New Mountain Finance: Growing Dividends With Further Potential Upside

Summary

- New Mountain Finance is benefiting from the higher interest rate environment, leading to increased quarterly dividend payments and the launch of a supplemental dividend program.

- NMFC's Q1 23 results were impressive, with revenues up 25% and net income jumping nearly 200% from the previous quarter.

- Despite potential risks such as a deeper-than-expected US recession, the company's focus on non-cyclical sectors and protective collateral and covenant structuring in their investments provide attractive risk-reward dynamics.

SARINYAPINNGAM/iStock via Getty Images

Investment Thesis

New Mountain Finance (NASDAQ:NMFC) is a Private Debt firm that is thriving in the higher interest rate environment, resulting in an increasing dividend payout in recent periods and the announcement of special dividends. However, the stock is down year-to-date and the market is underpricing the future potential of even higher income prospects for investors.

Company Summary & Industry Dynamics

NMFC is a business development company (BDC) that focuses on lending opportunities to middle market companies in defensive growth industries. Their investments target opportunities that possess both income and capital appreciation upside. Direct lending can be a risky business, but the firm differentiates itself by focusing on industries that can withstand economic downturns, primarily enterprise software, healthcare services, healthcare IT, and financial services. In addition, the company aims to protect its capital by focusing a significant part of their portfolio in 1st lien debt, which is secured by substantial collateral and covenants.

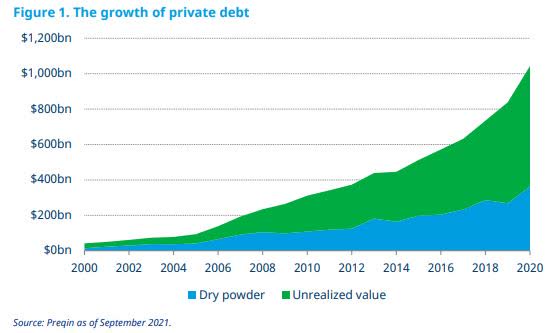

NMFC is well positioned in the growing asset management segment of Private Debt, which continues to be a high performing asset class even in the current macroeconomic conditions. These Direct Lending firms benefit when interest rates rise, as the majority of their investments are based on floating rate debt, which generates greater income in the current monetary environment. At the same time, the risk-reward prospects are favorably skewed by the nature of their secured debt structures mentioned above. The Federal Reserve's stance on "higher-for-longer US interest rates" will continue to positively impact NMFC's financial position and ability to continue increasing their dividends.

In addition, NMFC is riding the wave of the growing non-bank lenders/private credit firms stepping up their lending activity as larger, traditional US banks pull back their loan portfolios. Since the financial crisis, large banks have had to adhere to stricter capital regulations, reducing their appetite for middle market lending, which is compounded by a cooling US economy and tighter credit conditions. This trend is set to continue, opening up more opportunities for NMFC and its peers.

Growth of Private Debt (Preqin)

Financial Results & Dividend Strategy

NMFC posted impressive Q1 23 results, which led to a higher dividend and the announcement of commencing its supplemental dividend program.

Q1 23 Revenues hit $92M, up 25% from Q4 22, whilst Net Income jumped up to $44.6M, up nearly a staggering 200% from the prior quarter. Thanks to the recent results, management have been able to increase their regular quarterly dividend from 0.30 per share throughout last year, up to 0.32 this year, whilst also adding a further 0.03 of special dividend. The stock now has an impressive Dividend Yield (forward) of 10.42%, representing a significant income element for investors.

Importantly, NMFC launched its supplemental dividend program, in which 50% of quarterly adjusted Net Investment Income generated in excess of the regular dividend will be paid out to investors. Residual excess earnings beyond that may also be paid out as additional one-time special dividends.

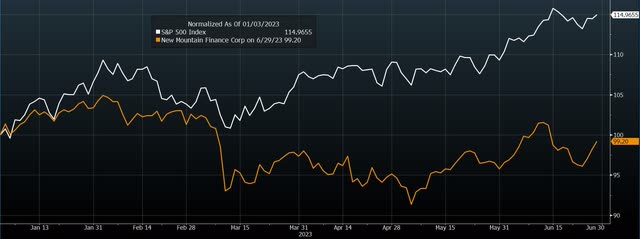

Despite the firm's positive trajectory and significant income upside for investors, this has not been reflected in the stock's performance. Year-to-date, NMFC has traded relatively flat, down just under 1%, significantly lagging the broader market indices, with the S&P 500 up ~15% over that period. I believe that NMFC's income potential is being overlooked, whilst at the same time possessing strong and growing fundamentals which warrant a higher fair value for the stock.

NMFC & SP500 Index - Normalized 2023 (Bloomberg)

Valuation

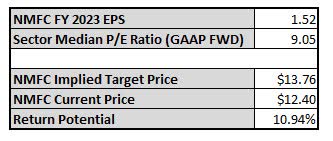

Whilst I prioritize NMFC as a promising income play, it also has an interesting value play angle when analyzing their multiples versus its industry peers, as the stock looks undervalued at current prices.

NMFC's P/E Ratio (GAAP FWD) currently sits at 7.70, at a discount of 15% to the sector median of peers picked by Seeking Alpha. The stock's EPS estimate for FY 2023 is 1.52, which if we apply to the sector median P/E Ratio (GAAP FWD) of 9.11, we can calculate a target price of $13.76 for NMFC. This represents an uplift of ~11% from the latest price. The prospect of combining a double digit capital appreciation + double digit dividend yield income, could make this stock a very attractive contributor to your portfolio.

P/E Ratio Valuation (Seeking Alpha)

Positive Shareholder Trends

An important part of my stock checklist is to analyze the shareholder trends to confirm my long view on this stock. Looking at the Bloomberg Insider Transactions screen, we can see that the Management team have been purchasing additional stock at the recent lows, indicating that they have a bullish outlook on their prospects and are increasing their holdings. This affirms my view that the stock is undervalued and worth betting on for a long-term play, especially considering the growing dividend potential and the rising financial results in this higher interest rate environment.

Management Transactions (Bloomberg)

Taking a look at the broader security ownership, the list of Top 20 shareholders provides further comfort on my assessment of the positive prospects. The majority of the largest shareholders have been increasing their stakes in NMFC in recent quarters, indicating another bullish trend, as these players position themselves for greater dividend income potential and capital appreciation potential as well.

Risks

Despite the gloomier economic backdrop in the US, the company has positioned itself well for the higher interest rate environment, thanks to their defensive growth focus on non-cyclical sectors for their investments, as well as the debt structuring and protective collateral and covenants in their stakes. Whilst Private Debt might offer less absolute return potential than their Private Equity peers, firms such as NMFC can offer better risk-reward dynamics, especially in tougher conditions.

Nevertheless, the rapid rise in the company's financial fundamentals could be at risk if the US were to enter a much deeper recession than expected. On a macro level, extreme economic hardship could force the Federal Reserve to reverse their hikes and enter another period of monetary easing, which would reduce the Net Investment Income of the firm and may place their dividend policy at risk. On a micro level, the portfolio companies that NMFC is invested in through their debt securities could also fall into recessionary hardship leading to investment markdowns and/or restructurings that could impact NMFC's bottom line.

In Conclusion

The direct lending market has been the rising star of asset management in recent times and is well positioned to continue this trend, thanks to higher rates and the reduced activity from the traditional bank lenders. These positive fortunes are clear to see in NMFC's recent financial results and in the progress made on both their dividend payments and plans for additional special dividends. This attractive income angle is yet to be reflected in the stock price, making NMFC an undervalued opportunity.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.