Coca-Cola FEMSA: Earnings Growth Continues, Valuation Still Appealing Amid Softer Momentum

Summary

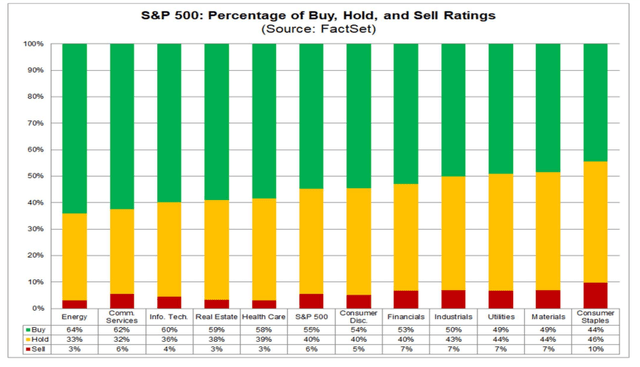

- The Consumer Staples sector has the lowest percentage of sell-side 'buy' ratings among the 11 S&P 500 sectors, but Coca-Cola FEMSA (KOF) is considered a valuable investment due to its low price-to-earnings ratio and strong fundamental trends.

- KOF, the largest bottler for The Coca-Cola Company outside the US, has seen strong demand in South America, with a 7% annual climb in consolidated volume and a 12% revenue jump from the same period a year ago.

- Despite a 60% rally off the low a year ago and a 10% drop from recent highs, KOF is still considered a good investment for long-term investors. However, investors should be aware of potential risks such as rising costs and political uncertainty.

Wirestock/iStock Editorial via Getty Images

The Consumer Staples sector features the lowest percentage of sell-side ‘buy’ ratings among the 11 S&P 500 sectors, according to FactSet. The reason: So many ‘safe’ consumer equities trade at lofty valuations following a flight to safety in 2022. Finding value within the space has become even more challenging this year as stock prices have climbed.

I assert, however, that Coca-Cola FEMSA (NYSE:KOF) remains an international gem on valuation. I reiterate my buy rating, but note a loss in technical momentum.

Staples: Relatively Unloved by the Sell-Side

FactSet

According to Bank of America Global Research, KOF is the largest bottler for The Coca-Cola Company (KO) outside the US, with total sales volumes of around 4bn unit cases, serving more than 375mn people. It manufactures and distributes Coca-Cola products in Argentina, Brazil, Colombia, Costa Rica, Guatemala, Mexico, Nicaragua, Panama, and Venezuela. KOF is controlled by FEMSA and KO, according to a shareholders’ agreement.

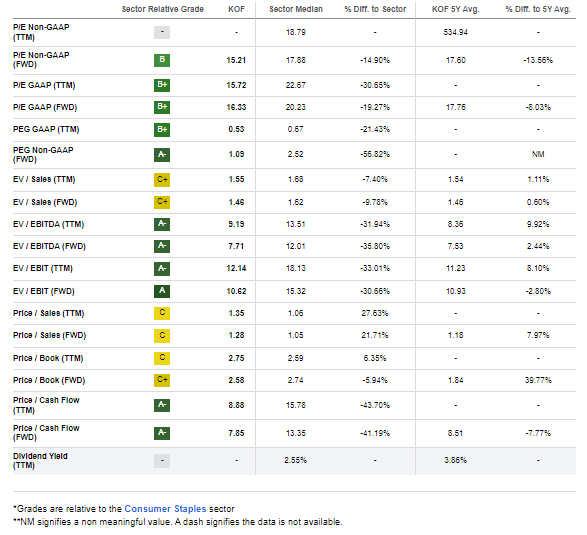

The Mexico-based $17.5 billion market cap Beverages industry company within the Consumer Staples sector trades at a low trailing 12-month GAAP price-to-earnings ratio of 16.3 and pays a 3.4% dividend yield, according to The Wall Street Journal. Implied volatility is low at 20.4%.

Back in April, KOF reported solid earnings results with EBITDA rising 7% YoY, above estimates. Revenues jumped 12% from the same period a year ago. The profit rise was driven by extraordinarily strong demand in its South America operations. Overall, consolidated volume reached 940 million unit cases in the first quarter of 2023, also a 7% annual climb. Shares rose in the days following the report. With such strong fundamental trends and what had been solid momentum, KOF was highlighted among Seeking Alpha’s top quant stocks in early May.

Going forward, investors must watch KOF’s margins. Cost pressures in Mexico were an issue last quarter amid rising labor expenses, marketing price increases, and more expensive raw materials. But with net leverage at just 0.9, liquidity is not seen as a major headwind. While I remain bullish, I acknowledge risks including adverse currency movements and commodity price increases, more industry competition, and political uncertainty.

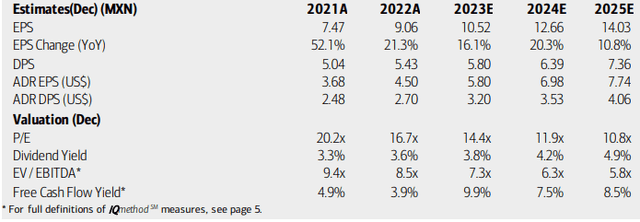

On valuation, analysts at BofA see earnings continuing to rise at a solid pace through 2025. EPS attributable to the ADR shares will likely climb above $5 this year, while distributable per-share profits are seen rising from $3 currently to above $4 by 2025. Now with mid-teens P/E multiples and with a yield above 3%, there remains a value case to be made even after a 60% rally off the low a year ago. With the stock now about 10% off its recent highs, I assert long-term investors can still own this high free cash flow consumer name that features strong profitability trends.

Coca-Cola FEMSA: Earnings, Dividend, Valuation, Free Cash Flow Forecasts

BofA Global Research

If we assume next-12-month earnings of $6 and apply the stock’s long-term earnings multiple of 17.6, then KOF should be near $105. That is significantly higher than what I estimated earlier this year as the earnings outlook has improved, and a market multiple is arguably on the cheap side considering the robust growth trajectory.

KOF: A Market P/E With High Growth

Seeking Alpha

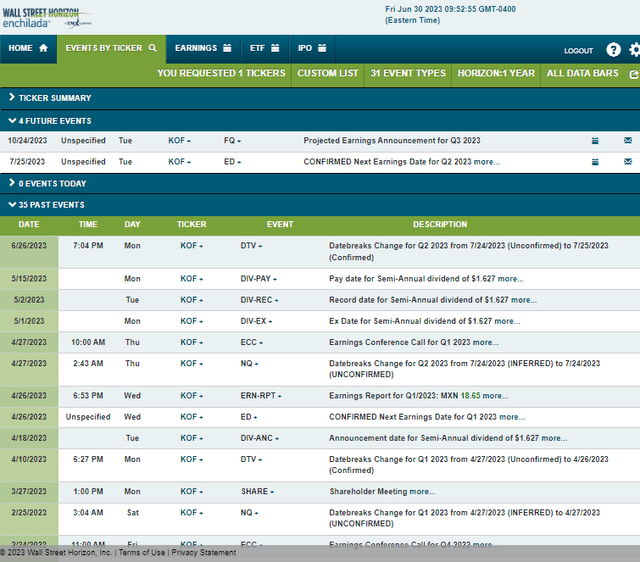

Looking ahead, corporate event data provided by Wall Street Horizon shows an unconfirmed Q2 2023 earnings date of Tuesday, July 25. No other volatility catalysts are expected before then.

Corporate Event Risk Calendar

Wall Street Horizon

The Technical Take

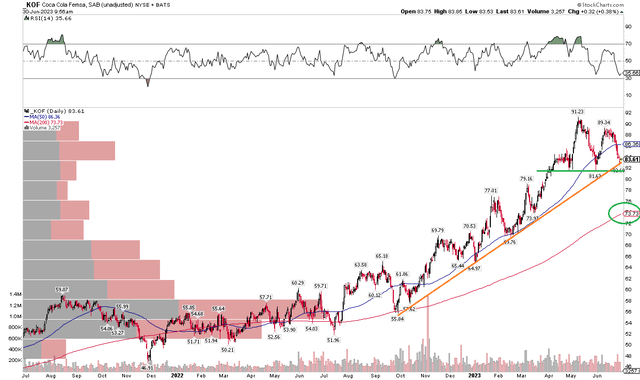

Earlier this year, I highlighted long-term resistance in the low $90s. Indeed, KOF paused just shy of $92 in May. So, the stock is doing all the right things from a technical perspective. Bulls were prudent to trim profits at that noted area of potential selling that was confirmed as resistance.

What now? I see emerging support in the $81 to $83 range. Notice in the chart below that an uptrend support line comes into play there, and the late-May nadir was initially met with a few buyers earlier this week. A breakdown under $80 could lead to a move to next support just shy of $70. With much worse RSI momentum at the top of the chart and limited volume by price as a cushion, the risk/reward situation has turned less sanguine than several months ago.

KOF: Uptrend Intact, But Shares Testing Support Amid Weaker Momentum

Stockcharts.com

The Bottom Line

I reiterate my buy rating on KOF. The valuation situation is just as good as what I assessed in April, but the chart has lost momentum and has turned less bullish.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.