ETY: Buy-Write CEF Killing It This Year, Up +16%

Summary

- ETY is a hybrid equity buy-write fund that has outperformed the S&P 500 this year.

- The vehicle's top holdings are some of the outperformers this year in the market, where breadth has been scarce.

- The fund's option overlay structure also allows the vehicle to retain some upside in exchange for a lower option premium.

- The fund holds only 69 names, versus 500 for the index. This allows the fund manager to focus on picking the right names for today's environment.

Szepy/iStock via Getty Images

Thesis

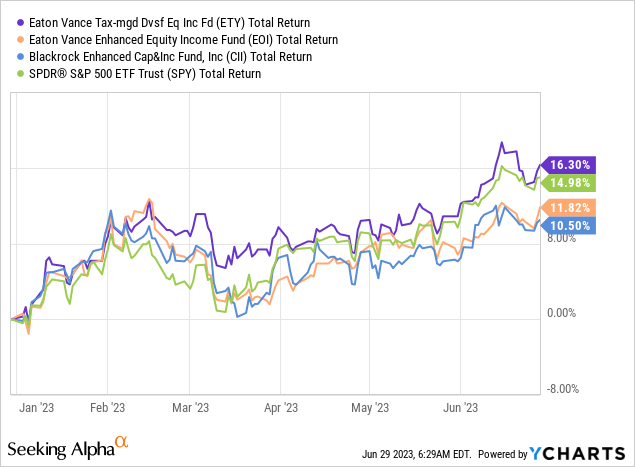

The Eaton Vance Tax-Managed Diversified Equity Income Fund (NYSE:ETY) is one of those rare equity CEFs that has outperformed the S&P 500 this year. In fact ETY is a hybrid buy-write fund. I call it hybrid because it only writes covered calls on half of its portfolio, unlike some of its peers, which cover the entire collateral. I have covered this name before here. The fund falls in the same cohort as the Eaton Vance Enhanced Equity Income Fund (EOI) and the BlackRock Enhanced Capital Fund (CII):

ETY outperforms both its competitors this year, having recorded a phenomenal start to the year. In this article, I am going to examine the factors behind its performance and analyze how the forward is shaping up for this name.

Factors behind ETY's outperformance

1. Collateral Build

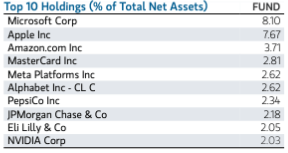

The fund holds only 69 names, versus 500 for the index. We have seen an outperformance by large cap tech names this year, and ETY is overweight those names:

Top Holdings (Fund Fact Sheet)

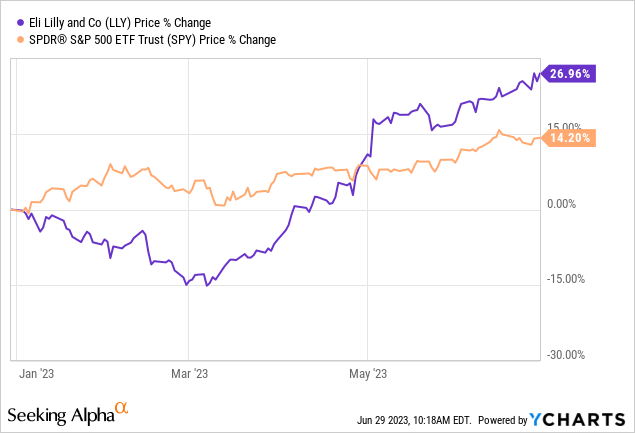

Outside PepsiCo (PEP) and JPMorgan (JPM), each and every name in the Top 10 Holdings has outperformed the index by miles this year. We are not going to talk about NVIDIA (NVDA) because it is such a well known story, but did you know Eli Lilly & Co. (LLY) is up 27% this year?

The fund manager has done an outstanding job here in picking the right names for today's environment. I see this quite often in the buy-write space, especially for the good funds, where the portfolio managers end up going long a smaller pool of names rather than replicating the entire index, with the general idea of generating alpha (i.e. picking individual names which are going to do better than the index). It has worked tremendously well in this case. Considering the top 10 names represent over 33% of the fund, it becomes a bit clearer how the vehicle has managed its outstanding performance.

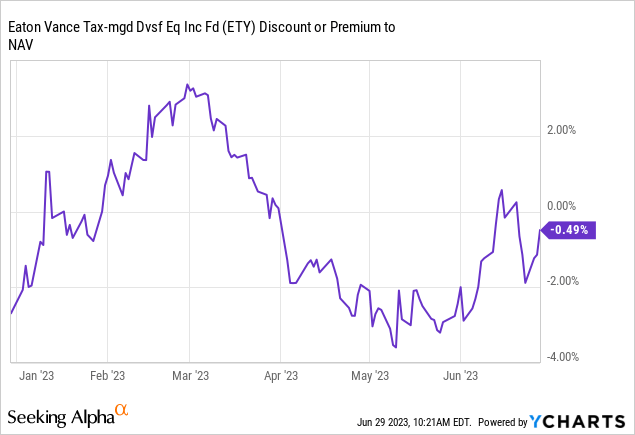

2. Premium to NAV has been very stable

While other buy write funds have experienced tremendous volatility (negative one) in their premiums to NAV, we see a stable performance here:

The fund is now trading flat to NAV, and has only fluctuated very slightly this year. That has helped the name with its performance.

3. The fund's options overlay has provided for upside

Today's market has surprised everybody. Instead of a Q1 meltdown, we are getting a massive H1 rally. A defensive positioning for a buy write fund entails writing covered calls very close to the strike, so the delta is maximized (i.e. you are getting the highest option premium possible). When the market goes down, this type of strategy does best. Conversely when the market rallies the best strategy to have is to write calls that leave the fund with upside:

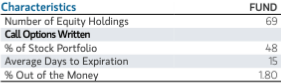

Options Overlay (Fund Fact Sheet)

We can see from the above table, the fund leaves itself a 1.8% upside every two weeks roughly. This translates into the fund making money if the market is range bound or does not rally aggressively in the respective time-span.

Furthermore, the fund only overwrites 48% of its portfolio. The lower this number in 2023, the better for a fund's performance, especially for one overweight mega cap tech names.

I do not know the optimal period for writing calls, however I do know the theta decay is the highest in the last 30 days, and I am also fairly certain the fund managers have run a high amount of historical simulations to figure out the best period for writing calls with the respective delta profile.

What is next for ETY

The end of the year performance for this fund is very much dependent on what the market does for the rest of the year. If the current themes persist, ETY will continue to outperform the index. The current theme is outperformance by mega caps, and in particular tech mega caps. Even if the market stops rallying and just stays range bound, ETY will outperform given its premium generation on half of its portfolio.

Even in a down market scenario, the fund will maintain its gains over the index given its option premium generation. The worst case scenario here is a violent down market that has a high beta factor for the high-flyers today. Basically, if the tech mega-caps mean revert, the fund will do worse than the S&P 500.

Conclusion

ETY is a hybrid equity buy-write fund. The vehicle writes covered calls on only 48% of its portfolio, and has been able to outperform the S&P 500 this year. The fund has had a stable premium/discount to NAV and contains only 69 names, overweight mega caps. The vehicle's top holdings are some of the outperformers this year in the market, where breadth has been scarce. Its option overlay structure also allows the vehicle to retain some upside in exchange for a lower option premium. ETY can be considered a great buy-write portfolio diversifier, and has correctly captured the tech mega-cap outperformance this year. For existing shareholders this fund is a Hold, while new entrants would do well to wait for a market wide retracement.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.