AMD Has A Massive Edge In Research

Summary

- Advanced Micro Devices, Inc. has expanded its R&D efforts in the last five years as its revenue growth improved.

- This has reduced the gap between Intel Corporation and AMD in terms of resources diverted towards research.

- AMD along with chip producer Taiwan Semiconductor should be able to overtake Intel in terms of R&D expense by 2025.

- Intel’s ability to beat AMD in terms of chip leadership might not happen, as the company cannot expand its research efforts without massively hurting the bottom line.

- AMD has delivered better bang for the buck within the research department, and this will increase in the future as R&D resources increase.

David Becker

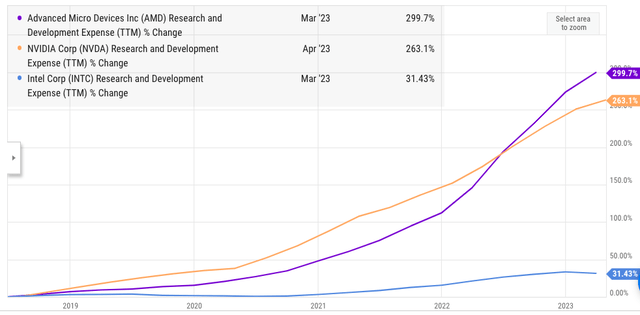

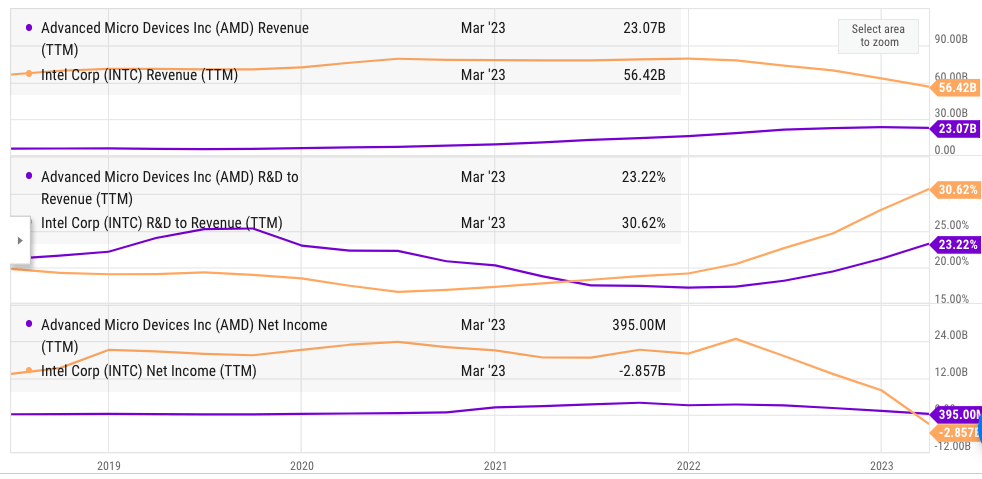

Advanced Micro Devices, Inc. (NASDAQ:AMD) has quadrupled its R&D expense in the last five years, from $1.3 billion in 2018 to $5.3 billion in the trailing twelve months. On the other hand, Intel Corporation (INTC) has managed to increase its R&D expense by a mere 30% within the same time period. AMD's R&D to revenue percentage is only 23% compared to 31% for Intel. Rapid revenue growth in AMD has helped the management increase the research efforts and launch new products in different categories. Taiwan Semiconductor Manufacturing Company Limited (TSM) has also increased its research efforts, and we could see the cumulative research expense of AMD and TSM overtake Intel by 2025. In our previous article, we mentioned that AMD could also take good market share from Nvidia Corporation (NVDA) in the artificial intelligence ("AI") industry, which should allow AMD stock to deliver better returns.

Intel has recently won significant subsidies to set up chip plants in Germany. The total investment by Intel in Germany would be $33 billion, while it is reported that Intel will receive subsidies worth $11 billion. Another plant in Israel will see an investment of $25 billion. These are staggering numbers that should help Intel improve its chip production abilities.

Some analysts have suggested that Intel might be able to retake process and product leadership in the next few quarters with its new products and the “5 nodes in 4 years” target. However, Intel could face the same challenges which TSM is showing when it moves to lower nodes. AMD has given a much better bang for the buck in its research initiatives.

The AI race is also very promising for AMD as it launches new products. AMD is in a better position compared to Intel within its product launch timeline, and it could leverage the rapidly increasing research expense to build an unassailable lead over Intel. Despite the higher valuation multiple, AMD is a better buy due to its future product roadmap and the ability to show faster growth in the research department.

AMD Gaining an Edge

Despite a lower revenue base and research expense, AMD was able to deliver products that rapidly gained market share under the current management. Higher revenue growth in the last five years has allowed the company to ramp up its research department. It has quadrupled the research expense in the last five years, from $1.3 billion in 2018 to $5.3 billion in the last twelve months. Intel’s 30% growth in research expense during this time frame pales in comparison with AMD.

Figure 1: Increase in R&D expense by AMD, Nvidia, and Intel in the last five years.

Intel had maintained a steady R&D to revenue percent of close to 20% for the past decade. However, under CEO Patrick Gelsinger, since 2021 there has been an effort to increase the focus on research. Intel has increased its research expense in the last few quarters even as its revenue base has declined. This has increased the R&D to revenue percentage to 30%. A higher R&D expense is the main reason behind the dip in margins at Intel.

Ycharts

Figure 2: Comparison of revenue, net income, and R&D to revenue percent between AMD and Intel.

Intel has reported a net income of negative $2.8 billion in the trailing twelve months. Prior to the pandemic, Intel had an average R&D expense of $13 billion, which has increased to over $17 billion. Hence, R&D department of Intel has been one of the major reasons behind the recent dip in profits and margins. It is unlikely that Intel can further ramp up its research efforts, as the R&D to revenue is already at a historic high.

Delays, Cancellations, and Market Share Gains

AMD has taken advantage of the delays and cancellations within Intel’s roadmap. Wall Street is eagerly looking at the next product launch from Intel in order to gauge the future market share within the data center and client computing segments. Intel has set a very aggressive roadmap of advancing 5 nodes in 4 years. This should help the company close the gap with AMD.

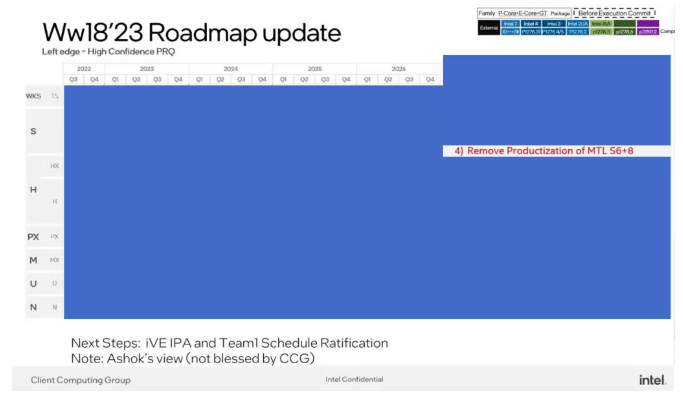

But there are already rumors that some products might be canceled. Tom’s Hardware recently shared the news that Intel is planning to cancel a configuration within Meteor Lake for Desktops.

Tom's Hardware

Figure 3: Intel intends to “remove productization” of MTL-S 6P+8E configuration. Source: Tom’s Hardware.

AMD has shown its ability to take advantage of Intel’s missteps. Any delays or cancellations in the upcoming products of Intel will be a massive boon for AMD as the macroeconomic situation improves.

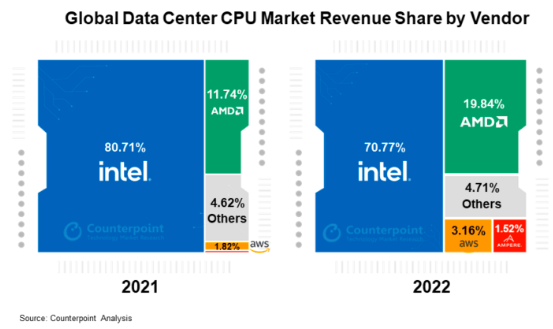

Counterpoint Research

Figure 4: Improvement in AMD’s market share in the data center CPU segment. Source: Counterpoint Research.

AMD Taking the Right Steps

AMD has made a number of right strategic moves in the last few years which has allowed it to build a better product lineup. We can see the result of this in the recent bull run within chip stocks. After Nvidia’s promising quarterly results, AMD stock has seen a strong bullish momentum which is comparable to Nvidia. This is due to the strong focus of AMD’s management on AI products. On the other hand, Intel’s stock has barely moved in the last few weeks. It is likely that Intel’s management would be too busy handling its current product roadmap and building the foundry business. This will leave little space for Intel to build a decent market share within the AI industry.

AMD’s market share within the AI industry is currently very low. However, this also gives the company a longer growth runway than market leader Nvidia. Even after the recent bull run, Nvidia’s market cap is almost five times that of AMD. If an investor is looking to make a bet within the AI industry, AMD stock could give better returns due to longer growth potential for market share increase by AMD.

Impact on AMD Stock

After the recent bull run, the gap between AMD and Intel stock has widened. AMD’s market cap is $180 billion, while Intel’s market cap is only $140 billion. Despite this difference, AMD’s forward P/E ratio is lower than Intel's due to estimates of a quick recovery as the macroeconomic situation improves. Intel has set up many aggressive targets within its product roadmap as well as foundry business. It would be a miracle if Intel is able to meet these targets at the time mentioned by the company. Any delays within Intel would be a major boon for AMD, which can gain further market share in data center and client segment.

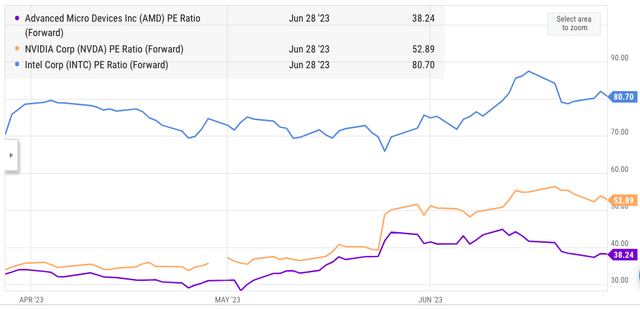

Figure 5: Comparison of forward P/E of AMD, Intel, and Nvidia.

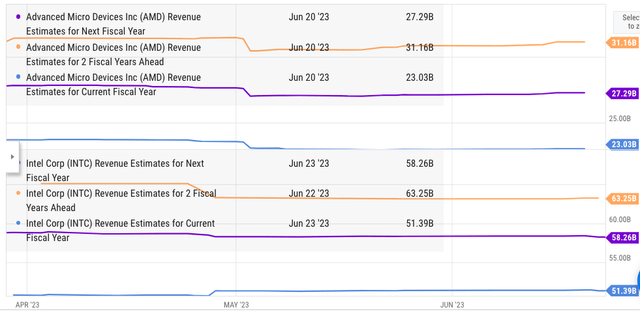

The long-term growth potential of AMD is also quite strong due to the massive demand increase within the AI industry. AMD is predicted to grow significantly faster than Intel in the next few years. It is likely that AMD will further ramp up its research efforts. This will lead to the past trend of higher R&D growth in AMD compared to Intel.

Figure 6: Future revenue estimates for AMD and Intel.

Any bullish news within the AI industry like the one we saw during Nvidia’s earnings would help AMD gain a better bullish sentiment. Nvidia's stock has a market cap six times that of AMD, which shows that Wall Street is counting on massive growth within the AI industry in the next few years. The stock return for AMD could beat Nvidia and Intel in the long term, as AMD has a longer growth runway within the AI industry and a good cash cow business where it is gaining market share from Intel.

Investor Takeaway

AMD’s R&D expense has quadrupled in the last five years due to a rapidly increasing revenue base. During the same period, Intel’s R&D expense has increased by a mere 30%. Despite the rapid growth in R&D expense, AMD’s R&D to revenue is only 23% while Intel’s ratio is at a historic high of 30%. It is unlikely that Intel would be able to divert more resources to research without significantly hurting its bottom line. Intel has set itself a very aggressive roadmap in terms of process jumps. Any delays and cancellations within this roadmap would help AMD improve its market share gains, and we could also see AMD become a market leader within the data center and client segment.

AMD has also been hyping up its entry within the AI industry and is set to launch new products. There is a massive market cap gap between Nvidia and AMD. Any improvement in AMD’s AI market share could lead to a bigger bullish jump in its stock price compared to other peers. We have already seen this happen recently after Nvidia’s earnings. The stock return potential of AMD is much better than for other competitors, which makes it a good bet for investors looking for an entry within the AI industry stocks.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.