremy Poland

CGX Energy (OTCPK:CGXEF) announced another discovery in the joint venture between CGX and Frontera (OTCPK:FECCF) that operates in Guyana. Whether shareholders will ever see any benefits from the announced discoveries is an open question.

The offshore business is risky and expensive. The projects are large. So, there is a need for a whole lot of money. The risk to investors of any company like CGX that has no obvious income source is dilution that completely destroys any hope of capital gains. Another risk includes too much debt that precludes company viability at some point in the future.

Furthermore, Frontera controls much of the outstanding stock and lends the company money as well. There is a potential conflict of interest in that a company with no income can default on loans made and the lender (in this case Frontera management arranged for the loans) can seize the assets in bankruptcy when CGX cannot pay.

There are opinions that a court case can result. But what investor needs a situation like this to start with? This is before the financial statements note a going concern issue. That makes the common shares a highly speculative and dangerous investment.

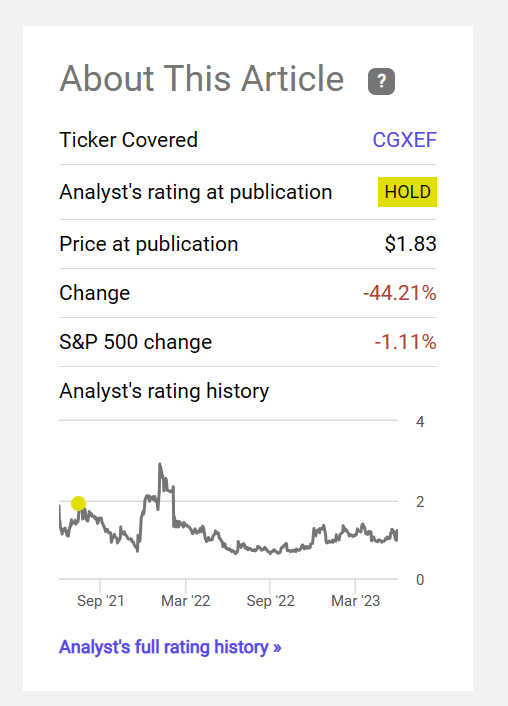

Seeking Alpha Record Of CGX Common Stock Price Since My Last Article (Seeking Alpha Website June 29, 2023)

Notice that the last article came out before the first discovery was announced. What investors needed to do was "sell on the news" and then walk away from this issue. Not much good has happened with the stock price ever since that announcement.

The latest stock price really has not responded to the discovery at all. But this is not all that uncommon when a company as small as CGX needs to fund very expensive offshore wells and (if things go far enough) an FPSO with all the connections that will cost billions of dollars. Even Frontera is not large enough to make the prospect less daunting.

Hess Corporation (HES) is the smallest partner of a partnership operated by Exxon Mobil (XOM) in Guyana. The latest project that was sanctioned is Uaru where the FPSO (and everything to get it running) is estimated to cost $10 billion.

Hess has kept literally a couple of billion on the balance sheet "just in case" for a long time. There were billions more in unused credit lines that the company had also for "just in case". But Hess had income and assets to back up all of that. CGX is not so lucky.

Furthermore, Hess management made the decision to sell assets when needed rather than increase the debt levels of the company. CGX really has no comparable value of assets to sell should that be necessary.

Now the Hess partnership has production from Guyana and hence a cash flow source. So, there is less need for credit facilities and cash backup for contingencies. But CGX has to get from a discovery or discoveries it essentially has no way to pay for the financing of to enough to justify an FPSO and then get to that operating FPSO.

The problem with all of this is that there is a limited market for the discoveries noted so far. Probably a neighboring operator might be interested. But it would be rare for another company to just "barge in" and want to purchase what has been accomplished. The neighboring operators are very large and will likely "play for keeps".

That does not bode well for individual investors. The stock price action since the last discovery announcement bears this out as the stock has lost nearly half its value since my last article. The stock is volatile enough for a disciplined traders to have made profitable trades. But most investors I write for are buy and hold. This stock is very much not suitable for something like that strategy.

Financing

The financing of this company has so far come extensively as a result of the same management that controls both companies. As long as there is no source of income, there is likely to be a going concern warning. Frankly, I would stay away from anything with a going concern warning. There are much safer ways to make money than this.

March Update Summary

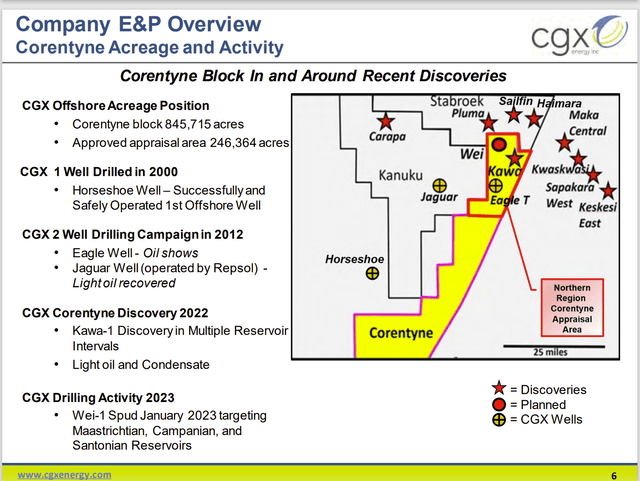

Before the first quarter report, the March Update summary has a one page overview of the company operations and obligations.

CGX Energy Overview Map Of Guyana Lease Position (CGX Energy March 2023, Update Presentation)

In addition to the above, management is also committed to developing a deep water port which likewise has some large financial obligations. One thing that is a positive is that the company has successfully drilled and abandoned (or suspended) wells.

What needs to be realized is that the time from a discovery to production is like in the five-to-seven-year range. This makes the before mentioned financing issues more challenging. Not only must financing be obtained; but along with that financing is the interest paid until there is a reliable source of income. Along the way, there is a gamble that the income will pay off the amounts owed. This is all ahead of the common shares.

Conclusion

The result of this is that shareholders can look forward to one capital raise after another. There is also a very good possibility that the stock price will not respond to discoveries (instead it will wait for the cash flow). This increases the risk of crippling dilution and reverse splits along the way.

The financial statements themselves discuss going concern issues that every investor needs to read before they invest. The result of this is that investors run a very high risk of losing their entire principal.

Frontera controls most of the common stock and the same management finds financing for the company to continue. This provides a potential conflict of interest that may at some point encourage the management to favor Frontera over the current company and its shareholders.

Hess corporation is probably a far better Guyana play because the partnership that Hess is in already has production and cash flow from Guyana. Increasing cash flow is now fairly predictable for years to come. So, the capital appreciation is visible without all the risks here. An investment in Hess has the usual upstream and offshore risks. But Exxon Mobil is an operator that knows how to reduce many of those risks to far below normal. Despite the price of Hess stock compared to this stock, a large future outperformance is very likely.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

I analyze oil and gas companies like CGX Energy and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

This article was written by

Occassionally write articles for Rida Morwa''s High Dividend Opportunities https://seekingalpha.com/author/rida-morwa/research

Occassionally write articles on Tag Oil for the Panick High Yield Report

https://seekingalpha.com/account/research/subscribe?slug=richard-lejeune

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (5)

Thanks for the article. It reinforces my position and solidifies that I won’t be going back in.