Seeking Solid Grounds: Evaluating Tingo's Chinese Operations

Summary

- TIO's Chinese operations, spanning insurance and securities trading, seem to lack substantial value.

- Investors should expect volatility in TIO's stock price due to the upcoming court summons response and the internal investigation results.

- The Hindenburg report raises legitimate concerns about TIO's financial performance and valuation.

Lemon_tm

Investment Thesis

Before its transformational acquisition of Tingo Mobile last December, Tingo Group Inc (NASDAQ:TIO) (formerly known as MICT Inc) housed a diverse set of small Chinese businesses that have historically dabbled across a wide range of sectors, from lottery ticket promotion, mobile top-ups, and even retailing sports merchandise on Tmall.com. Most recently, the company pivoted into insurance and securities trading. This varied engagement across multiple sectors hints at a lack of strategic focus, and a "hustler" mentality, constantly on the chase for the next big thing.

Last December, the acquisition of Tingo Mobile, an agriculture fintech company in Nigeria, shifted the narrative completely, turning the spotlight to this new, promising asset. At the same time, its "legacy" Chinese operations faded into the backdrop due to its relatively small size compared to Tingo Mobile and its younger cousin, Tingo Foods.

In my previous article, published last month, I delved into the intricacies of the Tingo Mobile deal, highlighting the structure and terms that favored TIO and its shareholders. I ultimately gave TIO a Hold rating, balancing the optimism over the deal's incredible financials and concerns over TIO's ability to return capital to its shareholders, given Nigeria's capital controls.

Since my initial analysis, the landscape surrounding TIO has changed dramatically. Two weeks after publication, TIO announced plans to roll out a quarterly dividend, putting a dent in my initial reservations over Nigeria's capital controls. Simultaneously, the emergence of a short report by Hindenburg Research launching serious allegations against TIO challenged my initial optimism about the company's financial performance and valuation.

More importantly, the confidence in TIO's African operations took a hit, shifting the spotlight back to MICT's complicated business in China. Investors are now seeking alternative sources of value within TIO as a hedge against uncertainties surrounding its African ventures. Unfortunately, as detailed below, I find that TIO's operations in Asia (and other regions) do not present substantial value that could counterbalance the potential risks associated with TIO's agriculture business in Africa.

Micronet Inc (TLV: MCRNT)

Before venturing into its current diversified portfolio in China and Africa, TIO, formerly known as MICT Inc, had a singular objective: to hold shares of Micronet Inc, an Israeli micro-cap company listed on the Tel-Aviv stock exchange.

The Company’s business relates to its ownership interest in Micronet, a former consolidated subsidiary.

Source: MICT 2019 Annual Report

The story of how a NASDAQ-listed company devolved into a shell enterprise is a curious one. More importantly, it bears significance given what it implies about Micronet's current leadership and, by extension, the potential value of TIO's 32% stake in Micronet.

Micronet's current Chairman, Chezy Ofir, previously served as a board executive member on David Lucatz's team, running both MICT Inc and Micronet. Under their leadership, MICT shares declined from about $7.9 in 2013 to $0.9 by 2019 year-end, while Micronet share price declined from 6.4 ILS to 0.4 ILS, driven down by consistent losses and sales declines. This leadership track record should give investors a pause when assessing what to expect from Micronet.

Initially, Micronet sold fleet management solutions, but the emergence of smartphones disrupted its business model. Currently, Micronet has pivoted to selling dashcams.

Micronet SmartCam (Micronet Inc Website)

According to the most recent data in TIO's 2022 annual report, TIO holds a 31.47% stake in Micronet Inc, valued at approximately $1.6 million. This valuation is based on Micronet's current share price, around $0.52 per share, and a market cap of $5 million. (Note: These figures have been converted to USD from Shekel at a rate of USD/ILS 0.28)

Micronet SmarTab-8 (www.micronet-inc.com)

Global Fintech Holdings "GFH" 2020 Acquisition

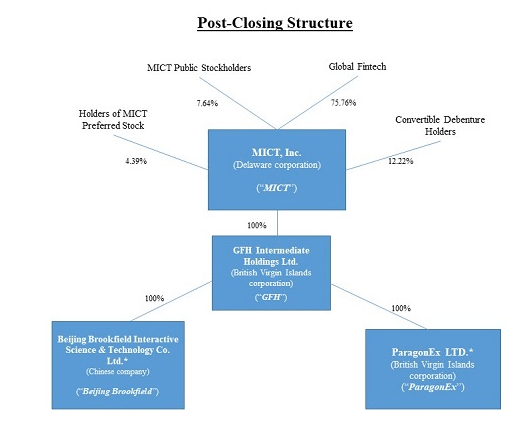

In July 2020, MICT Inc acquired assets of Beijing Brookfield Interactive. A special-purpose vehicle called Global Fintech Holdings "GFH" was created to facilitate the merger, serving as a Merger Subsidiary company.

GFH was formed on October 2, 2018 for purposes of effectuating the Acquisition Agreement and the business combination therein and related capital raising activities.

Source: F-4 SEC document filed February 2019.

After the acquisition, Darren Mercer (TIO's current CEO) became the CEO of the surviving entity.

Our acquisition of GFH is a transformative milestone which we believe will springboard our future revenue and earnings growth and positively impact stockholder value. [1]

We are very pleased on the completion of the acquisition of 100% of Global Fintech Holding Intermediate, or GFHI, giving us ownership of the platforms, technology and businesses that GFHI has built in the global fintech space, with the initial focus on China’s burgeoning fintech market. [2]

[1] Source: Darren Mercer, CEO, MICT Press Release, Titled " MICT Closes Acquisition of Global Fintech Holdings", Dated July 2020

[2] Source: Darren Mercer, CEO, Q3 2020 Earnings Call

Although management spotlighted GFH in the earnings calls, press releases, and SEC documents before and after the deal, the complexity of the transaction and the lack of clear communication made it challenging to understand its full scope and value. The GFH deal initially included ParagonEX, a B2B securities trading platform provider, which was at the time the Crown Jewel of the deal, being the largest in terms of sales, and the only profitable entity among the colossal of businesses included in the transaction. However, MICT subtly dropped it from the final agreement two months before the deal close on July 2020.

GFH Structure (Page 3, Preliminary proxy statements filed on 2020-01-21)

The second arm of the deal is a web of small Chinese businesses bundled under the Beijing Brookfield umbrella. The specific assets that GFH eventually acquired from Beijing Brookfield remain somewhat ambiguous, but from my understanding, whatever assets GFH initially had were acquired from Beijing Brookfield.

In any case, our interest in assessing Beijing Brookfield's historical performance extends beyond its operations. Before joining TIO as its current CEO, Darren Mercer was the CEO of BNN, the parent company of Beijing Brookfield. Thus, analyzing BNN and Beijing Brookfield gives valuable insights into Mercer's track record and strategic capabilities.

Beijing Brookfield Interactive Science & Technology Co.

Beijing Brookfield is a complex web of small Chinese enterprises that primarily operate within the Chinese lottery market, specializing in the online marketing, promotion, and processing of lottery tickets.

Beijing Brookfield Structure (Page 152, Preliminary proxy statements, MICT SEC filed 2020-01-21 )

Before merging with MICT, Beijing Brookfield was the operating subsidy of BNN Technology, a now-dormant UK entity founded by Darren Mercer in 2008. BNN and Beijing Brookfield's complex structure is designed to circumvent Chinese restrictions on foreign ownership in the e-commerce sector. I relied on the following evidence in determining whether BNN's historical performance could serve as a proxy for Beijing Brookfield value:

The Group [BNN Technology] acquired its foothold in China with the establishment of the WFOE legal structure and new relationship with NewNet in February 2009. The WFOE is called Beijing Brookfield Interactive Science & Technology Development Co., Ltd. [1]

Chinese law and regulations restrict foreign investment in lottery businesses. Accordingly, the Company’s Chinese business operations are conducted through a series of arrangements between the relevant operating Company and Beijing Brookfield Interactive Science & Technology Limited. These arrangements enable the Group to:

- receive substantially all of the economic benefits from the affiliated entities in consideration for the services provided by the wholly-owned subsidiary Beijing Brookfield Interactive Science &Technology Limited;

- exercise effective control over the affiliated entities; and

- hold an exclusive option to purchase all or part of the equity interests in the Company’s affiliated entities when and to the extent permitted by PRC laws.

The Group does not have any equity interest in the affiliated entities. However, as a result of the arrangements in place, the Company has effective control over and has a variable interest in the returns from these companies, and for this reason the Directors consider the affiliated entities to be contractually controlled entities [2]

To comply with PRC laws and regulations, the Group currently conducts substantially all of its business through two contractually controlled entities (Beijing Hulian Xincai Culture Development Co., Limited (“Hulian Xincai”) and Beijing NewNet Science & Technology Development Co., Limited (“NewNet”)) and their subsidiaries. [3]

[1] Source: Page 187, Offer To Purchase, found in Schedule TO, SEC filing, Dated February 5 2019

[2] Source: Page F/C-48, Registration of securities (F-4 SEC form), filed by Global Fintech Holdings, Dated February 2019.

[3] Source: Page F/C-27, Registration of securities (F-4 SEC form), filed by Global Fintech Holdings, Dated February 2019.

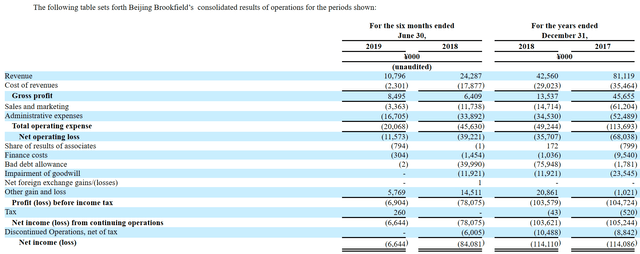

Assembling Beijing Brookfield's financial information required sifting through multiple sources and filings by different entities, including BNN Technology's filings to the UK Company House, Global Fintech Holdings' filings to the SEC, and multiple investor prospectuses filed by TIO. The comparability of reported figures were impacted by various reporting decisions, including reporting standards for what management deemed as discontinued operations at the time of filing, in addition to minor accounting errors, such as those highlighted on page 33 of the acquisition agreement.

What remains constant across these sources is the indication that the business was remarkedly unprofitable, having failed to generate profits since its inception in 2008. Beijing Brookfield's market position deteriorated further on March 2015 when China implemented a ban on the sale of online lottery tickets as part of a crackdown on fraudulent ticket sales. Since then, a significant part of Beijing Brookfield's operations has revolved around creating content and supporting the online promotion of lottery tickets.

| Revenue | Gross Profits | Operating Loss | Net Loss | |

| 2011 | £238,611 | £222,640 | $(4,410,184) | $(4,414,508) |

| 2012 | £721,472 | £709,397 | $(8,048,223) | $(8,039,201) |

| 2013 | £1,116,959 | £985,189 | $(7,160,109) | $(7,202,431) |

| 2014 | £13,413,542 | £5,596,372 | $(2,394,221) | $(3,625,649) |

| 2015 | £5,518,598 | £1,221,469 | $(9,313,236) | $(11,447,828) |

| 2016 | £2,064,000 | £926,000 | $(16,471,000) | $(18,210,000) |

| 2017 | £7,933,000 | £2,140,000 | $(22,959,000) | $(31,905,000) |

Note: Revenue figures are reproduced as reported each year to the UK Company House. Starting in 2015, BNN management changed its revenue recognition policy, which had a material impact on comparability, as noted on page 83 of the 2015 annual report filed to the UK Company House. Since spinning off Beijing Brookfield Interactive, BNN has been reporting as a dormant company.

It is noteworthy to know that China's lottery market is tightly-controlled, and tickets are supplied by two government-owned entities; China Welfare Lottery and China Sports Lottery. The private sector's role is limited to resale, promotion, and marketing. BNN's role, through Beijing Brookfield's company network, was as a reseller of lottery tickets, mostly online.

In response to changing market conditions in China, BNN, desperate for survival, entered the mobile top-up market via a service agreement with Hangzhou in 2016 via its operating subsidy, Beijing Brookfield. On July 2017, BNN created a business account on Tmall (China's Amazon) to sell Arsenal Football Club merchandise, announcing plans to become Arsenal's "Official Tmall Retail Partner." However, the current status of this endeavor is unclear.

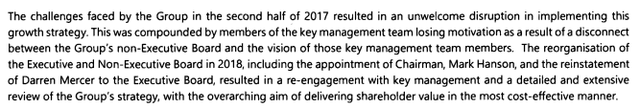

In September 2017, Darren Mercer, BNN's ex-CEO, and his right-hand man Wei Qi (current consultant for TIO) resigned following "serious allegations" leveled by their CFO, as reported by the Financial Times. Darren, who held a significant stake in BNN, later returned, and this was met by the resignation of the entire board of directors, indicating a clear lack of confidence and disagreement within the company's leadership at the time.

2017 BNN Annual Report UK Company House

Given these dynamics, and the historical feeble financial standing of BNN, it is not surprising that the company delisted from the AIM stock exchange, stopped reporting its earnings, and started looking for a way out (signing an initial acquisition agreement by December 2018), while simultaneously drawing plans (as noted on Page F/C-10 of GFH filing ) to turn around the business by the second half of 2018. However, sales continued to decline, and the company failed to reach profitability. These occurrences, coupled with the earlier internal turmoil and consistent underperformance, reinforce my belief in the limited value of Beijing Brookfield businesses and the "technology and business platform" TIO inherited from the GFH acquisition.

Page 208, PREM14A Preliminary proxy statement filed January 21, 2020

Note: One might notice the discrepancy between the 2017 revenue reported on the Preliminary proxy statement submitted to the SEC on January 21, 2020, and the revenue reported by BNN to the House of Companies. The SEC documents show revenue of ¥81,119,000, which converts to about £8,841,570 based on a GBP/RMB rate of 0.11. This compares to BNN's reported sales of £7,933,000, translating to a difference of about £900,000. This change seems to stem from adjustments related to acquisitions or reinstatement of previously discontinued businesses, as detailed on page 207 of the Preliminary proxy statement. In any case, the difference is relatively small and doesn't significantly change my negative view of Beijing Brookfield.

Insurance Business

A few months after the GFH acquisition, MICT announced the launch of its "online insurance" business. The specifics regarding which entity precisely obtained the license in 2020 are unclear. Regardless of the form or structure of this new insurance venture, its scale at the time appears to be limited.

Having launched and commenced revenue generation at the end of 2020, our insurance platform is off to a good start.

Source: MICT press release found on 8-K form filed January 7, 2021

On November 2, 2020, Intermediate, through an operating subsidiary, launched its insurance platform. Source: Q3 2020

Beginning on the second half of December 2020, we have launched our insurance platform operated by GFHI. Source 2020 10-k

Over the ensuing months, TIO engaged in a number of transactions, targeting small Insurance Brokerage and Insurance Agency businesses in complex deals involving multiple entities, mirroring the VIE structure previously seen in Darren Mercer's failed lottery business.

Before we examine TIO's "online insurance platform" in detail, it's crucial to understand that TIO's insurance entities do not function as traditional insurance companies. TIO doesn't hold a license to underwrite insurance policies. Instead, its subsidiaries operate as insurance brokers and agencies. These subsidiaries possess licenses to market, promote, and sell insurance products underwritten by licensed insurance companies, earning their revenue through commission. For more information, see Notes to Consolidated Financial Statements, Revenue Recognition, 2022 annual report (page F-23)

Beijing Fucheng Insurance Brokerage

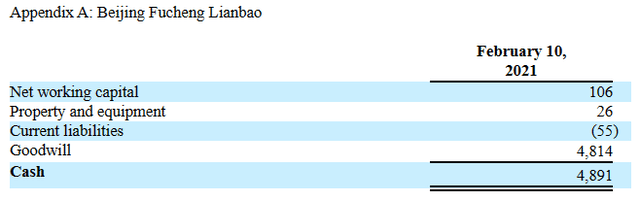

On February 2021, MICT announced the acquisition of Beijing Fucheng Insurance Brokerage, which the company described as "an established player in the insurance market," according to an 8-k form filed February 10, 2021. Fucheng Insurance has a page on Baidu Encyclopaedia (China's Wikipedia).

However, a closer look at the deal reveals a contradictory narrative, with Fucheng Insurance reporting total assets of a mere $130,000, a low sum for an "established" insurance broker.

Beijing Fucheng current website was created in March 2021, shortly after its merger with TIO. However, it seems Beijing Fucheng has been using a different address, which is now inactive. Using Whois.com search, Beijing Fucheng's old website was created in 2016, and remained active, with relatively updated information until December 2021, according to archived online data.

| Beijing Fucheng Insurance Brokerage Co., Ltd | http://www.bjfcib.com/ | Not Functional |

Note: TIO's management team could not be reached for an immediate response to confirm if these websites are indeed linked to its VIE subsidiary

Guangxi Zhongtong Acquisition

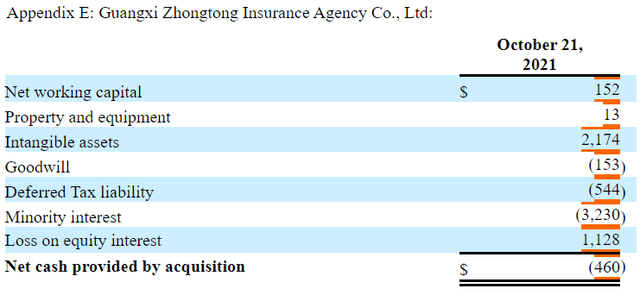

In Q1 2021, MICT extended a "framework loan" to Guangxi Zhongtong, a China-based insurance agency, of up to $6,125,000. As an insurance agent, Guangxi Zhongtong has a license to work on behalf of insurance companies in promoting policies to the public.

An online search yielded multiple results showing several branches on google maps, but I couldn't find a website (using Chinese and English names).

All Weather Acquisition In Q3 2021

On July 1, 2021, MICT extended a loan of $4.7 million to All Weather Insurance Inc., with equity conversion and contractual agreements that effectively transfers control to MICT. Q3 report shows a net working capital of $908,000 at the time of the acquisition, echoing the small size of the business. Similar to Guangxi Zhongtong, All Weather is an insurance agent.

After further research, I found a website associated with a company with the same name. I contacted TIO's management to ask about this, but they have yet to confirm whether this web address belongs to its VIE subsidiary. According to data obtained from Whois.com, the website was created in 2012. The site appears to be well-maintained and updated, implying active operations.

Insurance Segment Financial Performance

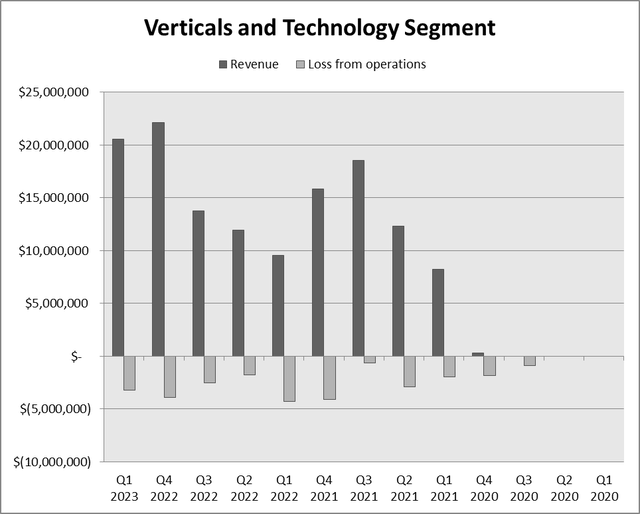

The financial trends in TIO's insurance operations strongly echo those of BNN Technology. Both companies have experienced initial revenue growth yet deeper net losses. The similarities between the two are not surprising when considering their shared characteristics. Both companies are spearheaded by Darren Mercer and operate primarily on a commission basis. Furthermore, their businesses are structured via a complex VIE structure, predominantly of "controlled" businesses that were acquired through M&A rather than developed internally.

Insurance Segment Revenue and Operating Loss (Author's estimates based on TIO filings)

What I find interesting in TIO's insurance segment is the high cost of revenue. Unlike BNN Technology, which included the full lottery ticket in reported sales (starting in 2015), TIO generally does not include insurance premiums in its revenue figures. Instead, it recognizes service fees from traffic generation insurance marketing, and brokerage services, net of insurance premiums.

Despite the automated nature of these tasks, which should theoretically yield high margins, TIO's insurance segments' cost of revenue and operating costs remain high. This suggests high customer acquisition costs and potential revenue-sharing with third-party brokers who may be carrying out a significant portion of the work in return for a share in the commission.

| Fintech Verticals and Technology | FY 2022 | FY 2021 | FY 2020 |

| Revenue | $57,364,000 | $54,932,000 | $299,000 |

| Cost of Revenue | $47,837,000 | $45,740,000 | $292,000 |

| Gross Profit | $9,527,000 | $9,192,000 | $7,000 |

| Gross Profit Margin | 17% | 17% | 2% |

Trading Platform

In February 2021, MICT acquired Huapie, a nascent brokerage technology firm catering to retail investors. Interestingly, the website for Huapei, which rebranded as Magpie shortly after the acquisition, was created in December 2020, a few months after MICT's initial agreement to purchase a 9% stake in the company.

However, Huapie, also known under the name Taihe Securities Limited, has apparently been in existence since 2016, according to webb-site.com, a commercial business directory, and also the Hong Kong official business registry (registration required). MICT exercised the option to acquire the remaining shares of Huapie in Q1 2021, thus fully incorporating the firm into its portfolio.

In September 2021, Magpie introduced its trading app, which shows mixed reviews. During the subsequent Q3 2023 earnings call, management acknowledged concerns over speed, performance, and coding bugs, suggesting that some of the issues might be tied to users outside of their primary target market, Hong Kong.

The financial results paint a painful picture, with Magpie generating a mere $55,000 in its first year. What is more concerning is that the Q1 2023 results are even worse than the same period of last year, with sales totaling $8,000.

| Magpie Securities | 2022 | 2021* |

| Revenue | 55,000 | 18,000 |

| Operating Loss | -$ 9,829,000 | -$ 7,504,000 |

*The 2021 figures only represent sales starting September, post-app launch

Recent Developments

TIO has initiated an internal investigation in response to allegations raised in the Hindenburg Research report. According to TIO's management the process is being led by White & Case, a well-respected international law firm. Its findings will be presented to TIO's independent directors, a trio with diverse backgrounds and significant professional achievements. Below is a brief overview on TIO's independent board members

Sir David Trippier is a well-known British politician, knighted in 1992, and has served in key roles, including Minister of State for the Environment under Prime Minister John Major and UK Member of Parliament for the Conservative Party.

John McMillan Scott is a finance broker. Before retirement in 2013, he was an executive director at WH Ireland Group Plc (LON: WHI), a publicly-traded UK financial institution.

John J Brown, the youngest member at 64, is a management consultant working with start-ups, founders, and entrepreneurs. His career highlights include positions at UPS and Merrill Lynch, according to his LinkedIn profile and SEC filings.

In addition to the ongoing internal review, a judge in a class-action suit has recently issued a summons for Tingo Group Inc, Dozy Mmobuosi, Darren Mercer, and company CFO Hao (Kevin) Chen. The defendants must respond to the complaint made by the plaintiffs (a group of shareholders represented by Mark J. Bloedorn and Christopher Arbour) within 21 days, starting the day after the summons has been served (handed to the defendant). The summons was issued on June 13, 2023, according to court documents (paywall). Thus investors should look for TIO's reply to the complaints soon. Any delay is likely attributed to a lag in serving the summons.

With the internal investigation in progress and the imminent response to the summons, investors should brace for potential volatility in TIO's shares in the coming few weeks.

Moving on to the recently announced plans to distribute dividends, I'll keep my commentary short and to the point. Given Nigeria's capital market requirements, I find it unlikely that Tingo will be able to distribute dividends at the level they describe in the press release. A dividend distribution will boost confidence if it ever materializes, but investors should also consider the payout ratio. It is clear to all parties involved that investors are yearning for stability and concrete evidence that TIO can return capital to shareholders rather than simply aiming for growth. Thus, management must demonstrate financial strength through capital distribution, and when they do, raising additional capital to build on a solid base should be much easier.

Summary

The narrative around TIO has evolved significantly since my last coverage. The company's plans to distribute dividends dented my concerns over Nigeria's capital controls and the ability of TIO to return capital to shareholders. On the other hand, a report by Hindenburg casts a shadow on my optimism over TIO's reported financials.

Given these developments, attention has turned toward TIO's Chinese operations. Upon close examination, I believe this segment presents little value and remains highly unprofitable, echoing the financial trends of Darren Mercer's previous businesses.

Investors should prepare for volatility in the coming days or weeks. The impending deadline for the court summons and the anticipated results of the internal investigation will likely to create significant waves on the market.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.