Carvana: Despite Short Squeeze Roller Coaster, The Ride Ends At $0

Summary

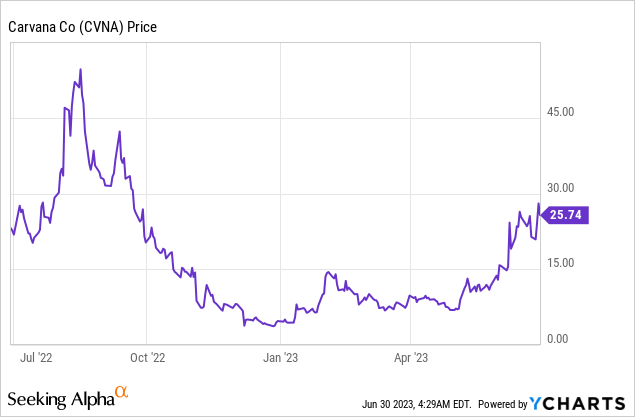

- Carvana has been the subject of an epic short squeeze that has seen shares skyrocket by 400% this year amidst a drumbeat of press releases about the company's "adjusted EBITDA" forecasts.

- However, actual losses are mounting at a clip of $200 million or more per quarter. Inventory is rapidly falling, while interest expense continues to rise.

- Creditors are closing in, and Carvana shares are likely headed to zero.

Joe Raedle

Tempe, Arizona-based Carvana (NYSE:CVNA) shares have staged an epic short squeeze in recent months after guiding towards positive "adjusted EBITDA" numbers. In its most recent 8-K filing, the company said it expected $50 million in adjusted EBITDA for Q2, but in an unusual move, declined to reconcile its adjusted EBITDA to GAAP figures. For reference, Carvana lost $286 million on a GAAP basis in Q1 but reported an "adjusted EBITDA" of -$24 million (more on why Carvana's adjusted EBITDA is uniquely tricky).

A back-of-the-envelope calculation here would suggest that Carvana is forecasting a Q2 net loss of another $200 million, plus whatever their "one-time" expenses are likely to be. Carvana has never made enough on a yearly basis to cover its operating expenses without having to raise new capital. In all, Carvana's 2022 losses totaled nearly $2.9 billion, including large write-downs for acquisitions gone wrong. Carvana had $8.6 billion in assets and about $10 billion in liabilities at the end of Q1. This is indicative of insolvency unless the company can start turning an actual profit.

Meanwhile, the stock has surged despite a steady worsening in the underlying fundamentals of the business. Of course, a similar short squeeze happened last year, only to be promptly crushed by the reality of continued losses and creditors closing in.

In March, Carvana's credit rating was cut to CC, while their unsecured notes were cut to C. Carvana tried to get creditors to swap their debt, but the creditors aren't playing ball, after forming a pact in December to negotiate the inevitable restructuring as a combined front. Apollo (APO) is leading the creditor group. As one of the world's largest private equity firms, I can't stress enough how much of an advantage in legal manpower they're likely to have over Carvana. Carvana owes a $165 million interest payment on November 1st, and I don't see how they get the money to pay the interest and also fund their continued losses.

The base case here is that Carvana will go bankrupt, common shareholders get nothing, and creditors end up owning the company. This is inevitable unless Carvana can start making enough money to not only cover SG&A expenses but also the interest on the debt. Using EBITDA to value publicly traded stocks is somewhat nonsense, but using adjusted EBITDA is doubly so. Using adjusted EBITDA without any reconciliations to GAAP is the square root of insanity! Carvana's GAAP figures aren't that solid either, with the company repeatedly failing a well-known statistical test designed to detect earnings manipulation.

Can Carvana Turn Things Around?

At this point, it seems highly unlikely. Carvana has responded to its massive debt load by shedding expenses, but it's not nearly enough. To make money, Carvana needs to grow, but the company is rapidly dropping inventory to raise cash. Inventory peaked at $3.3 billion in March 2022, and is now down to under $1.5 billion. This is a classic sign of financial distress, and the decline in inventory mirrors the company's losses over the last year.

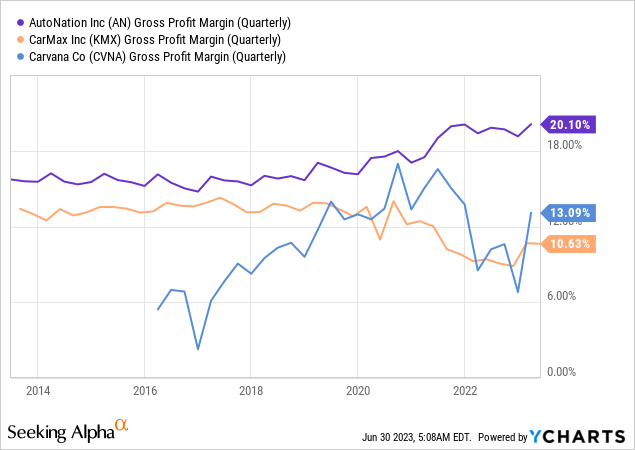

Here are the gross margin figures for Carvana and a couple of competitors, AutoNation (AN) and CarMax (KMX). I chose CarMax in particular because they're also solely in the used car business.

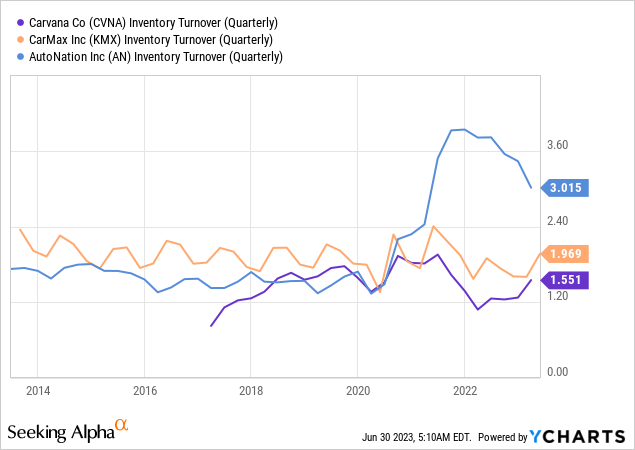

And inventory turnover.

Here we see that Carvana isn't quite the tech-fueled disruptor it would like to be. Carvana isn't great at turning over inventory, and its margins aren't great either. AutoNation's margins illustrate a key fact about the car business, which is that service departments pay the bills for dealerships. Without service, the car business is far more cyclical, far more economically sensitive, and far more exposed to changes in interest rates. In my past life, I worked in the back office of a chain of car dealerships, and service was our bread and butter.

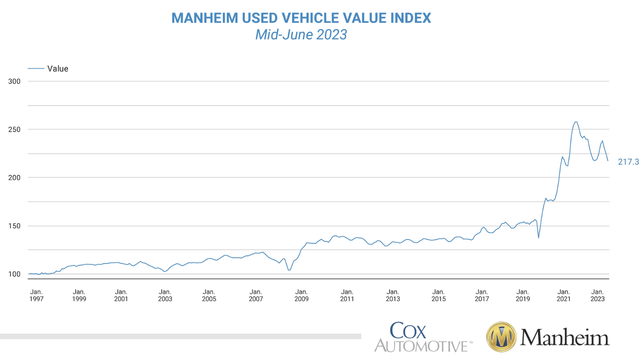

The other problem here is that we can see some serious pressure starting to build on the used car market. Used car prices surged in Q1 as part of a broader economic rebound. There were similar trends in the housing market. This rebound helped keep Carvana out of bankruptcy court. However, used car prices are now going back down. Used car purchases are heavily dependent on interest rates. The Fed has indicated that they'll keep hiking, which will continue to pressure the used car market. Indeed, the insane used car bubble is popping.

Used Car Wholesale Prices (Mannheim)

Carvana isn't going to get cash from its business, and no one is interested in lending them more money, because it will simply be incinerated by continued losses.

Carvana's only hope here is to do a massive secondary equity offering to retail investors to try to cover the losses. This is a tactic that was used successfully by AMC Entertainment (AMC) and other meme stocks. Here again, I think they'll fail. The meme stock situation in GameStop (GME) and AMC came at a time when the government was flooding the economy with money, including via direct stimulus checks to consumers. Additionally, interest rates were at 0%, so there was no sense in sticking the money in CDs or similar investments. This time around, consumers are under fire from rapid inflation, the Fed has rapidly hiked interest rates, and stimulus is set to go into reverse with the resumption of student loans. Moreover, retail investors have taken heavy losses in meme stocks like Bed Bath and Beyond (OTCPK:BBBYQ), so they're not as likely to pony up money again. For these reasons, I believe the liquidity in Carvana stock is far less than it appears, and that the company is likely to fail to meet November's interest payment due to continued losses and debt covenants. To this point, I own January 2024 puts on Carvana.

As for the short squeeze, here's what the company's 10-K has to say:

A large proportion of our Class A common stock has been and may continue to be traded by short sellers which may increase the likelihood that our Class A common stock will be the target of a short squeeze. A short squeeze has led and could continue to lead to volatile price movements in shares of our Class A common stock that are unrelated or disproportionate to our operating performance or prospects and, once investors purchase the shares of our Class A common stock necessary to cover their short positions, the price of our Class A common stock may rapidly decline. Investors that purchase shares of our Class A common stock during a short squeeze may lose a significant portion of their investment.

Bottom Line

Shorts have been squeezed in Carvana. Once vulnerable shorts cover, the air pocket between the company's valuation and fundamentals is likely to close. Companies like Carvana that lose gigantic amounts of money each quarter are a product of zero-interest Fed policies, and they can't survive without it. At some point, Carvana is likely to miss an interest payment, and it will be game over for shareholders as creditors take control of the company. Right now, that point looks like it will occur in November, but it could occur later if the company is able to drag things out by diluting shareholders.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial short position in the shares of CVNA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (12)

I was thinking the same thing. But. You would have to do an ATM. Because no reputable broker could underwrite a true secondary because there wouldn’t be any institutional interest. The street knows it’s going to zero.

You don't have any idea of their business economics. If they could easily raise capital, now would be a perfect chance to do it, while the stock price is high enough. In any case, if they had ways to pay off the debt as it came due, why did even ask for bond restructuring from bond holders, which, by the way, was soundly rejected. This company is in serious trouble as things stand currently.