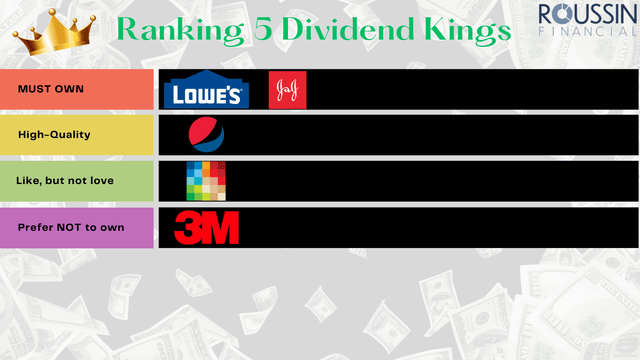

Ranking These 5 Dividend Kings From Highest Quality To Lowest

Summary

- The article ranks 5 Dividend Kings, from highest to lowest quality.

- A Dividend King is any stock that has raised their dividend for 50+ consecutive years, making them the most consistent dividend payers in the market today.

- Being a dividend king usually coincides with lower dividend growth, but two of the stocks on today's list bucked that trend a bit.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

Moussa81

I recently published a piece ranking 10 REITs from HIGHEST quality to the LOWEST, which was well received and I got numerous requests for similar style pieces, so here is another.

Today, we are going to rank 5 Dividend Kings from HIGHEST Quality to lowest quality. The ranking is again focused more on quality and less on current valuation, even though we will briefly look at the valuation.

As a reminder, a dividend king is any stock that has raised their dividend for 50+ consecutive years.

Here is a look at the 5 Dividend Kings we are going to rank today

#1 - Lowe’s Companies (LOW)

#2 - 3M (MMM)

#3 - Altria Group (MO)

#4 - PepsiCo (PEP)

#5 - Johnson & Johnson (JNJ)

Created by author

Ranking 5 Dividend Kings From Highest to Lowest Quality

Dividend King #1 - Lowe’s Companies

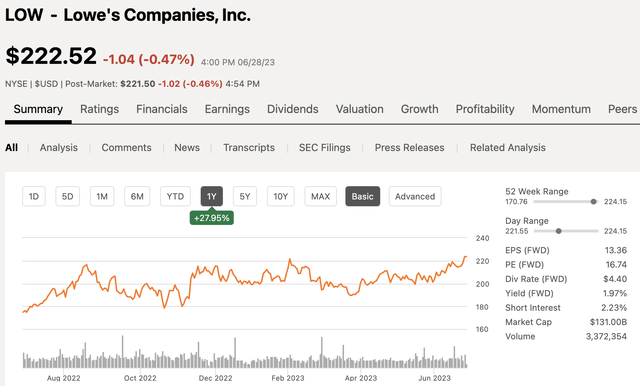

Lowe’s is one of the two largest home improvement retailers in the US with the other being The Home Depot (HD). Lowe's currently has a market cap of $131 billion and shares are up 28% over the past 12 months.

Seeking Alpha

Lowe’s has turned things around under the leadership of CEO Marvin Ellison, who held a senior leadership role at none other than Home Depot years back, which gave him direct insight into what made that company so great.

Improvement has been made to the efficiency of the supply chain, upfront technology, as well as store layout and the number of SKUs. Everything has been changed to build a more efficient company which has shown in the results over the past few years. In fact, even though sales were down in the most recent quarter, Lowe’s outperformed HD on a number of metrics including same-store sales. For years, HD has dominated Lowe's, but the gap is closing.

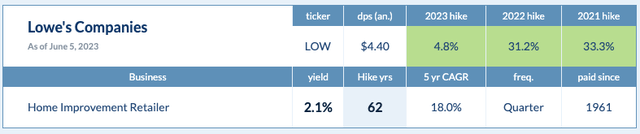

Lowe’s is a premiere dividend stock, having paid a growing dividend for 62 consecutive years. Usually when a company reaches Dividend King status, they tend to lack dividend growth, but that is not the case when it comes to Lowe’s as they have a 5-year dividend growth rate of 18%. Lowe’s currently yields a dividend of 2.1%, offering a good mix of share price appreciation and dividend growth

Dividendhike.com

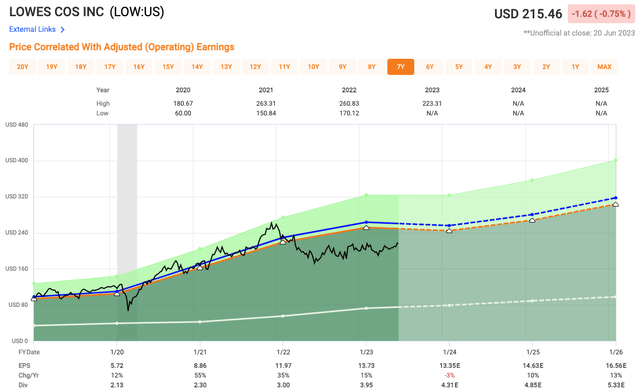

Analysts are looking for 2023 EPS of $13.35 which equates to an earnings multiple of 16.1x, which looks intriguing given they have a 5-year average multiple of 19.2x and a 10-year average multiple of 20x.

Fast Graphs

So where do we rank Lowe’s based on quality?

Lowe’s is a tremendous company with a sound balance sheet earning them a BBB+ credit rating that could move higher in the near future. They offer both share price appreciation and strong dividend growth in addition to buying back shares in huge chunks.

As such, I am going to rate Lowe’s as a MUST OWN given they are rather immune to the threat of e-commerce as well and operate within a duopoly.

Created by author

Dividend King #2 - 3M

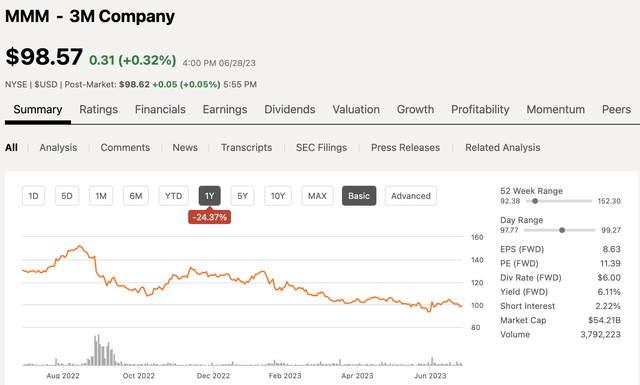

3M is a company that has been in turmoil given the ongoing lawsuits the company faces that has had the company under intense pressure of late. The company has a market cap of $54 billion and over the past 12 months, shares are down nearly 25%.

Seeking Alpha

3M has a very diversified portfolio of products and they have long played a HUGE role in the US economy ranging. However, a few years back, the company was faced with a major lawsuit regarding earplugs that were manufactured by one of the company's subsidiaries. These earplugs were used specifically for US military personnel. The lawsuits state that the earplugs were defective, which lead to hearing loss for the users and to date, there are roughly 230,000 lawsuits related to this product.

The legal proceedings continue and there is no real sense of how they are going one way or another, except that they have really weighed on the company’s value.

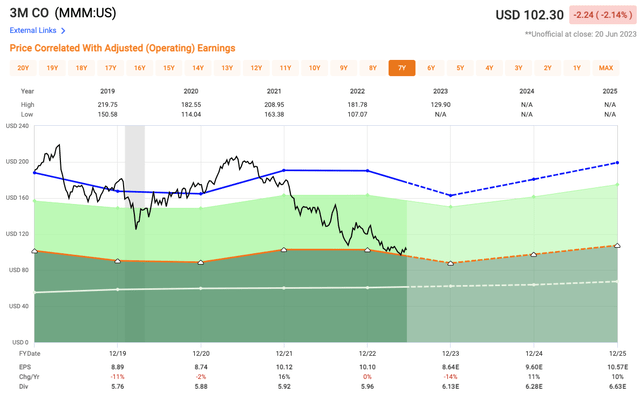

Looking at this chart, you can see the company’s fall from grace, reaching a peak market cap of nearly $160 billion in 2018 to now having a market cap of just $54 billion. This chart is the definition of a falling knife.

yCharts

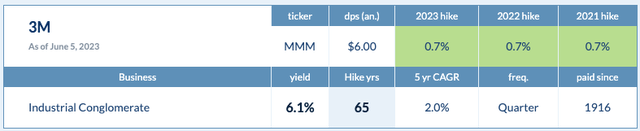

Nonetheless, the company is a Dividend King as they have paid a growing dividend for 65 consecutive years.

That is a very impressive streak, however, the quality of the increases are more of an administrative move at this point, as you can see here the company has a 5-year DGR of only 2% and the past 3 years have all included dividend hikes of less than 1%, especially as the company tries to preserve cash. 3M currently has a high-yield of 6.1%, which is the result of the falling stock price.

Dividendhike.com

Now for valuation, where analysts are expecting 2023 EPS of $8.64 which would be a 14% decline from the prior year. This equates to an earnings multiple of 11.8x. Over the past 5-years, shares have traded at an average multiple of 18.8x and over the past decade closer to 20x.

Fast Graphs

If you like higher risk, this may be worth a second look given the uncertainty surrounding the company with the lawsuits. If the legal issues get resolved the stock can really jump higher, but that seems to be the black eye holding the stock back.

As such, 3M not a stock I can own, therefore I rate 3M shares as “Prefer not to Own” due to the uncertainty.

Created by author

Dividend King #3 - Altria Group

Moving from one high-yield dividend king to another, Altria having an even higher dividend yield, which we will look at below.

Altria Group is the second largest tobacco company in the world trailing only Philip Morris. MO has a market cap of $79 billion and over the past 12 months, shares are up 3%.

Seeking Alpha

This company can be a bit controversial for some investors that don’t invest in certain companies like tobacco stocks, alcohol stocks, or any other “sin stock” if you will. For me, there are areas you can poke a hole in for many businesses in how they may negatively impact someone or something.

Altria was largely a cigarette manufacturer for many years, but management has done a nice job diversifying the portfolio to more smokeless products and venturing out into other areas as well. After all, the company’s slogan right now is “Moving Beyond Smoking.”

Over the years, cigarette shipment volumes have been in constant declines, but even with that, revenues have held up due to the company’s very strong pricing power. The decline in cigarette volumes seem to be gaining more steam as younger generations seem to be even less likely to use traditional cigarettes, which does not bode well for the company’s foreseeable future.

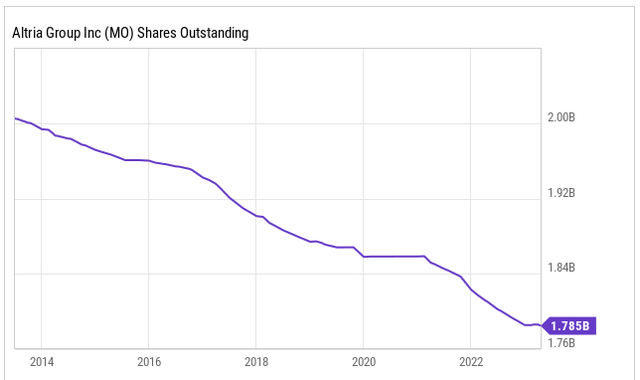

Altria is another company that has been aggressive in its share repurchasing policy as you can see here, shares outstanding have fallen from more than 2 billion in 2013 to roughly 1.75 billion in 2023

yCharts

Combine declining cigarette volumes with higher taxes and even future potential bans in certain areas, that makes Altria a tough call as they only have a presence in the US.

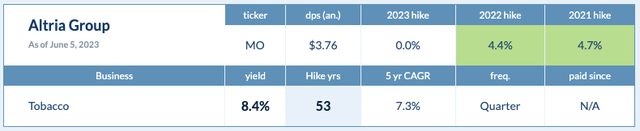

The company has paid a growing dividend for 53 consecutive years and they have a 5-year DGR of 7.3%. The stock currently yields a very high dividend yield of 8.4%, which is getting tighter and tighter in terms of payout ratio.

dividendhike.com

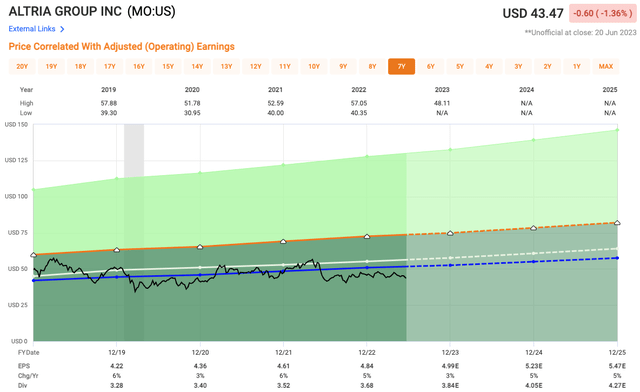

In terms of valuation, shares of Altria currently trade at an earnings multiple of just 8,7x compared to a 5-year average of 10.5x and a 10-year average of 15x, which is a multiple that may be something of the past.

Fast Graphs

In terms of ratings, I do not see much of a path for substantial growth for the company moving forward. The dividend is nice, but that is really all that can be relied on right now, but a dividend is not worth much if the stock price is falling. As such, I rate the stock in the Like, but not Love category for now, and that is with me even owning the stock.

Created by author

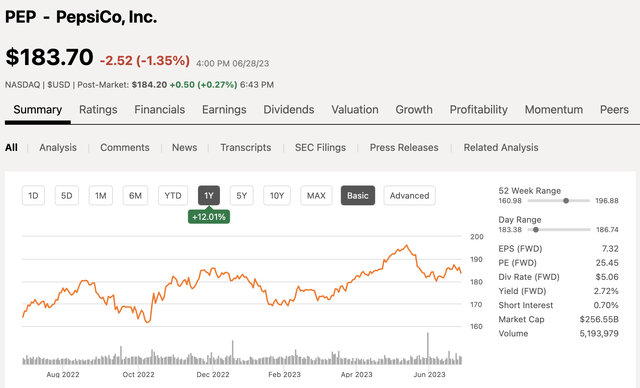

Dividend King #4 - PepsiCo

PepsiCo is one of the leading beverage and snack companies in the world, trailing only Coca-Cola (KO) when it comes to beverage.

PepsiCo has a market cap of $256 billion and over the past 12 months, shares of PEP are up 12%, outperforming shares of KO, which are down 3% over the same period.

Seeking Alpha

Coke dominates the beverage sector, but PepsiCo offers the compelling snack segment as well. Many investors like that component of PepsiCo even though the snacks can weigh on margins from time to time. KO dominates PEP when it comes to free cash flow margins.

I think there is plenty of room for improvement when it comes to efficiencies for PEP, even though the company proudly sports an A+ credit rating. The company reminds me a lot of Lowe's in terms of operating within a duopoly of the sorts and being the runner up in the space, depending on who you ask.

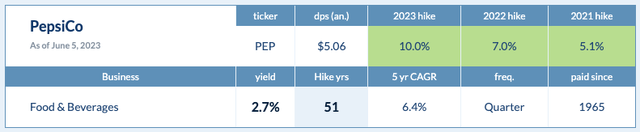

PepsiCo is the newest Dividend King as they have recently joined this prestigious list with their 50th consecutive year of dividend increases last year.

Like I mentioned earlier, usually when companies reach this level the dividend growth slows, which has been the case for every stock we have looked at besides Lowe’s. PepsiCo has at least some decent growth with a 5-year DGR of 6.4%, with the past 2 years' worth of hikes beating that average. PepsiCo recently hiked the dividend by 10%. The company currently yields a dividend of 2.7%.

Dividendhike.com

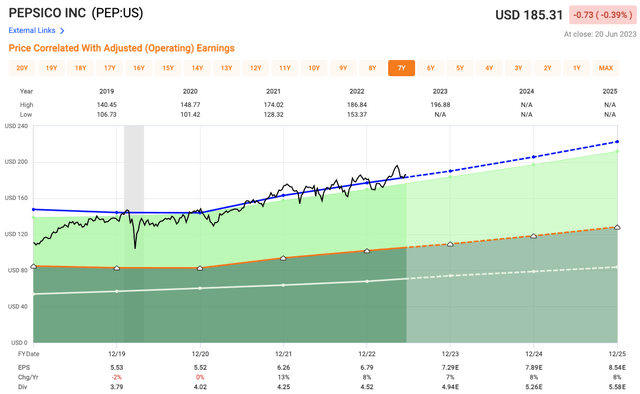

In terms of valuation, analysts are looking for EPS of $7.29 which equates to an earnings multiple of 25x, so not necessarily a cheap consumer staple stock by any means. Over the past 5-years, shares have traded at an average multiple of 26x and over the past decade closer to 23x.

Fast Graphs

I would still like to see the stock lower before initiating a position myself given the expected slowdown in consumer spending on the horizon.

In terms of our quality rating, PEP is a very quality company with the following attributes:

- Solid Balance Sheet

- Strong Management team

- In demand products

- Potential for efficiency improvement

As such, I rate PepsiCo as a "High-Quality" dividend king.

Created by author

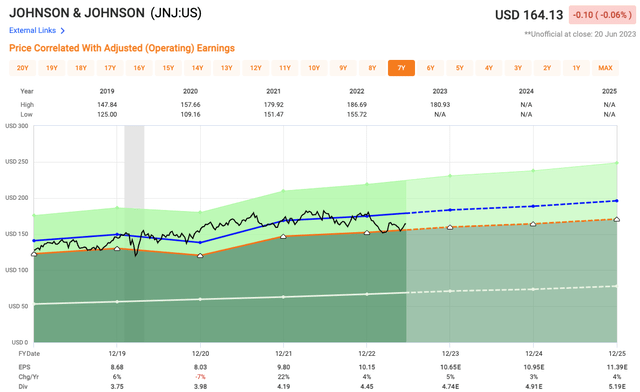

Dividend King #5 - Johnson & Johnson

All of the dividend kings we have looked at thus far have been well known companies for the most part, but I would argue that Johnson & Johnson would be the most well-known in terms of their product portfolio.

With products such as Tylenol, Motrin, Aveeno, Neutrogena, Zyrtec, and so many more being within their consumer health segment for so many years. However, that changed this year when JNJ spun off their Consumer Health segment into a new public company that went IPO recently under the name Kenvue (KVUE).

The idea behind this was to unlock value and also focus more on the other areas of the business, which is the pharmaceutical and Medtech segments

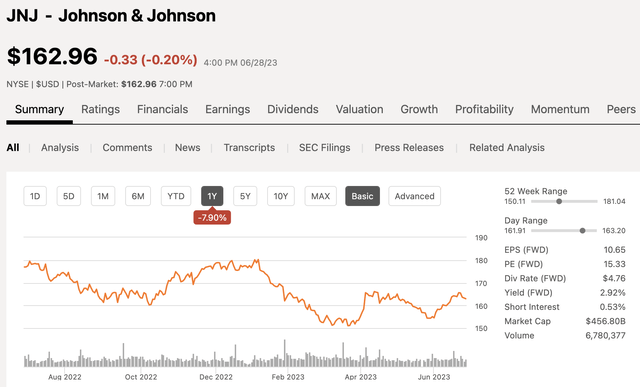

JNJ currently sports a market cap of $457 billion and over the past 12 months, the stock has fallen 8%.

Seeking Alpha

JNJ has been stuck in the mud due in part to their own set of legal issues, not to the extent of 3M, but large nonetheless. There is hope that a settlement will be reached around $9 billion that could be paid over 25 years. In addition, the healthcare segment, after a strong 2022, has lagged in 2023.

JNJ has a strong pharmaceutical pipeline that should propel the company to further growth moving forward and with surgical procedures returning to normal levels, the fast growing MedTech segment is sure to benefit.

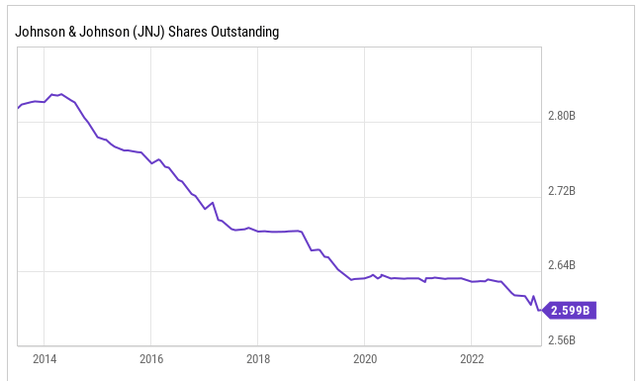

This is another company that has been a strong generator of free cash flow, but that has taken a hit since a lot was pulled forward during the pandemic. Strong FCF helps support a stable and even a growing dividend. FCF also allows a company to repurchase shares, both of which JNJ does.

Looking here, you can see how shares outstanding have decreased over the past decade from more than 2.8 billion shares outstanding to now having less than 2.6 billion, which is roughly an 8% decline during that period.

yCharts

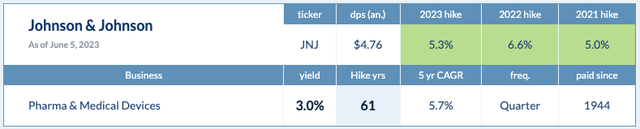

In terms of the dividend, JNJ has paid a dividend since 1944, growing it consistently for 61 consecutive years. The dividend currently sits at 3.0% and they have a 5-year DGR of 5.7%.

Dividendhike.com

Turning to valuation, analysts expect JNJ to generate EPS of $10.65 per share, which equates to an earnings multiple of 15.4x, which is slightly below the company’s 5-year average of 17.2x and their 10-year avg of 17.3x.

Fast Graphs

In terms of quality rating, JNJ is an extremely quality company with an AAA rated credit rating, higher than the US government, for what that is worth.

The company has shown the ability to generate strong amounts of FCF, produce nice yields, keep debt levels low, with the primary red flag being their litigation issues right now around their talc baby powder.

However, I have long stuck with this company and it is a top holding for me, as such, I rate the company as a MUST OWN.

Created by author

Investor Takeaway

Today we looked at 5 dividend kings, ranking them based on the quality and long-term viability of the company. This is not intended to be a buy now list by any means, as valuations look intriguing for some and less intriguing for others.

In the comment section below, let me know what changes, if any, you would make to my ranking of these 5 dividend kings.

Disclosure: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

No marketing to add

This article was written by

Mark Roussin is an active Certified Public Accountant (CPA) in the state of California. Mark has worked as a CPA, serving both public and private Real Estate corporations for over 10 years. Today, he provides his followers insights to both undervalued dividend stocks mixed with high-growth opportunities with a goal of them reaching financial freedom in the long-term. Mark tends to invest primarily in dividend stocks with a strong emphasis on Real Estate Investment Trusts (REITs).

Author of the weekly financial newsletter, "The Dividend Investor's Edge."

Mark has partnered with "iREIT on Alpha”, which is the premiere marketplace service that provides the best daily in-depth REIT research. The service boasts a community of like minded investors that also receive complete access to our various portfolios that you can track in real-time. Come check out all the exclusive content today!

-----------

DISCLAIMER: Mark is not a Registered Investment Advisor or Financial Planner. The Information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. He asks that you perform your own due diligence or seek the advice of a qualified professional. You are responsible for your own investment decisions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JNJ, KO, MO, MMM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Comments (6)